- Home

- »

- Medical Devices

- »

-

North America Unit Dose Manufacturing Market Report, 2028GVR Report cover

![North America Unit Dose Manufacturing Market Size, Share & Trends Report]()

North America Unit Dose Manufacturing Market Size, Share & Trends Analysis Report By Source (In-house, Outsourcing), By Product, By End Use (Independent Pharmacies, Long Term Care Facility), By Country, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-396-6

- Number of Pages: 77

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

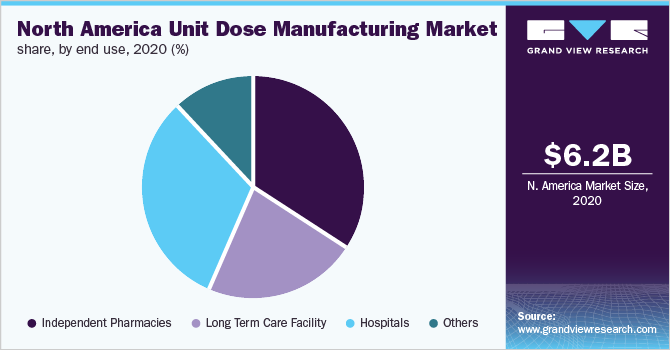

The North America unit dose manufacturing market size was estimated at USD 6.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 16.9% from 2021 to 2028. The market is majorly driven by various advantages associated with unit doses such as reduction in medication errors. They also play a vital role in improving drug control and drug use monitoring. Moreover, unit doses lead to the minimization of credits for drugs coupled with greater control by a pharmacist over work patterns and schedules.

The COVID-19 pandemic had a significant influence on the healthcare market, particularly the pharmaceutical industry, with significant implications on the short and long-term prospects, requiring effective planning to limit socioeconomic burden. Demand shifts, regulatory adjustments, R&D process changes, and the trend of using telecommunication and telemedicine are all short-term impacts of the COVID-19 pandemic. Long-term impacts of the pandemic on the pharmaceutical sector include approval delays for non-covid related pharmaceutical products as all countries are under pressure and their priority is covid-19, moving toward self-sufficiency in the pharmaceutical product supply chain, and changing trend of healthcare market product consumption, technological advancement for logistics and supply chain, as well as ethical dilemmas.

Unit dose-packed oral solid medications would not be subject to FDA action for noncompliance with expiration date regulations as long as specified criteria are met. The recommendation was developed in response to the growing tendency of repackaging solid oral medications for hospitals and long-term care facilities into unit-dose containers. As the use of unit dose repackaging has grown, concerns have arisen about stability studies and appropriate expiration dates for these repackaged pharmaceuticals. For unit-dose repackaged products assigned and labeled with an expiration date not exceeding the shorter of 6 months from the date of repackaging or 25% of the time between the repackaging date and the original expiration date, the FDA does not intend to take action regarding nonconformance with expiration dating determined by stability studies.

Compliance with USP General Chapter <800> is currently a top priority for many institutions. This means that pharmacies, caregivers, and patients across the country are modifying their medication procurement methods to ensure that they can meet their supply needs while also protecting pharmacy workers, caregivers, and patients. The USP General Chapter <800> outlines the criteria for workers handling hazardous pharmaceuticals, as well as facility and engineering controls, deactivation, decontamination, and cleaning procedures, spill control, and recordkeeping.

A manufactured unit dose from a reputed company offers various benefits such as prepackaged unit doses provided to staff by a reputed manufacturer with a track record of quality and compliance. This frees up resources that can be committed to patient care, giving them more time. In addition, unit doses are frequently available via partner group purchasing organizations and distributors in a matter of days. Therefore, time-saving, specialized expertise and cost-efficiency associated with unit doses are anticipated to boost market growth over the forecast period.

Sourcing Insights

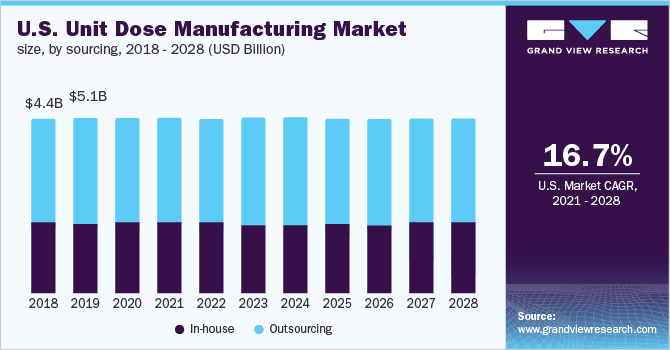

The outsourcing segment led the market for North America unit dose manufacturing and accounted for the largest revenue share of 59.6% in 2020. The segment is projected to register the fastest growth over the forecast period. The market is estimated to become 3.55 times of itself by 2028. This high growth can be attributed to cost-efficiency, specialized expertise, and time-saving offered by CDMOs.

Pharmaceutical companies that make unit dosages are included in the in-house segment. The market share of the in-house segment is projected to decline in the coming years. One of the main reasons for the drop is the growing number of small and medium-sized pharmaceutical businesses that lack the money and infrastructure to support in-house manufacturing. As these businesses are new and have limited resources, it is difficult for them to acquire experienced and technically competent full-time staff. Hence, they generally prefer outsourcing.

Product Insights

The solid unit dose segment dominated the market for North America unit dose manufacturing and accounted for 49.1% of revenue share in 2020. It involves a range of processing technologies to take a formulated API through to a finished dose form (e.g., capsule and tablet). Oral solid dose formulations are shelf-stable, simple to use, and efficient and cost-effective to produce. Perhaps most critically, they are well-understood and accepted by patients globally. In 2018, oral solid dose medicines accounted for 53% of all new pharmaceuticals approved by the FDA.

The solid unit dose is expected to witness rapid expansion in the coming years as they represent a significant share of finished dose formulations. Solid dose manufacturing and oral delivery of new drug candidates, fixed-dose combinations, controlled-release dosage forms, and reformulation of existing drugs are some of the factors propelling the growth of contract manufacturing of solid dosage formulations.

End-use Insights

Based on end-use, the independent pharmacies segment accounted for the largest revenue share of 34.1% in 2020 and is estimated to become 4.01 times of itself by 2028. The segment is also anticipated to register the fastest growth rate of 18.7% over the forecast period. This lucrative growth can be attributed to huge patient footfall, patient preference, and the versatile product portfolio offered by such establishments.

The hospitals segment accounted for the second-largest revenue share of 31.4% in 2020. Unit dose packaging is extremely beneficial in hospitals. Small modifications help make the overall system safer and more efficient for patients and personnel in a fast-paced hospital or long-term care institution. Medical workers, particularly those working in hospitals, are seeking methods to increase efficiency and safety. Unit dosage packaging methods were created to improve safety while also cutting down the time and effort required to prepare and dispense pharmaceutical medications.

Country Insights

The U.S. led the North America unit dose manufacturing market and accounted for 91.9% of the revenue share in 2020. Most drug product manufacturers, including branded big pharma, generics, over the counter, and nutraceutical segments, are adopting a patient-centric drug development approach. They are introducing products with innovative packaging technology and delivery solutions to better meet patient needs and increase therapeutic value. In the U.S., more than half of the population misrepresents their prescriptions, resulting in 125,000 deaths per year.

The geriatric population is especially at risk; patients aged 65 and above are gradually taking 10 or more prescriptions each day. Children are another high-risk group pertaining to medication adherence. According to Health Day News, nearly 700,000 children aged 6 and below experienced out-of-hospital medication errors between 2002 and 2012, with liquid doses accounting for 80% of those errors. Adolescents are also prone to unintended dosing errors, according to the same source. Unit dose aid in the elimination of the possibility of erroneous dosing, which is likely to boost its demand during the forecast period.

Key Companies & Market Share Insights

Key market players are implementing several strategic activities, including new partnerships, mergers, and acquisitions, geographic coverage to strengthen their services and manufacturing capacities in order to achieve a competitive advantage.

For instance, in August 2020, Unither Pharmaceuticals acquired Nanjing Ruinian Best Pharmaceutical Co. Ltd. This acquisition was expected to expand its operations in China and provide them with expertise in drug development and single-dose sterile preservative-free pharmaceuticals. Some of the prominent players in theNorth America unit dose manufacturing market include:

-

Catalent

-

Thermo Fisher Pantheon

-

Unither Pharmaceuticals

-

Mikart

-

TapeMark

-

Renaissance Lakewood LLC

-

Medical Packaging Inc.

-

CordenPharma

-

American Health Packaging

North America Unit Dose Manufacturing Market Report Scope

Report Attribute

Details

Market Size value in 2021

USD 7.2 billion

Revenue forecast in 2028

USD 21.7 billion

Growth Rate

CAGR of 16.9% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD Million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sourcing, product, end-use, country

Regional scope

North America

Country scope

U.S., Canada

Key companies profiled

Catalent; Thermo Fisher Pantheon; Unither Pharmaceuticals; Mikart; TapeMark; Renaissance Lakewood LLC; Medical Packaging Inc.; CordenPharma; American Health Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the North America unit dose manufacturing market report on the basis of product, sourcing, end use, and country:

-

Sourcing Outlook (Revenue, USD Million, 2016 - 2028)

-

In-house

-

Outsourcing

-

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Liquid unit dose

-

Solid unit dose

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Independent Pharmacies

-

Long term care facility

-

Hospitals

-

Others

-

-

Country Outlook (Revenue, USD Million, 2016 - 2028)

-

U.S

-

Canada

-

Frequently Asked Questions About This Report

b. The North America unit dose manufacturing market size was estimated at USD 6.2 billion in 2020 and is expected to reach USD 7.2 billion in 2021.

b. The North America unit dose manufacturing market is expected to grow at a compound annual growth rate of 16.9% from 2021 to 2028 to reach USD 21.7 billion by 2028.

b. Independent pharmacies dominated the North America unit dose manufacturing market with a share of 34.1% in 2020. This is attributable to high patient footfall and a diverse portfolio of independent pharmacies.

b. Some key players operating in the North America unit dose manufacturing market include Catalent Inc, Patheon, Unither, Mikart, Tape Mark, Renaissance, Medical packaging Inc, Corden pharma, and American health packaging.

b. Key factors that are driving the North America unit dose manufacturing market growth include increasing adoption of unit doses, benefits of manufacturing unit doses over packaging, and flourishing pharmaceutical industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."