- Home

- »

- Plastics, Polymers & Resins

- »

-

Nordic Beverage Packaging Market Size, Share, Industry Report, 2025GVR Report cover

![Nordic Beverage Packaging Market Report]()

Nordic Beverage Packaging Market Analysis Report By Product (Cans, Bottles & Jars, Pouches, Cartons), By Material (Plastic, Paper, Glass, Metal), By Application (Alcoholic, Non-alcoholic), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-713-1

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Bulk Chemicals

Industry Insights

The Nordic beverage packaging market size was estimated at USD 1.66 billion in 2017. Growing demand for beverage packaging, coupled with increasing demand for carbonated and fruits and vegetable juices, is anticipated to drive product demand over the forecast period. Beverage packaging in the Nordic region is used in applications such as alcoholic and non-alcoholic beverages. Beverage manufacturers count on packaging solutions that aid in preventing leakage, chemical deterioration, and alteration in flavor of the products. Packaging also plays an important role in improving shelf appeal.

A few major players in the market have been undertaking acquisition of small and medium sized companies as their key growth strategy. The demand for non-alcoholic products in the region has been increasing consistently over the past few years. Spiraling demand for soft drinks has been positively impacting the overall demand for non-alcoholic beverages. Furthermore, increasing consumption of vegetable and fruit juices is supplementing the growth of the market in the region.

Consumers in the Nordic region prefer 100% pure fruit juices owing to increased awareness regarding ingredients used in juices. Technological advancements in packaging procedures coupled with growing focus towards sustainable packaging solutions have been working in favor of the market.

The countries have been implementing general deposit system that is solely driven by governments of Nordic countries aiming for ban on landfills. This has resulted in high end-of-life product return rates that can be recycled. The region also offers a huge opportunity for bioplastic packaging players to tap into lucrative market owing to biodegradable properties of their offerings.

Product Insights

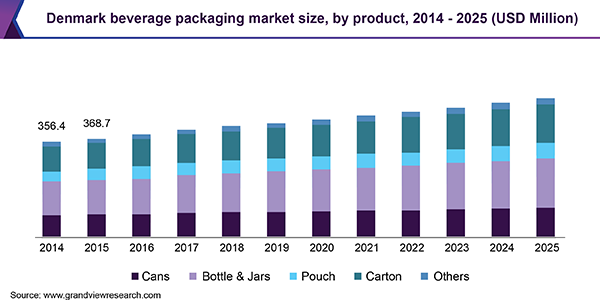

Bottles and jars, cans, pouches, and cartons are among predominantly used product types in beverage packaging in the Nordic region. In 2017, the bottles & jars segment dominated the overall market with a revenue share of just over 35.0%. Bottles & jars are preferred principally for their elegance on shelves and for the packaging of a larger quantity of liquids, compared to other packing solutions such as cans and pouches.

PET bottles have been extensively used in Nordic countries for bottling beverages such as fresh milk, fresh juices, cold brew coffee, and other cold drinks. They are preferred to increase the shelf appeal of end products. Another important factor that has led to increased use of PET bottles is recyclability. PET bottles are 100% recyclable and offer cost-saving benefits to their manufacturers.

Cartons that are ideal for packaging of beverages such as milk, soy products, and vegetable & fruit juices are expected to witness surge in demand over the coming years. They are considered to be environment-friendly in the region as they are recyclable and can be manufactured through various energy efficient processes.

Material Insights

Plastic is projected to dominate the Nordic beverage packaging market throughout the forecast horizon. The segment is further bifurcated into conventional plastics and bioplastics. Irrespective of the scale of operation, plastic is an ideal packaging solution owing to its cost-effectiveness. This has also benefited small-scale packaging manufacturers in the Nordic countries and has helped them gain access to various standardized packaging options.

The regional industry has witnessed an increased production of bio-based carton boxes in the recent past. These cartons are being delivered to a large number of international beverage brands in the region and internationally. Additional sustainable developments in recent past, including production of bioplastics from wood-based resources, has also been a major contributing factor to the growth of the overall market in the region.

Application Insights

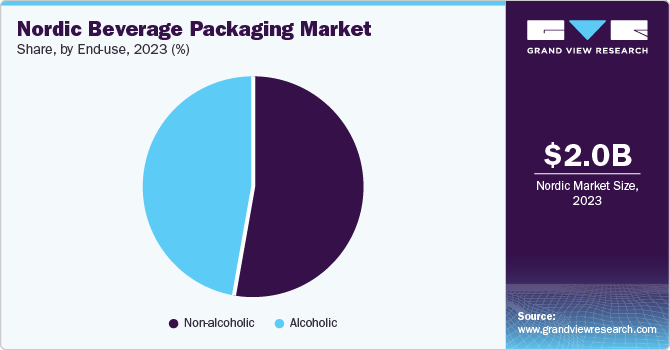

In 2017, the non-alcoholic beverages segment dominated the overall market, accounting for a share of approximately 53.0% in the overall revenue. Non-alcoholic beverages include milk, soft drinks, coffee, tea, soda, smoothies, mocktails, juices, and shakes.Rising health awareness and conscious effort to reduce consumption of alcoholic drinks has driven demand for packaging solutions in this segment.

Danish consumers, particularly consumers of alcoholic beverages, have driven demand for beverage packaging products and solutions in the region. Denmark is among the leading countries in the Nordic region that engages in the re-export of alcoholic products. Furthermore, consumer research shows that there is an ongoing trend of greater consumption of premium alcoholic beverages among elderly Danes. This has prompted beverage packaging product manufacturers to enter into supply agreements with suppliers of premium alcohol.

Regional Insights

Sweden was the leading market segment in 2017 and is expected to continue its dominance over the forecast period. Major factors driving the market in this country include considerable growth of both alcoholic and non-alcoholic beverage segments. Furthermore, rising number of microbreweries in the country has positively impacted the growth of this market.

Iceland is expected to be the fastest-growing market and is projected to expand at a CAGR of 3.85% during the forecast period. This can be attributed to increasing demand for both alcoholic and non-alcoholic beverages across the country.

Nordic Beverage Packaging Market Share Insights

The industry is characterized by the presence of both global and domestic players. Key players operating in the market compete primarily on the basis of products and services offered. With packaging entering the stage of digital transformation, market participants have turned their focus to technological advancements to sustain their competitive positions in the industry.

Some of the key players present in the industry are Amcor Limited; Mondi Plc; COVERIS; Bemis Company, Inc.; Ball Corporation; Tetra Laval International S.A.; Stora Enso; Crown Holdings, Inc.; Reynolds Group Holdings Limited; Saint-Gobain S.A.; Sonoco Products Company; ELOPAK; Synvina; Refresco Group; Kulleborn & Stenström; Alcoa Corporation; BillerudKorsnäs AB; Danish Bottling Company A/S; Altia Plc; and Trensums Food AB.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2014 - 2016

Forecast period

2018 - 2025

Market representation

Revenue in USD Million & CAGR from 2018 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Country Scope

Norway, Sweden, Denmark, Finland, Iceland

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the Nordic beverage packaging market report based on application and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Cans

-

Bottles & Jars

-

Bottles

-

Jars

-

-

Pouches

-

Cartons

-

Others

-

-

Material Outlook (Revenue, USD Million, 2014 - 2025)

-

Plastic

-

Conventional

-

Bioplastics

-

-

Paper

-

Glass

-

Metal

-

Others

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Alcoholic

-

Non-alcoholic

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

Norway

-

Sweden

-

Denmark

-

Finland

-

Iceland

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."