- Home

- »

- Homecare & Decor

- »

-

Nonstick Cookware Market Size Report, 2021-2028GVR Report cover

![Nonstick Cookware Market Size, Share & Trends Report]()

Nonstick Cookware Market Size, Share & Trends Analysis Report By Raw Material (Teflon Coated, Ceramic Coating), By Distribution Channel (Supermarkets & Hypermarkets, Online), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-3-68038-254-9

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

The global nonstick cookware market demand was 206.1 million units in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.0% from 2021 to 2028. Increased spending on home repair projects or remodeling is driving up the demand for nonstick cookware, thanks to customers' growing preference for modular kitchens. According to Houzz's 10th annual Houzz & House survey, home renovations increased by 15% in the previous year, with kitchens, outdoor areas, home offices, and technology receiving the most attention. Another aspect driving demand for nonstick cookware is the surge in popularity of home cooking, particularly during the ongoing COVID-19 pandemic. Consumers are not only experimenting with new dishes at home but also honing their culinary talents.

Self-cooked meals are one of the main drivers of the nonstick cookware industry and 37% of individuals think consuming immunity-boosting foods has become more of a priority since the pandemic began, according to Mintel. The rapid expansion in commercial construction, particularly in developing economies such as India and China, is paving the way for eateries, restaurants, and food joints, indicating rising growth prospects for nonstick cookware products. The increasing number of meals consumed away from home due to the surge in the working population worldwide will further fuel the market growth, particularly in the commercial segment.

The growing culture of house parties in western countries is resulting in increased use of nonstick cookware at home, such as pans, pots, whisks, and other cookware, in order to provide quality food to the guests. Rising consumer preference for eating outside, whether as a form of social gathering or for trying foods of different cultures, is paving the way for more eateries and food joints serving diverse cuisines. These commercial spaces are generating a high demand for nonstick cookware in order to serve more customers in a shorter time period without compromising on quality or presentation.

High competition and rapidly changing consumer demand are likely to facilitate the development of innovative products, leading to high R&D costs for manufacturers. Nonstick cookware products find use in both commercial and household applications. In commercial applications, these products are used in restaurants, hotels, resorts, food stations, and other public eateries.

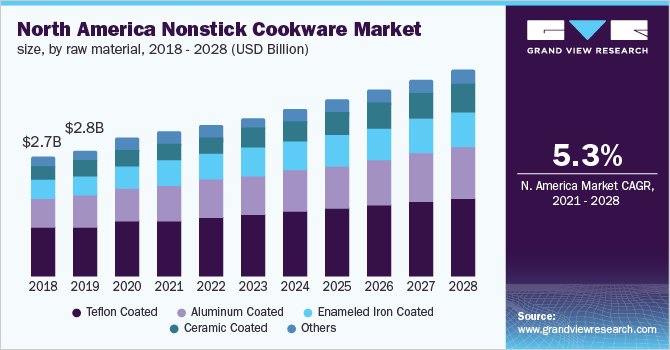

Raw Material Insights

The teflon-coated segment held the largest volume share of 47.0% in 2020. Because of its stiffness and longevity, this cookware type has always been the most popular among middle-income families. Cookware lined with Teflon has a frictionless surface which helps in cooking the food easily.

Millennials are projected to be one of the primary buyer groups of cookware products following the pandemic. As a result, industry participants are focusing on millennials and offering them a one-stop-shop for home cooking. For example, in September 2019, Equal Parts, a kitchen brand, debuted a new line of non-stick, non-toxic cookware.

For players to thrive in this competitive industry, continuous research and development to improve technologies that form the backbone of the market is recommended. Product releases and innovations have been noted to play an important role in market growth. However, the high cost of non-stick cookware and the availability of low-cost, high-durability alternatives, such as aluminum and stainless steel, limit the market growth.

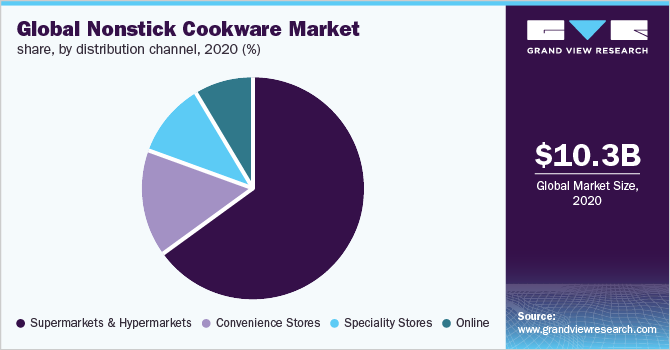

Distribution Channel Insights

The supermarkets and hypermarkets segment accounted for the largest revenue share of 59.7% in 2020. While shopping at a supermarket or hypermarket, people are more likely to be selective and observant as a product on the shelf may readily be compared to those of other brands before making a purchase decision. Nonstick cookware is accessible in a variety of price ranges at supermarkets and hypermarkets and consumers can choose from a variety of local and worldwide brands.

The easy availability of cookware across many sales channels and the increasing penetration of the internet have raised the demand for non-stick cookware through e-commerce sites. Online distribution channels have seen a boom in sales as they allow buyers to access premium and global brands with well-informed information about the product.

Regional Insights

In 2020, Europe held the largest revenue share of 37.7%. The concept of innovation and uniqueness through the use of diverse colors and personalized collections is what attracts consumers in Europe. In Europe, aluminum nonstick cookware is the most popular category in the market. The region is home to a large number of aluminum cookware manufacturers and within this category, the types of products vary significantly-from pressed aluminum and forged to die cast-depending upon the production process and the price positioning consumers look for.

Several consumers in the region prefer riveted and welded fixing systems for the handles. The consumers’ preference for pressed aluminum cookware with riveted handles is due to their budget-friendly nature and their easy availability in supermarkets, bazaars, and distribution centers. These are usually simple-looking products, mainly in black or dark colors, are perfect for daily use, and are often sold in bi or tri packs.

Key Companies & Market Share Insights

Companies have been focused on inorganic development strategies to penetrate regional markets and take advantage of the growth potential. Mergers and acquisitions are among the corporate strategies that help organizations grow their market share. Showa Denko K.K. (SDK) purchased all of the shares of the ILAG Group, a specialty non-stick coating chemicals manufacturer based in Zurich, Switzerland, in May 2019. ILAG's non-stick coatings are used in both consumer and industrial goods.

In order to sustain their market presence, key companies are progressively focusing on introducing new products and product development. For instance, in February 2020, Fissler added three new products to the existing cenit pan series, which now includes the cenit pan, cenit induction pan, and cenit induction serving pan. Some prominent players in the global nonstick cookware market include:

-

Groupe SEB (Tefal, All-Clad Group, WMF)

-

Tefal

-

All-Clad Group

-

WMF

-

Newell Brand Inc. (Calphalon)

-

Cuisinart

-

Meyer Corporation

-

TTK Prestige Limited

-

Scanpan USA, Inc.

-

Hawkins Cookers

-

The Cookware Company

Nonstick Cookware Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 10.79 billion

Revenue forecast in 2028

USD 15.39 billion

Growth Rate

CAGR of 5.2% from 2021 to 2028

Market demand in 2021

212.9 million units

Volume forecast in 2028

281.4 million units

Growth Rate

CAGR of 4.0% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion, volume in million units, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; China; India; Brazil; South Africa

Key companies profiled

Groupe SEB (Tefal, All-Clad Group, WMF); Tefal; All-Clad Group; WMF; Newell Brand Inc. (Calphalon); Cuisinart; Meyer Corporation; TTK Prestige Limited; Scanpan USA, Inc.; Hawkins Cookers; The Cookware Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global nonstick cookware market report on the basis of raw material, distribution channel, and region:

-

Raw Material Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

-

Teflon Coated

-

Aluminum Coated

-

Enameled Iron Coated

-

Ceramic Coated

-

Others

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia pacific

-

China

-

India

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nonstick cookware market size was estimated at USD 10.29 billion in 2020 and is expected to reach USD 10.79 billion in 2021.

b. The global nonstick cookware market is expected to grow at a compound annual growth rate of 5.2% from 2021 to 2028 to reach USD 15.39 billion by 2028.

b. Europe dominated the nonstick cookware market with a share of 37.7% in 2020. This is attributable to the increasing emphasis on cookware functionality and aesthetics among consumers in developed economies such as Germany and the U.K.

b. Some key players operating in the nonstick cookware market include TTK Prestige Limited, Newell Brands, Groupe SEB, Scanpan, Hawkins Cookers, All-Clad, Calphalon, Cuisinart, Cook N Home, and Tefal.

b. Key factors that are driving the nonstick cookware market growth include product characteristics & features such as easy cleanliness, excellent scratch resistance, and ability to uniformly distribute heat in the pan.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."