- Home

- »

- Consumer F&B

- »

-

North America Memory Supplements Market Report, 2021-2028GVR Report cover

![North America Memory Supplements Market Size, Share & Trends Report]()

North America Memory Supplements Market Size, Share & Trends Analysis Report By Product (Natural Molecules, Herbal Extract, Vitamins & Minerals), By Distribution Channel (Offline, Online), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-352-8

- Number of Pages: 60

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

The North America memory supplements market size was valued at USD 731.7 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.9% from 2021 to 2028. The market is anticipated to witness significant growth in the next few years on account of the surging number of self-directed consumers and growing awareness of these products among students and the elderly. The COVID-19 pandemic has led to the strict imposition of lockdown and stay-at-home orders across North America. Such restrictions have led to job losses, extended working hours, less work-life balance, and limited social interaction. During this period, people were confined to their homes, which severely impacted their mental health.

The COVID-19 pandemic has fueled the demand for memory supplements among consumers mainly because of two reasons: the deteriorating mental and emotional state of people and elderly people who are suffering from Alzheimer’s and dementia. Thus, these consumers are increasingly spending on memory supplements due to the uncertainty associated with the continued COVID-19 cases across the region.

With the growing awareness and rising concerns related to individual productivity, the demand for memory supplements is expected to increase from consumers. Moreover, an increasing number of students and working individuals have been looking for additional ways to gain a competitive advantage in their respective fields and achieve high productivity. This scenario is expected to favor the growth of the market over the next few years.

Additionally, college students exhibit the maximum need for dynamic cognitive functioning, which drains their brainpower. This is anticipated to drive the demand for memory supplements, particularly nootropics, which are known to boost learning ability and improve brain health. The acceptance of brain health supplements is a growing trend observed in the nutritional supplements industry. The rising consumer focus on mental health and well-being is favoring the market growth.

Over the past few years, consumers have been opting for naturally derived supplements. Green tea, matcha tea, Kucha tea, beets, eggs, spinach, peanuts, liver, arctic root, brahmi, turmeric, pine bark, ginseng, and fish oil are among the popular natural ingredients used in memory supplements. The growing vegan population in North America is anticipated to boost the demand for plant-based supplements in the upcoming years.

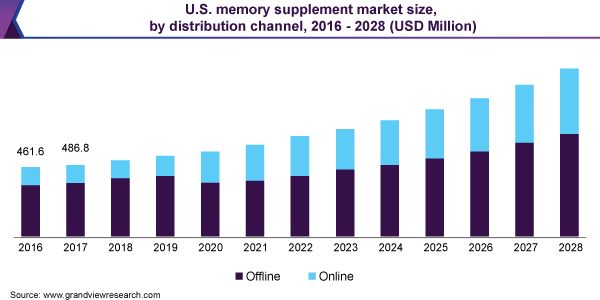

Distribution Channel Insights

The offline distribution channel held the largest share of more than 60.0% in 2020. This segment is projected to maintain its lead throughout the forecast period as most consumers prefer buying health products from hypermarkets and supermarkets and pharmacy stores, where they can physically examine the products.

Moreover, the wide availability of various brands at these stores attracts consumers to purchase products through these channels. Most of the products are available at big retail chains, such as Walmart, Walgreens, CVS Pharmacy, and Kroger, due to their large customer bases and wide supply networks.

The online distribution channel is expected to register the fastest CAGR of 9.3% from 2021 to 2028. The shift in consumers’ shopping behavior is one of the major factors driving the sales of the product through the online channel. Benefits offered by online platforms, including doorstep delivery, free shipping, subscription services, and significant discounts, are attracting millennials and the younger generation to opt for this channel.

The growing consumer inclination toward the online platform has prompted companies to offer products through the direct-to-consumer (D2C) channel. Companies such as HVMN Inc., Synergy CHC Corp., and Onnit Labs, Inc. offer their products through the D2C channel. Manufacturers are also focused on offering products through third-party distribution channels, like Amazon.com, due to their large customer bases and wide reach.

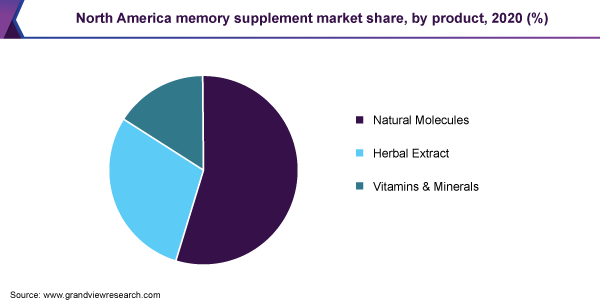

Product Insights

The natural molecules segment captured the largest share of more than 54.0% in 2020. The rising use of products containing natural ingredients as compared to synthetic supplements that are artificially made is projected to boost the growth of this segment.

Natural molecules are made from concentrated, dehydrated whole foods that help in enhancing alertness, clarity in thinking, focus, concentration, memory, and even mood; thus, manufacturers are focusing on developing innovative products that contain natural molecules. For instance, in April 2019, Reckitt Benckiser Group plc launched Neuriva that enhances cognitive health and is made with two natural and GMO-free ingredients, plant-sourced Sharp Phosphatidylserine (PS) and Neurofactor.

The herbal extract segment is likely to expand at the fastest CAGR of 10.1% from 2021 to 2028. The natural plant-based content in the herbal memory supplement products includes ginkgo biloba, curcumin, ginseng, and green tea extracts, which help in enhancing and sharpening memory and increase the oxygen supply to the brain that improves an individual’s cognitive functions and aids in relieving mental fatigue.

The growth of this segment is attributed to the increasing preference for herbal products among consumers as they appear to be safer than other supplements. Supplements with herbal extracts have been used to maintain brain health and treat various brain and memory-related issues. Herbal supplements are popular across the U.S. and as per a study conducted by the Centers for Disease Control and Prevention (CDC), in 2019, over half of the people in the U.S. take herbal supplements daily.

Country Insights

The U.S. held the largest share of over 78.0% in 2020. The increasing aging population is one of the major factors resulting in dementia and cognitive impairment. The geriatric population in the U.S. has been rising significantly, thus resulting in higher occurrences of mental health issues, such as dementia. This is anticipated to widen the application scope of the product, in turn, augmenting the overall market growth over the forecast period.

Over the past few years, there has been a shift in consumer preference toward herbal health products containing caffeine, matcha tea, spinach, beets, Brahmi, Arctic root, turmeric, ginseng, and pine bark. Moreover, the growing vegan population in the U.S. is expected to drive the demand for herbal products.

Furthermore, the rising awareness regarding the consumption of these products in Mexico on account of new product launches and geographic expansions is expected to promote the regional market growth over the forecast period. For instance, in August 2018, Synergy CHC Corp. expanded its reach in Mexico through the launch of the Focus Factor brand in the country. Synergy CHC’s products are available in more than 160 locations of Sam’s Club Mexico division.

The market in Canada is expected to expand at a CAGR of 9.9% over the forecast period. The increasing sales of multivitamins that boost memory and help in improving cognitive functions are expected to have a positive impact on the market growth over the forecast period. This is attributed to their increasing demand among the working-class population as well as athletes.

Key Companies & Market Share Insights

The North American market is characterized by the presence of a few well-established players and several small- and medium-sized players. Strategic partnerships are among the key strategic initiatives taken up by the industry players to develop new products and promote their existing products.

For instance, in March 2021, Quincy Bioscience sponsored the ‘Memories’ segment of Wheel of Fortune, an American game show. This will enhance the awareness of the company’s products among the millions of viewers of the show. Additionally, in 2017, HVMN Inc. partnered with researchers of Oxford University for product development (Ketone Ester). This research was worth USD 60 million. Some prominent players in the North America memory supplements market include: -

-

HVMN Inc.

-

Reckitt Benckiser Group plc

-

Synergy CHC Corp.

-

Purelife Bioscience Co., Ltd.

-

AlternaScript LLC

-

Liquid Health, Inc.

-

Natural Factors Nutritional Products Ltd.

-

Onnit Labs, Inc.

-

Quincy Bioscience

-

Snap Supplements

North America Memory Supplements Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 787.3 million

Revenue forecast in 2028

USD 1,443.7 million

Growth Rate

CAGR of 8.9% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

HVMN Inc.; Reckitt Benckiser Group plc; Synergy CHC Corp.; Purelife Bioscience Co., Ltd.; AlternaScript LLC; Liquid Health, Inc.; Natural Factors Nutritional Products Ltd.; Onnit Labs, Inc.; Quincy Bioscience; Snap Supplements

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the North America memory supplements market report on the basis of product, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Natural Molecules

-

Herbal Extract

-

Vitamins & Minerals

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Offline

-

Online

-

-

Country Outlook (Revenue, USD Million, 2016 - 2028)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America memory supplements market size was estimated at USD 731.7 million in 2020 and is expected to reach USD 787.3 million in 2021.

b. The North America memory supplements market is expected to grow at a compound annual growth rate of 8.9% from 2021 to 2028 to reach USD 1.44 billion by 2028.

b. The natural molecules segment contributed to the highest share of more than 50% in the North America memory supplements market in 2020. The rising use of products containing natural ingredients as compared to synthetic supplements that are artificially made is projected to boost the growth of this segment.

b. Some key players operating in the North America memory supplements market include HVMN Inc., Reckitt Benckiser Group plc, Synergy CHC Corp, Purelife Bioscience Co., Ltd., AlternaScript LLC, Liquid Health, Inc., Natural Factors Nutritional Products Ltd., Onnit Labs, Inc., Quincy Bioscience, and Snap Supplements.

b. Key factors that are driving the North America memory supplements market growth include the surging number of self-directed consumers and growing awareness of these products among students and the elderly in the region.

b. The offline distribution channel segment dominated the North America memory supplements market with the largest share of more than 60.0% in 2020.

b. The U.S. led the North America memory supplements market and accounted for the largest share of over 78.0% in 2020.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."