- Home

- »

- Advanced Interior Materials

- »

-

North America And EMEA Ferrosilicon Market Report, 2028GVR Report cover

![North America And EMEA Ferrosilicon Market Size, Share & Trends Report]()

North America And EMEA Ferrosilicon Market Size, Share & Trends Analysis Report By Application (Carbon & Alloy Steel, Stainless Steel, Cast Iron), By Region (North America, EMEA), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-568-0

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Advanced Materials

Report Overview

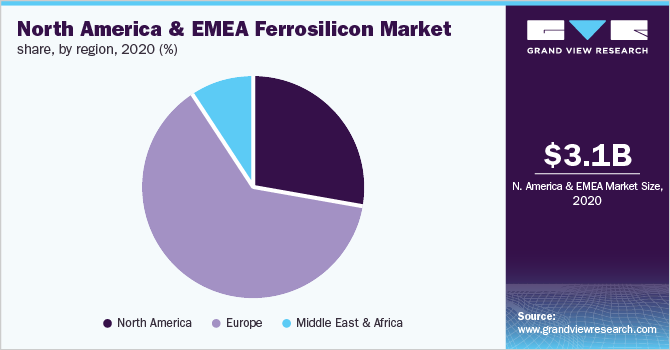

The North America and EMEA ferrosilicon market size was valued at USD 3.10 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 2.6% from 2021 to 2028. The market is expected to gain momentum owing to the growth of solar energy coupled with the driving shift toward Electric Vehicles (EVs) over the forecast period. The rising market growth was, however, hampered in 2020 owing to the emergence of the novel coronavirus. The pandemic restricted all industrial operations, which had a major impact on the demand and production across the world. Ferrosilicon production was significantly affected in the first half of 2020, as the raw material movement was impacted owing to the lockdown imposition in various nations.

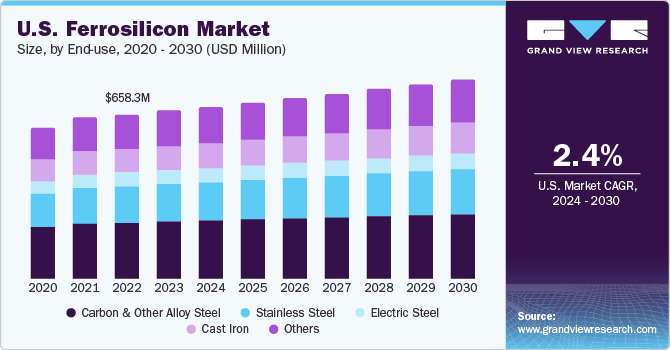

The U.S. holds a significant position in the industry owing to extensive product utilization in major end-use industries including electronics, automotive, and construction. A rise in construction activities is propelling the product demand. For instance, in June 2021, President Joe Biden announced support for the USD 1.2 trillion Bipartisan Infrastructure Framework.

The product demand is high in the steel industry as over 80% of the total ferrosilicon production is consumed by the industry as a source of silicon and as a deoxidizer and inoculant. Steel products are widely used across multiple industries, such as construction, automotive, oil & gas, appliances, industrial machinery, and others. Thus, steel demand directly influences market growth.

The product demand, however, declined in 2020 amidst the COVID-19 pandemic as many key players decided to shut down their production plants owing to unfavorable market conditions. Also, increased raw material prices and shortage in their supply further impacted the product demand. The disruption in labor migration, financial constraints, and disturbed supply chain operations are the factors hindering market growth.

Moreover, the use of aluminum as a substitute for steel, mainly in automotive applications, is projected to restrain the latter’s demand, thus, impacting the growth of the ferrosilicon market over the coming years. One pound of aluminum can replace up to 1.8 pounds of conventional steel, thereby, reducing the overall vehicle weight.

Application Insights

Carbon & alloy steel dominated and accounted for more than 44% revenue share of the total market in 2020. Increasing consumption of carbon steel in the construction industry coupled with a growing number of infrastructure projects across developing and developed economies is fueling the market growth.

Stainless steel is in high demand owing to its various features including corrosion resistance, low maintenance, and recyclability. Rising applications of stainless steel in the construction, medical, and food processing industries along with consumer products, such as stoves, cookware, and aesthetic goods, are stimulating the market growth.

Cast iron is another vital application of ferrosilicon. Low cost, high compressive strength & hardness, and strong electrical resistivity are the properties making cast iron viable for various applications. Increasing demand for cast iron cookware, radiators, machinery, and pipes owing to the aforementioned properties is expected to boost the segment growth over the forecast period.

Regional Insights

North America is projected to grow at the fastest CAGR of 2.8%, in terms of revenue, over the forecast period. The growth is attributed to increasing demand for steel from the construction, automotive, aviation, and defense industries. The North America construction sector is one of the leading sectors globally and contributes significantly to the global GDP. Growth in the construction industry is a key driver boosting the product demand in North America.

Various efforts are being put by the countries in North America to recover economic growth and overcome the losses in 2020. Special focus is being put onthe construction sector by investing morein infrastructural developments. Moreover, the shifting trend towards zero-energy building and increasing spending on renovation activitiesare expected to propel market growth.

The production of crude steel in Europe drives the demand for ferrosilicon products in the region. The European Union reported total crude steel production of 138.8 million tons in 2020,which was 11.8% lower than in 2019. The decline in steel production impacted ferrosilicon demand in the region. Thus, Europe is projected to witness sluggish growth over the forecast period.

Middle East & Africa has a strong presence of prominent oil producers on account of which, the demand for various machinery is very high in the region. Steel is used in the making of most of the drilling equipment. Increasing production of steel to cater to the rising demand from machinery and equipment of the oil & gas industry is thus, expected to benefit market growth over the forecast period.

Key Companies & Market Share Insights

The companies are focusing on increasing the production capacity owing to the rising demand for steel. For instance, in February 2019, Maithan Alloys Ltd., a company engaged in manufacturing ferrosilicon, silicomanganese, and ferromanganese, announced its plan to invest INR 600 crore for setting up 1,20,000 ton units near Kolkata, India to double the capacity in the coming years.Some of the prominent players in the North America and EMEA ferrosilicon market include:

-

Eurasian Resources Group

-

Ferroglobe

-

Eti Elektrometalurji AS

-

Elkem ASA.

-

Iran Ferroalloys Co.

-

FINNFJORD AS

-

Eramet Norway

-

Thyssenkrupp Materials Trading GmbH

-

Huta Åaziska SA

-

EFACO

North America And EMEA Ferrosilicon Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 3.34 billion

Revenue forecast in 2028

USD 3.81 billion

Growth rate

CAGR of 2.6% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Russia; Germany; U.K.; GCC

Key companies profiled

Eurasian Resources Group; Ferroglobe; Eti Elektrometalurji AS; Elkem ASA.; Iran Ferroalloys Co.; FINNFJORD AS; Eramet Norway; Thyssenkrupp Materials Trading GmbH; Huta Åaziska SA; EFACO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the North America and EMEA ferrosilicon market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Carbon & Alloy Steel

-

Stainless Steel

-

Electrical Steel

-

Cast Iron

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Germany

-

U.K.

-

-

Middle East & Africa (MEA)

-

GCC

-

-

Frequently Asked Questions About This Report

b. The North America & EMEA ferrosilicon market size was estimated at USD 3.10 billion in 2020 and is expected to reach USD 3.34 billion in 2021.

b. The North America and EMEA ferrosilicon market is expected to grow at a compound annual growth rate of 2.6% from 2021 to 2028 to reach USD 3.81 billion by 2028.

b. Carbon & alloy steel application segment dominated the North America & EMEA ferrosilicon market with a revenue share of over 44.0% in 2020, owing to their increasing usage in heavy machinery parts that require high strength and toughness.

b. The key players operating in the North America & EMEA ferrosilicon market include Pyxus International, Inc.; Eurasian Resources Group; Ferroglobe; Eti Elektrometalurji AS; Elkem ASA.; Iran Ferroalloys Co.

b. Increasing production of steel owing to its extensive usage in industries including building & construction, automotive, and mechanical equipment is driving the North America & EMEA ferrosilicon market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."