- Home

- »

- Plastics, Polymers & Resins

- »

-

North America PC And PC/ABS In IT Server Market 2021-2028GVR Report cover

![North America PC And PC/ABS In IT Server Market Size, Share & Trends Report]()

North America PC And PC/ABS In IT Server Market Size, Share & Trends Analysis Report Product By Application (Polycarbonate, Polycarbonate/Acrylonitrile Butadiene Styrene), By Country (U.S., Canada, Mexico), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-575-9

- Number of Pages: 24

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Bulk Chemicals

Report Overview

The North America PC and PC/ABS in IT server market size was valued at USD 49.37 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2021 to 2028. Factors, such as increasing demand for internet services and data storage from the growing population, in addition to the introduction of data centers and server units by major tech companies, have fueled the demand for polycarbonate across the IT server industry. Server systems including standalone servers, blade servers, and tower servers utilize air conditioning housings for applications such as server racks, in-row heat exchangers, and other cooling accessories. These air conditioning housings are manufactured using Polycarbonate (PC) resin due to their high flexibility, durability, and efficient thermal control characteristics. Furthermore, enclosures manufactured using Polycarbonate/Acrylonitrile Butadiene Styrene (PC/ABS) blends provide high insulation characteristics, reducing the risk of damage due to electrical errors.

To cater to the rising demand for data centers, server rooms, and other IT racks have propelled the demand for Polycarbonate (PC) and Polycarbonate/Acrylonitrile Butadiene Styrene (PC/ABS) for manufacturing of twin walls, wall-mounted enclosure, and aisle containment panels. In addition, the increasing requirement for cloud storage from the growing population across the region is anticipated to fuel the growth of the North America PC and PC/ABS in IT server market.

The high demand for data storage in recent years has propelled the demand for blade servers for the management and distribution of data in a collection of networks. Cooling system housings in blade servers are manufactured using polycarbonate resin due to their higher thermal resistance. In line with the growing remote workforce, security companies across Canada are likely to increase IT spending, increasing cloud-based security tools, log management, and virtual private network (VPN).

Polycarbonate is utilized across the IT server industry for the manufacturing of housing for cooling systems, twinwalls for thermal separation, wall-mounted enclosure, aisle containment panels, and other components. Due to high thermal resistance, inductive characteristics, flexibility, and durability, PC is preferred over its counterpart polyvinyl chloride and acts as a substitute to metals such as steel and aluminum.

Product By Application Insights

Polycarbonate twinwalls are highly flexible; extremely durable and impact resistant; provide UV protection and air layer for insulation; lightweight; and flame retardant. Data centers, server rooms, and other IT racks generally are lined up in an alternating row where the fronts of the equipment face each other creating a cold aisle. Similarly, the exhausts from the equipment facing each other create a hot aisle.

The polycarbonate-based twinwalls provide an effective barrier between the server racks and other equipment with a significant advantage over polyvinyl chloride aisle curtains. The thermal properties of polycarbonate allow alternating cold and warm aisles to be placed side by side without heat transfer between the twinwall and multiwall sheets.

Wall-mounted enclosures are made of high-impact resistant, non-conductive lightweight reinforced polycarbonate. These wall-mounted enclosures are used in server and networking equipment attached against the wall, in areas with limited space, such as technology store fronts and repair centers. In addition, polycarbonate provides lightweight characteristics and is easy to install.

Country Insights

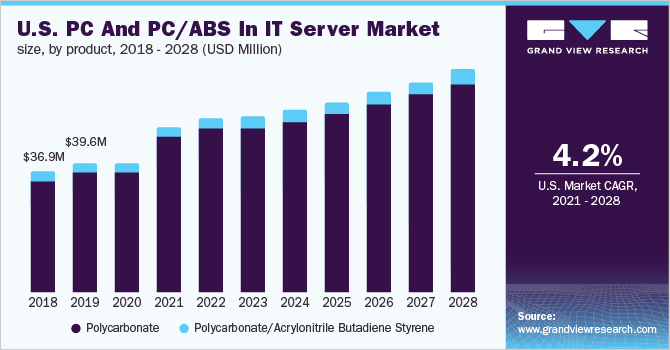

The rising number of data centers across the U.S. has increased the demand for rack servers, blade servers, microservers, tower servers, and other such equipment. Polycarbonate provides higher durability, flexibility, and lightweight characteristics, making it suitable for the manufacturing of twinwalls, wall-mounted enclosures, aisle containment panels, cooling system housings, and others.

Furthermore, the growing demand for data servers with the increasing trend of cloud computing has propelled players like Facebook, Inc., Amazon.com, Inc., Twitter, Microsoft Corporation, and others to install server systems for data storage. This has propelled the demand for polycarbonate (PC) and polycarbonate/acrylonitrile butadiene styrene (PC/ABS) blend across the U.S. IT server industry.

Increased connectivity has spurred the growth of Mexico’s digital economy in recent years. In June 2021, Mexico had approximately 80.0 million internet users, more than the recorded number in 2020. This increasing number of internet users has led tech companies to invest in cloud storage and IT services across the country, increasing the demand for server units across datacenters.

Key Companies & Market Share Insights

The key players operating in the North America market for PC and PC/ABS in IT servers are SABIC, Mitsubishi Chemical Corporation, Covestro AG, Sumika Polycarbonate Ltd., and others along with a few medium- and small-sized regional players. These major players compete based on product development and form strategic partnerships with regional players to minimize the risk of expanding into a new marketplace.

Several companies are expanding their product offerings owing to rising demand from IT applications including twinwalls, wall-mounted enclosure, aisle containment panels, cooling system housings, and others. Since polycarbonate and polycarbonate/acrylonitrile butadiene styrene are highly flexible and are well-suited for components for thermal separation in server rooms, the demand for these resins has witnessed a rise in demand from the IT server market across the country. Some of the prominent players operating in the North America PC and PC/ABS in IT server market are:

-

SABIC

-

Mitsubishi Chemical Corporation

-

Covestro AG

-

Sumika Polycarbonate Ltd.

North America PC And PC/ABS In IT Server Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 61.02 million

Revenue forecast in 2028

USD 81.95 million

Growth Rate

CAGR of 4.3% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, and Trends

Segments covered

Product by application, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

SABIC; Mitsubishi Chemical Corporation; Covestro AG; Sumika Polycarbonate Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue and volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the North America PC and PC/ABS in IT server market report based on product by application and country:

-

Product by Application Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Polycarbonate (PC)

-

Twinwalls

-

Wall-mounted Enclosure

-

Aisle Containment Panels

-

-

Polycarbonate/Acrylonitrile Butadiene Styrene (PC/ABS)

-

Twinwalls

-

Wall-mounted Enclosure

-

Aisle Containment Panels

-

-

-

Country Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America PC and PC/ABS in IT Server market size was estimated at USD 49.37 million in 2020 and is expected to reach USD 61.02 million in 2021.

b. The North America PC and PC/ABS in IT Server market is expected to grow at a compound annual growth rate of 4.3% from 2021 to 2028 to reach USD 81.95 million by 2028.

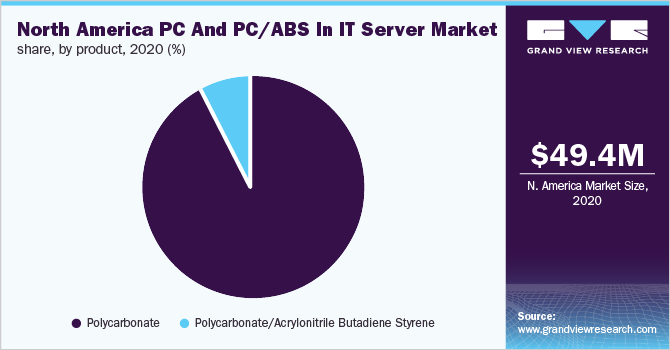

b. The polycarbonate segment dominated the North America PC and PC/ABS in IT Server market with a share of 92.6% in 2020. This is attributable to its properties such as high flexibility, extremely durable, high impact resistance, UV protection, lightweight, and flame retardent, suitable for manufacturing polycarbonate-based twinwalls.

b. Some key players operating in the North America PC and PC/ABS in IT Server market include SABIC; Mitsubishi Chemical Corporation; Covestro AG; and Sumika Polycarbonate Ltd.

b. Key factors that are driving the North America PC and PC/ABS in IT Server market growth include the rising number of data centers across the U.S. and growing demand for data servers with increasing trend of cloud computing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."