- Home

- »

- Communication Services

- »

-

North America Customer Experience Management Market Report, 2025GVR Report cover

![North America Customer Experience Management Market Size, Share & Trends Report]()

North America Customer Experience Management Market Size, Share & Trends Analysis Report By Analytical Tool, By Touch Point Type, By End User, By Deployment, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68039-914-4

- Number of Pages: 103

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Technology

Report Overview

The North America customer experience management market size was valued at USD 2,512.4 million in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 17.1% from 2019 to 2025. The rising adoption of big data solutions to gain insights on customer behavior and customer preferences is triggering the CEM market growth in the North America region. Additionally, the need to improve customer engagement by addressing their concerns in real-time is also expected to lead to high demand for CEM solutions in North America. CEM solutions offer quantifiable metrics and actionable insights related to the issues that impact end-users the most to help organizations improve their overall customer experience.

Moreover, the increasing rate of digitalization of processes or infrastructure in the enterprise sector is facilitating the increased adoption of automated CEM solutions in North America. The growing adoption of digital channels for interactions is allowing enterprises to gain a better understanding of the underlying needs of end-users through digital experiences. Today’s highly informed and demanding customers are presenting a growing need for on-time and personalized interaction services. Thus, it has become necessary for enterprises in the region to adopt CEM solutions that ensure consistent services.

Moreover, the increasing need for customer retention is compelling companies in North America to focus on providing diverse products and services that rank high in terms of end-user satisfaction and can help companies gain customer loyalty. Moreover, companies are focusing on providing multichannel services to deliver a seamless experience across all touchpoints. Customer experience management solutions, coupled with technologies such as business analytics and artificial intelligence, would help businesses create improved customer experience management strategies.

However, flawless implementation and a robust strategy are required for creating a seamless experience across all channels. Lack of quality control is often experienced in the case of outsourcing customer support/service operations. On certain levels, outsourced support turns out to be an expensive alternative, thereby increasing the operational costs of an organization. Companies offering outsourced CEM services can charge hefty amounts for scaling up of operations across business processes. These factors could challenge the growth prospects of the CEM market in North America in the near future.

Analytical Tool Insights

In terms of analytical tools, the text analytics segment dominated the customer experience management (CEM) market in North America, accounting for USD 1,014.9 million in 2018. It is expected to continue leading the market over the forecast period as well. Organizations are benefitting from text analytics tools to evaluate the text that was written by customers. Although text analytics can be performed manually, it may not always turn out to be a time-effective option. Hence, developing robust software for text analytics using a blend of natural language processing and text mining helps analyze massive amounts of text, saving time and resources otherwise spent on doing the task manually.

Adoption of web analytics and content management tools is also gaining traction in the North America market for CEM. Web analytics tools can be used as a diagnostic tool to understand customers and their preferences better, providing fast and comprehensive insights about changing consumer preferences. As web content management has evolved to deliver optimized customer experience throughout the customer service industry, web analytics is expected to become an integral part of customer experience management and customer service in the near future.

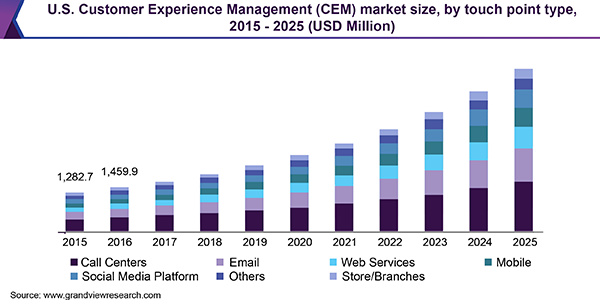

TouchPoint Type Insights

Based on the touchpoint type, the call centers segment dominated the customer experience management (CEM) market in North America in 2018, accounting for a market size of USD 850.1 million. The growth of the segment is accredited to the expanding global call center space owing to its potential of transforming the success of a brand wherein customers can expect prompt responses on call. Moreover, the increasing investment in advanced training & skill enhancement of call center workforce in the U.S. strengthens the growth prospects of the segment. On the other hand, the current scenario deals with the rising competition between digital channels and analog channels of distribution. For instance, automated solutions have cut the overhead costs of customer service operations for companies and have resulted in high customer satisfaction.

The web services touchpoint type segment is expected to register the highest CAGR in the customer experience management market in North America. Web service technologies such as WSDL and UDDI have helped organizations to reduce the time to market of a product, generate sustainable profits, and achieve consistent growth. Moreover, the increasing number of e-businesses globally is creating an increasing need for tools for assessing customer data and address their concerns to drive business growth. The adoption of CEM solutions would help to reduce the time spent in transferring data from one system to another, thereby providing a swift response to the real-time queries.

Deployment Insights

In terms of deployment, the North America CEM market for customer experience management (CEM) is segmented into the cloud and on-premise. Of these, the on-premise segment accounted for the largest share in 2018 and is likely to dominate the market throughout the forecast period. On-premise deployment of CEM tools is often preferred by large organizations for better control and data security.

Cloud deployment is the fastest-growing deployment segment in the North America market for customer experience management owing to advantages such as convenience, reasonable pricing, speed, and flexibility. The cloud offers features such as high storage capacity and real-time operation, making it a more beneficial mode of deployment from a technical perspective. For instance, live chat offers real-time engagement with the consumer under cloud hosting. In the U.S., cloud solutions are known for high agility and, hence, the deployment lifecycle experiences constant evolution. This results in a flexible platform with the need for minimal upgrades and integrations.

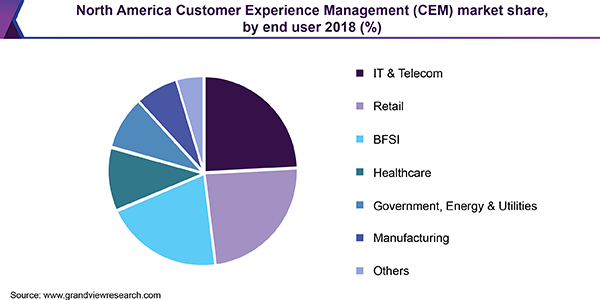

End-User Insights

On the basis of end-user, the North America customer experience management market has been segmented into IT & telecom, manufacturing, healthcare, retail, BFSI, and government, energy & utilities. The IT and telecom segment accounted for a substantial market share in 2018 and is likely to continue to hold a significant share in the market over the forecast period as well. This can be attributed to the intense competition in these industries and the increased focus of companies on digital readiness and improving front desk experience through the use of digital tools as a way of cutting marketing costs. The need for effective analytical tools for streamlining the contextual interaction process with customers and leveraging the data gathered for pattern analysis is also likely to drive the adoption of CEM tools in the IT and telecom segment in North America.

The BFSI segment is likely to witness robust growth in the North America CEM market over the forecast period. The proliferation of mobile banking, coupled with internet banking, has paved the way for the increased adoption of CEM tools in the sector. Organizations in the BFSI sector are becoming more focused on personalizing customer experience to gain public trust and build long-term customer loyalty. Moreover, enterprises are looking to understand the needs and behavior of their target audience to optimize their offerings and provide enhanced services, thereby maintaining the competitiveness in the North America market.

Country Insights

The North America CEM market has been examined for the U.S. and Canada for the report. Of these, the U.S. customer experience management market accounted for the lion’s share and is likely to grow at a promising pace over the forecast period. The U.S. has witnessed significant investments by companies for software development, network deployment, and building the latest technology in the past few years. The trend is likely to remain strong in the near future, strengthening the U.S. market for CEM over the forecast period.

The Canadian customer experience management market is also gaining momentum owing to the growing BFSI & IT sectors in the country. Canadian companies are focusing on improving customer experience by offering satisfactory services. Many organizations are focusing on implementing better CEM plans, investing in special CX teams that develop strategies to tap unsatisfied customers and improve their experience, and gain new customers and retain them through loyalty programs.

Key Companies & Market Share Insights

CEM vendors are adopting strategies such as mergers and acquisitions, new product development, and collaborations to maintain their market positions. For instance, in June 2018, Avaya Inc. released a new version of Avaya Workforce Optimization Suite. The latest version offers enhanced data privacy, employee productivity, and service quality.

In North America, companies are focusing on developing their KPIs and optimization metrics to reduce costs. The use of social media for improving customer experience is gaining popularity. Companies are employing dedicated social media customer experience management solutions to offer better services. This trend is likely to remain strong in the near future as well. Some of the prominent players in the North America customer experience management market include:

-

Adobe

-

Avaya Inc.

-

Clarabridge

-

Freshworks Inc.

-

Nokia

-

Open Text Corporation

-

Qualtrics

-

Genesys

North America Customer Experience Management Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 3.4 billion

Revenue forecast in 2025

USD 7.5 billion

Growth Rate

CAGR of 17.1% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Analytical tool, touch point type, deployment, end user,country

Country scope

U.S.; Canada

Key companies profiled

Adobe; Avaya Inc.; Clarabridge; Freshworks Inc.; Open Text Corporation; Qualtrics; Genesys

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments covered in the report

This report forecasts revenue growth at regional and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the North America customer experience management market report based on the analytical tool, touchpoint type, deployment, end-user, and country.

-

Analytical Tool Outlook (Revenue, USD Million, 2015 - 2025)

-

Enterprise Feed Management (EFM) Software

-

Speech Analytics

-

Text Analytics

-

Web Analytics

-

Others

-

-

TouchPoint Type Outlook (Revenue, USD Million, 2015 - 2025)

-

Store/Branches

-

Call Centers

-

Social Media Platform

-

Email

-

Mobile

-

Web Services

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2015 - 2025)

-

Cloud

-

On-Premise

-

-

End-User Outlook (Revenue, USD Million, 2015 - 2025)

-

BFSI

-

Retail

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Government, Energy & Utilities

-

Others

-

-

Country Outlook (Revenue, USD Million, 2015 - 2025)

-

The U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America customer experience management market size was estimated at USD 2.9 billion in 2019 and is expected to reach USD 3.4 billion in 2020.

b. The North America customer experience management market is expected to grow at a compound annual growth rate of 17.1% from 2019 to 2025 to reach USD 7.5 billion by 2025.

b. The U.S. dominated the North America customer experience management market with a share of 75.5% in 2019. This is attributable to the significant investments and allocating budgets for marketing and digital channels made by companies in the U.S.

b. Some key players operating in the North America customer experience management market include Adobe; Avaya Inc.; Clarabridge; Freshworks Inc.; Open Text Corporation; Qualtrics; and Genesys amongst others.

b. Key factors that are driving the market growth include the rising adoption of big data solutions to gain insights on customer behavior and customer preferences and the need to improve customer engagement by addressing their concerns in real-time.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."