- Home

- »

- Consumer F&B

- »

-

North America Healthy Snack Chips Market Size Report, 2026GVR Report cover

![North America Healthy Snack Chips Market Size, Share & Trends Report]()

North America Healthy Snack Chips Market Size, Share & Trends Analysis Report By Product (Pop, Popcorn, Puff, Potato, Tapioca, Tortilla Chips), By Country (U.S., Canada, Mexico), And Segment Forecasts, 2019 - 2026

- Report ID: GVR-2-68038-828-2

- Number of Pages: 60

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Consumer Goods

Industry Insights

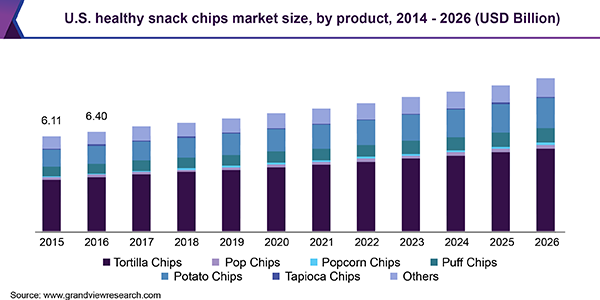

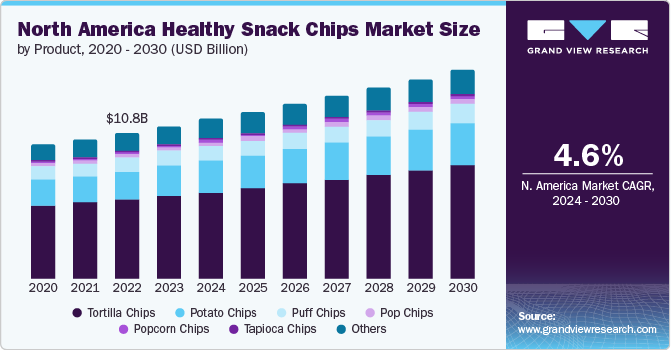

The North America healthy snack chips market size was estimated at USD 9.07 billion in 2018 and is projected to grow at a CAGR of 4.5% from 2019 to 2026. The growth of the product is driven by increasing demand for Ready-to-Eat (RTE) foods. The market is expected to witness substantial growth on account of a surge in demand for easy-to-eat foods. This is also projected to boost the growth of the manufacturing sector, especially in the U.S., Canada, and Mexico.

Millennials are an important driving force behind the growth of the RTE meal market. The snacks sector in North America is likely to exhibit significant growth over the coming years. Snacks and RTE products are replacing elaborate meals, thereby leading to increased sales of products that are healthy as well as convenient. Prominent product categories in the market include tortilla, popcorn, potato, and pop chips. Distribution channels play an important role in this market, wherein supermarkets and hypermarkets are the preferred distribution channels by most manufacturers.

Rising penetration of e-commerce is also expected to play a major role in the growth of this market. The tapioca product segment is expected to witness rapid growth over the next few years on account of the rising demand for healthy snacking options. Moreover, the rising popularity of the product as an instant source of energy is further expected to drive its demand. There is rising pressure from consumers for good-quality and healthy products leading to a rise in product cost.

This factor may hinder market growth to some extent. However, the food products segment in retail formats has received a boost after the introduction of healthy chips. For instance, in the U.S., major retailers, such as Walmart, The Kroger Co., and Whole Foods Market, have recognized the increased demand for healthy snack products and are taking necessary steps to introduce new flavors in the segment. Potato and tortilla chips are among the major product segments in this market.

Product Insights

On the basis of products, the market is categorized into tortilla, pop, popcorn, puff, potato, tapioca chips, and others. The others segment is further segmented into pop rings, soy, multigrain, rice, and rye chips. Kettle-cooked potato chips are the fastest-growing product in the market, which accounted for 18% of the revenue share in 2018. Healthy tortilla products are convenient, gluten-free, and a great source of digestive health-promoting fiber. Major manufacturers of tortilla healthy snack chips include Way Better Snacks; Late July Snacks, LLC; Garden of Eatin'; and FoodShouldTasteGood, Inc. Rising consumption of RTE meals due to busy lifestyles and hectic work schedules has provided companies with many growth opportunities.

Thus, major manufacturers focus more on introducing innovative, on-the-go healthy products. Growth of distribution channels, such as online stores, retail stores, and supermarkets, have further augmented the sales of tortilla chips in the region. Potato chips are rapidly becoming prominent as the market’s preferred option of snack. Innovations in the healthy potato chips market are mostly in terms of manufacturing technology (kettle cooked and baked potato products), wherein the advancement provides a variety of snacks in a wide range of shapes, grains, and sizes.

Growing inclination toward gluten-free products is also a key factor responsible for the rising demand for healthy potato chips. Moreover, the product also provides an advantage in terms of consumer outreach, as it can be sold through a variety of sales channels. The market in the region witnessed consolidation in recent years, which is likely to have positive implications on the demand for potato chips in the coming years.

Country Insights

Increasing awareness regarding the benefits of eating a healthy diet has led to a rise in the consumption of healthy snack chips. On-the-go-lifestyle of the working population in the U.S. is expected to propel the market over the forecast period. The convenience and easy-to-carry options offered by these products are additional factors driving the overall industry.

Moreover, consumers are preferring snack foods over traditional sit-down meals. One important driver of this trend is the shrinking size of the U.S. households, leading many to substitute cooking meals at home with eating single-portion, portable snack foods. In addition, increased income levels and spending power in the country will augment the demand further.

The U.S. accounted for a significant market share of the healthy potato chips market. The product has been receiving due importance on account of several promotional and awareness campaigns run across matured economies of the region to explain the importance of nutrition and health.

High demand for healthy tapioca chips is also attributed to the rising need for nutrition from snacks. Consumers in the U.S., Canada, and Mexico are becoming increasingly aware of the benefits offered by the consumption of the product, thereby boosting its demand. Growing distribution networks are also anticipated to propel the demand in the future.

North America Healthy Snack Chips Market Share Insights

Deep River Snacks; The Kellogg Company; Mission Foods; Tastemorr Snacks; Shearer's Foods, Inc.; Popchips; and ARA Food Corporation are some of the major companies in the market. They focus on manufacturing products that comply with the United States Department of Agriculture (USDA) Organic certification, contain no artificial flavors, are gluten-free, and are manufactured using non-genetically Modified Organism (GMO) ingredients.

For instance, in August 2016, BFY Brands launched a master brand, known as Our Little Rebellion, which constitutes three non-GMO and gluten-free popped snacks, namely Bean Crisps, Crinkles, and PopCorners’. The products were then marketed to U.S. consumers through natural food retailers, conventional retailers, club & convenience channels, and online retailers.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2026

Market representation

Revenue in USD Million and CAGR from 2019 to 2026

Regional scope

North America

Country scope

U.S., Canada, and Mexico

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2026. For the purpose of this study, Grand View Research has segmented the North America healthy snack chips market report on the basis of product and country:

-

Product Outlook (Revenue, USD Million, 2014 - 2026)

-

Tortilla

-

Pop

-

Popcorn

-

Puff

-

Potato

-

Tapioca

-

Others

-

-

Country Outlook (Revenue, USD Million, 2014 - 2026)

-

The U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."