- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Molded Pulp Packaging Market Report, 2030GVR Report cover

![North America Molded Pulp Packaging Market Size, Share & Trends Report]()

North America Molded Pulp Packaging Market Size, Share & Trends Analysis Report By Source (Thick Wall, Transfer, Thermoformed, Processed), By Product, By Application, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-305-9

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Market Size & Trends

The North America molded pulp packaging market size was estimated at USD 1.25 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. The rising consumer demand for sustainable packaging, especially in the food industry, is expected to drive market growth. Molded pulp packaging is widely used in the packing of eggs and fresh fruits. The growing demand for these products has a positive impact on market growth.

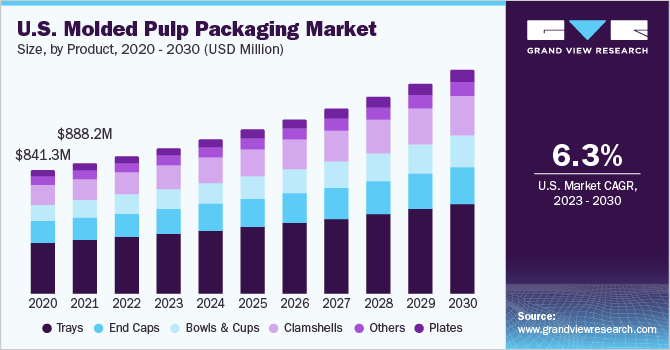

The demand for molded pulp packaging in the U.S. is expected to witness significant growth over the forecast period on account of increasing usage in consumer goods and packaging applications. Molded Pulp Packaging is utilized in consumer goods applications including garden equipment, water bottles, water dispensers, sporting goods, and others. The increasing reliability of molded pulp packaging owing to its cost-effectiveness, durability, and appearance is expected to propel product demand over the forecast period.

In addition, the rising trend of food trucks in the region is another factor driving the demand for molded pulp packaging. This is expected to continue to grow over the forecast period. States including North Carolina and Texas have observed an increased growth in food trucks, which requires low initial capital requirements and growing convenience food demand from consumers. In contrast to full-service establishments, food trucks require no wait staff, menus tend to be limited, and dining amenities are relatively sparse thus, convenience and fast service are the selling points. Comparatively low-priced food leads to increased consumer outreach, and a high demand for convenient and sustainable packaging solutions such as molded pulp packaging.

Molded pulp packaging solutions such as bowls, plates, and clamshells, plates, bowls, and cups are widely used in the food packaging industry for packaging on-the-go products, ready-to-eat meals, and beverages. The rising trend of consumption of single-serve meals and on-the-go snacks owing to busy schedules, specifically in the city areas, is anticipated to boost the demand for molded pulp packaging products in the food packaging industry during the forecast period.

Moreover, the growing foodservice industry coupled with an increasing number of foodservice establishments is expected to increase the demand for molded pulp packaging products over the forecast period. In addition, owing to the growing concerns about plastic waste and increasing demand from consumers for sustainable packaging, several food service operators across the globe are expected to switch from traditional plastic-based packaging products to molded pulp packaging products.

Source Insights

Based on source, the market is segmented into non-wood pulp and wood pulp. The wood pulp segment recorded the largest market share of 85.4% in 2022 in terms of revenue. The demand for ecofriendly packaging along with the presence of several end-users to adopt these forms of packaging has been bolstering the demand for molded wood pulp packaging owing to its 100% degradable properties.

The non-wood pulp segment is expected to expand at a fast CAGR of 8.1% over the forecast period 2023-2030. It is produced using cellulosic of non-wood plant materials such as reeds, cereal straw, sugar cane bagasse, and grasses. With the rising concerns regarding deforestation, the consumer demand for non-wood pulp is anticipated to grow at a faster pace.

Type Insights

Based on type, the market is segmented into thick wall, transfer, thermoformed, and processed. The transfer segment accounted for the largest market share of 57.0% in 2022 in terms of revenue. Transfer molded pulp packaging is gaining momentum in several industries due to its unique properties. For instance, in the food service industry, it adds to the prolonged shelf life of transported food and beverage products owing to its air permeability and hygroscopic properties.

The thermoformed segment is expected to grow at a fast CAGR of 8.3% during the forecast period due to its wide application in the food service industry for trays, plates, cups, and bowls. The rigidity and smooth finish of the packaging make it a better option than plastic packaging. Furthermore, in recent years, molded pulp packaging solutions such as thermoformed are standing as an alternative for thermoformed plastic packaging products.

Product Insights

Based on product, the market is segmented into trays, end caps, bowls & cups, clamshells, plates, and others. The tray segment recorded the largest market share of 41.0% in 2022 in terms of revenue. This is due to a number of problems with plastic trays. For instance, foam and plastic trays are not recommended for use in food service packaging because they have a propensity to distort when food temperatures rise. A significant drawback is that many plastics, with the exception of CPET and PET, cannot be microwaved and are expensive. This is increasing demand for microwaveable molded pulp trays. Molded pulp trays can also be used in conventional and microwave ovens, making them double oven compatible.

The clamshells segment is anticipated to expand at a fast CAGR of 8.2% during the forecast period 2023-2030 owing to the increased demand for retail egg packaging. Eggs are packed either in molded pulp or plastic clamshells. However, the consumer demand for plastic clamshells has been declining in the past few years owing to the increasing demand for molded pulp clamshells. This can be attributed to the convenience, in terms of carrying and disposing, offered by molded pulp clamshells.

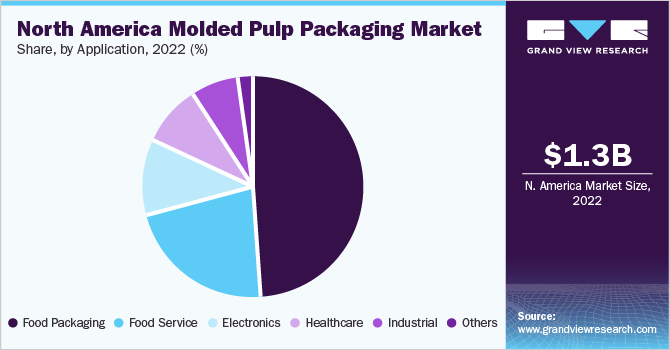

Application Insights

Based on application, the market is segmented into food packaging, food service, electronics, healthcare, industrial, and others. The food packaging segment accounted for the largest market share of 48.6% in 2022 in terms of revenue. Molded pulp clamshells and trays are considered the key packaging solutions for vegetables, eggs, and fruits to the low price and cushioning offered. In addition, molded pulp trays offer the extended freshness of the eggs owing to the ventilation provided in the trays.

The electronics segment is expected to expand at a fast CAGR of 8.5% over the forecast period. Molded pulp packaging solutions such as clamshells, trays, and end caps are largely used across the electronic industry for packaging various delicate electronic devices such as computers, printers, hard drives, and others. For instance, Cell phones are delicate electronic devices that require careful handling and protection during transportation. This packaging can be designed to fit the unique shape and size of each cell phone model, providing a secure and snug fit for the device.

Country Insights

Based on country, the market is segmented into the U.S., Canada, and Mexico. The U.S. segment accounted for the highest market share of 75.1% in 2022 in terms of revenue. This is attributed to the presence of several food service companies in the country including catering services, restaurants, and fast-food outlets. The increasing demand base for out-of-home food due to busy work-life schedules and convenience boosts the demand for molded pulp packaging solutions.

Canada is expected to grow at a fast CAGR of 8.8% over the forecast period 2023-2030. With a relatively low population, Canada expanse over a vast range of landmass mostly concentrated in the Northern part of the country, this essentially directs toward a heavier demand for energy and higher emissions. The government of Canada has decided to take firm decisions to reduce greenhouse gas emissions and support clean technology innovation. This type of governmental support via tax subsidies is expected to boost the demand for sustainable packaging solutions such as molded pulp packaging.

Key Companies & Market Share Insights

The key players operating in the market include Huhtamaki, Brødrene Hartmann A/S, Thermoform Engineered Quality LLC (Sonoco Products Company), Pro-Pac Packaging Limited, and others along with the presence of a few regional players. Major players are continuously working on developing packaging solutions owing to the rising demand for molded pulp packaging from several applications including food packaging, food service, electronics, and others.

A majority of companies are spending extensively on research & development activities to develop advanced products and integrate new technologies and characteristics to offer innovative packaging solutions. For instance, In January 2023, U.S.-based Knoll Printing and Packaging, Inc. introduced a series of make-up compacts produced from Knoll Ecoform molded pulp made of wood, sugar cane fibers, and bamboo. Some of the prominent players operating in the North America molded pulp packaging market are:

-

Brødrene Hartmann A/S

-

Huhtamäki Oyj

-

UFP Technologies

-

Thermoform Engineered Quality

-

Genpak, LLC

-

Eco-Products, Inc

-

Pro-Pac Packaging Limited

-

Fabri-Kal

-

Henry Molded Products, Inc.

-

Sabert Corporation

-

Pacific Pulp Molding

North America Molded Pulp Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.33 billion

Revenue forecast in 2030

USD 2.13 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, type, product, application, country

Region scope

U.S.; Canada; Mexico

Key companies profiled

Brødrene Hartmann A/S; Huhtamäki Oyj; UFP Technologies; Thermoform Engineered Quality (Subsidiary of Sonoco Product Company); Genpak, LLC; Eco-Products, Inc; Pro-Pac Packaging Limited; Fabri-Kal; Henry Molded Products, Inc.; Sabert Corporation; Pacific Pulp Molding

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Molded Pulp Packaging Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America molded pulp packaging market report based on source, type, product, application, and country:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Wood pulp

-

Non-wood pulp

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Thick wall

-

Transfer

-

Thermoformed

-

Processed

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Trays

-

End Caps

-

Bowls & Cups

-

Clamshells

-

Plates

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Food Packaging

-

Food Service

-

Electronics

-

Healthcare

-

Industrial

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. Based on application, the food packaging segment dominated the molded pulp packaging market with a share of over 48.0% in 2022. Shifting consumer inclination towards sustainable packaging and increasing regulations on single-use plastics are anticipated to spur the product demand in the North America region.

b. Some of the key players operating in the molded pulp packaging market include Brødrene Hartmann A/S, Huhtamäki Oyj, UFP Technologies, Inc., Thermoform Engineered Quality, LLC, Genpak, LLC, Eco-Products, Inc., Pro-Pac Packaging Limited, Fabri-Kal, Henry Molded Products, Inc., Sabert Corporation.

b. The key factors that are driving the North America molded pulp packaging market include growing consumer demand for sustainable packaging and stringent government regulations & government initiatives to curb plastic pollution. The cost-effectiveness of molded pulp is an added benefit for the use of molded pulp packaging products, thus incentivizing the use resulting in higher market penetration.

b. North America molded pulp packaging market size was estimated at USD 1.25 billion in 2022 and is expected to reach USD 1.33 billion in 2023.

b. North America molded pulp packaging market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 2.13 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."