- Home

- »

- Healthcare IT

- »

-

North America Long-term Care Software Market, Industry Report, 2025GVR Report cover

![North America Long-term Care Software Market Size, Share & Trends Report]()

North America Long-term Care Software Market Size, Share & Trends Analysis Report By Product (EHR, eMAR, Payroll Management), By Mode of Delivery (Web, Cloud, On-Premise), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-653-0

- Number of Pages: 70

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Healthcare

Industry Insights

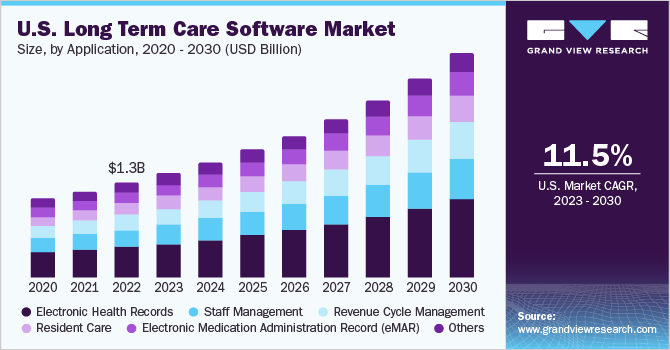

The North America long-term care software market size was valued at USD 859.2 million in 2017 and is projected to expand at a CAGR of 12.4% over the forecast period. It is driven by increasing incidence of chronic diseases, geriatric population coupled with growing life expectancy due to medical advancements in the world. Healthcare professionals and long-term care facilities are increasingly using software technology to address their healthcare management needs. This factor is anticipated to further fuel the expansion.

According to Vincent & Velkoff, 2010 (U.S. Census Bureau), the number of Americans above 65 years is likely to increase from 40.2 million in 2010 to 88.5 million in 2050. The number of people aged 85 years and over is expected to triple, from 6.3 million in 2015 to 17.9 million in 2050, accounting for 4.5% of total population. This demographic tends to have the highest disability rate and maximum need for Long-term Care Facilities (LTCFs), which is anticipated to propel the market growth.

High prevalence of chronic diseases is a major cause of disabilities requiring medical attention. Long-term care software offers effective workflow methodologies saving time and cost. According to the World Health Organization (WHO), chronic diseases will cause approximately three-quarters of all deaths worldwide by 2020. In developing countries, 75% of deaths will be due to stroke, 70% of deaths due to diabetes, and 71% of deaths due to Ischemic Heart Disease (IHD).

Governments of developed countries are reforming their healthcare infrastructure to provide affordable care solutions for senior citizens. The U.S. government supports long-term care software for the elderly through Medicare and Medicaid systems, fueling growth of the long-term care software market in North America.

Development of sophisticated and easy-to-use devices and services such as internet-enabled home monitors, digitization of data, telemedicine, and mobile health (mHealth) apps is likely to boost the market growth over the forecast period. In November 2016, McKesson Pharmacy launched the 7.0 version of EnterpriseRx system, which is a cloud-based pharmacy management system that manages data centrally and allows promise-time workflow for prescription processing to help clinical and business services.

Product Insights

Based on product, the market is segmented into Electronic Health Record (EHR), Electronic Medication Administration Record (eMAR), and payroll management. The EHR segment accounted for the largest segment in 2017 and is expected to expand at the fastest CAGR over the forecast period. This is due to the improvement in patient safety and efficiency, effective care, and implementation and management of chronic conditions.

Rise in product launches is expected to propel growth of the North America long-term care software market. In March 2017, Epic Systems Corporation and Acumen Physician Solutions signed collaboration to develop Acumen 2.0, a new practice management and EHR software.

Mode of Delivery Insights

Based on mode of delivery, the market is segmented into web-based, cloud-based, and on-premise solutions. The cloud-based segment accounted for the largest segment in 2017. The cloud-based solutions segment is gaining traction and is expected to expand at the fastest CAGR over the forecast period. These cost-effective solutions have less operational issues, flexible cost and usage, low investment, and easy implementation procedure with advanced security.

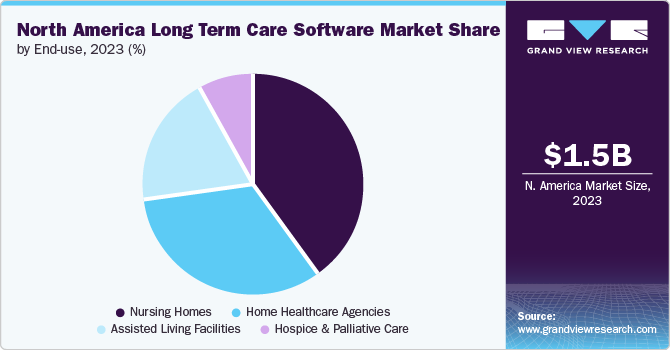

End-use Insights

On the basis on end-use, the market is segmented into nursing homes, home health agencies, and assisted living facilities. Nursing homes dominated the segment in 2017 owing to increasing efficiency, effectiveness, and patient satisfaction and safety.

The rate of home health care use for women aged 65 and over was 55% higher than the rate for men. According to the National Care Planning Council (NCPC), in 2010, around 33,000 home health agencies served approximately 12,000,000 clients across U.S. According to the U.S. Census Bureau, more than 7.6 million Americans suffering from chronic diseases and acute illnesses receive in-home healthcare.

Country Insights

U.S. held the dominant market share and is expected to register the fastest CAGR over the forecast period. Increasing awareness about long-term care software amongst healthcare professionals coupled with technological advancements, and adoption of cloud-based solutions can propel growth in U.S.

Market players are also putting in efforts to gain greater market penetration in this region through different business strategies. For instance, in May 2018, SingHealth collaborated with Allscripts for geographical expansion and increased its product portfolio by implementing the iPro Anesthesia software solution across its institutions.

North America Long-term Care Software Market Share Insights

Key market players are strengthening their position in the industry through collaborations and mergers and acquisitions. In April 2017, Omnicell, Inc. acquired InPharmics to expand the capabilities of Omnicell’s Performance Center. Performance Center combines enterprise software solutions with its services to monitor pharmacy operations and to deliver information for improved regulatory compliance, operational efficiency, and patient outcomes.

Similarly, in April 2017, McKesson Corporation completed its acquisition of CoverMyMeds LLC, a developer of Electronic Prior Authorization (ePA) solutions. Moreover, the company automates prior authorization process for more than 500 EHR systems, 700,000 providers, 49 thousand pharmacies, most health plans, and Pharmacy Benefit Managers (PBMs).

Some key market contributors are Allscripts Healthcare Solutions, Inc.; Epic Systems Corporation; Cerner; McKesson Corporation; Omnicare; Omnicell, Inc.; MatrixCare; Optimus EMR; Netsmart; and PointClickCare.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2014 - 2016

Forecast period

2018 - 2025

Market representation

Revenue in USD Million & CAGR from 2018 to 2025

Regional scope

North America

Country scope

U.S., Canada

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the North America long-term care software market report based on product, mode of delivery, end use, and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Electronic Health Record (EHR)

-

Electronic Medication Administration Record (eMAR)

-

Payroll Management

-

-

Mode of Delivery Outlook (Revenue, USD Million, 2014 - 2025)

-

Web-based solutions

-

Cloud-based solutions

-

On-premise solutions

-

-

End-use Outlook (Revenue, USD Million, 2014 - 2025)

-

Nursing Homes

-

Home Health Agencies

-

Assisted Living Facilities

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."