- Home

- »

- Biotechnology

- »

-

Oligonucleotide Synthesis Market Size & Share Report, 2030GVR Report cover

![Oligonucleotide Synthesis Market Size, Share & Trends Report]()

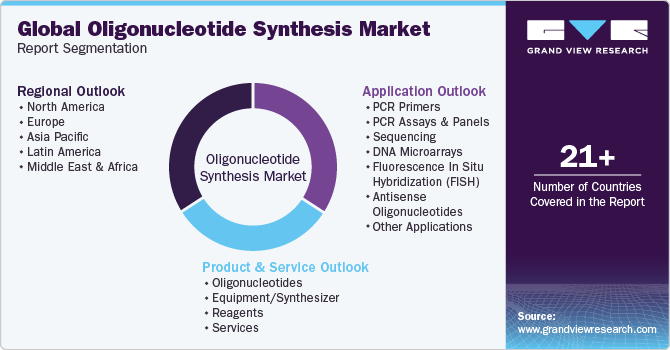

Oligonucleotide Synthesis Market Size, Share & Trends Analysis Report By Product & Service (Oligonucleotides, Equipment/Synthesizer), By Application (PCR Primers, PCR Assays & Panels), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-593-9

- Number of Pages: 135

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Oligonucleotide Synthesis Market Trends

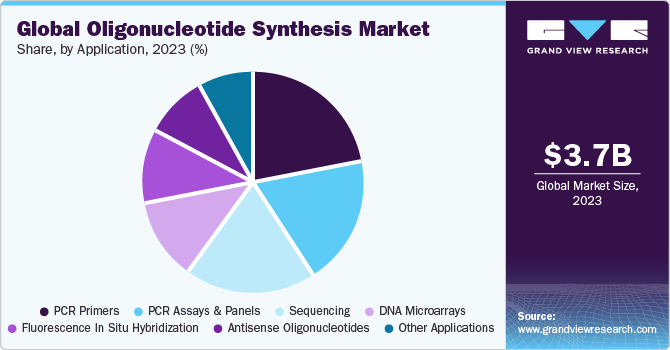

The global oligonucleotide synthesis market size was estimated at USD 3.68 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 13.21% from 2024 to 2030. The decreasing prices of sequencing have led to increasing demand for custom-made nucleotides for applications across genetic testing, research, forensics applications, and drug development. This has further boosted the demand for oligonucleotide synthesis. The COVID-19 pandemic has affected every market globally and there has been a surge in the demand for efficient treatment against COVID-19.

Oligonucleotide therapeutics hold immense potential for treating chronic conditions such as cardiovascular diseases, cancers, and retinal disorders. Emerging new applications of oligo sequences in multiple fields of biotechnology are expected to increase market growth. Demand for molecular diagnostics in precision care is an important emerging application field for oligonucleotide synthesis.

The introduction of advanced techniques such as CRISPR and high-throughput sequencing for gene expression analysis has simplified the genetic screening and modification of genomes. Such innovations are observed to influence the demand for oligonucleotide synthesis. Manufacturers invest in technology development to enable the production of long Oligonucleotides with higher precision and better yield to cater to the growing need for custom oligos.

The availability of a regulatory environment that supports the progress of genomics is the key factor contributing to the market growth. Changes in the regulatory policies to provide a well-framed environment for advanced biological research and application in human use are expected to influence demand for oligonucleotide synthesis significantly. Stem cells, regenerative medicine, genetic engineering, and synthetic biology are the prominent fields identified with high potential in healthcare. For instance, the International Society for Stem Cell Research (ISSCR) ethics and public policy committee aims to recognize and resolve issues by conducting open discussions. The committee includes experts in ethics, law, and social policy worldwide.

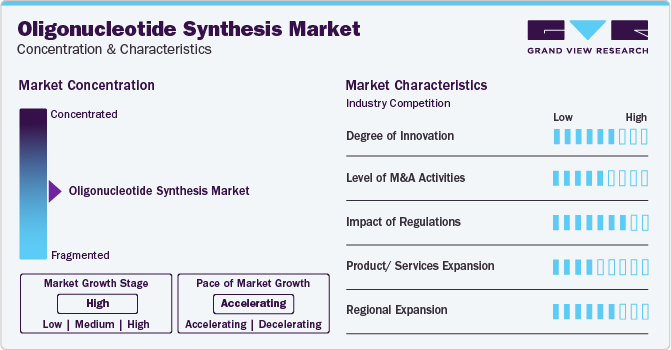

Market Concentration & Characteristics

The market growth stage is high, and the market growth is accelerating. The oligonucleotide synthesis industry is characterized by a moderate to high degree of innovation due to rapid advancements in gene editing technology. Gene editing technology - Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) is projected to be the most influential and innovative technology in biotechnology.

The oligonucleotide synthesis sector is further characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new DNA & RNA facilities, increase their capabilities, expand product portfolios, and improve competencies.

The market is also subject to high regulatory scrutiny. Clinical applications of genomics face stringent monitoring and restriction in most countries, while some allow genetic research in sectors other than human use. Changes in the regulatory policies to provide a well-framed environment for advanced biological research and application in human use are expected to influence demand for oligonucleotide synthesis significantly.

The market has a moderate level of product/service expansion. This expansion involves introducing new types of oligonucleotides, improving synthesis technologies, and providing additional services to support customers. Service expansion involves offering comprehensive solutions, including synthesis, purification, and analytical services.

Regional expansion is a key factor with moderate to high growth in the market. Since several end-user industries are driving demand for oligonucleotide synthesis, the market players are investing in regional expansion to increase production capacity. Furthermore, regional expansion enables players to capture the untapped customer base, thereby contributing to the growth of the market.

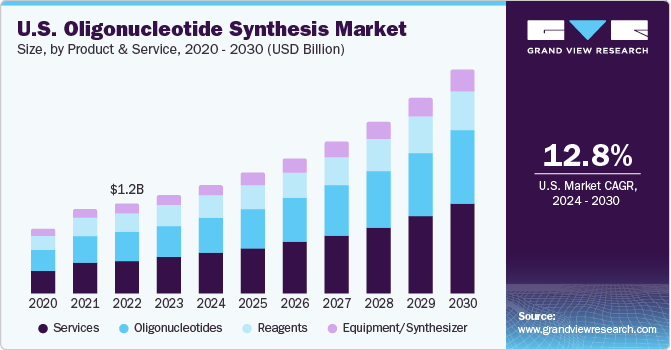

Product & Service Insights

The services segment dominated the market with the highest share of 37.35% in 2023 and is expected to witness the fastest growth during the forecast period. Certain factors, such as the growing use of molecular diagnostic tests and the higher adoption of oligonucleotide therapeutics, are expected to contribute to market growth. Moreover, key players are also broadening their offerings by entering new markets or acquiring service providers in different countries.

For instance, in November 2023, Twist Bioscience, a company specializing in synthetic biology and genomics, introduced Express Genes, a novel gene synthesis service with an expedited turnaround time of 5 to 7 business days. This service, conducted at the company's manufacturing facility in Wilsonville, Oregon, enables the swift production of genes.

The oligonucleotide segment is anticipated to grow at a significant CAGR during the forecast period. The increase in genomic studies, such as gene expression analysis and genetic testing, can be attributed to a substantial growth of the segment. In addition, introducing biochips (DNA chips) for parallel analysis of many clinical samples is anticipated to contribute considerably to the market’s revenue. With the growing usage of antisense oligonucleotides in clinical trials for conditions such as cancer, cardiac disorders, and ocular dysfunctions, the segment is anticipated to witness lucrative growth shortly.

Moreover, the growing awareness and understanding of genetic disorders contribute to the demand for oligonucleotides in diagnostics & potential therapeutic interventions. For instance, in August 2023, UC San Diego launched a Gene Therapy Initiative to develop innovative treatments for rare diseases, made possible by a USD 5 million donation from the Nancy and Geoffrey Stack Foundation.

Application Insights

The PCR primers segment held the largest market share in 2023. Primers are the most widely used oligonucleotide in PCR. They are part of sequences complementary to the 5’ end of the targeted sequence and are used for sequencing or amplification applications. The adoption of primers for gene sequencing experiments is increasing. Their use in fluorescent detection and target amplification has led to various primer designs with different probe- and primer-based detection chemistries. With technological advances, PCR has evolved, resulting in RT-PCR, qPCR, and digital PCR. PCR assays and panels are designed for detecting and measuring gene expression. The need for primers to suit the application of these enhanced systems for uses such as accurate quantification of gene expression is anticipated to fuel market growth.

The sequencing segment is anticipated to witness the highest CAGR during the forecast period. Sequencing applications are used to study various aspects of genomics and genetics. These applications involve the analysis of genetic material, such as DNA and RNA, to better understand the genetic makeup & function of organisms. Sequencing is crucial in identifying and tracking pathogens, particularly for emerging viruses and antibiotic-resistant bacteria. It necessitates rapid and accurate pathogen detection through oligonucleotide-based assays. Advancements in sequencing technologies and bioinformatics tools have also contributed to the growth of this market. In January 2023, QIAGEN acquired Verogen, specializing in NGS technologies, in a transaction worth USD 150 million. QIAGEN plans to integrate Verogen's technologies and talent into its existing operations.

Regional Insights

North America dominated the global market with a revenue share of 40.15% in 2023. The large share is mainly attributed to many companies and research institutes creating high demand for oligonucleotides. For instance, in April 2021, DNAScript collaborated with Moderna along with a USD 5 million grant from the U.S. Defense Advanced Research Projects Agency. This collaboration was intended to develop a prototype for robust manufacturing of therapeutics and vaccines as part of the global nucleic acids on-demand program.

Asia Pacific is expected to witness the highest CAGR during 2024-2030. The growth is due to key players' growing interest in gaining higher profits in emerging markets. Players have adopted acquisitions, collaborations, and distribution agreements to gain a higher market share by increasing their revenue generation. Furthermore, Japan, China, and India, among other countries, are witnessing several business initiatives in the oligonucleotide synthesis market, thereby driving the regional market. For instance, in May 2023, GenScript Biotech Corporation expanded its primary manufacturing facility for oligonucleotide production in Jiangsu, China.

Key Companies & Market Share Insights

Some of the key players operating in the market include Merck KGaA, Thermo Fisher Scientific, Inc., and Agilent Technologies. These players focus on business strategies such as partnerships/collaborations, product launches, and expansion. Twist Bioscience, Biolegio, and LGC Biosearch Technologies are some of the emerging market participants in the oligonucleotide market. These players primarily focus on expansion and partnerships to strengthen their position in the market.

Key Oligonucleotide Synthesis Companies:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Danaher Corporation

- Dharmacon Inc.

- Agilent Technologies

- Bio-synthesis

- Kaneka Eurogentec S.A

- LGC Biosearch Technologies

- Biolegio

- Twist Bioscience

Recent Developments

-

In October 2023, IDT inaugurated a new therapeutic manufacturing facility to meet the increasing demand in genomic medicine. The new facility is equipped to support the production of therapeutic oligonucleotides, catering to the expanding needs in the field of genomics and personalized medicine.

-

In September 2023, Danaher Corporation (Integrated DNA Technologies) introduced a range of xGen NGS products tailored for the Ultima Genomics UG 100TM platform. The suite includes adapters, primers, and universal blockers, catering to various applications such as DNA, RNA, & methylation sequencing workflows. This offering is complemented by IDT's proven hybridization capture chemistry, enhancing versatility for researchers.

-

In July 2023, Analytix introduced two new instruments designed for organic synthesis, including wavePREP, tailored for oligonucleotide synthesis, and Xelsius, a workstation for multireaction synthesis.

-

In May 2023, GenScript expanded its life sciences facility in Zhenjiang, Jiangsu, China, to offer a rapid, high-purity oligonucleotide and peptide synthesis service tailored for research & development as well as preclinical applications.

-

In May 2023, Twist Bioscience and CeGaT GmbH launched the Twist Alliance CeGaT RNA Fusion Panel. This collaborative effort aims to provide a specialized tool for oncology research, facilitating the detection of RNA fusions and enabling transcript variant analysis. RNA fusions, a result of chromosomal arrangements often seen in cancers, can now be efficiently studied using this newly introduced panel.

-

In February 2023, Fluor Corp. and Agilent Technologies, Inc. collaborated to enhance its oligonucleotide therapeutics manufacturing facility in Frederick, Colorado. Under this collaboration, Fluor is expected to support the project's engineering and procurement. The total value of the project is evaluated at USD 725 million.

Oligonucleotide Synthesis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.05 billion

Revenue forecast in 2030

USD 8.53 billion

Growth rate

CAGR of 13.21% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Danaher Corporation; Dharmacon Inc.; Agilent Technologies; Bio-synthesis; Kaneka Eurogentec S.A; LGC Biosearch Technologies; Biolegio; Twist Bioscience

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oligonucleotide Synthesis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oligonucleotide synthesis market report based on product & service, application, and region:

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Oligonucleotides

-

DNA

-

Column-based

-

Array-based

-

-

RNA

-

By Technology

-

Column-based

-

Array-based

-

-

By Type

-

Short RNA Oligos (<65 nt)

-

Long RNA Oligos (>65 nt)

-

CRISPR (sgRNA)

-

-

-

-

Equipment/Synthesizer

-

Reagents

-

Services

-

DNA

-

Custom Oligo Synthesis Services

-

25 nmol

-

50 nmol

-

200 nmol

-

1000 nmol

-

10000 nmol

-

-

Modification Services

-

Purification Services

-

-

RNA

-

Custom Oligo Synthesis Services

-

25 nmol

-

100 nmol

-

1000 nmol

-

10000 nmol

-

-

Modification Services

-

Purification Services

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR Primers

-

Academic Research Institutes

-

Diagnostic Laboratories

-

Pharmaceutical - Biotechnology Companies

-

-

PCR Assays & Panels

-

Academic Research Institutes

-

Diagnostic Laboratories

-

Pharmaceutical - Biotechnology Companies

-

-

Sequencing

-

Academic Research Institutes

-

Diagnostic Laboratories

-

Pharmaceutical - Biotechnology Companies

-

-

DNA Microarrays

-

Academic Research Institutes

-

Diagnostic Laboratories

-

Pharmaceutical - Biotechnology Companies

-

-

Fluorescence In Situ Hybridization (FISH)

-

Academic Research Institutes

-

Diagnostic Laboratories

-

Pharmaceutical - Biotechnology Companies

-

-

Antisense Oligonucleotides

-

Academic Research Institutes

-

Diagnostic Laboratories

-

Pharmaceutical - Biotechnology Companies

-

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oligonucleotide synthesis market size was estimated at USD 3.68 billion in 2023 and is expected to reach USD 4.05 billion in 2024.

b. The global oligonucleotide synthesis market is expected to grow at a compound annual growth rate of 13.21% from 2024 to 2030 to reach USD 8.53 billion by 2030.

b. Services dominated the oligonucleotide synthesis market with a share of 37.35% in 2023. This is attributable to the increasing demand for oligonucleotides in precision medicine.

b. Some key players operating in the oligonucleotide synthesis market include Thermo Fisher Scientific, Inc; Merck KGaA; Danaher Corporation; Dharmacon Inc.; Agilent Technologies, Inc.; Bio-Synthesis; Kaneka Eurogentec S.A.; LGC Biosearch Technologies; Biolegio; Twist Bioscience

b. Key factors that are driving the oligonucleotide synthesis market growth include the declining cost of sequencing, technological advancements in gene editing technologies, and rising investments in genetic research.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."