- Home

- »

- Medical Devices

- »

-

Nasal Drug Delivery Technology Market Size Analysis Report 2030GVR Report cover

![Nasal Drug Delivery Technology Market Size, Share & Trends Report]()

Nasal Drug Delivery Technology Market Size, Share & Trends Analysis Report By Dosage Form, By Container Type, By Therapeutic Application, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-740-7

- Number of Pages: 185

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global nasal drug delivery technology market was valued at USD 71.89 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.45% from 2023 to 2030. The increasing preference of patients for alternative modes of drug administration is one of the major factors expected to fuel the market growth. The growing incidence of chronic disease is expected to affect the overall market growth over the forecast period. According to a study published in Research and Development (RAND) Review blog, a research organization that develops solutions for the public, in 2018, stated that around 60% of American adults had at least one chronic condition, which accounts for hundreds of billions of dollars in healthcare spending every year. In addition, nearly 30 billion Americans live with five chronic conditions or more.

Nasal drug delivery has previously been restricted to topically acting medications used to treat allergies and the common cold. However, there has recently been a rise in interest in nasal delivery as a substitute for oral and intravenous injection for many systemic medications and vaccinations. Highly vascularized and immunogenic nasal mucosa offers prospective benefits including fast action, increased bioavailability, patient compliance, and improved immune response to vaccinations. Moreover, drug administration by using the intranasal route is less invasive, virtually painless, and well-suited for children. The simple, needle-free injection method 0and the permeable application site in the nasal cavity, which allow for a quick start to local and systemic medication effects, are the main benefits. Additionally, trans mucosal nasal absorption protects medicines from hepatic first-pass metabolism and gastrointestinal degradation.

Additionally, influenza (flu) is a very common and highly infectious disease caused by a virus. In 2021, over three billion children were vaccinated against flu across the U.K. This vaccination is carried out by a nasal spray for children. The popular nasal flu vaccines include Fluenz Tetra and FluMist by AstraZeneca AB.

The COVID-19 pandemic had a positive effect on the nasal drug delivery systems market since many patients desired to complete their chronic respiratory illness drug therapy at home. As a result, more people used inhalers at home than in hospitals or outpatient clinics. Nasal inhalers are now more frequently used to treat conditions such as asthma, migraines, and other mental diseases. Additionally, a number of pharmaceutical companies have been involved in the development of vaccines employing nasal drug delivery technology, and several of them are currently undergoing clinical trials. Moreover, health officials are encouraging vaccination, and the 200 billion doses of flu vaccine administered last year indicated a huge rise from the prior years. Manufacturers supplied a record of 175 billion dosages last year. This has resulted in the positive impact of the Covid-19 pandemic on the growth of the market.

Furthermore, the commercialization of novel products and the development of newer products are anticipated to fuel the market growth. For instance, in July 2019, Eli Lilly and Company received FDA approval for its BAQSIMI (glucagon) nasal powder of 3 mg to treat severe hypoglycemia in people with diabetes ages four years and above. Eli Lilly and Company declared that BAQSIMI is the first and only nasally administered glucagon, developed for severe hypoglycemia patients. In addition, NATESTO, developed by Endo Pharmaceuticals Inc., received approval in 2014 for Testosterone Replacement Therapy (TRT). The product is the first and only gel administered on the nose for TRT in male adults diagnosed with hypogonadism and was commercialized in 2015.

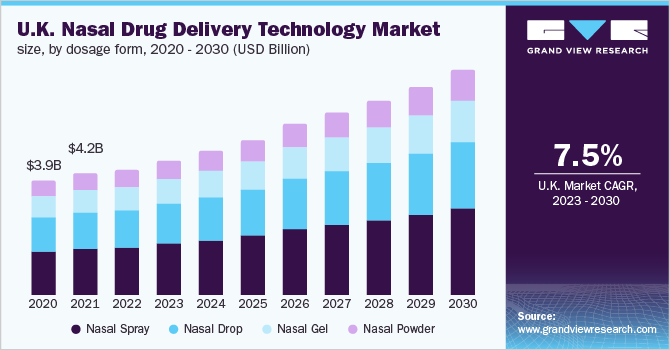

Dosage Form Insights

The nasal spray segment held the largest revenue share of over 35.0% in 2022 owing to the increasing incidence of infections and allergic rhinitis and growing demand for generic nasal spray drugs. Rising demand for self-administration and increasing patient compliance are also likely to augment the market growth. Additionally, the nasal spray has a long-lasting effect on reducing swelling and mucus in the nose. However, nasal spray overuse can also cause headaches, coughing, swelling (inflammation) of the nasal passages, an increased risk of sinus infections, and, very infrequently, tears in the membranes of the nostrils.

Nasal drop is estimated to expand at the fastest CAGR of 7.58% over the forecast period due to its affordability and treatment success rates. Furthermore, rising demand for self-administration and increasing patient compliance are some of the factors responsible for segment growth. In addition, the availability of a number of drops in the market is expected to fuel the segment growth.

Container Type Insights

The non-pressurized container segment led the market with a revenue share of over 85.0% in 2022. Nasal drops, nasal powder, and nasal gels usually come in non-pressurized containers. Growing demand for related products is expected to propel the segment growth over the forecast period. Furthermore, according to an article published by Intertek Group plc, nasal drug delivery technologies provide opportunities to deliver drugs systematically or topically. All the aforementioned factors are expected to propel the segment growth.

The pressurized containers segment is estimated to register a notable CAGR of 7.38% over the forecast period. Nasal sprays usually come in these containers. Increasing consumption of nasal sprays due to the increasing prevalence of chronic diseases such as asthma, diabetes, and cardiovascular diseases is anticipated to boost the segment growth.

Distribution Channel Insights

The retail pharmacies segment accounted for the largest share in 2022 owing to the easy availability and convenience. Due to rising patient demand for nasal drug delivery, retail pharmacies are expected to invest in inhalers, thus expanding the market size. Based on distribution channel, the market is classified into hospital pharmacies, retail pharmacies, and online pharmacies.

The hospital pharmacies segment held the second-largest share in 2022 owing to a significant rise in the number of hospital admissions for asthma and COPD patients. According to the Asthma and Allergy Foundation of America, asthma accounted for 178,530 discharges from hospital inpatient care and 1.6 billion emergency department visits in 2018.

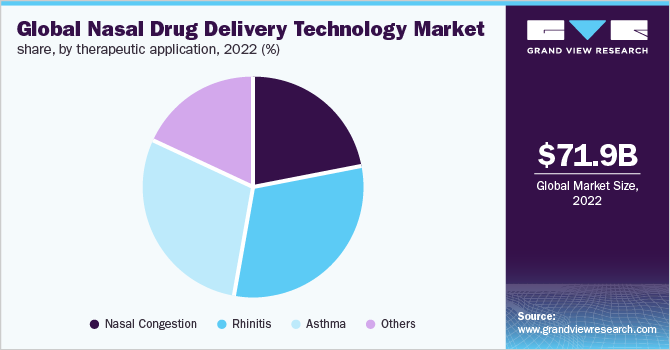

Therapeutic Application Insights

The rhinitis segment held the largest share of over 30.0% in 2022 due to the availability of related products for its treatment. According to the American Academy of Allergy, Asthma & Immunology, allergic rhinitis affects between 10%-30% of the population globally and around 13% of people of age 18 and above in the U.S. have sinusitis. Antihistamines, such as Loratadine (Claritin), Cetirizine (Zyrtec), Fexofenadine (Allegra), and Levocetirizine (Xyzal), Decongestants such as Afrin nasal spray, Phenylephrine nasal spray (Neo-Synephrine), and Pseudoephedrine (Sudafed). Corticosteroid nasal sprays including Flonase, Nasacort, and Rhinocort and leukotriene inhibitors such as montelukast (Singulair) are some of the medicines that are generally used to treat allergic rhinitis. These medications come in various forms such as pills, sprays, gels, and powders as well.

Asthma is estimated to expand at the fastest CAGR of 7.82% over the forecast period. This is attributed to the rising geriatric population and increasing incidences of asthma cases globally. Around 25 billion people in the U.S. are suffering from asthma and around 20 billion of them are of age 18 and above. Rising government initiative to control asthma incidences is also expected to boost the market growth. According to World Health Organization, Asthma is involved in the WHO Global Action Plan for the Prevention and Control of NCDs and the United Nations 2030 Agenda for Sustainable Development. The WHO is taking action to extend the diagnosis and treatment of asthma in various ways.

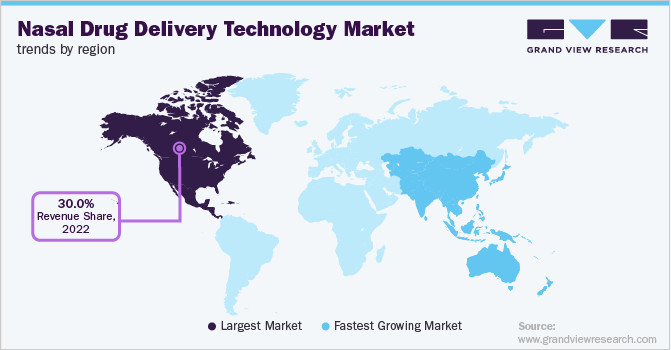

Regional Insights

North America held the largest share of over 30.0% in 2022. Asthma and chronic obstructive pulmonary diseases are becoming more prevalent, and early treatment measures are being widely used. Chronic obstructive pulmonary disease is the third leading cause of death in the U.S. Therefore, the rising incidence of COPD may encourage more people to utilize nasal drug delivery devices.

The Asia Pacific market is expected to grow at the highest rate over the forecast period owing to rising investment in R&D activities, an increase in the prevalence of chronic diseases, and rising public awareness. The growing patient population and the presence of important healthcare providers in swiftly developing countries such as China and India create growth potential. Additionally, government funding is causing healthcare costs in Asia Pacific to rise.

Key Companies & Market Share Insights

The nasal drug delivery systems market is highly competitive owing to the presence of several key players at the global level. These players focus on growth strategies, such as new product launches, collaborations, partnerships, operational expansion, mergers & acquisitions, and patient awareness campaigns. For instance, in September 2022, Nanopharm, which is an Aptar Pharma company, announced a collaboration with Fluidda. The companies have agreed to leverage their respective proprietary technology platforms to help accelerate U.S. Food & Drug Administration (FDA) approvals for oral inhalation drug products (OIDPs) via the alternative bioequivalence pathway. Additionally, in July 2021, GlaxoSmithKline plc announced that the U.S. Food and Drug Administration has approved Nucala (mepolizumab), which is a monoclonal antibody used for the patients with chronic rhinosinusitis with nasal polyps. Some prominent players in the global nasal drug delivery technology market include:

-

GlaxoSmithKline PLC

-

AstraZeneca PLC

-

Pfizer, Inc.

-

OptiNose, Inc.

-

Becton, Dickinson and Company

-

Promius Pharma, LLC

-

Cadila Pharmaceuticals Ltd.

-

B.F. Ascher & Company, Inc.

-

PendoPharm, Inc.

-

Douglas Pharmaceuticals Ltd.

-

ENT Technologies Pty. Ltd.

-

NAVEH Pharma Ltd.

Nasal Drug Delivery Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 76.89 billion

Revenue forecast in 2030

USD 127.12 billion

Growth rate

CAGR of 7.45% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Dosage form, container type, therapeutic application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; India; China; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GlaxoSmithKline PLC; AstraZeneca PLC; Pfizer, Inc.; OptiNose, Inc.; Becton, Dickinson and Company; Promius Pharma, LLC; Cadila Pharmaceuticals Ltd.; B.F. Ascher & Company, Inc.; PendoPharm, Inc.; Douglas Pharmaceuticals Ltd.; ENT Technologies Pty. Ltd.; NAVEH Pharma Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.Explore purchase options

Global Nasal Drug Delivery Technology Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nasal drug delivery technology market report based on dosage form, container type, therapeutic application, distribution channel, and region:

-

Dosage Form Outlook (Revenue, USD Billion, 2018 - 2030)

-

Nasal Spray

-

Nasal Drop

-

Nasal Gel

-

Nasal Powder

-

-

Container Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pressurized Containers

-

Non-pressurized Containers

-

-

Therapeutic Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Nasal Congestion

-

Rhinitis

-

Asthma

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nasal drug delivery technology market size was estimated at USD 17.89 billion in 2022 and is expected to reach USD 76.89 billion in 2023.

b. The global nasal drug delivery technology market is expected to grow at a compound annual growth rate of 7.45 % from 2018 to 2030 to reach USD 127.12 billion by 2030.

b. North America dominated the nasal drug delivery technology market with a share of 34.85% in 2022. This is attributable to increased disease prevalence coupled with heavy R&D investment in the development of novel drug delivery technology.

b. Some key players operating in the nasal drug delivery technology market include GlaxoSmithKline PLC; AstraZeneca PLC; Pfizer, Inc.; OptiNose, Inc.; Becton, Dickinson and Company; Promius Pharma, LLC; Cadila Pharmaceuticals Ltd.; B.F. Ascher & Company, Inc.; PendoPharm, Inc.; Douglas Pharmaceuticals Ltd.; ENT Technologies Pty. Ltd.; and NAVEH Pharma Ltd.

b. Key factors that are driving the market growth include the growing incidence of chronic diseases and the rising preference for an alternative mode of drug administration with better patient comfort.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."