- Home

- »

- Automotive & Transportation

- »

-

North America Electric Vehicles Market Size Report, 2021-2028GVR Report cover

![North America Electric Vehicles Market Size, Share & Trends Report]()

North America Electric Vehicles Market Size, Share & Trends Analysis Report By Product (BEV, PHEV), By Vehicle Type (PCLT, Commercial Vehicles), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-439-7

- Number of Pages: 94

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Technology

Report Overview

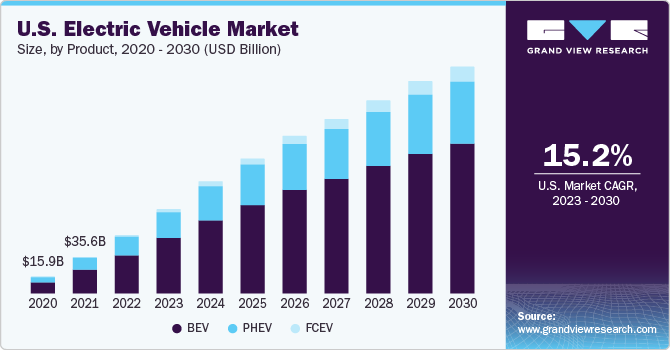

The North America electric vehicles market size to be valued at USD 147.60 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 37.2% during the forecast period. Favorable government initiatives, subsidies, and tax rebate programs to promote EV adoption will drive market growth. Additionally, several advantages of electric vehicles over conventional vehicles in terms of cost will also favor market growth over the forecast period. A decline in battery pack prices is also another factor expected to create significant growth opportunities for players operating in the market. According to a research paper published by the international council on clean transportation, battery pack prices in the U.S. are expected to drop from USD 11,500 in 2018 to USD 8,000 in 2025.

Electric vehicles are amongst the most prominent technologies that contribute to reducing air pollution. Thus, governments across the globe have proposed tax rebate programs to promote the adoption of electric vehicles. For instance, in the U.S., under the Clean Vehicle Rebate Project (CVRP), qualified applicants would be provided a rebate from the State of California, effective for applicants received on or after April 23, 2021. After meeting the eligibility requirements, the applicants would be eligible to receive cashback on a new electric vehicle based on the type selected. The applicant will receive a cashback of USD 2,000 on the purchase of a new battery electric vehicle and USD 1,000 on the purchase of a new plug-in hybrid electric vehicle.

The adoption of electric vehicles has gained traction in several regions/countries due to increasing fuel prices. Electric vehicles act as a substitute for petrol and diesel vehicles and are powered by lithium-ion batteries that offer a hybrid charging facility. These vehicles are eco-friendly and do not cause any pollution. They do not emit harmful greenhouse gases while operating. The cost of electricity is much lower than the cost of fossil fuels. This reduces the cost of operation of electric vehicles as compared to other petrol and diesel vehicles. Thus, the rising crude oil prices and depletion of fuel reserves are expected to drive electric vehicle demand.

The COVID-19 pandemic negatively impacted the North America EVs market growth in 2020. The electric passenger car and light truck sales in the U.S. totaled over 200K units in 2020, which was significantly lesser than units recorded in 2019, thus registering a year-on-year decline of over 5% primarily due to the pandemic. According to the data published by Electric Mobility Canada (EMC), the electric vehicle sales in Canada witnessed a decline in the second quarter of 2020, with only over 8,000 units sold between April and June. The results represent a drop of over 50% from the units sold during the same period in 2019. However, the overall sales of electric passenger cars and light trucks in Canada remained the same in 2020 compared to 2019.

North America Electric Vehicles Market Trends

The market has grown as a result of increased attention toward sustainable development and greater awareness of the negative consequences of using traditional automobiles. Furthermore, local authorities from several regions are providing subsidies to encourage the sale of electric vehicles in anticipation for overall infrastructural development.

The increased investments from public and private entities for electric charging infrastructure like Tesla supercharger, Volkswagen Electrify America, etc., and increasing the number of electric charging stations across the U.S. is helping create trust in customers and help in mitigating the problem of range anxiety (range anxiety is the fear of driving an electric vehicle and running out of power, without being able to find a charging station on time to replenish the battery) amongst the new drivers of electric cars.

The Government of United States has set a net-zero greenhouse gas emission target for 2050, aligned with significant impacts and enforced rigorous standards of CO2 emission limits for motorized vehicles. This acts as a driver for the market as automobile manufacturing companies are compelled to adopt, develop and sell electric vehicles in the future.

Electric Vehicles (EVs) are more expensive and require a larger investment than Internal Combustion Engines (ICEs). The cost difference between an electric automobile and a comparable internal combustion engine vehicle is as much as three to four times, making EVs a less tempting option for the average customer. This large gap in EV upfront prices is due to the factors such as high research and development costs involved in battery production, a fragile raw material supply chain, and insufficient economies of scale.

The cost of a lithium-ion cell is predicted to reduce to USD 100 per kWh by 2021, according to General Motors Company (US). Manufacturing on a big scale, falling component prices, and the use of sophisticated technologies to increase the battery capacity are just a few of the factors driving down the prices. A lower price of the lithium-ion cell makes the electric vehicle cheap when compared to current prices and this make them more affordable to customers. The reduction in the cost of production of lithium-ion batteries will create a great opportunity for the larger adoption of these vehicles in the forecast period.

Product Insights

Based on product, the market has been segmented into Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV). The BEV segment accounted for the largest revenue share of over 75% in 2020 and is expected to maintain its dominance from 2021 to 2028. The high revenue share is mainly attributable to the increasing environmental awareness and benefits of BEV among end users. Additionally, the average driving range of BEVs has been steadily increasing. The average range of BEVs was about 350 km in 2020, up from 200 km in 2015.

Meanwhile, the PHEV segment is estimated to expand at the highest CAGR of over 40% in terms of revenue from 2021 to 2028. This upsurge can be attributed to the initiatives taken by the U.S. and Canadian governments to promote the use of EVs. PHEVs are generally offered in larger vehicle segments such as electric trucks and buses. The growing transportation and logistics industry is expected to witness segmental growth over the forecast period. Moreover, companies such as Volkswagen Group are focusing on increasing their plug-in electric car sales. In January 2020, the company announced an increase of about 60.0% in its plug-in electric car sales compared to 2018.

Vehicle Type Insights

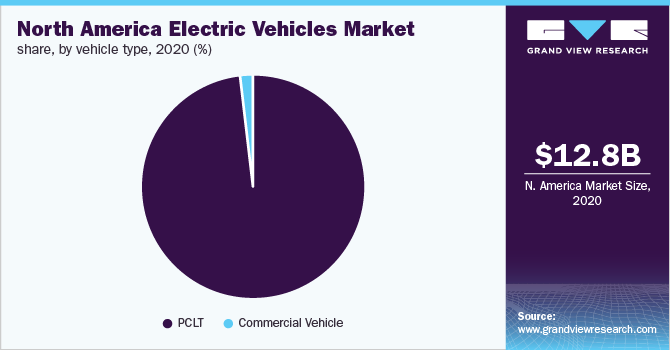

Based on vehicle type, the market has been segmented into Passenger Cars and Light Trucks (PCLT), and commercial vehicles. The PCLT segment accounted for a dominant revenue share exceeding 85% in 2020 and is anticipated to continue its dominance over the forecast period. The PCLT segment includes passenger cars and light trucks. The light trucks segment is estimated to expand at a CAGR exceeding 35% from 2021 to 2028 as SUVs offer advanced features, affordability, comfort, and durability, among other advantages. Moreover, several prominent manufacturers are focused on launching electric vehicles in the light truck segment. BMW iX, Tesla Cybertruck, Audi Q4 e-tron, and GMC Hummer, among others are some of the light trucks that will be available in the market in the coming years.

The commercial vehicle segment is estimated to expand at a CAGR exceeding 45% in terms of revenue over the forecast period. Increasing demand in the logistics sector, incentives for adopting zero-emission vehicles, and reducing the fuel and maintenance costs are some of the factors driving the segment growth. Moreover, stringent emission norms imposed on commercial vehicles are expected to propel manufacturers to invest in electric truck manufacturing.

Regional Insights

The U.S. accounted for the largest revenue share of over 70% in 2020 and is anticipated to continue its dominance over the forecast period. The increasing demand from the logistics sector is expected to lead to regional growth. Besides, in June 2020, the California Air Resources Board has set electric truck sales targets for manufacturers beginning in 2024. The rule is expected to bring around 0.3 million electric trucks to California’s roads by 2035. The electric vehicle sales in the U.S. had declined in 2019 and 2020 as the federal tax credit was decreased for General Motors Company and Tesla.

Canada is projected to expand at the highest CAGR exceeding 40% in terms of revenue from 2021 to 2028. The government in the country is investing significantly to promote adoption. The province of Ontario and the federal government each provided USD 220 million to Ford Motor Company to support EV production. Besides, the government will also provide USD 2 billion over the next few years to electrify school and transit buses across the country.

Key Companies & Market Share Insights

The market is highly competitive with the presence of several global as well as regional players. In 2020, the market was dominated by Tesla, General Motors Company, Toyota Motor Corporation, Nissan Motor Company, and Volkswagen AG. Organic growth remains the key strategy for the overall industry, focusing on product launches to expand product offerings and meet consumer demands. For example, in September 2020, Volkswagen AG announced the launch of ID.4, a fully electric driven SUV generating zero local emission. The company has planned to launch the car in the compact SUV segment.

Market players also focus on joint ventures and partnerships to increase the adoption of electric vehicles. For instance, in July 2020, General Motors partnered with EVgo to accelerate widespread adoption in the U.S. The companies planned to add over 2,700 new fast chargers to expand the public fast-charging network over the next few years.

Recent Developments

-

In June 2021, Tesla announced the roll of the first production Tesla Model S Plaid. It’s a four-door electric car with an estimated range of 390 miles.The Plaid is the top-of-the-line Model S, with 1,020 horsepower, and a 0-to-60-mph time of 2 seconds.The Plaid charges faster at Tesla superchargers has a more spacious back seat, and a better entertainment system

-

In March 2022, Tesla announced the opening of its Tesla Gigafactory Texas. Gigafactory Texas is located near Austin and will manufacture Tesla Cybertruck, Tesla Semi, Model 3, and Model Y for the eastern United State market. The factory is the second-largest factory in terms of size in the U.S. and the second-largest in terms of volume

-

In June 2022, Volkswagen AG announced the operation of its North American Battery engineering laboratory in Chattanooga. The company invested USD 22 million in developing and constructing the new flagship facility and its main purpose is to test EV batteries and high voltage engineering activities

Some of the prominent players operating in the North America electric vehicles market are:

-

BYD Company Ltd.

-

Daimler AG

-

Ford Motor Company

-

General Motors Company

-

Lucid

-

Mitsubishi Motors Corporation

-

Nissan Motor Company

-

Tesla

-

TOYOTA MOTOR CORPORATION

-

Volkswagen AG

North America Electric Vehicles Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 16.13 billion

Revenue forecast in 2028

USD 147.60 billion

Growth Rate

CAGR of 37.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million, volume in units, and CAGR from 2021 to 2028

Report coverage

Revenue and volume forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, vehicle type, region

Regional scope

North America

Country scope

U.S., Canada

Key companies profiled

Tesla, General Motors Company, Toyota Motor Corporation, Nissan Motor Corporation, Volkswagen AG

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Electric Vehicles Market SegmentationThis report forecasts volume and revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the North America electric vehicles market report based on product, vehicle type, and region:

-

Product Outlook (Volume, Units; Revenue, USD Million, 2016 - 2028)

-

Battery Electric Vehicle (BEV)

-

Plug-In Hybrid Electric Vehicle (PHEV)

-

-

Vehicle Type Outlook (Volume, Units; Revenue, USD Million, 2016 - 2028)

-

PCLT

-

Passenger Cars

-

Light Trucks

-

-

Commercial Vehicles

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America EVs market size was estimated at USD 12.80 billion in 2020 and is expected to reach USD 16.13 billion in 2021.

b. The North America EVs market is expected to grow at a compound annual growth rate of 37.2% from 2021 to 2028 to reach USD 147.60 billion by 2028.

b. The U.S. accounted for the largest revenue share of over 70% in 2020 and is anticipated to continue its dominance over the forecast period in the North America EVs market.

b. Some key players operating in the North America EVs market include Tesla, General Motors Company, Toyota Motor Corporation, Nissan Motor Company, and Volkswagen AG.

b. Key factors that are driving the North America EVs market growth include favorable government initiatives, subsidies, and tax rebate programs to promote EV adoption coupled with several advantages of EVs over conventional vehicles in terms of cost.

b. The BEV segment accounted for the largest revenue share of over 75% in 2020 and is expected to maintain its dominance from 2021 to 2028 in the North America EVs market.

b. The PCLT segment accounted for a dominant revenue share exceeding 85% in 2020 and is anticipated to continue its dominance over the forecast period in the North America EVs market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."