- Home

- »

- Smart Textiles

- »

-

Nonwoven Disposable Gloves Market Size Report, 2030GVR Report cover

![Nonwoven Disposable Gloves Market Size, Share & Trends Report]()

Nonwoven Disposable Gloves Market Size, Share & Trends Analysis Report By Technology (Spunlace, Needle-punched), By End-use (Laboratory, Janitorial), By Product (Non-soaped, Pre-soaped), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-497-0

- Number of Pages: 152

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global nonwoven disposable gloves market size was estimated at USD 884.9 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030. Global healthcare spending has been increasing considerably over the past few years. The demand for healthcare services and products has led to the increased use of nonwoven disposable gloves in medical devices and other medical supplies, such as drapes, bedsheets, masks, gloves, etc. In addition, the increasing geriatric population across developed nations is expected to drive the demand for healthcare spending over the forecast period. Increasing birth rates and awareness about the benefits of hand hygiene are expected to drive product demand over the forecast period.

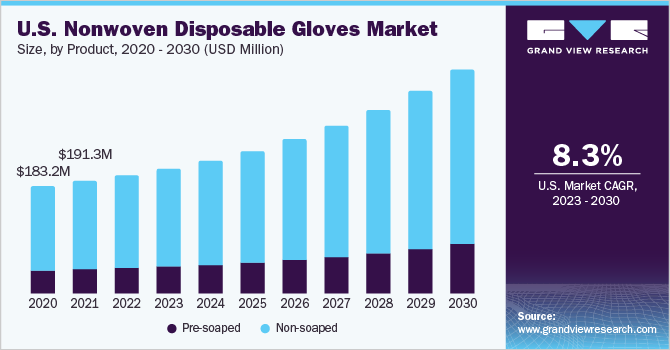

In addition, the use of wash gloves in spas and other domains of the hospitality industry is expected to drive its demand in developed economies over the forecast period. In the U.S., the healthcare application segment accounted for the largest share in 2022 on account of high productpenetration in the healthcare industry to prevent pathogen and germ transmission in healthcare facilities. The rising demand for perfume, alcohol, and paraben-free wash gloves, which are hypoallergenic and dermatologically tested, is driving the U.S. market over the forecast period. Simple cleaning using non-soaped wash gloves no longer suffices as over 50% of the population in the region has sensitive skin and has tested positive for one or more allergens.

The increasing prevalence of skin sensitivity among newborns and the elderly is expected to drive the demand for pre-soaped wash gloves over the forecast period. For instance, in the U.S., smoking, the leading cause of preventable death, causes nearly 500,000 deaths annually and causes smokers to die 10 years earlier than non-smokers. This decline in life expectancy was caused by rising mortality rates among working-age adults, particularly those from lower socioeconomic status. The growing health concerns owing to unhealthy lifestyles are expected to drive the demand for healthcare services and the need for advanced medical infrastructure, which, in turn, will drive the demand for medical products and devices.

The adoption of new practices in medical and healthcare industries and the development of advanced medical care products and devices are expected to have a positive impact on the use of medical services across the globe. In addition, the increasing disposable income in developing economies is expected to enable them to avail of advanced healthcare services and use improved products, which is expected to drive the expenditure in the healthcare industry. For instance, spending on healthcare in the U.S. increased 2.7% in 2021 to USD 4.3 trillion, or USD 12,914 per person and the spending on healthcare accounted for 18.3% of the country’s GDP.

Technology Insights

The spunlace technology segment led the market in 2022 and accounted for more than 54.30% of the global revenue share. This technology offers a high strength-to-weight ratio, soft and even surface, good absorbency, and excellent processability to nonwoven materials. It also offers low processing costs and lint-free nonwoven disposable gloves. Due to its low costs and environmentally friendly production method, it holds a substantial market share. The wetlaid technology segment accounted for a considerable revenue share in 2022. It is a low-cost production technology with a high production rate. The technology is used to manufacture nonwoven fabric from staple fibers, which undergo a sequence of opening and mixing processes followed by web formation and adhesive or thermal bonding process.

The airlaid technology segment is likely to grow at a significant CAGR over the forecast period. This technology is used to manufacture lightweight nonwovens ranging from low to high densities. Airlaid nonwoven fabric offers low density, high softness, and great versatility of fiber blends, which finds application in hygienic products, adult continence, wet & dry wipes, tabletop products, wound care products, and healthcare products, such as disposable gloves. The needle-punched technology segment also had considerablegrowth. Needle-punched wash gloves are highly absorbent, antibacterial, and have high strength properties, whichsupportsegment penetration in various application industries. Thus, these gloves are used for absorbing and wiping oil & water, as well as for cleaning bedridden patients in hospitals, nursing homes, and homecare settings.

Product Insights

The pre-soaped product segment is estimated to register the fastest CAGR of 9.2% from 2023 to 2030. Soft nonwoven disposable gloves that are pre-soaped or un-soaped are typically utilized in medical settings for thorough cleaning of body parts. In addition, pre-soaped nonwoven disposable gloves are primarily used in healthcare facilities, where the risk of cross-contamination and Hospital-acquired Infections(HAIs) is high. Pre-soaped wash gloves are used as warm and cold products, which can be heated in a microwave or stored in a refrigerator. Rising demand for pre-soaped gloves intended for cleaning extra-sensitive skin during radiation treatment is expected to drive the segment over the forecast period.

The non-soaped product segment will register a steady CAGR over the forecast period. Nonwoven disposable gloves are cost-efficient products that offer efficient hygienic cleaning solutions while preventing the transmission of microorganisms from one part of the body to other body parts, as well as to the external environment, as the gloves are immediately discarded after use. Non-soaped wash gloves are cost-efficient, highly absorbent, and used with soap, lotion, or water. These gloves can dry patients easily & quickly, and are used during maternity and for outpatients & baby care in hospitals, nursing homes, and households. Non-soaped wash gloves have applications in hygiene and cleaning verticals. The products are expected to have a high demand from salon and spa facilities over the forecast period.

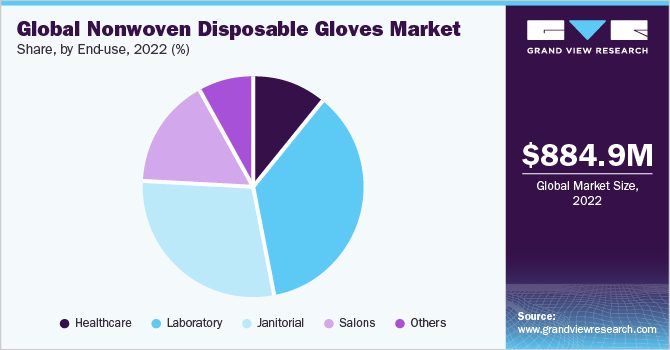

End-use Insights

The laboratory end-use segment accounted for the maximum revenue share of more than 36.05% in 2022. Nonwoven disposable gloves are significantly used in laboratories to prevent accidents from chemicals, sharp-edged objects, and other cold or hot materials. These gloves are removed and thrown away as soon as they get contaminated as they are only meant to be used as a temporary physical barrier against chemical contact. The healthcare end-use segment also held a considerable revenue share in 2022. In addition to being used in a variety of products in nursing homesandhospitals, nonwoven disposable gloves are also used in the filtering of clean air and on a personal level to fight infection.

10% of patients contract an infection while receiving medical care, according to the WHO. With effective infection control and treatment, HAIs can be reduced by at least 30%. To protect against biological dangers, nonwoven disposable gloves are frequently used in the medical sector and other industries. They offer essential safety aspects including illness and infection prevention. The aforementioned factors are anticipated to drive market growth. The janitorial end-use segment will register the fastest CAGR over the forecast period. Disposable gloves are necessary for workers in the janitorial and sanitation sector to protect themselves from a variety of health and safety dangers.

The main danger that these workers face comes from the cleaning agents themselves. Six out of every 100 professional janitors experience chemical-related accidents, including skin burns, according to the Hawaii Department of Health. Glass, metal, and other cleaners may contain hazardous substances, such as hydrofluoric acid, nitrilotriacetate, and phosphoric acid. Therefore, the growing product scope is anticipated to fuel the segmentgrowth over the forecast period. The salons end-use segment is likely to grow at a significant CAGR over the forecast period.

Esthetician nonwoven disposable gloves must be designed for superior performance in the spa or salon environment if they are to be used for commercial beauty services. With their chemical resistance, nonwoven disposable gloves are useful in spa and salon settings. Nonwoven disposable gloves protect against chemical contaminationwhen exposed to color, bleach, or wax nails. Thus, these benefits will augment theproduct demand over the forecast period.

Regional Insights

Europe accounted for the largest revenue share of more than 35.90% in 2022. The region has witnessed technological advancements for manufacturing nonwoven fibers with improved absorbency, tear resistance, color-free, fragrance-free materials, and low tint, thus, leaving less residual fiber after use.The application of efficient and cost-effective spunlace nonwoven fabric in manufacturing disposable gloves has high market penetration, both globally and regionally. The Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period. The growing aging population coupled with increasing consumer concern regarding hygiene and HAIs is expected to drive product demand, in turn, boosting the market growth. Central & South America is expected to witness significant growth owing to increasing product penetration in the healthcare industry.

The presence of major spunbond nonwoven fabric manufacturing companies, such as DUCI and Fibertex, in Brazil and Argentina has resulted in increased penetration of the fabric in the manufacture of disposable medical products, such as gloves. North America also held a significant revenue share in 2022. The product demand in North America is expected to witness moderate growth over the forecast period owing to the continuous demand from the healthcare industry. The market is expected to grow at a slower pace compared it its nearing maturity. However, technological advancements resulting in superior product properties including high tear resistance, effective infection control measures, and reduced risk of cross-contamination are expected to play a significant role in driving the region’s growth over the forecast period.

Key Companies & Market Share Insights

Manufacturers adopt several strategies, including acquisitions geographical expansions, new joint ventures, product developments, and mergers to enhance market penetration and to cater to the changing technological requirements of various applications, such as healthcare, laboratory, janitorial, and salons. For instance, in February 2021, Pastel Glove Sdn. Bhd. was granted a manufacturing license by the Ministry of International Trade and Industry Malaysia (MITI) for the creation of medical-grade nitrile-& natural rubber-based examination gloves. Some of the prominent players in the global nonwoven disposable gloves market include:

-

A.M.G. Medical, Inc.

-

Medical Depot, Inc. dba Drive DeVilbiss Healthcare

-

Cleanis SASU

-

Mediberg S.r.l.

-

Hefei Telijie Sanitary Material Co., Ltd.

-

BODY Products GmbH

-

Shanghai Dragon Medical Co., Ltd.

-

Laian Yonghao Sanitary Material Co., Ltd.

-

Riway Group

-

Suzhou Suning Underpad Co. Ltd.

Nonwoven Disposable Gloves Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 938.7 million

Revenue forecast in 2030

USD 1.72 billion

Growth rate

CAGR of 8.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; France; Germany; Italy; Russia; Spain; U.K.; Germany; France; China; India; Japan; South Korea; Brazil; Chile; Peru; South Africa

Key companies profiled

A.M.G. Medical, Inc.; Medical Depot, Inc.; dba Drive DeVilbiss Healthcare; Cleanis SASU; Mediberg S.r.l.; Hefei Telijie Sanitary Material Co., Ltd.; BODY Products GmbH; Shanghai Dragon Medical Co., Ltd.; Laian Yonghao Sanitary Material Co., Ltd.; Riway Group; Suzhou Suning Underpad Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nonwoven Disposable Gloves Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nonwoven disposable gloves market report on the basis of technology, product, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Spunlace

-

Wetlaid

-

Airlaid

-

Needle-punched

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-soaped

-

Non-soaped

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Laboratory

-

Janitorial

-

Salons

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Russia

-

Spain

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Chile

-

Peru

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nonwoven disposable gloves market size was estimated at USD 884.9 million in 2022 and is expected to reach USD 938.7 million in 2023

b. The nonwoven disposable gloves market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.7% from 2023 to 2030 to reach USD 1.72 billion by 2030

b. Europe dominated the nonwoven disposable gloves market with a revenue share of 35.0% in 2022. The region has witnessed technological advancements for manufacturing nonwoven fibers with improved absorbency, tear resistance, color-free, fragrance-free materials, and low tint, thus, leaving less residual fiber after use. The application of efficient and cost-effective spunlace nonwoven fabric in manufacturing disposable gloves has high market penetration, both globally and regionally.

b. Some of the key players operating in the nonwoven disposable gloves market • A.M.G. Medical, Inc. Medical Depot, Inc. dba Drive DeVilbiss Healthcare, Cleanis SASU, Mediberg S.r.l., Hefei Telijie Sanitary Material Co., Ltd., BODY Products GmbH, Shanghai Dragon Medical Co., Ltd., Laian Yonghao Sanitary Material Co., Ltd., and among others.

b. The key factors that are driving the nonwoven disposable gloves market include rising product demand from healthcare industry including hospitals, nursing homes and home healthcare. Furthermore, an increasing geriatric population across the developed nations is expected to drive the demand for healthcare spending over the forecast period thereby resulting into market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."