- Home

- »

- Alcohol & Tobacco

- »

-

North America Spirits Market Size Report, 2021-2028GVR Report cover

![North America Spirits Market Size, Share & Trends Report]()

North America Spirits Market Size, Share & Trends Analysis Report By Product (Whiskey, Gin), By Caps & Closures Material (Plastic, Metal), By Caps & Closures (Bar-top, Screw-top), By Distribution Channel, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-707-3

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

The North America spirits market size was valued at USD 154.0 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 7.7% from 2021 to 2028. The growing demand for premium products has been driving the growth of the market across the region. Consumers have been switching to premium spirit brands with amplified brand experience. Many spirits with unique flavors and distinct tastes were launched in North America even during the COVID-19 pandemic and thus, the market is expected to continue to grow in the coming years. For instance, Onda, a New York-based company, launched a canned spirit-based cocktail with Blanco Tequila and real fruit juice, which is gluten-free and contains no sugar and no carbs.

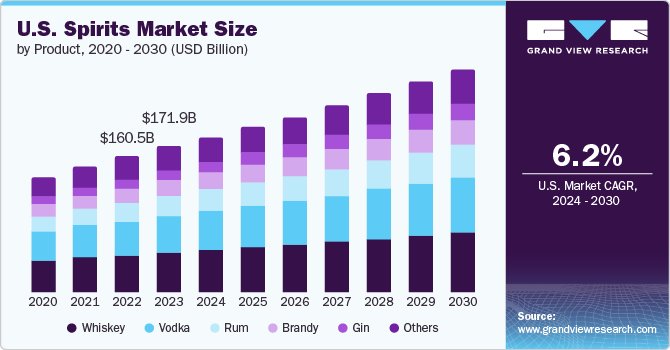

In the U.S. market, whiskey emerged as the largest product segment in 2020. The demand for whiskey in the U.S. market is growing owing to the rising demand for premium drinks. Moreover, changing consumer preferences, improved standards of living, increasing disposable income levels, and changing lifestyles are stimulating the demand. Furthermore, the growing popularity of the cocktail culture is expected to boost the demand for premium products. Over the past few years, the growth of the high-end alcohol segment has been outpacing the growth of the overall segment, hence driving product consumption in North America.

The growing demand for unique and crafted alcoholic beverages is emerging as a rising trend in North America, which is expected to drive the product demand. Increasing product promotion and tasting/educating programs are boosting the sales of spirits among millennials. Over the past few years, with the changing lifestyles, consumers are choosing quality over quantity. The availability of a wide range of these drinks, including flavored and gluten-free, has boosted the sales of these products across the region. Companies have been introducing innovative flavors to their drinks to attract a wider range of consumers.

Product Insights

The whiskey product segment held the largest market share of more than 27% in 2020 and is expected to maintain dominance over the forecast period. Premiumization has become a growing trend in the alcohol industry. Most of the categories in the industry are going through substantial premiumization. Whiskey, in particular, has been gaining traction among consumers over the years. According to the data statistics published in Alcohol.org in 2019, the consumption of spirits has grown by 28% in America between 2000 and 2018. Among spirits, nearly 24 million (9-liter bottles) of American whiskey and 17 million (9-liter bottles) of Canadian whiskey are consumed every year. Such factors indicate a significant growth potential for the market.

However, the gin product segment is projected to register the fastest CAGR during the forecast period. The demand for distilled gin manufactured in the U.S. is expected to grow in the coming years as consumer interest is shifting toward exotic, handcrafted drinks. According to the statistics released by the Distilled Spirits Council of the U.S. (DISCUS), in June 2021, the premium, high-end premium, and super-premium categories increased in gross revenue by 6.3%, 7.7%, and 8.7%, respectively.

Caps & Closure Insights

The screw-top segments accounted for the largest revenue share of more than 85% in 2020 due to various benefits associated with this format, primarily the ease of sealing spirits for later consumption. Screw-top caps can be either endless threads or lugs, generally with a metal skirt down the neck to resemble the conventional wine capsule. These caps are cost-efficient, easy to use, provide an effective seal, and adhere to product, package, & environmental laws & administrations.

The others segment is expected to register the fastest growth during forecast years. Other caps & closures include non-refillable closures. Non-refillable closures are used by distilleries for the packaging of spirits, such as whisky, vodka, rum, brandy, and gin. In addition, the practice of counterfeiting and refilling spirit bottles represents a serious risk to the well-being of consumers. To avoid such risks, manufacturers are coming up with a wide range of non-refillable closures for spirits, which, in turn, is expected to drive the segment growth.

Caps & Closure Material Insights

The plastic material segment held the largest market share of more than 50% in 2020 and is expected to maintain dominance over the forecast period due to the abundant availability of these raw materials. The spirits industry relies heavily on plastic caps and closures as they provide a cost-effective sealing solution. Thus, the growing demand for plastic packaging solutions is the key factor fueling the segment growth.

On the other hand, the metal segment is projected to register the fastest CAGR during the forecast period. The growth is credited to the rising demand for effective packaging solutions for spirits, such as metal caps and closures. These packaging solutions come with a plastic liner so that the content and the closure are never in contact with each other. Furthermore, technological advancements in the metal caps and closures market have helped in the aging of spirits, which in turn, drives the segment growth.

Distribution Channel Insights

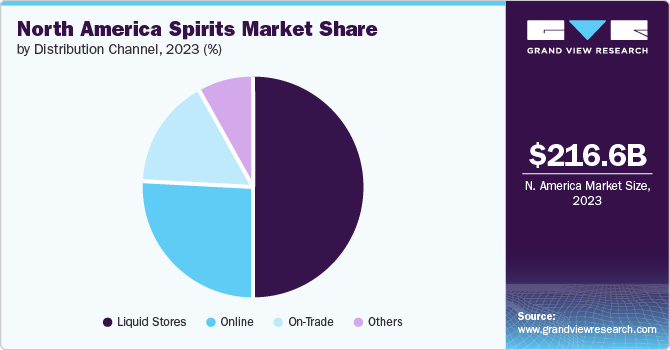

The liquor stores segment held the largest market share of over 50% in 2020 and is expected to maintain dominance over the forecast period. Liquor stores are a prominent distribution channel for selling these drinks. Small retailers always look for opportunities to establish and maintain an effective retail chain due to significant changes in consumers’ purchase behavior and patterns, especially for premium and innovative products. Earlier, key players in the North America market offered their range of products through exclusive stores that were usually situated at prime locations in various cities.

However, the online segment is projected to register the fastest CAGR during the forecast period. The hassle-free shopping experience offered by various online platforms is expected to drive the growth of the online segment. Easy payment methods that fit into the regulatory standards of different countries have made online transactions a lot easier. Moreover, due to the outbreak of COVID-19, consumers have started to purchase products through online channels to avoid physical contact, which is expected to fuel product sales through online distribution channels.

Regional Insights

The U.S. accounted for the highest revenue share of more than 77% in 2020. New product developments, mergers & acquisitions, and expansions are some of the most preferred strategies by key players in the U.S. market. For instance, in April 2021, Diageo plc announced the acquisition of Loyal 9 Cocktails, a rapidly growing spirits-based RTD brand from Sons of Liberty Spirits Company. The market is mainly dominated by players like Diageo plc, Suntory Holdings Ltd., and Sazerac and Company, Inc. Furthermore, the rising number of super-premium brands, including Bacardi Ltd. and Pernod Ricard, is expected to fuel the market growth.

Mexico is expected to be the fastest-growing market in the region from 2021 to 2028. The growing popularity of high-end drinks among millennials is the key growth-driving factor. The sales of cocktails, such as margaritas and martinis, have gained remarkable traction in Mexico. In addition, the presence of some of the popular tequila brands in the country, such as Jose Cuervo and Tequila Herradura, will support market growth. Tequila has been shifting from conventional consumption as a ‘party shot’ to luxury cocktails, such as margaritas and tequila sunrise. This growing trend is expected to encourage players to invest in drinks like tequilas.

Key Companies & Market Share Insights

The market has a large number of regional and several international players. Some of the key players in the industry are Diageo plc, Pernod Ricard, Constellation Brands, Bacardi Ltd., Campari Group, William Grant & Sons, Rémy Cointreau, Asahi Group Holdings, Ltd., Suntory Holdings Ltd., and Brown-Forman. Companies have been implementing various expansion strategies, such as M & As and new product launches, to stay ahead in the game. For instance, in September 2021, Bacardíintroduceda a new cask-finished range with the launch of a Sherried rum and Jameson with an orange-flavored expression. Some of the key players operating in the North America spirits market include:

-

Suntory Holdings Ltd.

-

Pernod Ricard

-

Diageo plc

-

Constellation Brands

-

Rémy Cointreau

-

Brown-Forman

-

Asahi Group Holdings, Ltd.

-

Bacardi Ltd.

-

Campari Group

-

William Grant & Sons

North America Spirits Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 169.8 billion

Revenue forecast in 2028

USD 278.5 billion

Growth rate

CAGR of 7.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, caps & closure, caps & closure material, distribution channel, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Suntory Holdings Ltd.; Pernord Ricard; Constellation Brands; Rémy Cointreau; Brown-Forman; Asahi Group Holdings, Ltd.; Bacardi Ltd.; Campari Group; William Grant & Sons

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the North America spirits market report on the basis of product, cap & closure, caps & closure material, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Whiskey

-

Vodka

-

Gin

-

Rum

-

Brandy

-

Others

-

-

Caps & Closure Outlook (Revenue, USD Million, 2016 - 2028)

-

Screw-top

-

Bar-top/Cork

-

Others

-

-

Caps & Closure Material Outlook (Revenue, USD Million, 2016 - 2028)

-

Metal

-

Plastic

-

Others

-

-

Distribution ChannelOutlook (Revenue, USD Million, 2016 - 2028)

-

On-Trade

-

Liquid Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

U.S.

-

Mexico

-

Canada

-

Frequently Asked Questions About This Report

b. The North America spirits market size was estimated at USD 154.0 billion in 2020 and is expected to reach USD 169.8 billion in 2021.

b. The North America spirits market is expected to grow at a compound annual growth rate of 7.7% from 2021 to 2028 to reach USD 278.5 billion by 2028.

b. The U.S. dominated the North America spirits market with a share of 77.5% in 2020. New product developments, mergers & acquisitions, and expansions are some of the most preferred strategies for players in the spirits industry in the U.S.

b. Some key players operating in the North America spirits market include Suntory Holdings Limited, Pernord Ricard, Diageo plc, Constellation Brands, Brown-Forman, Asahi Group Holdings, Ltd., and Bacardi Limited.

b. The growing demand for premium products has been driving the growth of the North America spirits market across the region. Consumers have been switching to premium spirit brands with amplified brand experience.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."