- Home

- »

- Healthcare IT

- »

-

North America And Europe Medical Technology Market Report, 2021-2028GVR Report cover

![North America And Europe Medical Technology Market Size, Share, And Trends Report]()

North America And Europe Medical Technology Market Size, Share, And Trends Analysis Report By Type (Hardware, Software, Service), By Application, By End Use (Hospitals, Ambulatory Surgery Centers), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-830-4

- Number of Pages: 122

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

North America and Europe medical technology market size was valued at USD 270.4 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 11.5% from 2021 to 2028. Rising healthcare expenditure, ineffective hospital service management, growing influx of patient population at various healthcare facilities, increasing healthcare personnel shortage, is boosting public and private organizations to discover and develop innovative models of healthcare delivery. Healthcare professionals are constantly demanding for advanced technological solutions to improve the quality of patient care, eliminate growing data siloes, reduce operational costs. The increasing adoption of digital health technologies is anticipated to drive market growth over the forecast period.

The rapidly growing geriatric population in North America and Europe coupled with the rising prevalence of diseases, increasing healthcare costs, and lack of healthcare infrastructure in developing regions are driving the demand for medical technological solutions. The increasing penetration of smartphones and advancements in internet connectivity is supporting and boosting the adoption of mHealth technologies by healthcare providers and patients. As per The Mobile Economy 2018 estimates, the smartphone penetration is expected to reach 77% by 2025 from 57% in 2017. The increasing adoption of smartphones by the consumer is paving a path for the adoption of telehealth, patient monitoring, mHealth apps, and other digital health technologies.

Technological advancements in smartphone technology for improving disease diagnostics are anticipated to drive market growth. For instance, as per data published in 2017, researchers at the University of Illinois have developed a camera to improve the diagnostic features of smartphones. Furthermore, continuous improvement in network infrastructure and growing network coverage are boosting the demand for digital health services. Mobile network operators view digital health as an opportunity for investment owing to growing user adoption of smartphones and rising awareness about fitness.

COVID19 North America And Europe medical technology market impact: 11.3% increase in revenue growth from 2019 to 2020

Pandemic Impact

Post COVID Outlook

North America and Europe medical technology market increased by 11.3% from 2019 to 2020

The market is estimated to witness a y-o-y growth of approximately 12% in the next 5 years

The pandemic exposed the downfalls and shortcomings of the existing, overburdened healthcare system and significantly drove the demand for digitalization and automation of healthcare services

Government authorities are promoting and supporting the adoption of digital health solutions such as telehealth and remote monitoring platforms to enable and enhance patient-provider engagement.

The pandemic created multiple challenges for the healthcare services sector with the imposed travel restrictions and lockdowns which restricted patients from visiting healthcare facilities to avail care.

Various industry participants and consultants have witnessed a surge in the adoption of digital health solutions. For example, before the outbreak of the pandemic in Germany, only 2% to 7% of healthcare professionals were using video consultancy platforms, whereas now approximately 60% of them are using telehealth and teleconsultation platforms. The medical technology market is anticipated to witness a boost in market revenue in forthcoming years and would follow an upward projected technology life cycle trajectory.

Easy availability of technologically advanced devices and growing penetration of smartphones and enhanced internet connectivity, public and private investors have begun investing in the potential of the industry to deliver innovative healthcare solutions and enhance patient care through various digital platforms. Through these digital solutions, patients can easily track their fitness regimes and well-being, obtain answers to medical inquiries. For instance, several apps have been launched over the last decade to help the patient population book appointments, track their consultations and medical prescriptions, and store their healthcare information throughout the treatment.

Telehealth solutions are being widely adopted by the healthcare fraternity and thereby, improving patient-provider engagement and enabling delivery of care to patients in remote locations. Telemedicine has been legalized and is regulated in many countries such as the U.S., Canada, Germany, Russia, and many other European countries. Technology companies such as Apple, Google, and IBM are focusing on improving mobile health experience by providing numerous options through different subscription plans and are emphasizing data security. Thus, these factors are expected to drive the market over the forecast period. The ongoing Covid-19 pandemic exposed the shortcoming of the existing healthcare systems and drove the need to rapidly adopt digitalization and automation.

Medical technological solutions have enabled healthcare facilities to streamline their workflows and automate manual tasks, thereby reducing the burden on the workforce. Government authorities in North America and Europe laid down restrictions and imposed lockdowns to curb the transmission of infection. These preventive measures led to a significant surge in the number of visitors and active members utilizing digital health solutions such as telehealth and teleconsultation to avoid hospital visits. The Covid-19 pandemic had a positive impact in unearthing the potential of digital health technologies. Healthcare fraternities grew aware of the potential of outpatient hospital care and primary care which can be delivered virtually and digitally, thereby boosting the adoption of medical technology solutions.

The emergence and integration of the Internet of Things (IoT), Artificial Intelligence (AI), and Machine Learning (ML) algorithms into digital healthcare platforms are revolutionizing the healthcare industry. Through the support of integrated analytics, advanced wearables, and strong connectivity, IoT has evolved and transformed the healthcare sector by facilitating various activities such as optimization of prescriptions, tracking of healthcare staff and patients, and chronic disease management. AI/ML algorithms can enhance the personalization of healthcare services. For example, a doctor can accurately diagnose patients by availing the patient’s ancestry and DNA information from an AI-based healthcare information system and provide the best course of treatment.

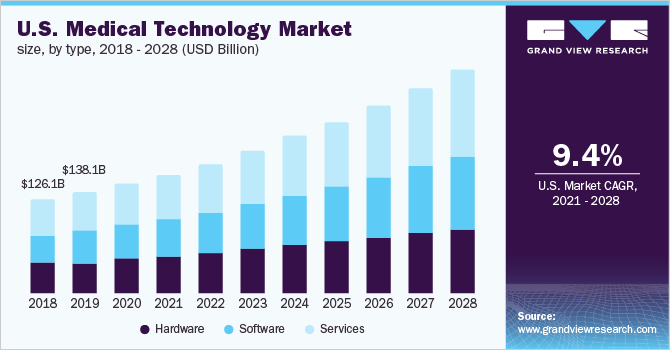

Type Insights

In 2020, the services segment dominated the market and accounted for the highest revenue share of 46.7%. It can be attributed to the rapid advancements in hardware and software and the increase in the number of software upgrades. The prevailing trend of outsourcing medical technology services is expected to drive the growth of the segment. Since healthcare facilities lack resources and required skillsets for the deployment of digital health solutions, these services are outsourced, either as a completed package or partially in the form of long-term contracts. The increasing number of companies providing outsourcing services to healthcare facilities is boosting the segment growth.

For instance, Aclerar Tech provides a wide range of solutions for outsourced revenue cycle management systems such as clinical documentation, managing denials, medical coding, patient health information entry, patient accounts management, and preadmission and post-registration processes. Services such as installations, education and training, and upgrade are all dependent on the development of hardware and software platforms. Growing demand for software platforms, such as electronic health records, propels the demand for the service market as companies are increasingly focusing on providing post-installation services, including training, optimization, staffing, and clinical services.

On the other hand, the software segment is anticipated to record the fastest growth rate over the forthcoming years. Rapid implementation of electronic health records, patient health information, and telemedicine platforms is driving the growth of the software segment. The increasing need for accurate and timely information procurement of patient health information and the growing number of data siloes in healthcare facilities is contributing to the growing need for software platforms and solutions. The growing need for efficient management of organizational workflows, shift to value-based care in developing regions, and advancements in healthcare IT infrastructure are some key factors boosting segment growth.

The rising demand for technologically advanced healthcare IT solutions will lead to the launch of various innovative software solutions. Various software solutions such as electronic health records are witnessing rapid adoption as they have significantly improved workflow efficiencies and provide enhanced access to comprehensive patient data. Applications of software are rapidly increasing in medical devices, clinical decision support, health IT system, artificial intelligence, mHealth apps, fitness trackers, telehealth systems, and wearable devices, which, in turn, is propelling the market growth.

Application Insights

In 2020, the Revenue Cycle Management (RCM) segment dominated the market and accounted for the largest revenue share of 62.1% in 2020 owing to the multiple functions of RCM such as member engagement, product development, network management, care management, claim management, and risks and compliance. Healthcare systems are executing electronic claim processing, coding, and reimbursements, Industry participants, including providers and payers are having to adjust by accepting factors, such as value-centric reimbursement structures, growth in risk sharing, and executing cost limits. Additionally, government reforms play a vital role in boosting the adoption of RCM solutions.

For instance, the Affordable Care Act (ACA) in the U.S. is focused on providing health insurance coverage to individuals with low income and improving the quality of care while reducing the cost of care. Expanding insurance coverage is expected to increase the number of reimbursement approvals and denials that are required to be managed. The prevailing trend of outsourcing RCM solutions can be leveraged by the healthcare industry in terms of efficacy and economic value presented by third-party RCM service providers and focus more on optimum patient care. The advantages associated with outsourcing RCM services include the availability of skilled and trained professionals, cost-effective and efficient service, and compliance with rules and regulations.

On the other hand, the telemedicine segment is anticipated to register the fastest growth rate over the forthcoming years. Increasing demand for telemedicine platforms for Covid-19 treatment management, chronic disease management, and mental health monitoring is expected to drive the segment growth. Furthermore, the growing government and insurance companies’ support is boosting the adoption of telemedicine platforms. The growing demand for reduction in hospitalizations and emergency rooms visits is contributing to the adoption rate. Moreover, telemedicine solutions allow healthcare providers to deliver care to patients in remote locations.

The alarming shortage of healthcare professionals, increasing healthcare expenses, and lack of adequate healthcare infrastructure in developing regions are driving the demand for affordable and quality virtual care services. In addition, enhanced internet connectivity and the rising smartphone penetration are boosting the adoption of telemedicine services across the two regions. Key market players are focusing on innovating their offerings to enhance patient acquisition and engagement.

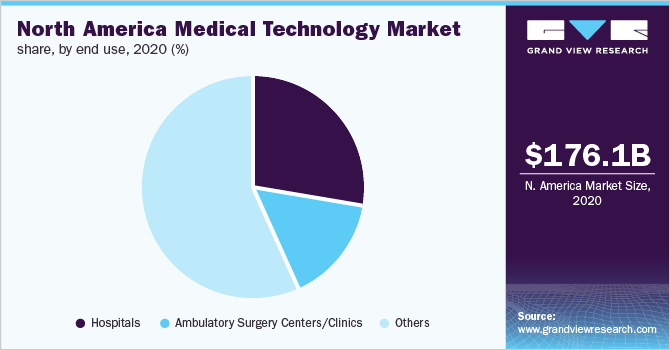

End-use Insights

In 2020, the other segment dominated the North America and Europe medical technology market and accounted for the largest revenue share of 57.4%. The others segment includes office-based physicians, diagnostics centers and laboratories, and payers. The high market share of the other segment can be attributed to the growing investment in the digitalization of healthcare services. Growing demand for reducing diagnostic costs and reducing machine downtime are some of the factors boosting the adoption of digital health solutions in these facilities. Moreover, the growing demand for ambient-assisted living to offer specialized services to the elderly and pediatric population from distant places is one of the factors driving the segment.

Growing awareness about medication management, wheelchair management, imminent healthcare, and smartphone healthcare solutions is also another factor driving the market. The growing need to reduce healthcare costs, shortage of healthcare personnel, increasing technological advancements, and rising prevalence of chronic diseases is driving the adoption of digital health solutions at these facilities. On the other hand, the ambulatory surgery centers/clinics segment is anticipated to register the fastest growth rate over the forthcoming years. The rise in the number of ambulatory surgery centers and growing patient preference are expected to drive the segment.

Digital health systems in ambulatory surgery centers and clinics allow providers to initiate laboratory tests, insurance eligibility verification, and admissions. As per an article published in the Association for Service Management International journal, practice management systems are used more in ambulatory surgery centers and clinics in the U.S. by healthcare personnel to assist with the smooth functioning of their units. Clinics are facing multiple challenges such as rising operating expenses, physician reimbursement, patient contentment, and boosting patient and payer revenue. The need to stay sustainable in fluctuating healthcare markets is driving clinics to adopt digital health solutions to achieve optimum clinical and financial outcomes.

Regional Insights

North America dominated the market and held the largest revenue share of 65.1% in 2020 and is attributable to the rapid digitalization of healthcare owing to the improving Internet connectivity, rising smartphone penetration, acute shortage of primary caregivers, increase in geriatric population, and growing demand for health-related smart solutions. North America is one of the pioneering regions to adopt digital health solutions such as electronic medical records, telemedicine, smart wearables, and mHealth apps for remote access to information on patient health and chronic disease management.

Furthermore, the availability of sound IT infrastructure high digital literacy, and supportive government policies are driving the growth of the market for medical technology in North America. For instance, in Canada, The Center for Future Health (CFH) promotes “Digital Health” to integrate information technology, including electronic communication tools into healthcare networks to facilitate the delivery of high-quality care. On the other hand, Europe is anticipated to register the fastest growth rate during the forecast period owing to the growing demand for digitalization and automation of healthcare delivery services to curb the growing healthcare costs and shrinking healthcare workforce.

The healthcare fraternity in Europe is embracing digital health technologies such as health apps, telemedicine, EHR, and other digital health solutions. The European market focuses on the digitalization of monitoring services for chronic disease management and solutions allowing seamless access to health records. Healthcare providers are rapidly adopting these innovative digital technologies to improve the quality of patient care, streamline workflows, and increase clinical and financial efficiencies. Various government initiatives are being undertaken to promote technological advancements and provide high-quality healthcare services to drive the growth of the market in Europe.

Key Companies & Market Share Insights

Partnerships, technological collaborations, mergers and acquisitions, and the development of innovative technologies are some of the key strategies adopted by these players to gain a competitive edge in the market. For instance, in March 2021, Greenway Health launched its latest revenue cycle management solution, Greenway Revenue Services (GRS) Select. This customizable revenue cycle management solution meets the growing needs of ambulatory care practices. Similarly, in January 2021, athenahealth, Inc. collaborated with Humana, Inc. to deliver value-added insights using athenahealth’s athenaClinicals and Humana’s intelligence to empower EHR workflows. Some of the prominent players in the North America and Europe medical technology market include:

-

Allscripts Healthcare Solutions

-

eClinical Works

-

Athenahealth, Inc.

-

Carestream Health

-

e-MDS Incorporation

-

American Well

-

Teladoc Health

-

MDLive Inc.

-

AdvancedMD Inc.

-

Qualcomm Technologies Inc.

-

Greenway Health LLC

-

CureMD Healthcare

-

DXC Technology Company

-

HealthTapInc

-

Doctor On Demand, Inc.

North America And Europe Medical Technology Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 301.3 billion

Revenue forecast in 2028

USD 647.1 billion

Growth Rate

CAGR of 11.5% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America, Europe

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia

Key companies profiled

Allscripts Healthcare Solutions; eClinical Works; Athenahealth, Inc; Carestream Health; e-MDS Incorporation; American Well; Teladoc Health; MDLiveInc; AdvancedMD, Inc; Qualcomm Technologies, Inc; Greenway Health, LLC; CureMD Healthcare; DXC Technology Company; HealthTap, Inc; Doctor On Demand, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research, Inc. has segmented the North America and Europe medical technology market report on the basis of type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Hardware

-

Software

-

Service

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Telemedicine

-

Electronic Health Records

-

mHealth Apps

-

Revenue Cycle Management

-

Enterprise Resource Planning

-

Healthcare Consulting

-

Wearables

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Ambulatory Surgery Centers/ Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Russia

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the North America and Europe medical technology market include Allscripts Healthcare Solutions; eClinical Works; Athenahealth, Inc; Carestream Health; e-MDS Incorporation; American Well; Teladoc; MDLive Inc; AdvancedMD, Inc; Qualcomm Technologies, Inc; Greenway Health, LLC; CureMD Healthcare; DXC Technology Company; Doctor On Demand, Inc.

b. Key factors that are driving the North America and Europe medical technology market growth include rising healthcare expenditure, ineffective hospital service management, growing influx of patient population at various healthcare facilities, increasing healthcare personnel shortage, growing digitalization of healthcare.

b. The North America and Europe medical technology market size was estimated at USD 270.4 billion in 2020 and is expected to reach USD 301.3 billion in 2021.

b. The North America and Europe medical technology market is expected to grow at a compound annual growth rate of 11.5% from 2021 to 2028 to reach USD 647.1 billion by 2028.

b. The services segment dominated the North America and Europe medical technology market with a share of 46.7% in 2020.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."