- Home

- »

- Electronic Devices

- »

-

Non-destructive Testing (NDT) Market Size Report, 2030GVR Report cover

![Non-destructive Testing Market Size, Share & Trends Report]()

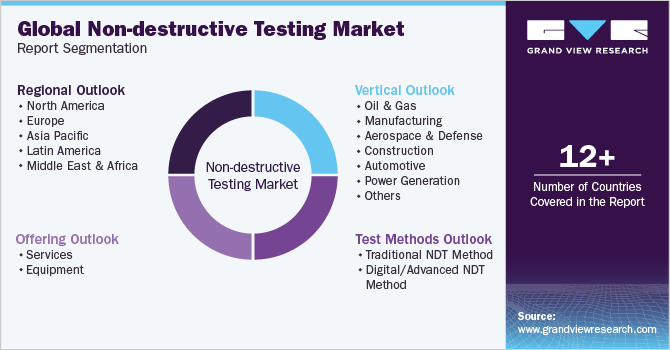

Non-destructive Testing Market Size, Share & Trends Analysis Report By Offering (Services, Equipment), By Test Methods (Traditional NDT Method, Digital/Advanced NDT Method), By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-602-8

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2023

- Industry: Semiconductors & Electronics

Non-destructive Testing Market Trends

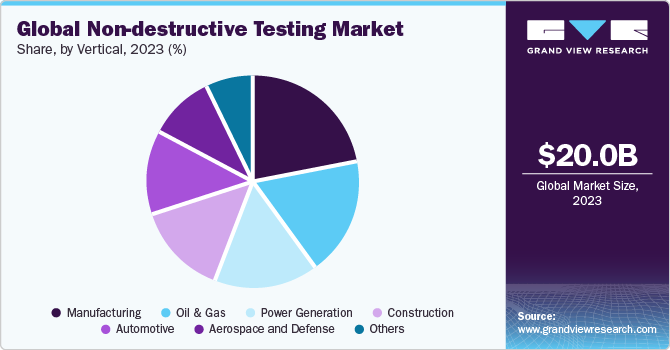

The global non-destructive testing market size was valued at USD 20,019.5 million in 2023 and is expected to register a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The growing manufacturing activities across the developing and the developed nations is estimated to drive the market over the forecast period. Furthermore, the increasing technological innovations pace have enable the development of advanced non-destructive testing processes with improved & precise safety & fault detection. Furthermore, increasing awareness amongst the manufacturers regarding the use of Non-destructive Testing (NDT) is expected to improve the penetration of NDT techniques in the coming years.

The utilization of NDT techniques in projects allows for quicker completion due to the detection of faults in complex areas and irregular surfaces. This reduction in the possibility of failures is expected to drive the demand for non-destructive testing in the coming years. Additionally, the ease of operating and efficiency in fault detection provided by ultrasonic equipment, compared to other NDT equipment, is a significant factor contributing to the increasing adoption of the ultrasonic test method. Moreover, advancements in ultrasonic technology anticipated within the next eight years are likely to further boost the adoption of this testing procedure due to its simplicity.

The market is projected to experience significant growth during the forecast period. This growth can be attributed to the increasing urbanization in developing countries like India and China, which involves extensive construction and manufacturing projects. The fast pace of such projects necessitates the implementation of testing processes to ensure the quality of work. This trend is expected to have a positive impact on the growth of non-destructive testing (NDT) in these countries, consequently enhancing its global market penetration.

Increasing oil and gas projects in the Middle East and North America are expected to deploy NDT techniques in order to complete the projects in prescribed timelines and with finesse, thus fueling the demand for NDT equipment over the regions. Besides, the advancements in non-destructive testing technology have led to the development of radiographic testing equipment such as industrial CT scanners, which precisely detect faults in machinery and components. However, the cost of the NDT equipment and the expertise required to perform the tests increases the complexity and difficulty of deploying the radiographic testing method.

The global COVID-19 pandemic has had detrimental and unexpected consequences for various industries worldwide, such as automotive, construction, airlines, and manufacturing, among others. To mitigate the spread of the novel coronavirus and its negative impacts, governments around the world implemented lockdowns as a precautionary measure. This led to disruptions in the global supply chain and a decline in industrial productivity, placing a strain on the global economy. Furthermore, the sudden outbreak of the virus also caused disruptions in companies' production and manufacturing capabilities.

Moreover, the influence of the pandemic on the non-destructive testing (NDT) market arises from the combined response of interconnected industries that utilize NDT for their operations. One such example is the defense industry, which has experienced a relatively mild impact compared to other sectors. This can be attributed to government budget allocations that safeguard the supply and demand ecosystem. While certain defense companies have been significantly affected by the financial shock, the impact is comparatively lesser than that observed in the aerospace sector.

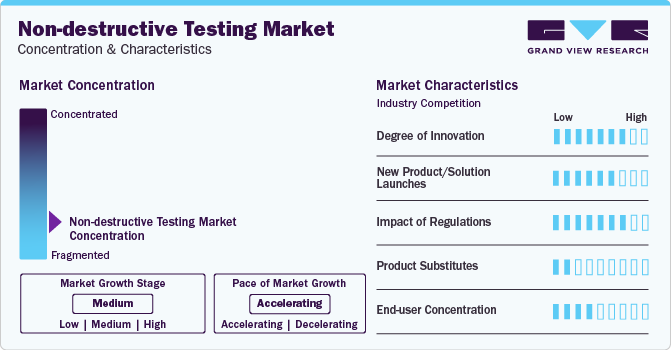

Market Concentration & Characteristics

The non-destructive testing market growth stage is medium, and the pace of the market growth is accelerating. The market is fragmented, with the presence of numerous market players. The developments in the technologies related to NDT present numerous growth opportunities to NDT service providers and equipment manufacturers. The recent advancements in robotics have enabled the use of automated crawlers, robots, and drones to carry out NDT in cases where there is a lack of scope for human intervention. For instance, Eddyfi Technologies, a Canada-based company providing NDT solutions, provides high-performance NDT technologies, including sensors, robots, and software.

The target market is also characterized by a high number of product launches by the leading players. For instance, in January 2023, NDT Global, a Previan Technologies, Inc. business unit, announced the introduction of an ultrasonic testing phased array inspection platform, PROTON. The platform offers an advanced diagnosis of data for enhanced pipeline inspection, such as cracks in misaligned welds and dents.

Non-destructive testing agencies and regulatory bodies such as The American Society for Nondestructive Testing (ASNT), American Society for Testing and Materials (ASTM) International, and American Welding Society (AWS), among others, set specific codes, specifications, regulations, standards, and recommended practices, subject to the industry and country performing NDT.

The threat of substitutes in the non-destructive testing market can be considered low because NDT procedures are critical to the component or raw material testing process. Moreover, the benefits offered by NDT techniques in inspecting materials, systems, or components without permanently altering their structure are not provided by other testing/inspection methods.

Numerous sectors, including aerospace and defense, manufacturing, construction, and oil & gas, among others, use NDT solutions and services. For instance, in the automotive industry, NDT is used for inspecting automotive components after heat treating, forging, and machining, ensuring that they meet the required standards. Moreover, NDT can be used to check welds that hold components and body panels together, ensuring there are no defects that could reduce the vehicle's reliability and safety.

Offering Insights

The services segment dominated the market and accounted for the largest revenue share of over 75% in 2022 and is expected to remain dominant over the forecast period. The primary factor that drives end-users to outsource their NDT operations is the significant upfront cost associated with non-destructive equipment, combined with the technical complexities involved in their deployment and installation. Additionally, the shortage of skilled workforce proficient in non-destructive testing acts as another constraint, limiting the widespread adoption of NDT equipment worldwide. Furthermore, stringent government regulations pertaining to workplace safety further encourage end-users to outsource their NDT operations to third-party service providers.

The equipment segment is expected to experience steady growth throughout the forecast period. This growth can be attributed to technological advancements, which have resulted in the availability of state-of-the-art equipment variants. The availability of these advanced variants has broadened the range of applications for non-destructive testing (NDT) equipment, thereby generating additional demand. Moreover, the resurgence of the industrial sector, particularly in emerging economies such as India and China, is anticipated to stimulate new installations of NDT equipment in the coming years.

Test Methods Insights

The non-destructive testing methods include traditional NDT methods anddigital/advanced NDT methods. The traditional test method segment dominated the market and accounted for the largest revenue share of over 80% in 2022. The notable market growth is attributed to the increasing utilization of traditional non-destructive testing methods, including visual testing, magnetic particle testing, liquid penetrant testing, eddy current testing, ultrasonic testing, and radiographic testing. Among these methods, ultrasonic testing stands out as it dominates the market due to its portability, ease of use, and ability to provide precise results compared to other traditional NDT techniques. Consequently, the adoption of ultrasonic testing is experiencing significant growth and is expected to continue improving in the forthcoming years.

Within the digital/advanced NDT method segment, the phased array ultrasonic testing (PAUT) segment accounted for a significant share of 20.0% in 2023. This growth can be attributed to the increasing preference for PAUT over other digital NDT methods. The detailed visualization feature offered by the PAUT method enables the identification of defect size, depth, shape, and orientation. PAUT is considered an advanced version of ultrasonic testing as it employs multiple transducers and sets of ultrasonic testing (UT) probes comprised of numerous smaller elements.

Vertical Insights

The manufacturing vertical segment dominated the NDT market and accounted for the largest revenue share of more than 22% in 2022. The growth is attributed due to ever-increasing volume of manufacturing across the globe. The manufacturing vertical is expected to deploy numerous NDT processes thereby leading to an increase in demand for non-destructive testing services, globally. Moreover, non-destructive testing has been traditionally used extensively in oil and gas applications. Test methods such as ultrasonic and eddy current have been used to detect cracks in the pipes both underground and elevated. However, with increasing awareness, non-destructive testing techniques are being deployed in several other applications such as aerospace, defense, and automotive.

The oil & gas vertical is further sub segmented into Upstream, Midstream, & Downstream. The downstream activities in the oil & gas industry include refining petroleum products to produce end products, such as gasoline and kerosene. Refineries and petrochemical plants work with large volumes of oil flowing through tubing, pressure vessels, storage tanks, and pipes. Hence, downstream oil & gas companies particularly need to ensure the safety of the environment, workers, and the facility by ensuring the integrity of equipment and spot welding.

The power generation segment comprises numerous industries such as power grids and hydroelectric power plants. The segment is expected to witness healthy growth over the forecast period with a CAGR of more than 8.6%. Continuous increase in the power demand in developing nations is the major reason for the considerable adoption rate of NDT techniques in power generation as the use of NDT techniques guarantees faster production rates.

Regional Insights

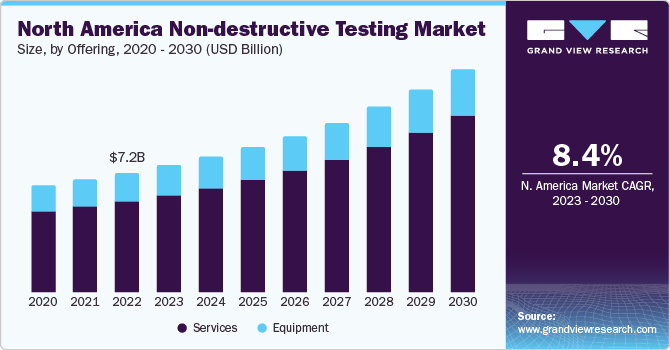

North America emerged as the dominant segment in 2022 with a revenue share exceeding 36%. This is due to there is widespread acceptance of NDT techniques in various applications, the presence of a proficient workforce, and the presence of multiple non-destructive testing training institutes in the region. Moreover, the growth rate in the region is anticipated to be positively influenced by the utilization of shale oil for power generation in the United States and Canada. Additionally, the increasing emphasis on the application of non-destructive testing (NDT) to prevent unforeseen system failures is expected to drive the regional market.

In Asia Pacific, the market is expected to witness a CAGR of more than 9.3% over the forecast period. This growth is ascribed to an increase in manufacturing, construction, and power generation activities in the region. Despite the current shortage of skilled labor in the region, it is projected to decrease over time as awareness and adoption of non-destructive testing techniques increase in the upcoming years. Furthermore, Middle East, due to the significant presence of the oil and gas industry is expected to be a potential market for NDT techniques.

Key Companies & Market Share Insights

Some of the key players operating in the market include MISTRAS Group, Olympus Corporation, Bureau Veritas, and General Electric.

-

General Electric has a diverse set of business units, including GE Power, GE Healthcare, GE Aviation, GE Digital, GE Transportation, GE Renewable Energy, GE Addictive, GE Lighting, GE Capital, GE Global Research, and Baker Hughes, a GE Company (BHGE). BHGE was formed by merging GE Oil & Gas with Baker Hughes Company in July 2017. In 2020, Baker Hughes Digital Solutions' Inspection Technologies division was rebranded as Waygate Technologies.

-

MISTRAS Group is a provider of asset protection solutions for evaluating the structural reliability and integrity of critical industrial, public, and energy infrastructure. The company specializes in integrating products and technologies to deliver customized solutions ranging from complex to routine inspections. It offers destructive testing, non-destructive testing, predictive maintenance, and mechanical integrity services.

-

Sonatest and Comet Group (YXLON International) are some of the emerging Non-destructive Testing (NDT) manufacturers.

-

Sonatest is a provider of non-destructive testing equipment. The company caters to industries such as manufacturing, marine, oil & gas, power generation, chemical, and railways. The company has a research center in Québec City, Canada, and a production facility in Texas, U.S. Moreover, the company’s distributors and agents offer sales and service coverage worldwide.

-

YXLON International offers Computed Tomography (CT) and X-ray systems for non-destructive testing and analysis. The company is part of Comet Holding AG, which was founded in 1948, and offers ebeam, radio frequency, and X-ray technology solutions worldwide. The company has a wide range of product portfolios, from modular CT & X-ray systems to fully automated, customized, and complex systems. It also offers training, remote diagnostics, and installation of X-ray & CT systems worldwide.

Key Non-destructive Testing Companies:

- Previan Technologies, Inc.

- Bureau Veritas

- Fischer Technology Inc. (Helmut Fischer)

- MISTRAS Group

- Comet Group (YXLON International)

- MME Group

- TWI Ltd.

- Nikon Corporation

- Olympus Corporation

- Sonatest

- Acuren

- Intertek Group plc

- CREAFORM

- Vidisco Ltd.

- SGS S.A.

- General Electric

Recent Developments

-

In February 2023, Sonatest announced a collaboration with Echobolt, a U.K.-based operations and maintenance service provider. As part of the collaboration, the company combines its advanced hardware solutions with Echobolt's innovative services to offer Phased Array Ultrasonic Technology (PAUT) to the wind industry. It provides a solution for the inspection of bolts in wind turbines.

-

In February 2023, Waygate Technologies, a Baker Hughes business, announced a significant upgrade to its Krautkramer USM 100 ultrasonic testing device. The upgrade includes new features and improvements aimed at enhancing the device's performance and functionality. Krautkramer USM 100 is widely used in non-destructive testing applications across various industries, and the upgrade is intended to provide users with enhanced capabilities and efficiency.

-

In May 2021, MISTRAS Group introduced advanced Automated Ultrasonic Testing (AUT) pipeline inspection solutions in the Netherlands. The solution provides enhanced efficiency and safety during inspections.

Non-destructive Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20,019.5 million

Revenue forecast in 2030

USD 34,148.1 million

Growth Rate

CAGR of 7.9% from 2023 to 2030

Actual values

2017 - 2023

Forecast values

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, test methods, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Previan Technologies, Inc.; Bureau Veritas; Fischer Technology Inc. (Helmut Fischer); MISTRAS Group; Comet Group (YXLON International); MME Group; TWI Ltd.; Nikon Corporation; Olympus Corporation; Sonatest; Acuren; Intertek Group plc; CREAFORM; Vidisco Ltd.; SGS S.A

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-destructive Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Non-destructive testing market report based on offering, test methods, vertical, and region:

-

Offering Outlook (Revenue, USD Million; 2017 - 2030)

-

Services

-

Inspection Services

-

Support and Maintenance Services

-

Training Services

-

Others

-

-

Equipment

-

-

Test Methods Outlook (Revenue, USD Million; 2017 - 2030)

-

Traditional NDT Method

-

Visual Testing

-

Magnetic Particle Testing

-

Liquid Penetrant Testing

-

Eddy Current Testing

-

Ultrasonic Testing

-

Radiographic Testing

-

-

Ded Ultrasonic Testing (AUT)igital Radiography (DR)

-

Phased Array Ultrasonic Testing (PAUT)

-

Pulsed Eddy Current (PEC)

-

Time-Of-Flight Diffraction (TOFD)

-

Alternating Current Field Measurement (ACFM)

-

Automat

-

-

-

Vertical Outlook (Revenue, USD Million; 2017 - 2030)

-

Oil & Gas

-

Upstream

-

Midstream

-

Downstream

-

-

Manufacturing

-

Aerospace and Defense

-

Construction

-

Automotive

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global non-destructive testing (NDT) market size was estimated at USD 18.9 billion in 2022 and is expected to reach USD 20.02 billion in 2023.

b. The global non-destructive testing (NDT) market is expected to grow at a compound annual growth rate of 7.9% from 2023 to 2030 to reach USD 34.15 billion by 2030.

b. The services segment dominated the NDT market and accounted for the largest revenue share of more than 75% in 2022, and is expected to remain dominant over the forecast period.

b. The ultrasonic testing segment led the NDT market and accounted for the largest revenue share of over 25% in 2022. The segment is expected to emerge as the fastest-growing test method segment at a CAGR of over 8.7% over the forecast period.

b. The manufacturing vertical segment dominated the non-destructive testing market and accounted for the largest revenue share of more than 22% in 2022. The segment is expected to witness a CAGR of more than 9.3% over the forecast period, primarily due to the ever-increasing volume of manufacturing across the globe.

Table of Contents

Chapter 1. Non-destructive Testing Market: Methodology and Scope

1.1. Research Methodology

1.2. Research Scope and Assumptions

1.3. List of Data Sources

1.4. List of Abbreviations

Chapter 2. Non-destructive Testing Market: Executive Summary

2.1. Market Insights

2.2. Market Snapshot

2.3. Segmental Insights

2.4. Non-Destructive Testing Market Revenue Estimates, 2017 - 2030

Chapter 3. Non-destructive Testing Market: Variables, Trends, & Scope Outlook

3.1. Market Segmentation

3.2. Non-Destructive Testing Market - Value Chain Analysis

3.3. Non-Destructive Testing Market - Market Trends

3.3.1. Technology Trends

3.3.2. Regulatory Trends

3.3.3. Supplier Trends

3.3.4. Buyer Trends

3.4. Non-Destructive Testing Market Dynamics

3.4.1. Market Driver Analysis

3.4.1.1. Technological Advancements in NDT

3.4.1.2. Growing Industrialization & Urbanization

3.4.2. Market Restraint Analysis

3.4.2.1. Lack of Skilled Workforce

3.4.2.2. Increasing Complexities of NDT processes

3.4.3. Market Opportunity Analysis

3.4.3.1. Forward Integration with the Latest Technologies

3.4.3.2. Growing Significance of Advance NDT Techniques in Various Industrial Sectors

3.5. Non-Destructive Testing Penetration & Growth Prospects Mapping

3.6. Non-Destructive Testing Covid-19 Impact Analysis

3.7. Non-Destructive Testing Market - Porter's Five Forces Analysis

3.7.1. Supplier power

3.7.2. Buyer power

3.7.3. Substitution threat

3.7.4. Threat from new entrant

3.7.5. Competitive rivalry

3.8. Non-Destructive Testing Market - PEST analysis

3.8.1. Political landscape

3.8.2. Economic landscape

3.8.3. Social landscape

3.8.4. Technology landscape

Chapter 4. Non-Destructive Testing Offering Outlook

4.1. Non-Destructive Testing Market, By Offering Analysis & Market Share, 2022 & 2030

4.2. Services

4.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.2.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

4.3. Equipment

4.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.3.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

Chapter 5. Non-Destructive Testing Test Methods Outlook

5.1. Non-Destructive Testing Market, By Test Methods Analysis & Market Share, 2022 & 2030

5.2. Traditional NDT Method

5.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.2.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.2.3. Visual Testing

5.2.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.2.3.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.2.4. Magnetic Particle Testing

5.2.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.2.4.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.2.5. Liquid Penetrant Testing

5.2.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.2.5.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.2.6. Eddy Current Testing

5.2.6.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.2.6.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.2.7. Ultrasonic Testing

5.2.7.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.2.7.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.2.8. Radiographic Testing

5.2.8.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.2.8.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.3. Digital/Advanced NDT Method

5.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.3.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.3.3. Digital Radiography (DR)

5.3.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.3.3.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.3.4. Phased Array Ultrasonic Testing (PAUT)

5.3.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.3.4.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.3.5. Pulsed Eddy Current (PEC)

5.3.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.3.5.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.3.6. Time-Of-Flight Diffraction (TOFD)

5.3.6.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.3.6.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.3.7. Alternating Current Field Measurement (ACFM)

5.3.7.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.3.7.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

5.3.8. Automated Ultrasonic Testing (AUT)

5.3.8.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.3.8.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

Chapter 6. Non-Destructive Vertical Methods Outlook

6.1. Non-Destructive Testing Market, By Vertical Analysis & Market Share, 2022 & 2030

6.2. Oil & Gas

6.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.2.3. Upstream

6.2.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.3.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.2.4. Midstream

6.2.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.4.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.2.5. Downstream

6.2.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.5.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.3. Manufacturing

6.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.3.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.4. Aerospace and Defense

6.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.4.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.5. Construction

6.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.5.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.6. Automotive

6.6.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.6.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.7. Power Generation

6.7.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.7.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

6.8. Others

6.8.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.8.2. Market estimates and forecasts, by region, 2017 - 2030 (USD Million)

Chapter 7. Non-Destructive Testing Market: Regional Estimates & Trend Analysis

7.1. Non-Destructive Testing Market Share by Region, 2022 & 2030

7.2. North America

7.2.1. Market estimates and forecasts, 2017 - 2030

7.2.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.2.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.2.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.2.5. U.S.

7.2.5.1. Market estimates and forecasts, 2017 - 2030

7.2.5.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.2.5.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.2.5.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.2.6. Canada

7.2.6.1. Market estimates and forecasts, 2017 - 2030

7.2.6.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.2.6.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.2.6.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.3. Europe

7.3.1. Market estimates and forecasts, 2017 - 2030

7.3.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.3.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.3.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.3.5. U.K.

7.3.5.1. Market estimates and forecasts, 2017 - 2030

7.3.5.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.3.5.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.3.5.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.3.6. Germany

7.3.6.1. Market estimates and forecasts, 2017 - 2030

7.3.6.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.3.6.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.3.6.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.3.7. France

7.3.7.1. Market estimates and forecasts, 2017 - 2030

7.3.7.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.3.7.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.3.7.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Market estimates and forecasts, 2017 - 2030

7.4.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.4.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.4.4. Market estimates and forecasts, by Vertical, 2017 - 2030 (USD Million)

7.4.5. China

7.4.5.1. Market estimates and forecasts, 2017 - 2030

7.4.5.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.4.5.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.4.5.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.4.6. India

7.4.6.1. Market estimates and forecasts, 2017 - 2030

7.4.6.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.4.6.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.4.6.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.4.7. Japan

7.4.7.1. Market estimates and forecasts, 2017 - 2030

7.4.7.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.4.7.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.4.7.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.4.8. South Korea

7.4.8.1. Market estimates and forecasts, 2017 - 2030

7.4.8.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.4.8.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.4.8.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.5. Latin America

7.5.1. Market estimates and forecasts, 2017 - 2030

7.5.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.5.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.5.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.5.5. Brazil

7.5.5.1. Market estimates and forecasts, 2017 - 2030

7.5.5.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.5.5.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.5.5.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.5.6. Mexico

7.5.6.1. Market estimates and forecasts, 2017 - 2030

7.5.6.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.5.6.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.5.6.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.6. Middle East & Africa

7.6.1. Market estimates and forecasts, 2017 - 2030

7.6.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.6.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.6.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.6.5. Saudi Arabia

7.6.5.1. Market estimates and forecasts, 2017 - 2030

7.6.5.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.6.5.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.6.5.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

7.6.6. South Africa

7.6.6.1. Market estimates and forecasts, 2017 - 2030

7.6.6.2. Market estimates and forecasts, by offering, 2017 - 2030 (USD Million)

7.6.6.3. Market estimates and forecasts, by test methods, 2017 - 2030 (USD Million)

7.6.6.4. Market estimates and forecasts, by vertical, 2017 - 2030 (USD Million)

Chapter 8. Non-Destructive Testing Market Competitive Landscape

8.1. Key Market Participants

8.1.1. Previan Technologies

8.1.2. Bureau Veritas

8.1.3. Fischer Technologies Inc.

8.1.4. Mistras Group, Inc

8.1.5. Comet Group (YXLON International GmbH)

8.1.6. MME Group

8.1.7. TWI Ltd

8.1.8. Nikon Metrology Inc.

8.1.9. Olympus Corporation

8.1.10. Sonatest

8.1.11. Zetec Inc.

8.1.12. Acuren

8.1.13. Intertek Group plc

8.1.14. CREAFORM

8.1.15. Vidisco Ltd

8.1.16. SGS S.A.

8.2. Key Company Market Share Analysis, 2022

8.3. Company Categorization/Position Analysis, 2022

8.4. Strategic Mapping

8.4.1. Expansion

8.4.2. Acquisition

8.4.3. Collaborations

8.4.4. Product/service launch

8.4.5. Partnerships

8.4.6. Others

List of Tables

Table 1 List of abbreviations

Table 2 Non-Destructive Testing market, 2017 - 2030 (USD Million)

Table 3 Non-Destructive Testing market, by region, 2017 - 2030 (USD Million)

Table 4 Non-Destructive Testing market, by offering, 2017 - 2030 (USD Million)

Table 5 Non-Destructive Testing market, by test methods, 2017 - 2030 (USD Million)

Table 6 Non-Destructive Testing market, by vertical, 2017 - 2030 (USD Million)

Table 7 Offering non-destructive testing market, 2017 - 2030 (USD Million)

Table 8 Offering non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 9 Test methods non-destructive testing market, 2017 - 2030 (USD Million)

Table 10 Test methods non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 11 Vertical non-destructive testing market, 2017 - 2030 (USD Million)

Table 12 Vertical non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 13 Services non-destructive testing market, 2017 - 2030 (USD Million)

Table 14 Services non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 15 Equipment non-destructive testing market, 2017 - 2030 (USD Million)

Table 16 Equipment non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 17 Traditional NDT Method non-destructive testing market, 2017 - 2030 (USD Million)

Table 18 Traditional NDT Method non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 19 Visual Testing non-destructive testing market, 2017 - 2030 (USD Million)

Table 20 Visual Testing non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 21 Magnetic Particle Testing non-destructive testing market, 2017 - 2030 (USD Million)

Table 22 Magnetic Particle Testing non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 23 Liquid Penetrant Testing non-destructive testing market, 2017 - 2030 (USD Million)

Table 24 Liquid Penetrant Testing non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 25 Eddy Current Testing non-destructive testing market, 2017 - 2030 (USD Million)

Table 26 Eddy Current Testing non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 27 Ultrasonic Testing non-destructive testing market, 2017 - 2030 (USD Million)

Table 28 Ultrasonic Testing non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 29 Radiographic Testing non-destructive testing market, 2017 - 2030 (USD Million)

Table 30 Radiographic Testing non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 31 Digital/Advanced NDT Method non-destructive testing market, 2017 - 2030 (USD Million)

Table 32 Digital/Advanced NDT Method non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 33 Digital Radiography (DR) non-destructive testing market, 2017 - 2030 (USD Million)

Table 24 Digital Radiography (DR) non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 25 Phased Array Ultrasonic Testing (PAUT) non-destructive testing market, 2017 - 2030 (USD Million)

Table 26 Phased Array Ultrasonic Testing (PAUT) non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 37 Pulsed Eddy Current (PEC) non-destructive testing market, 2017 - 2030 (USD Million)

Table 38 Pulsed Eddy Current (PEC) non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 39 Time-Of-Flight Diffraction (TOFD) non-destructive testing market, 2017 - 2030 (USD Million)

Table 40 Time-Of-Flight Diffraction (TOFD) non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 41 Alternating Current Field Measurement (ACFM) non-destructive testing market, 2017 - 2030 (USD Million)

Table 42 Alternating Current Field Measurement (ACFM) non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 43 Automated Ultrasonic Testing (AUT) non-destructive testing market, 2017 - 2030 (USD Million)

Table 44 Automated Ultrasonic Testing (AUT) non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 45 Oil & Gas non-destructive testing market, 2017 - 2030 (USD Million)

Table 46 Oil & Gas non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 47 Manufacturing non-destructive testing market, 2017 - 2030 (USD Million)

Table 48 Manufacturing non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 49 Aerospace and Defense non-destructive testing market, 2017 - 2030 (USD Million)

Table 50 Aerospace and Defense non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 51 Construction non-destructive testing market, 2017 - 2030 (USD Million)

Table 52 Construction non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 53 Automotive non-destructive testing market, 2017 - 2030 (USD Million)

Table 54 Automotive non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 55 Power Generation non-destructive testing market, 2017 - 2030 (USD Million)

Table 56 Power Generation non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 57 Others non-destructive testing market, 2017 - 2030 (USD Million)

Table 58 Others non-destructive testing market, by region, 2017 - 2030 (USD Million)

Table 59 North America non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 60 North America non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 61 North America non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 62 U.S. non-destructive testing market, 2017 - 2030 (USD Million)

Table 63 U.S. non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 64 U.S. non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 65 U.S. non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 66 Canada non-destructive testing market, 2017 - 2030 (USD Million)

Table 67 Canada non-destructive testing market, by offering, 2017 - 2030 (USD Million

Table 68 Canada non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 69 Canada non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 70 Europe non-destructive testing market, 2017 - 2030 (USD Million)

Table 7 Europe non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 72 Europe non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 73 Europe non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 74 U.K. non-destructive testing market, 2017 - 2030 (USD Million)

Table 75 U.K. non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 76 U.K. non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 77 U.K. non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 78 Germany non-destructive testing market, 2017 - 2030 (USD Million)

Table 79 Germany non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 80 German non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 81 Germany non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 82 France non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 83 France. non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 84 France non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 85 Asia Pacific non-destructive testing market, 2017 - 2030 (USD Million)

Table 86 Asia Pacific non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 87 Asia Pacific non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 88 Asia Pacific non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 89 China non-destructive testing market, 2017 - 2030 (USD Million)

Table 90 China non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 91 China non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 92 China non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 93 India non-destructive testing market, 2017 - 2030 (USD Million)

Table 94 India non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 95 India non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 96 India non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 97 Japan non-destructive testing market, 2017 - 2030 (USD Million)

Table 98 Japan non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 99 Japan non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 100 Japan non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 97 South Korea non-destructive testing market, 2017 - 2030 (USD Million)

Table 98 South Korea non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 99 South Korea non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 100 South Korea non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 101 Latin America non-destructive testing market, 2017 - 2030 (USD Million)

Table 102 Latin America non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 103 Latin America non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 104 Latin America non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 105 Brazil non-destructive testing market, 2017 - 2030 (USD Million)

Table 106 Brazil non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 107 Brazil non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 108 Brazil non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 109 Mexico non-destructive testing market, 2017 - 2030 (USD Million)

Table 110 Mexico non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 111 Mexico non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 112 Mexico non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 113 MEA non-destructive testing market, 2017 - 2030 (USD Million)

Table 114 MEA non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 115 MEA non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 116 MEA non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 117 Saudi Arabia non-destructive testing market, 2017 - 2030 (USD Million)

Table 118 Saudi Arabia non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 119 Saudi Arabia non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 120 Saudi Arabia non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 121 South Africa non-destructive testing market, 2017 - 2030 (USD Million)

Table 122 South Africa non-destructive testing market, by offering, 2017 - 2030 (USD Million)

Table 123 South Africa non-destructive testing market, by test methods, 2017 - 2030 (USD Million)

Table 124 South Africa non-destructive testing market, by vertical, 2017 - 2030 (USD Million)

Table 125 Company Categorization

List of Figures

Fig. 1 Non-Destructive Testing market, 2022 (USD Million)

Fig. 2 Non-Destructive Testing market segmentation and scope

Fig. 3 Non-Destructive Testing market, 2017 - 2030 (USD Million)

Fig. 4 Offering Segmental Insights

Fig. 5 Test Methods Segmental Insights

Fig. 6 Vertical Segmental Insights

Fig. 7 Value chain analysis

Fig. 8 Non-Destructive Testing market driver impact

Fig. 9 Non-Destructive Testing market restraint impact

Fig. 10 Non-Destructive Testing market opportunity impact

Fig. 11 Non-Destructive Testing penetration and growth prospects mapping

Fig. 12 Non-Destructive Testing market - Porter’s five forces analysis

Fig. 13 Non-Destructive Testing market - PEST analysis

Fig. 14 Non-Destructive Testing market, by offering, 2022 & 2030 (USD Million)

Fig. 15 Non-Destructive Testing market, by test methods, 2022 & 2030 (USD Million)

Fig. 16 Non-Destructive Testing market, by vertical, 2022 & 2030 (USD Million)

Fig. 17 Non-Destructive Testing market, by region, 2022 & 2030

Fig. 18 North America Non-Destructive Testing market - Key takeaways

Fig. 19 Europe Non-Destructive Testing market - Key takeaways

Fig. 20 Asia Pacific Non-Destructive Testing market - Key takeaways

Fig. 21 Latin America Non-Destructive Testing market - Key takeaways

Fig. 22 MEA Non-Destructive Testing market - Key takeawaysWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Non-Destructive Testing Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Non-Destructive Testing Test Methods Outlook (Revenue, USD Million; 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- Non-Destructive Testing Vertical Outlook (Revenue, USD Million; 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Others

- Oil & Gas

- Non-Destructive Testing Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- North America Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- North America Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Others

- Oil & Gas

- U.S. Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- U.S. Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- U.S. Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Others

- Oil & Gas

- Canada Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Canada Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- Canada Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Others

- Oil & Gas

- North America Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Europe

- Europe Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Europe Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- Europe Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- U.K. Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- U.K. Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- U.K. Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- Germany Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Germany Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Germany Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- France Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- France Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- France Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- Europe Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Asia Pacific

- Asia Pacific Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Asia Pacific Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- Asia Pacific Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- China Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- China Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- China Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- India Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- India Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- India Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- Japan Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Japan Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- Japan Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- South Korea Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- South Korea Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- South Korea Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- Asia Pacific Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Latin America

- Latin America Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Latin America Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- Latin America Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- Brazil Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Brazil Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- Brazil Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- Mexico Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Mexico Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- Mexico Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- Latin America Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Middle East & Africa (MEA)

- Middle East & Africa (MEA) Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Middle East & Africa (MEA) Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- Middle East & Africa (MEA) Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- Saudi Arabia Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- Saudi Arabia Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- Saudi Arabia Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- South Africa Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Services

- Equipment

- South Africa Test Methods Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional NDT Method

- Visual Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Ultrasonic Testing

- Radiographic Testing

- Digital/Advanced NDT

- Method Digital Radiography (DR)

- Phased Array Ultrasonic Testing (PAUT)

- Pulsed Eddy Current (PEC)

- Time-Of-Flight Diffraction (TOFD)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Traditional NDT Method

- South Africa Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Manufacturing

- Aerospace and Defense

- Construction

- Automotive

- Power Generation

- Oil & Gas

- Middle East & Africa (MEA) Offering Outlook (Revenue, USD Million, 2017 - 2030)

- North America

Non-destructive Testing Market Dynamics

Driver: Technological advancements in NDT

The main objectives of non-destructive testing are the assessment, examination, and testing of materials, assemblies, and components that are either raw materials or parts of a system. NDT ensures that the features of the thing being tested are not changed or interfered with, ensuring that the thing will continue to function consistently once the test is over. NDT has seen several technical developments throughout the years, primarily due to improvements in tools and processes. For example, conventional test techniques utilized in NDT welding included radiography, liquid penetrant, visual, and ultrasonic testing to assess the quality of the welds. Nevertheless, it turned out that these methods needed to be revised to quantify flaws. The application of image and signal processing techniques in combination with traditional testing methods has been made possible by recent developments in NDT technology, which has significantly improved test and derived result quality.

Additionally, advancements in testing apparatus and protocols have significantly improved concrete structure defect identification. Test results have improved due to the application of cutting-edge methods, such as the Ultrasonic Plus Velocity (UPV) approach, which uses the compression wave methodology. Additionally, the UPV approach allows for semi-continuous data collection for any structure, significantly increasing testing speed and data quality.

Driver: Growing industrialization and urbanization

Global industrialization and urbanization rates have accelerated due to notable economic stability in several countries. The creation of industrial centers, automation of already-existing facilities, and rising building costs have all contributed to the manufacturing sector's increased need for raw materials, systems, and components. In actuality, NDT may be used to test assemblies, components, and raw materials at any level of the production process. NDT is crucial for testing and evaluating the current equipment and systems, and it also plays a significant part in the manufacturing stage. In addition, the construction sector is expanding at the quickest rate and shows no indications of slowing down shortly. Global urbanization and population growth are driving the need for visual and non-visual assessment of structures. NDT is frequently employed for several tasks, including finding concrete cracks and evaluating the material's and the structure's strength. For the duration of the projection, the expansion of the construction sector worldwide is thus anticipated to drive demand for NDT.

Restraint: Lack of skilled workforce

NDT techniques necessitate the use of sophisticated machinery with similarly complicated operations. Tests involving several NDT techniques, including penetrant, ultrasonic, magnetic particle, and CT testing, must be performed by qualified personnel. In addition, the expensive price makes it impossible for an inexperienced technician to utilize the equipment. For the reasons listed above, technicians undertaking NDT operations must be certified by reputable organizations and have proper training. In addition to requiring a graduate or undergraduate degree, most NDT training programs favor applicants with prior technical experience. Because of the expected low return on investment, fewer candidates engage in NDT training programs because the institutions' programs are expensive. The NDT sector needs competent staff to conduct procedures with significant speed, competence, and safety of the equipment and the entity under test. The rapid advancements in industrial processes worldwide present an excellent opportunity for exponential growth in the NDT industry. Throughout the projection period, the NDT market's expansion is anticipated to be hampered by a shortage of qualified technicians.

What Does This Report Include?

This section will provide insights into the contents included in this non-destructive testing market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Non-destructive testing market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Non-destructive testing market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the non-destructive testing market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for non-destructive testing market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of non-destructive testing market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Non-destructive Testing Market Categorization:

The non-destructive testing market was categorized into four segments, namely offering (Services, Equipment), test methods (Traditional NDT Method, Digital/Advanced NDT Method), vertical (Oil & Gas, Manufacturing, Aerospace and Defense, Construction, Automotive, Power Generation), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The non-destructive testing market was segmented into offering , test methods, vertical, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology: