- Home

- »

- Electronic Devices

- »

-

North America LED Lighting Market Size, Share Report, 2030GVR Report cover

![North America LED Lighting Market Size, Share & Trends Report]()

North America LED Lighting Market Size, Share & Trends Analysis Report By Product (Lamps, Luminaires), By Application (Indoor, Outdoor), By End-use (Commercial, Residential, Industrial, Others), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-052-1

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

North America LED Lighting Market Trends

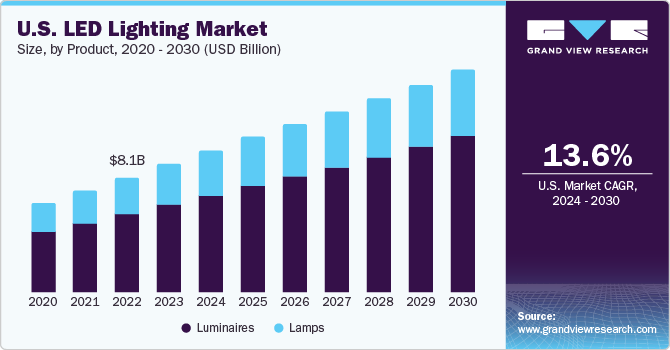

The North America LED lighting market size was valued at USD 10.41 billion in 2022 and is expected to grow a compound annual growth rate (CAGR) of 8.8% from 2023 to 2030. Technological advancements and rising concerns over environmental protection have increased the need for energy-efficient lighting products among industrial, commercial, and residential applications across North America. The rising trend of connected lighting controls for indoor and outdoor applications is further expected to contribute to the development of the market. Encouraging initiatives and rebate programs by government agencies have contributed to market growth.

As per officials at the U.S. Department of Energy, LEDs with ENERGY STAR ratings consume at least 75% less energy than traditional incandescent lighting. Additionally, they have a significantly longer lifespan, up to 25 times longer. LED technology offers an energy-efficient and durable lighting solution for residential applications, thereby reducing energy consumption and delivering longer-lasting illumination. As a result, the need for reduced energy consumption and energy-efficient light sources emerged in the region.

The adoption of LED lighting in North America has grown significantly over the years. The growth is primarily attributed to the high energy-saving potential LED lighting offers compared to conventional lights. For instance, according to the U.S. Department of Energy, by 2035, a majority of lighting installations is expected to transition to LED technology. This shift is projected to result in substantial energy savings, with estimates suggesting that LED lighting could save up to 569 TWh (terawatt-hours) annually. To put this into perspective, the energy savings achieved from LED lighting would be equivalent to the yearly energy production of over 92 power plants with a capacity of 1,000 MW each. It highlights the immense potential of LED technology in reducing energy consumption and promoting sustainability in the lighting sector.

The growing popularity of intelligent and connected lighting systems also encourages market development. Connected lighting systems are used in the commercial sector, where low bay/high bay fixtures, linear fixtures, downlighting, and decorative lighting are required. The light sources used in connected lighting systems result in the consumption of high energy owing to a larger floor area. Adding LED sources in smart and connected systems has significantly reduced energy consumption, thus augmenting market growth.

Advancements in LED technology and continued innovation contribute to increased LED lighting sales in North America. The application of LED technology in horticulture has reduced energy wastage as it regulates a different spectrum of light according to the various stages of plant growth. Furthermore, the emergence of smart light-filling technology is anticipated to present potential opportunities in the market.

Product Insights

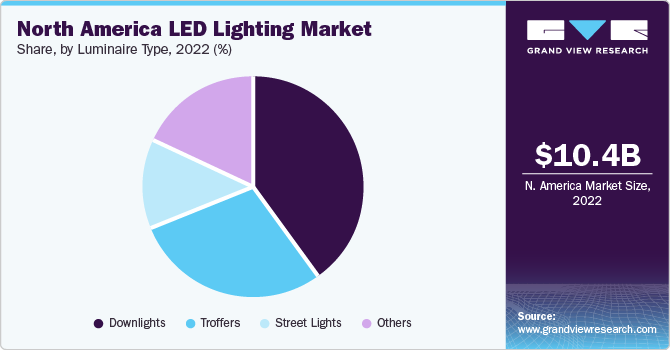

The North America LED lighting market is segregated into lamps and luminaires based on product. The luminaires segment registered a share of more than 65.5% in 2022. The adoption of luminaires is primarily attributed to increased demand for downlights and troffers for indoor applications. Moreover, the consistent development of new products catering to the demand for a comfortable experience has amplified demand. For instance, Signify Holding offers Luminous flux LED luminaires, which provide visual comfort in natural light for indoor applications in hospitals, retail, hotels, and offices.

The lamps segment is expected to register the highest CAGR of 9.1% over the forecast period. The increasing adoption of advanced A-lamps and T-lamps among residential and commercial spaces is driving the LED lamp segment in the region. The legislative efforts towards the sustainable use of LED lights and the substantial decrease in LED lamps have led to widespread adoption. For instance, the new federal light bulb regulations enforced from January 2020 prohibit the sale of non-complying light bulbs included in the line of A-lamps, T-lamps, and other lamps. Moreover, continual efforts raised by the Canadian government to improve the import and export certification process and ensure product quality also strengthen market development.

Application Insights

The indoor application segment dominated the market in 2022 with a market share of 66.5%. It can be attributed primarily to the growing use of LED light products in household lighting. Decreased prices, customer-centric product designs, and availability of various options have encouraged users to opt for LED light products for indoor applications. Furthermore, visually comforting and soothing experience through LED lighting within commercial office spaces has broadened the use of indoor LED applications.

The outdoor application segment is expected to register the highest CAGR of 10.3% over the forecast period. Encouraging government policies for adopting energy-efficient lighting products has led to the surging adoption of streetlight applications. Street, roadway, and walkway lighting are integral to cities and are among the highest energy consumption points. Traditionally, HID light sources dominated these applications due to high lumens output and hence could be mounted at distances. However, this can be compensated by LED lighting products, particularly for outdoor applications, as they exhibit features such as high durability, excellent directional light sources, and greater efficiency.

End-use Insights

LED lighting in commercial spaces led the market with a revenue share of over 50.5% in 2022. Increased use of energy-efficient lighting in retail outlets, offices, educational premises, and health centers across Canada and the U.S. enables market growth. Furthermore, several incentives and rebate schemes are provided for commercial users to offset the additional costs of installing LED lights. These parameters also contribute to the rise in the adoption of LED lights among commercial end users.

The residential segment is expected to register the highest CAGR of 9.6% over the forecast period. Residential spaces across North America have widely adopted LED lighting solutions primarily due to decreased pricing. The development of smart homes has compelled manufacturers to launch intelligent lighting systems.

In April 2023, Vivint, Inc. introduced the second generation of the Ring Floodlight Cam Pro, equipped with two powerful LED floodlights that emit 2000 lumens of brightness. This advanced security camera boasts many impressive features, including color night vision, a loud 110 dB siren, 3D Motion Detection, and a radar sensor. The radar sensor promptly sends an alert when any person or object crosses the distance threshold defined by the property owner in the Ring app. Configuring personalized motion and privacy zones allows one to tailor the camera's settings to suit specific needs. Additionally, the Ring Floodlight Cam Pro offers a unique Bird's Eye view of your property, a feature exclusive to Ring's outdoor security cameras. Such advancements are projected to create new growth avenues for the market.

Country Insights

The U.S. market held the dominant share of 78.2% in 2022 and is expected to continue its lead over the forecast period. The presence of prominent market leaders such as Cree, Inc., Acuity Brands, and GE Lighting has contributed to widespread product adoption. The lighting industry is dependent on the growth of the construction sector. The rising number of new construction projects has led to the implementation of cost-saving lighting systems. According to the Associated General Contractors (AGC) of America, Inc., spending on public construction (street and highway construction and education structures) witnessed a substantial rise in 2022, thus allowing LED manufacturers to flourish in the U.S.

Canada is anticipated to expand at the fastest CAGR of 10.5% over the forecast period. The growth in the region can be attributed to a rise in real estate infrastructure development and investments across Vancouver and Toronto. Furthermore, the Canadian government has implemented legislation that mandates the registration of products with energy labeling. Moreover, the government has paved the way for ENERGY STAR-certified lighting, which has contributed to optimizing the lighting energy consumption.

Key Companies & Market Share Insights

The industry players are undertaking product launches, collaborations, mergers & acquisitions, and expansion strategies to increase their global reach. New product development has been a key strategy to advance in the evolving market. For instance, in January 2023, Signify expanded its selection of Philips CorePro PL LED lamps, anticipating the EU ban. This expansion includes the introduction of PLT LED lamps and more sizes of PLL LED lamps in addition to the existing PLS and PLC LED lamps. With this extended range, the Philips CorePro PL LED series encompasses all popular sizes and shapes. These lamps provide a convenient 1-to-1 replacement solution and offer energy savings of up to 67% compared to non-integrated compact fluorescent lamps.

Key North America LED Lighting Companies:

- Acuity Brands Lighting, Inc.

- Eaton

- WOLFSPEED, INC.

- Digital Lumens, Incorporated.

- General Electric

- Hubbell

- LSI Industries Inc.

- LumiGrow, Inc.

- OSRAM GmbH.

- Panasonic Holdings Corporation

- Signify Holding

- Vishay Intertechnology, Inc.

Recent Developments

-

In June 2023, OSRAM launched the latest generation of its OSLON Square Hyper Red horticulture LED. This latest iteration is specifically designed to enhance plant growth rate and optimize system costs. OSRAM developed LED solutions to deliver higher levels of photosynthetic photon flux (PPF) with greater efficacy than the previous generation. The new OSLON Square Hyper Red LED suits various horticultural lighting applications, including inter-lighting, greenhouse top lighting, vertical farming, and sole source lighting.

-

In June 2023, Philips introduced a range of LED lights designed specifically for outdoor spaces such as gardens, offering durability and energy efficiency in various weather conditions. These top-class LED outdoor lights, including posts, spotlights, pedestals, and wall lights, are equipped with UltraEfficient Solar technology. Along with reducing energy consumption it also contributes to cost savings. The lights are easy to install, ensuring a hassle-free experience for users while providing reliable and eco-friendly lighting solutions for outdoor environments.

-

In March 2023, Cree LED, a subsidiary of SGH, launched its latest innovation, the J Series 5050C E Class LEDs. These LEDs set a new industry standard for high-power LEDs by achieving a remarkable efficacy of 228 LPW at typical conditions of 70 CRI, 4000K, and 1W. The LEDs of the J Series take over the competitors by delivering up to three times the light output while maintaining the same level of efficacy. These advanced LEDs are also designed with exceptional corrosion resistance, making them well-suited for operation in challenging environments.

-

In October 2021, LTF, LLC. announced the launch of its latest controller module that features five channels and a power output of 300W. This module is designed to provide RGBW+WW capability, enabling full-color customization for LED strip lighting. The LiteStream C wireless mesh controller modules are compact and straightforward to install.

-

In October 2021, NICHIA, a global manufacturer of LEDs and the pioneer of high-brightness blue and white LEDs commenced large-scale production of a new UV-C LED with high radiant flux. This innovative LED effectively targets sterilizing and inactivating various bacteria and viruses, particularly in industrial water and air applications.

North America LED Lighting Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.72 billion

Revenue forecast in 2030

USD 21.08 billion

Growth Rate

CAGR of 8.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Acuity Brands Lighting, Inc.; Eaton; WOLFSPEED, INC.; Digital Lumens; Incorporated.; General Electric;Hubbell; LSI Industries Inc.; LumiGrow, Inc.; OSRAM GmbH.; Panasonic Holdings Corporation; Signify Holding; Vishay Intertechnology, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America LED Lighting Market Report Segmentation

This report forecasts revenue growth at country levels and analyses the latest industry trends in each sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America LED lighting market report based on product, application, end-use, and country:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Lamps

-

A-Lamps

-

T-Lamps

-

Others

-

-

Luminaires

-

Street Lights

-

Downlights

-

Troffers

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial

-

Residential

-

Industrial

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The global North America led lighting market size was estimated at USD 10.41 billion in 2022 and is expected to reach USD 21.08 billion in 2023.

b. The global North America led lighting market is expected to grow at a compound annual growth rate of 8.8% from 2023 to 2030 to reach USD 21.08 billion by 2030.

b. Downlights luminaire segment dominated the North America led lighting market with a share of 40.25% in 2022. This is attributable to its vast application as recessed, surface-mount, pendants, ceiling lights, spotlights, and track lights across residential and commercial indoor areas.

b. Some key players operating in the North America led lighting market include Acuity Brands Lighting, Inc., Eaton, WOLFSPEED, INC., Digital Lumens, Incorporated., General Electric, Hubbell, LSI Industries Inc., Lumigrow, Inc., OSRAM GmbH., Panasonic Holdings Corporation, Signify Holding, and Vishay Intertechnology, Inc.

b. Key factors that are driving the market growth include technological advancements, increased use of energy-efficient lighting products, and the rising trend of connected lighting controls for indoor and outdoor applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."