- Home

- »

- Communication Services

- »

-

Network Slicing Market Size & Share Report, 2022-2030GVR Report cover

![Network Slicing Market Size, Share & Trends Report]()

Network Slicing Market Size, Share & Trends Analysis Report By Component, By End User (Communication Service Providers, Enterprises), By Industry Vertical, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-965-0

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

The global network slicing market was valued at USD 315.45 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 50.7% from 2022 to 2030. A network slice is a concept of creating several virtual networks on shared multi-domain infrastructure and comprises various state-of-the-art technologies based on open-source community and standardization. It is an independent end-to-end network and includes dedicated or shared resources capable of providing service quality. Each slice specifies functionality comprising core network functions and radio access network functions.

An assembly of systems/platforms is required to create and manage a sliced virtual network inclusive of well-designed tools and mechanisms. Network slicing solution provides customized services to meet the service provider’s requirements utilizing limited network resources. Moreover, its customization enables efficient network capabilities such as data security, massive connectivity, energy efficiency, reduced latency, reachability, and guaranteed quality of service (QoS).

The network slicing market is projected to witness significant growth attributed to the increasing adoption of Internet of Things (IoT) solutions and deployment of cutting-edge technologies such as AI, AR/VR, and advancements in machine-to-machine (M2M) communications. Additionally, a growing emphasis on the usage of cloud services is anticipated to boost the growth of the industry.

Furthermore, the rising adoption of network slicing-enabled 5G in several verticals such as BFSI, healthcare, retail & e-commerce, among others, are contributing positively to the growth. It also enables efficient usage and management of services resulting in a maximized return on investment (ROI). It also provides access to businesses and organizations to customize networks tailored to meet specific requirements efficiently and cost-effectively governed by a service level agreement.

Utilizing network functions management (NFV), software-defined networking (SDN), analytics, orchestration, and automation enables the creation of network slices that supports specific service, application, or sets of users. Each slice has its management, architecture, and security to support a specific use case. It can span multiple network domains deployed across multiple operators, inclusive of core, transport, and access.

The use cases include enhanced mobile broadband, massive machine-type communications, and ultra-reliable low-latency communication. These use cases allow video-centric applications and require MNOs to hold mobile edge computing capacity and generate less traffic.

COVID-19 Impact On The Network Slicing Market

The COVID-19 pandemic had a favorable impact on broadband services owing to the increasing penetration of smartphones, growing adoption of internet subscribers, emerging adoption of mobile networking, and remote access services in industries such as IT, BFSI, retail & e-commerce, hospitality, and media & entertainment. The gradual shift from conventional business practices to online platforms resulted in the establishment of efficient telecom services and solutions for technological advancements in 5G services.

Therefore, the telecom sector played a pivotal role in supporting digital infrastructure. Enterprise virtual private network (VPN) servers became crucially important with the emerging work from home and online education during the pandemic. However, the delays in the release of 5G technology have negatively impacted the industry during the pandemic. In December 2020, 3GPP announced the delay of Release 16 and 17 of 5G commercial rollouts by three months, wherein Release 16 comprises phase 2 of the industrial IoT and 5G system, and Release 17 includes further enhancements of the 5G system.

As the pandemic restrictions eased, the communication service providers accelerated investments in network slicing solutions and commenced a 5G rollout. The use cases of 5G services and network slicing, including remote education, remote office, and e-health services, are anticipated to propel the industry’s growth. Moreover, use cases such as remote education, remote office, robotics, and telemedicine, have driven the market demand for 5G services and network slicing solutions during the pandemic.

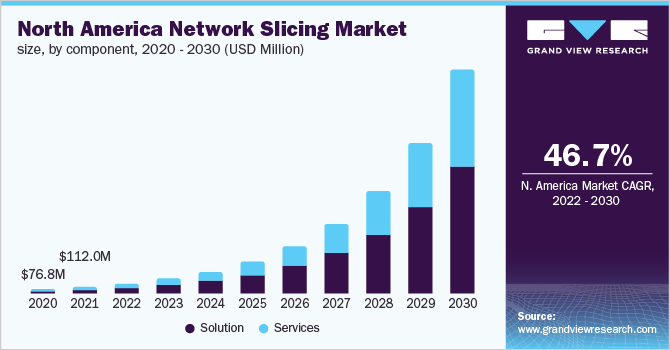

Component Insights

In terms of components, the market is classified into solutions and services. The solution segment dominated with the largest revenue share of 60.3% in 2021 and is expected to witness a CAGR of 49.5% during the forecast period. The growth of the solution segment can be attributed to the adoption of network slicing solutions by CSPs to accelerate the delivery of these applications and services.

Additionally, the key participants are introducing enhanced network slicing solutions to meet end-users requirements. The increasing demand for wide coverage and high-speed network, rising need for ultra-low latency, and proliferation of NFV are fueling the growth. The aforementioned benefits offered by network slicing are encouraging the CSPs to invest in research and development to enable solutions at a low cost and effectiveness which is expected to provide lucrative opportunities for the industry.

The services segment is anticipated to witness the fastest CAGR of 52.3% throughout the forecast period. The growth of this segment is attributed to the integration and deployment of network slicing services. These services ensure effective functioning and improved operational efficiencies throughout the process. The services segment is further categorized into professional and managed services.

The professional services held a revenue share of 59.2% in 2021 and are expected to witness a CAGR of 51.2% during the forecast period. Professional services such as business analysis and consulting, design and architecture, integration, and deployment help to evaluate business cases and build solutions to minimize costs and deliver operational efficiency, security, and QoS.

The managed services sub-segment is anticipated to witness the fastest CAGR of 53.9% throughout the forecast period. Managed services provide services that include network management, infrastructure management, data center management, backup and recovery, maintenance, and support. This services model allows an organization to outsource the operations, management, and delivery of processes to enable proactive network management, a lower total cost of ownership (TCO), and smart bundling.

End-user Insights

In terms of end-user, the market is classified into communication service providers and enterprises. The communication service providers dominated with a revenue share of almost 75.0% in 2021. It is expected to witness a CAGR of 49.9% during the forecast period. Increasing demand for better bandwidth connectivity to meet the end-user’s requirement is driving the growth.

The key communication service providers are actively engaged in partnerships and collaborations to test the slicing technology. For instance, in 2019, Ericsson announced a collaboration with AT&T to demonstrate and develop an end-to-end network slice along with lifecycle management based on ONAP software.

The enterprise's segment is anticipated to witness the fastest CAGR of 52.9% over the forecast period. The growth is attributed to the rising demand for robust network solutions and services to enhance productivity among enterprises. The use cases of 5G, such as remote education, remote office, robotics, and telemedicine, have driven the demand for enterprise 5G services and network slicing solutions.

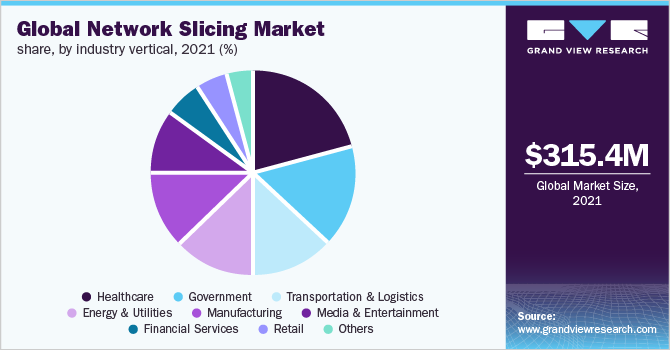

Industry Vertical Insights

In terms of industry vertical, the market is classified into healthcare, government, transportation and logistics, energy and utilities, manufacturing, media and entertainment, financial services, retail, and others. The healthcare segment dominated with a revenue share of 20.6% in 2021. It is anticipated to witness a CAGR of 44.7% during the forecast period.

The growth of the healthcare segment is attributed to the increasing adoption of innovative 5G technologies and network slicing solutions in the healthcare sector. The healthcare industry is expected to witness a technological transformation with an increasing number of use cases in the industry, such as robotic surgeries, IoT, and AI.

With extremely low latencies and high data, 5G services and network slicing is expected to revolutionize the entire healthcare value chain. The key participants of the healthcare value chain include providers, health plan providers, and pharmaceutical companies. All these participants are expected to affect differently by the deployment of these services and solutions.

The use of these solutions enables extensive inventory monitoring, monitor occupancy levels in hospitals, tracking people's movement, and many more to improve the patient experience, quality of care, and reduce costs. All these insights can be integrated into the Electronic Medical Record (EMR) system using the 5G network, which would help manage and evaluate the hospital's activities.

The manufacturing segment is anticipated to witness the fastest CAGR of 58.1% throughout the forecast period. The manufacturing vertical has been witnessing a transformation towards advanced technologies, thereby resulting in factory automation. This trend of shifting to smart factory operations results in decentralizing the decision-making processes through interconnected devices.

These devices can sense their environments and cooperate through wireless communication systems, requiring robust, high-speed, and uninterrupted communication. The exceptional benefits such as high-speed connectivity, high bandwidth, and ultra-low latency offered by network slicing services are anticipated to be a catalyst in the manufacturing sector, thereby resulting in the highest growth of this vertical.

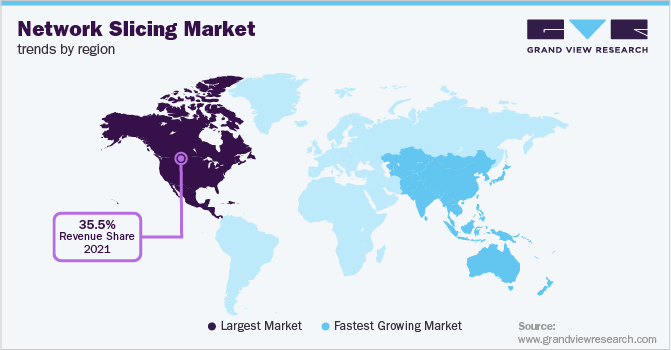

Regional Insights

North America led with a revenue share of 35.5% in 2021. This is attributed to the increasing penetration of smartphones, the growing proliferation of internet services, and the number of internet subscribers in the region. The key factor driving the regional industry is the presence of significant players such as Cisco System Inc., Mavenir Systems, Inc., and Intel Corporation, among others, which have propelled the market growth. Several companies operating in this region are developing innovative solutions to provide end-to-end efficient usage and management of network services which is contributing to the growth.

Moreover, factors such as promoting the deployment of public 5G by several companies increased investment, and early adoption of advanced technologies owing to high digital end-user engagement are contributing positively to the market growth. Furthermore, the considerable adoption of IoT and rapid development of smart cities in North America are expected to provide numerous opportunities for the market in the forecasted period.

Asia Pacific is expected to develop substantially over the forecast period at a CAGR of 54.4%. India and China have an extensive and distributed customer base driving the demand and creating new opportunities for network slicing solutions and services. The growth is prominently due to the increasing developments of IoT technologies and infrastructure and the growing adoption of solutions in several applications, such as healthcare, government, manufacturing, and financial services.

Furthermore, the region's untapped potential is generating new investment opportunities for communication service providers in the region. Moreover, several companies are expanding their presence across the APAC region, which results in a broad customer base and internet subscribers, which provides lucrative opportunities for the regional industry.

Key Companies & Market Share Insights

The market is fragmented and is anticipated to witness increased competition due to several players' strong presence. Some prominent players include Ericsson; Samsung; Nokia Corporation; Huawei Technologies; ZTE Corporation; Cisco Systems Inc.; HPE; Mavenir Systems, Inc.; Amdocs, Inc.; and Intel Corporation.

These companies are also collaborating with telecom operators, advertisers, and local & regional players to gain a competitive edge over their peers and capture a significant share. Players operating in the network slicing industry are adopting different key strategies and developments to occupy substantial revenue share. For instance, in July 2022, Ericsson announced a collaboration with Telefonica to demonstrate end-to-end, automated network slicing in 5G standalone in Madrid. Some prominent participants in the global network slicing market include:

-

Ericsson

-

Samsung

-

Nokia Corporation

-

Huawei Technologies

-

ZTE Corporation

-

Cisco Systems Inc.

-

HPE

-

Mavenir Systems Inc.

-

Amdocs, Inc.

-

Intel Corporation

Network Slicing Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 469.74 million

Revenue forecast in 2030

USD 12.48 billion

Growth Rate

CAGR of 50.7% from 2022 to 2030

Base year for estimation

2021

Historical year

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-user, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Italy; France; China; Japan; India; South Korea; Brazil

Key companies profiled

Ericsson; Samsung; Nokia Corporation; Huawei Technologies; ZTE Corporation; Cisco Systems Inc.; HPE; Mavenir Systems Inc.; Amdocs, Inc.; Intel Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

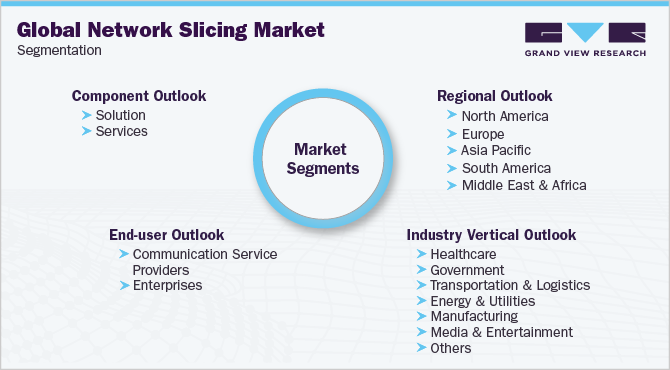

Global Network Slicing Market Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends for each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global network slicing market report based on component, end-user, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

Professional services

-

Managed services

-

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Communication Service Providers

-

Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Government

-

Transportation & Logistics

-

Energy & Utilities

-

Manufacturing

-

Media & Entertainment

-

Financial Services

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global network slicing market size was estimated at USD 315.45 million in 2021 and is expected to reach USD 469.74 million in 2022.

b. The global network slicing market is expected to grow at a compound annual growth rate of 50.7% from 2022 to 2030 to reach 12.48 billion by 2030.

b. North America dominated the network slicing market with a share of 35.5% in 2021. Factors such as the growing deployment of public 5G by a number of companies, and early adoption of advanced technologies owing to high digital end-user engagement are contributing positively to the market growth.

b. Some of the key players operating in the network slicing market include Ericsson, Samsung, Nokia Corporation, Huawei Technologies, ZTE Corporation, Cisco Systems Inc., HPE, Mavenir Systems, Inc., Amdocs, Inc., and Intel Corporation.

b. Key factors that are driving the network slicing market growth include increasing adoption of Internet of Things (IoT) solutions and deployment of cutting-edge technologies such as AI, AR/VR, and advancements in machine-to-machine (M2M) communications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."