- Home

- »

- Petrochemicals

- »

-

North America Paraffin Wax And Emulsions Market ReportGVR Report cover

![North America Paraffin Wax And Emulsions Market Size, Share & Trends Report]()

North America Paraffin Wax And Emulsions Market Size, Share & Trends Analysis Report By Paraffin Wax Application (Candles, Packaging), By Paraffin Wax Emulsion Application (Woodworking, Paper), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-667-3

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Report Overview

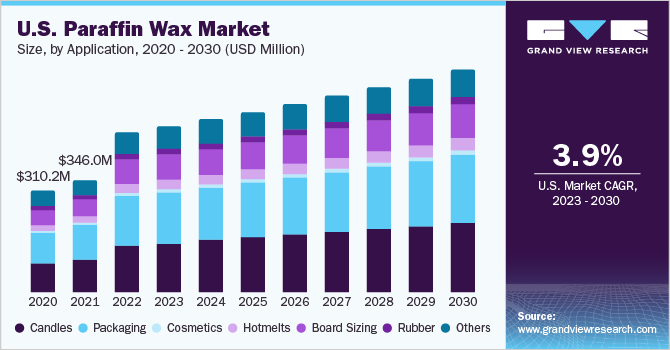

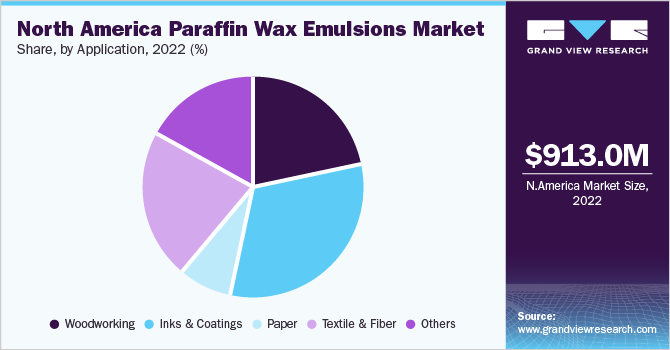

The North America paraffin wax and emulsions market size was valued at USD 913.04 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030. The North America paraffin wax market is anticipated to be driven by the increased demand for candle manufacturing and packaging across North America. Moreover, the rising demand for inks & coatings coupled with the growing demand for wood-based panels, windows, and doors in construction industry is expected to drive the demand for paraffin wax emulsions in North America. The U.S. and Canada product markets are expected to witness substantial growth owing to the rising living standards and increasing pace of industrialization. North America paraffin wax market is expected to grow owing to the presence of various personal care & cosmetics companies such as Colgate-Palmolive, Maybelline, Avon, Unilever, Johnson & Johnson, and Procter & Gamble, among others. Thus, the increasing popularity of cosmetics is expected to promote the demand for the product market over the forecast period.

The North America paraffin wax market is expected to witness significant growth over the forecast period owing to its rising applications in the candles, packaging, and cosmetic industries. The demand for product market grew over time as it offers enhanced bonding properties and is a key component used across several households globally. However, its carcinogenicity led to a switch in consumer preference from these artificial wax products to natural wax products.

The North America cosmetics market has grown tremendously owing to high diversity in consumer preferences and innovations in the market. Paraffin wax is a petroleum-based product that has the capability to store heat as well as provide hydration to the skin. It is most commonly used in cosmetic products such as sunscreen lotions, hair care, and skin care, among other products.

Among the various types of additives available, waxes have significant impact on many processes and formulations. Even on application of about 3% solid content of the total composition, waxes improve abrasion resistance, anti-blocking, lubrication, water repellency, matting, and other critical properties in coatings and inks. Hence, paraffin waxes are classified as surface conditioner additives.

Paraffin Wax Application Insights

The candle segment dominated the market with a revenue share of 29.7 % in 2022. This is attributable to its increasing usage in homes and restaurants for decoration purposes. Moreover, the rising demand for scented candles to enhance the aesthetic appeal and aura of different places favors the growth of the product market

Paraffin wax-based candles are inert and burn well. The melting point of candle is generally between 1100 Fahrenheit and 1500 Fahrenheit, and it is the primary property that helps determine the type of candle that can be made using this wax. For instance, paraffin wax with a melting point of less than 1300 Fahrenheit is used for manufacturing jar, glass, and other container-based candles, while paraffin wax with a melting point between 1300 Fahrenheit and 1500 Fahrenheit is used for manufacturing votive candles and other standing candles.

The packaging application segment is anticipated to offer a number of opportunities during the forecast period owing to rising demand for packaging material and the growth of e-commerce across the globe. Paraffin wax is widely used in the packaging industry on account of its moisture and odor absorbing characteristic. Paraffin wax is a saturated hydrocarbon mixture, which is often added with PE molecules to improve their melting point. However, these waxes are mixed with antioxidants to enhance their properties. Key players manufacturing flexible packaging materials are Mars Inc., Tyson Foods Inc., Nestle SA, and PepsiCo Inc.

Paraffin waxes are derived from petroleum, which got recognition in the early 20th century owing to its rising application in the cosmetics sector. The main petroleum products used in the cosmetic industry are Vaseline oils and Vaseline and crystalline paraffin. It has application in various products, such as antiperspirants, hair serums, facial care products, beauty masks, and creams. Macro crystalline paraffin wax is mainly used as a protective cream by workers to protect their skin from any harmful chemicals. It is also used in manufacturing of lipsticks and other cosmetics such as skin foundation.

Paraffin Wax Emulsion Application Insights

The inks and coatings application dominated the market with a revenue share of over 32.0% in 2022 owing to increasing construction activities in North America, due to rapid urbanization and increasing repair & renovation activities of old buildings and structures, and rising use of inks & coatings in automotive industry.Inks and coatings are used in various industries including construction, automotive, electrical and electronics, and industrial manufacturing owing to their ability to protect materials or substances from wear and tear and rusting.

In paper industry, it has its application in reducing the moisture absorption tendency of papers. In addition, they promote the uniform distribution of fibrous structure in papers. Paraffin wax emulsions support the function of resin adhesives in papers. For instance, about 1-5 weight% addition of paraffin wax emulsion leads to a considerable anti-moisture effect. Paraffin wax emulsions prevent the adhesive from mixing with other pigments and improve the print efficiency of papers.

In textile industry, the product is used as a textile and yarn finishing agent. It is used to enhance softness, glossiness, and smoothness as well as and improve the quality of the final product. In textile industry, paraffin wax emulsions are used during the sewing process to protect the thread from breakage, improve water resistance, and reduce friction. The increasing use of textiles in various end-use industries including apparel and home furnishing is expected to drive the demand for product market over the forecast period.

Key Companies & Market Share Insights

The global market is fragmented with the presence of numerous global and regional players. The global players are integrated in the supply chain. Most of the players are clustered in U.S. and Canada as these countries offer easy access to raw materials. Companies engage in expansions activities such as merger and acquisition, and develop their product portfolios to expand their footprint across the globe. In addition, they are heavily investing in research and development and technology innovation to enhance their product offering. Some of the prominent players in the North America paraffin wax and emulsions market include:

-

Dominion Chemical Company

-

Hexion

-

The International Group, Inc.

-

Walker Industries

-

Willamette Valley Company

-

Accu-Blend Corporation

-

King Honor International Ltd.

-

Clariant

-

Moretex Chemical

North America Paraffin Wax And Emulsions Market Report Scope

Report Attribute

Details

Market size value in 2023 (Paraffin Wax Market)

USD 947.78 million

Revenue forecast in 2030

USD 1,242.2 million

Growth rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD Thousand, Volume in Tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Dominion Chemical Company; Hexion; The International Group, Inc.; Walker Industries; Willamette Valley Company; Accu-Blend Corporation; King Honor International Ltd.; Clariant; Moretex Chemical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Paraffin Wax And Emulsions Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America paraffin wax and emulsions market report on the basis of application and region:

-

Paraffin Wax Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Candles

-

Packaging

-

Cosmetics

-

Hotmelts

-

Board Sizing

-

Rubber

-

Others

-

-

Paraffin Wax Emulsions Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Woodworking

-

Inks & Coatings

-

Paper

-

Textile & Fiber

-

Others

-

-

Country Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. North America Paraffin Wax Market was valued at USD 912.8 Million in 2022 and is expected to reach USD 1,242.0 Million by 2030. North America Paraffin Wax Emulsions Market was valued at USD 162.2 Thousand in 2022 and is expected to reach USD 218.6 Thousand by 2030.

b. North America Paraffin Wax Market registered a CAGR of 3.9% over the forecast period. North America Paraffin Wax Emulsions Market registered a CAGR of 3.8% over the forecast period.

b. Candle manufacturing is one of the prominent applications of paraffin wax. This wax is used for developing a variety of candles that are used in homes and restaurants for decoration purposes. Paraffin wax-based candles are inert and burn well.

b. Key manufacturers operating in North America paraffin wax & emulsions market are Dominion Chemical Company, Hexion, The International Group, Inc., Walker Industries. The industry is marked by the presence of key multinationals that have established a strong regional presence.

b. The rising demand for inks & coatings coupled with the growing demand for wood-based panels, windows, and doors in construction industry is expected to drive the demand for paraffin wax emulsions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."