- Home

- »

- Consumer F&B

- »

-

North America Packaged Salad Market Report, 2021-2028GVR Report cover

![North America Packaged Salad Market Size, Share & Trends Report]()

North America Packaged Salad Market Size, Share & Trends Analysis Report By Category (Branded, In-store/Private Label), By Product, By Processing, By Type, By Distribution Channel, By Country, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-354-6

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

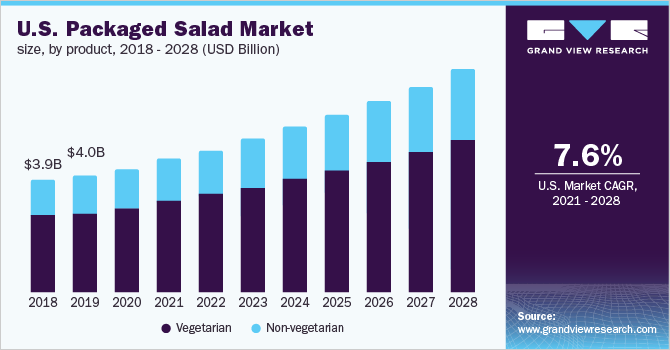

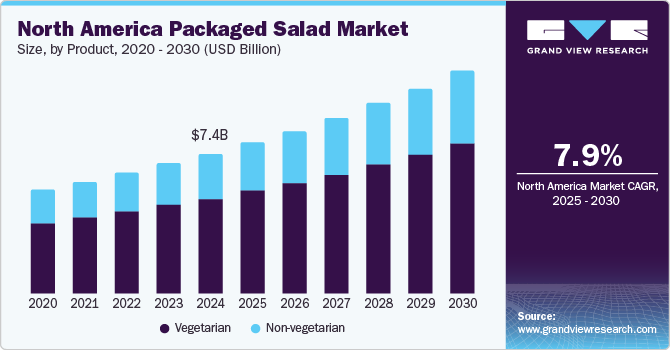

The North America packaged salad market size was valued at USD 5.5 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2021 to 2028. The growth of the market can be attributed to the rising popularity of salads and the ease of consumption provided by packaged salad products. The COVID-19 crisis has offered some respite to the North American market as people around the world have taken an unprecedented interest in cooking at home. With restaurants shut in most parts of the region, consumers have been preparing their own meals, which has driven the demand for various basic food items and ingredients, including packaged salads. This scenario is likely to keep the market prospects upbeat.

Packaged salads are prepared by a combination of various kinds of vegetables and fruits, which are dressed in various condiments and accompanied by meat and seafood. These salads have gained substantial popularity across the region. Collecting various ingredients of the dish, along with cleaning, chopping, and preparing can be a tedious and time-consuming task, which is increasing the demand for alternatives, such as packaged salads.

The increasing preference for light meals, along with the rising demand for convenience food options among U.S. consumers, has been driving the market over the last few years. These have become healthy and convenient meal options for consumers. Furthermore, the high penetration of key market players in the U.S. has improved product accessibility across the country.

The demand for packaged salads is also driven by the rising consumer interest in healthy foods instead of high-calorie foods. Nowadays, consumers are increasingly preferring foods that have more nutritional properties and are customizable, organic, and natural. These consumer trends are anticipated to ensure high penetration and growth over the forecast period.

The increasing demand for organically processed packaged salads is attributed to the rising concerns for one’s health and the environment. These organic food items support ecosystem preservation, biodiversity, and water conservation. The consumption of these products is increasing across the region as consumers increasingly prefer natural ingredients that are free from chemicals.

Product Insights

The vegetarian segment held the largest share of over 65.0% in 2020 and is expected to maintain its lead over the forecast period. As with other sectors within the food and beverage industry, the demand for vegetarian packaged salads is driven by the growing number of health-conscious consumers in North America. In this respect, individuals shopping for organic produce/products continue to create a sizable demand for the product in the market.

A key new entrant strategy for emerging brands will be to progressively expand in the regional markets. For instance, San Francisco is likely to be seen as an attractive location for brands to set up manufacturing operations, given its proximity to produce suppliers in Salinas, California, where a wide variety of crops are available all year round. At a macro-level, the rising popularity of vegetarian and vegan food continues to boost the demand for vegetarian packaged salads.

The non-vegetarian segment is expected to register a CAGR of 7.8% from 2021 to 2028. Shifting consumer focus on protein-enriched diets to achieve the desired body figure or shape has been a contributing factor for the increasing demand in North America. Brands offering non-vegetarian packaged salads typically promote their products as a wholesome choice for the present-day active lifestyle.

White chicken meat is one of the most common ingredients used in non-vegetarian packaged salads. Recent years have witnessed various key developments in the non-vegetarian space. For instance, in September 2018, Taylor Farms, a U.S.-based producer of fresh-cut vegetables, introduced salad kits featuring ready-to-eat grilled chicken.

Processing Insights

The conventional processing segment held the largest share of over 70.0% in 2020 and is expected to maintain its lead over the forecast period. Conventionally processed products are typically cheaper than their organic counterparts as conventional farming is generally cheaper than organic farming. Lack of consumer awareness regarding organic products is expected to favor the growth of the conventional segment over the forecast period.

Organically processed products are generally perceived to contain more nutrients and antioxidants than conventional processed. Health-conscious consumers who focus on reducing their exposure to artificial chemicals and antibiotic-resistant bacteria usually prefer organically processed to conventionally processed products.

Type Insights

The packaged greens segment held the largest share of over 60.0% in 2020 and is expected to maintain its lead over the forecast period. These have been gaining popularity owing to their raw taste without the addition of any type of seasonings, dressings, and condiments.

Furthermore, people across the region are increasingly adopting packaged greens in order to cut down their intake of extra calories, sugar, and fat. Other forms contain a number of condiments, sauces, and dressings, which are added calories. Such types of consumer preferences are driving the demand in the North American market.

Conventional style cooking is too time- and effort-intensive for cooking a meal for one, or even for preparing a fresh salad. The most time-intensive part is washing, cutting, and mixing the ingredients with proper sauces or condiments in order to make it taste good. This hectic process is opening new scope for the manufacturers in the North American market.

Distribution Channel Insights

The offline segment accounted for the largest share of over 80.0% in 2020. Grocery stores are among the largest offline distribution channels for packaged salad. The mainstream grocery distribution platform includes local grocery stores and national chains, such as Kroger, in the U.S. Unlike supermarkets, grocery stores help these brands stay customer-focused by offering products that consumers want.

The online platform is expected to register the fastest CAGR of 8.2% from 2021 to 2028. The North American market for packaged salad is yet to adopt e-commerce widely as compared to other sectors, like household products and consumer electronics. The perishable nature of packaged salads with unique logistic and storage requirements is a key factor slowing down the distribution of these products through online/e-commerce channels.

The online segment witnessed significant growth throughout 2020, given the temporary and permanent closures of physical distribution channels in the region. Amazon witnessed a dramatic increase in demand on multiple fronts, including grocery items, throughout 2020.

Category Insights

The branded segment held the largest share of over 75.0% in 2020 and is expected to maintain its lead over the forecast period. The branded ones are those that are widely available on a national or international scale and are not confined to a single store or location. In comparison to private label or in-store packaged salads, which are unique items made or obtained for distribution through a certain domestic supplier, these are established or prominent products.

To take advantage of unique items, retail outlets typically trade both branded as well as private labels. Branded products are identified by the brand name, which buyers trust while making a purchase. Dole Food Company, Inc.; Fresh Express Incorporated; and Boduelle are some of the established companies offering packaged salads. Branded packaged salads typically cost more to promote, with higher price points.

Private label products are expected to register the fastest CAGR of 9.0% from 2021 to 2028. Retailers in North America have extended and diversified private label packaged salads assortment by offering premium-quality private label food products. With price being the major barrier for purchases, these products have emerged as a more suitable and affordable alternative for several consumers.

In-store or private label brands are offered by retailers to differentiate their retail brand and assortment from other competitors. Private label brands carry the retailer’s own brand or a name used exclusively by that retailer. Over the last few years, the market share of private label brands has kept increasing in North American countries.

Country Insights

The U.S. held the largest share of over 75.0% in 2020. With the increasing awareness about leading a healthy lifestyle, the demand has been growing significantly among consumers. According to data from the Simmons National Consumer Study and the U.S. Census Bureau published in 2020, 242.86 million consumers in the U.S. consumed bagged or packaged salads in 2020.

Canada is expected to exhibit the highest CAGR of 9.2% from 2021 to 2028. Packaged salad is popular in Canada owing to the increasing awareness regarding the health benefits of eating salads as a part of a daily diet. However, there are some concerns surrounding the consumption of these products.

Key Companies & Market Share Insights

The market is highly fragmented owing to the presence of a large number of multinational as well as domestic manufacturers. A large part of the industry is dominated by some of the large and strong companies. For instance, in June 2019, Bonduelle acquired LLC SHOCK frozen vegetable company’s production plant in Belgorod region, Russia. This new plant acquisition will increase the production capacity of Bonduelle and help it in coping with the rising frozen market demand in Russia. Similarly, in June 2020, Dole Food Company Inc. extended its Chopped! and Premium salad kits that offer innovative flavor combinations and new salad ingredients. Some prominent players in the North America packaged salad market include: -

-

Earthbound Farm

-

Vegpro International Inc.

-

Dole Food Company, Inc.

-

Fresh Express Incorporated

-

BrightFarms

-

Eat Smart

-

Misionero

-

Gotham Greens Holdings, LLC

-

Mann Packing Co.

-

Bonduelle

North America Packaged Salad Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 5.9 billion

Revenue forecast in 2028

USD 10.0 billion

Growth rate

CAGR of 7.8% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, product, processing, type, distribution channel, country

Regional scope

North America

Country scope

U.S.; Canada

State/Region scope

Florida; New York; Pennsylvania; Illinois; Ohio; Georgia; Quebec; British Columbia; Ontario; Alberta; Rest of Canada

Key companies profiled

Earthbound Farm; Vegpro International Inc.; Dole Food Company, Inc.; Fresh Express Incorporated; BrightFarms; Eat Smart; Misionero; Gotham Greens Holdings, LLC; Mann Packing Co.; Bonduelle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the North America packaged salad market report on the basis of category, product, processing, type, distribution channel, and country:

-

Category Outlook (Revenue, USD Million, 2016 - 2028)

-

Branded

-

In-store/Private Label

-

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Vegetarian

-

Non-vegetarian

-

-

Processing Outlook (Revenue, USD Million, 2016 - 2028)

-

Organic

-

Conventional

-

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Packaged Greens

-

Packaged Kits

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million, 2016 - 2028)

-

U.S.

-

Florida

-

New York

-

Pennsylvania

-

Illinois

-

Ohio

-

Georgia

-

-

Canada

-

Quebec

-

British Colombia

-

Ontario

-

Alberta

-

Rest of Canada

-

-

Frequently Asked Questions About This Report

b. The North America packaged salad market size was estimated at USD 5.5 billion in 2020 and is expected to reach USD 5.9 billion in 2021.

b. The North America packaged salad market is expected to grow at a compound annual growth rate of 7.8% from 2021 to 2028 to reach USD 10.0 billion by 2028.

b. The U.S. dominated the North America packaged salad market with a share of 77.2% in 2020. With increasing awareness about leading a healthy lifestyle, the demand has been growing significantly among consumers.

b. Some key players operating in North America packaged salad market include Earthbound Farm, Vegpro International Inc., Dole Food Company, Inc., Fresh Express Incorporated, BrightFarms, Eat Smart, Misionero, Gotham Greens Holdings, LLC, Mann Packing Co., and Bonduelle.

b. The North America packaged salad market growth include can be attributed to the rising popularity of salads and the ease of consumption provided by packaged salad products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."