- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Oman Industrial Salts Market For Oil & Gas Industry Report, 2020-2027GVR Report cover

![Oman Industrial Salts Market For Oil & Gas Industry Size, Share & Trends Report]()

Oman Industrial Salts Market For Oil & Gas Industry Size, Share & Trends Analysis Report By Product (Rock Salt, Salt In Brine, Solar Salt), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-648-6

- Number of Pages: 112

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Advanced Materials

Report Overview

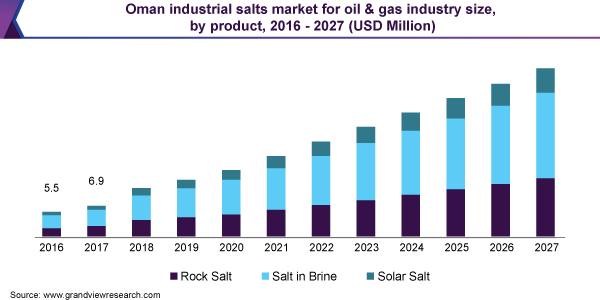

The Oman industrial salts market for oil and gas industry size was valued at USD 12.6 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 14.5% from 2020 to 2027. The demand for the product to carry out an efficient enhanced oil recovery option is likely to remain the key driver for the market growth over the forecast period.

The use of Enhanced Oil Recovery (EOR) technique to carry out efficient oil and gas operations in the country has widely influenced the growth of the market over the last few years. The use of brine with diluted salt content has been proven as an effective way to enhance oil operation efficiencies.

Oman’s drive to expand its oil production relies heavily on innovative technologies such as EOR. The key EOR techniques used in Oman include polymer, steam injection, miscible, and solar techniques. Due to the high cost of production and lack of technology in the country, the government of Oman offers tax rebates to International Oil Companies (IOCs) for exploration and development activities.

The government preludes foreign companies in new exploration and production projects, offering generous rebates for the development of fields that require the sophisticated technologies and expertise of the private vendors. The technical difficulties and challenges involved in oil production; the contract based arrangement for IOCs have become more popular in Oman than in other countries in the region.

In addition, PDO reported that by 2025, nearly 23% of the PDO’s production is projected to come from EOR projects. Owing to such government-sponsored schemes and incentives, EOR is likely to play a major role in Oman’s oil and gas production over the coming years. Thereby, offering numerous opportunities for the market growth of industrial salts.

Product Insights

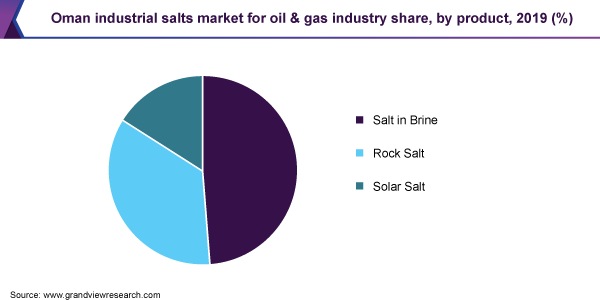

Salt in brine segment led the Oman industrial salts market for oil and gas market and accounted for more than 52% revenue share in 2019. On the basis of product, the market is segmented into rock salt, salt in brine, and solar salt. Salt in brine product segment dominated the market in terms of revenue as well as volume. Brine is acquired from huge waterbodies by dissolving mine deposits through a mining technique called solution mining. The product has a high concentration of saline solution. The product is prominently used by the oil and gas operators of Oman who engage in oil extraction work using the EOR technique.

Rock salt segment acquired a volume share of 35.2% in 2019. Rock salt occurs in the form of sedimentary evaporite minerals and is mined for industrial use. The demand for rock salt is expected to benefit from rising downstream oil and gas activities in the country. For instance, TheSohar Refinery Project capacity expansion was completed in 2017, expanding its capacity to 197,000 b/d from 116,000 b/d in previous years. Sohar refinery uses course and extra coarse rock salt to remove water from the finished product. Thus, factors such as the expansion of refineries along with steady production rates are likely to drive the segment growth over the forecast period.

Solar salt has a high purity level with sodium chloride content greater than 99.5%. The solar salt product segment accounted for a revenue share of 14.3%.The production of solar salt initiates when the salt brine is pumped into large outdoor ponds. These ponds are exposed to sunlight, and, hence, the product is called solar salt. The sunlight increases the temperature of the pond, which, in turn, results in the evaporation of water, leaving behind purified salt crystals that can be harvested.

Regional Insights

The quantity of industrial salts imported for the Oman oil and gas industry was estimated at 66.9 kilotons in 2016 and the imports were witnessing a rising trend. Until 2018, the demand for industrial salts was met almost entirely through imports. The primary exporters of industrial salt to the country include Saudi Arabia and the UAE.

In July 2018, Global Integrated Engineering Company, a subsidiary of Al-Ghalbi International Engineering & Contracting, established Duqm Salt, an industrial salt plant, at Bentoot in the Wilayat of Mahout in Wusta Governorate. The plant was launched to meet the rising demand for industrial salt from Oman’s oil and gas sector, particularly from EOR operations and drilling operations in the oil wells of Oman.

The company’s mission was to set up an industrial salts production plant to manufacture industrial salt from seawater as an alternative for import-substitute in the oil and gas industry of the country. The company, therefore, is localizing industrial salt production for Oman’s domestic consumption. Furthermore, the company, in line with its In-Country Value (ICV) commitments, is localizing its supply chain and product development activities in incremental stages.

According to the company, the plant spans over 1,700 square meters area with production estimated to be 100 kilotons per annum. The company intends to increase its production to about 200 kilotons in the near future. It mostly sells industrial salt products to the oil and gas industry of Oman and produces high purity (99.8%) industrial salts that meet the standards and specifications of domestic companies.

The company currently supplies its industrial salt products to Occidental Petroleum Corporation (Oxy) of Oman for steam operations and Petroleum Development Oman (PDO) for EOR operations. In 2019, Halliburton, a major oilfield services contractor, was expected to sign a supply agreement with Duqm Salt (Global Integrated Engineering Company) of 30 kilotons of industrial salts per year.

Key Companies & Market Share Insights

The country has a couple of domestic manufacturers coupled with strong domination of regional traders or suppliers. The country also has an affirmative presence of regional suppliers from Saudi Arabia and UAE. The key vendors of the industry are continuously focusing their efforts to expand their production capacities in order to cater strong demand for the product, specifically from enhanced oil recovery activities in the country. Some of the prominent players in the Oman industrial salts for oil and gas industry include:

-

Modern Salt Industries & Trading Co. LLC

-

Duqm Salt

-

Omanian Salt Company LLC

-

Feiz New Works Company

-

Al Mandoos Trading Co. LLC.

-

Riyadh Salt Factory

-

Delmon Salt

-

Gulf Salt Company

Oman Industrial Salts Market For Oil & Gas Industry Report Scope

Report Attribute

Details

Market size value in 2020

USD 14.7 Million

Revenue forecast in 2027

USD 37.3 Million

Growth Rate

CAGR of 14.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

Oman

Key companies profiled

Modern Salt Industries & Trading Co. LLC; Duqm Salt; Omanian Salt Company LLC; Feiz New Works Company; Al Mandoos Trading Co. LLC.; Riyadh Salt Factory; Delmon Salt; Gulf Salt Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the Oman industrial salts market for oil and gas industry report on the basis of product:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Rock Salt

-

Salt in Brine

-

Solar Slat

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."