- Home

- »

- Advanced Interior Materials

- »

-

Non-ferrous Scrap Recycling Market Size Report, 2027GVR Report cover

![Non-ferrous Scrap Recycling Market Size, Share & Trends Report]()

Non-ferrous Scrap Recycling Market Size, Share & Trends Analysis Report By Sector (Construction, Automotive, Consumer Goods, Industrial Goods), By Metal (Aluminum, Copper, Lead), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-828-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Advanced Materials

Report Overview

The global non-ferrous scrap recycling market size to be valued at USD 308.5 million by 2027 and is expected to grow at a compound annual growth rate (CAGR) of 2.8% from 2020 to 2027. The increasing demand for non-ferrous scrap in secondary production coupled with end-use industries is anticipated to propel market growth across the forecast period. Growing consumer demand has propelled manufacturers to increase their production of electronics, vehicles, and other products. In addition, rapid industrialization across the world has led to increasing demand for non-ferrous scrap. As a result, more emphasis is being given to its collection and recycling. For example, European Aluminum released its “Circular Aluminum Action Plan”, which aims at achieving the full potential of aluminum for a circular economy by the year 2030.

Recycling of aluminum gives rise to various industrial and environmental opportunities in Europe. The Circular Aluminum Action Plan forecasts that 50.0% of Europe’s aluminum demand can be supplied through post-consumer recycling if the correct policy framework is put in place. The high recycling rate of aluminum in Europe, which is over 90.0% in the automotive and building sectors, and over 75.0% in beverage cans is a positive aspect of the plan to become successful.

Non-ferrous metals including aluminum, copper, lead, nickel, and zinc have the ability to be recycled over and over without losing their chemical or physical properties. This ability further augments the demand for non-ferrous scrap, which is collected from various end-use industries and processed at recycling centers for further use. Rising society awareness of the environment, economy, and energy saving in terms of recycling these metals is a growth driver for the market.

Non-ferrous metals account for a small volume share compared to ferrous in the industry, however, in terms of value, they have a higher share. The large revenue share is due to a higher market price compared to ferrous, which is another reason to emphasize recycling in order to reduce the manufacturing costs. The high price of these metals is a motivator for consumers pushing them towards recycling, as they find a fair price from non-ferrous scrap dealers in exchange for their old products, which becomes a source for extracting metals like aluminum and copper.

The growth of the market in terms of both revenue and volume is facing a declining trend on account of the spread of the covid-19 pandemic, as of 2020. Amidst the lockdown scenario, the demand for non-ferrous scrap has declined drastically. Although recycling has been considered as an essential service in several countries, the demand for non-ferrous scrap has been declining owing to low manufacturing activities, restricted transportation, and social distancing protocols.

In the U.S., scrap exports have declined to owe to the unavailability of containers. In Europe, due to a shortage of workers and government protocols, the manufacturing activities are running at extremely low capacity leading to less demand for non-ferrous scrap. In addition, factors like social distancing have compelled recycling firms to stop the collection of non-ferrous scrap from third parties. Such measures have compelled many non-ferrous scrapyards to shut down.

Non-ferrous Scrap Recycling Market Trends

During the forecast period, the market is anticipated to rise due to the rising demand for non-ferrous scrap in end-use and secondary production industries that pushed the manufacturers to ramp up the production for automobiles, electronics, and other goods. In addition, the increased industrialization globally has resulted in an increase in the demand for non-ferrous scrap. As a result, a greater focus is being placed on its recollection and recycling. Furthermore, rise in public awareness about the environment, economy, and energy conservation in the recycling of these metals is driving the market growth. However, with the increase in complexity of goods it makes recycling more difficult. Furthermore, uncontrolled metal waste collection in developing countries and strict regulations restricting open and fair scrap metal trade are two concerns that are expected to restrict the market's expansion.

The scarcity of earth metals and the high cost of mining them are driving the scrap recycling sector to fulfill the rising demand for non-ferrous metals. The rising automobile and the construction industry in developing economies such as India and China are resulting in the rise in demand for non-ferrous metals. As a result, these countries are anticipated to offer huge opportunities for the non-ferrous scrap recycling market.

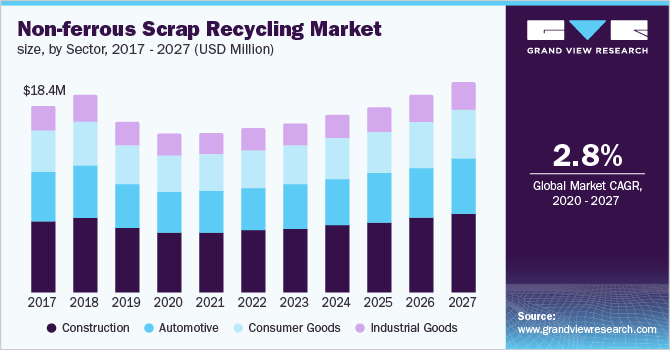

Sector Insights

The construction segment dominated the market and held a revenue share of over 36.0% in 2019. Non-ferrous scrap collection has been segmented based on four sectors; construction, automotive, consumer goods, and industrial goods. A huge amount of non-ferrous scrap is collected from the construction industry, for example, copper from pipes and tubing; aluminum from window frames, shop fronts, curtain walling, door handles, and other structures, and zinc from roofing and galvanized steel products.

Despite the largest share, construction is anticipated to witness a low growth rate compared to other sectors owing to the durability of the non-ferrous materials and the long life span of structures before they can be used for scrap. However, the sector is anticipated to dominate the market on account of rapid industrialization and infrastructural developments with more use of non-ferrous metals across the forecast period.

Consumer goods are anticipated to witness the fastest growth rate across the forecast period on account of the increasing usage of non-ferrous metals in household appliances and rising consumer awareness of recycling. Electronics and appliances tend to have a short lifespan and when they are beyond repair it is advisable to recycle them. Appliances such as refrigerators, dishwashers, air conditioners, and dryers consist of copper tubing, which can be recycled.

Automotive held the second-largest volume share in 2019. Despite the decline in automotive production past couple of years; millions of vehicles are discarded annually across the globe. Automotive is a reliable source for recycling as over 25.0 million tons of materials are recycled from automobiles every year. Cars are the most recycled item in the U.S. The country recycles over 12 million cars annually and the figure is around 8 million for Europe.

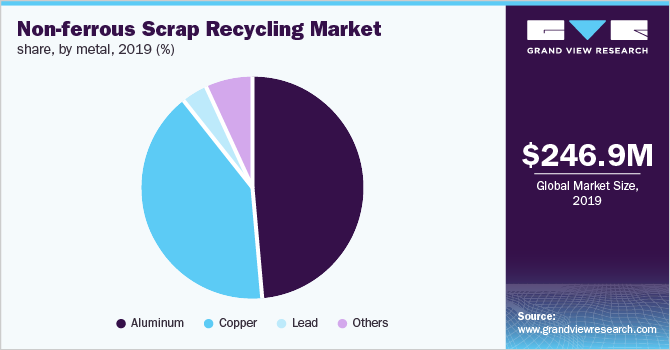

Metal Insights

Aluminum dominated the non-ferrous scrap recycling market and held the largest volume share of over 48.0% in 2019. Increasing demand for recycled aluminum from construction, automotive, and packaging industries has augmented the demand for its scrap. For instance, in August 2019, demand for recycled aluminum grew by 800 basis points in India from three years ago. The construction and automotive sectors are major contributors to aluminum scrap, followed by packaging. Around 70-90% of cans are processed in developed countries and worldwide processing is nearly 50.0%.

Copper is one of the most expensive non-ferrous metals. It is extensively used in the construction and consumer goods industry owing to its property of conducting electricity. It is used in pipes, electric cables, and electrical components. Copper can be found in most electronic and household appliances. For example, a computer contains about 1.5 kilograms of copper. Around 90% of copper used in civil infrastructure is recycled.

Lead is among the most recycled non-ferrous metal. Recycled lead is a major raw material in the production of new lead products. Batteries are the major application of lead and their recovery rate is 100.0%. The lead-acid battery is known to be the most recycled consumer product across the globe, according to Battery Council International and EUROBAT. Lead scrap is mostly obtained from automotive batteries, but it is also obtained from the construction industry owing to its application as lead sheets.

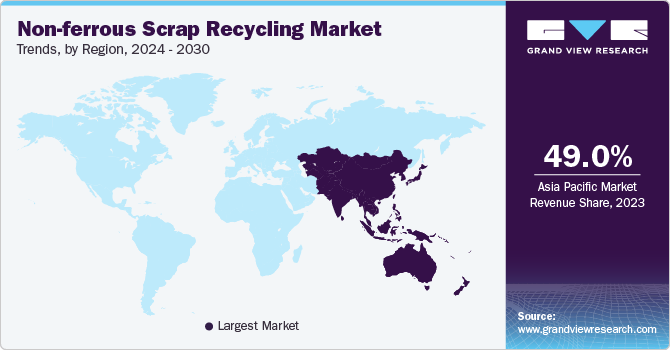

Regional Insights

The Asia Pacific dominated the market and accounted for the largest revenue share of 45.4% in 2019. India is anticipated to witness a significant growth rate in the Asia Pacific during the forecast period, in terms of recycling. The country generates a huge amount of non-ferrous metal scrap, however, a largely unorganized market along with insufficient awareness leads to a major proportion going to landfills rather than recycling centers. Where the average global recycling rate is around 45.0%, India’s rate is 25.0%. The statistics indicate the huge potential for the market to grow. The country generated 120 kilotons of aluminum scrap in 2016, the automotive and power sectors being the major contributors.

North America held a revenue share of over 20.0% in 2019 of the global market. The share and growth in the region is majorly attributable to the recycling industry in the U.S. Non-ferrous scrap is of high significance in the U.S., as according to the Institute of Scrap Recycling Industries, Inc. it accounts for nearly 50% of the overall value of traded recycled materials in the country. The country is a key importer and exporter of aluminum scrap and is amongst the leading producers of secondary aluminum in the world.

Europe held the second-largest revenue share of the market in 2019. The growth in the region is owing to technological advancements in scrap generation and processing. For example, in April 2020, with an aim toward achieving complete recovery of valuable materials, Erdwich-Zerkleinerungs-Systeme GmbH, developed a plant for separating non-ferrous metals from heavy & light materials.

Recycling is of key significance in the region as Europe is a leading exporter of non-ferrous metal scrap. Germany, the United Kingdom, and France are amongst the top five aluminum scrap exporters in the world. Europe accounts for a major share of global aluminum consumption, where Germany is its main market. The automotive industry is the major contributor to aluminum and copper scrap generation in the region.

Key Companies & Market Share Insights

A large number of recyclers, scrap yards, and key producers of secondary metals in the industry makes the market highly competitive and unorganized in nature. Considering the low volume and high value of non-ferrous scrap, the market has huge potential to further grow. The rising significance of recycling non-ferrous metals is attracting prominent players in the industry to invest in the market, especially in developing nations. For example, in September 2018, Hindalco Industries announced the investment of a sum of over USD 480 million in establishing recycling plants in Gujarat, India. The aluminum recycling plant is expected to have a processing capacity of around 300 kilotons per year.

Recent Developments

-

In May 2022, Sims Metal Management Inc., a global recycling giant invested $88 million for a plot of property in Brisbane's portside suburb of Pinkenba to secure one of the few remaining locations with deep water access. The company plans to create a metals processing and resource renewal facility for non-ferrous and ferrous metals

-

In June 2022, Aurubis the largest copper producer and recycler in Europe announced an investment of USD 320 million for the construction of a multimetal recycling plant in Georgia. The plant will help in waste reduction while supplying essential metals to businesses that design batteries for electric cars and other products and alternative energy sources like solar and wind

-

In October 2021, Grossman Iron and Steel Company was sold by Brown Gibbons Lang & Company to The David J. Joseph Company (DJJ), a Nucor Corporation operational unit. The acquisition demonstrates the BGL team's extensive experience with ferrous and non-ferrous scrap metal processing companies

Some of the prominent players in the non-ferrous scrap recycling market include:

-

Sims Metal Management Inc.

-

OmniSource Corp.

-

TSR Recycling GmbH & Co. KG

-

Aurubis

-

Kuusakoski

-

Hindalco Industries Ltd.

-

Matalco Inc.

-

SA Recycling LLC

Non-ferrous Scrap Recycling Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 236.5 million

Revenue forecast in 2027

USD 308.5 million

Growth rate

CAGR of 2.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Sector, metal, region

Regional scope

North America; Asia Pacific; Europe; Central & South America; Middle East & Africa

Country scope

The U.S.; Canada; Mexico; Germany; The U.K.; France; China; Japan

Key companies profiles

Sims Metal Management Inc.; OmniSource Corp.; TSR Recycling GmbH & Co. KG; Aurubis; Kuusakoski; Hindalco Industries Ltd.; Matalco Inc.; SA Recycling LLC

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-ferrous Scrap Recycling Market SegmentationThis report forecasts revenue at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global non-ferrous scrap recycling market report on the basis of sector, metal, and region:

-

Sector Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Construction

-

Automotive

-

Consumer goods

-

Industrial goods

-

-

Metal Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Aluminum

-

Copper

-

Lead

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

The U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global non-ferrous scrap recycling market size was estimated at USD 246.9 million in 2019 and is expected to drop to USD 236.5 million in 2020.

b. The non-ferrous scrap recycling market is expected to grow at a compound annual growth rate of 2.8% from 2020 to 2027 to reach USD 308.5 million by 2027.

b. Construction dominated the non-ferrous scrap recycling market with a share of over 36.0% in 2019, owing to extensive use of materials like aluminum and copper in the industry, which leads to a huge amount of scrap generation.

b. Some of the key players operating in the non-ferrous scrap recycling market include Sims Metal Management Inc., OmniSource, SA Recycling, Hindalco Industries Inc., Kuusakoski, and Chiho Environmental Group.

b. The high cost of producing primary metals coupled with increasing consumer awareness pertaining to recycling is anticipated to drive the non-ferrous scrap recycling market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."