- Home

- »

- Medical Devices

- »

-

Ophthalmic Handheld Surgical Instruments Market Report, 2030GVR Report cover

![Ophthalmic Handheld Surgical Instruments Market Size, Share & Trends Report]()

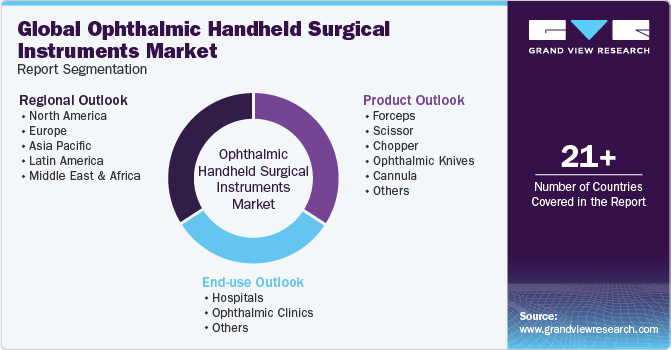

Ophthalmic Handheld Surgical Instruments Market Size, Share & Trends Analysis Report By Product (Forceps, Scissor, Chopper, Ophthalmic Knives, Cannula), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-309-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Market Size & Trends

The global ophthalmic handheld surgical instruments market size was valued at USD 2.42 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. The factors that are expected to fuel growth for cutting-edge handheld surgical instruments during the projected period include the rising incidence of ocular conditions such as glaucoma, cataracts, and refractive errors, the increasing popularity of ambulatory surgery centers, patient preferences for short hospital stays, and the increased use of ophthalmic handheld surgical instruments.

The number of people with visual impairments and blindness is rising proportionally as the older population grows across the globe. Due to this, diseases such as cataracts, glaucoma, age-related macular degeneration, and diabetic retinopathy are increasing and are among the leading causes of vision loss and blindness. These factors have led to a rise in the need for surgeries, thus driving the demand for ophthalmic handheld surgical instruments.

For instance, according to the American Academy of Ophthalmology, around 1.3 million Americans aged 40 years and above have legal blindness, which is defined as having visual acuity that is worse than or equal to 20/200 in the eye with better vision after the best correction. While in the case of best-corrected visual acuity being lower than 20/40 (which includes people who are legally blind), poor vision affects over 2.9 million adults aged 40 and older.

Technological advancements and an increasing preference for minimally invasive surgical options that provide permanent solutions to common ophthalmic conditions are expected to boost the number of surgeries, especially in developing regions. Additionally, factors such as the advent of minimally invasive surgical techniques with potential advantages such as shorter recovery periods and shorter turnaround times in the treatment of glaucoma and cataracts have increased the average number of ophthalmic surgeries performed worldwide.

Various government and non-government programs aimed at raising public awareness regarding visual impairments and providing financial assistance to patients for ophthalmic surgeries are anticipated to play a crucial role in the growth of the ophthalmic handheld surgical instrument market. For instance, the government of India grants NGOs free ocular surgeries to perform on underprivileged patients living in remote areas under the National Programme for Control of Blindness (NPCB) scheme.

During the COVID-19 pandemic, routine healthcare services, including ophthalmic services, were canceled, and patients were recommended to avoid hospital visits unless absolutely necessary to minimize the risk of COVID-19 transmission, leading to substantial disruptions in the provision of ophthalmic services and patient care. During this period, a significant reduction in ophthalmic elective surgeries, particularly cataract surgery, was observed, resulting in a significant decline in the sales of ophthalmic handheld surgical instruments.

High levels of competition, outdated technologies, and a global scarcity of ophthalmology surgeons are some of the reasons expected to restrain the growth of the market for ophthalmic handled surgical tools. Longer wait times due to a lack of ophthalmic surgeons lead some patients to forego ocular procedures in favor of other forms of treatment. The Association of American Medical Colleges (AAMC) projects a shortage of ophthalmologists by 2025.

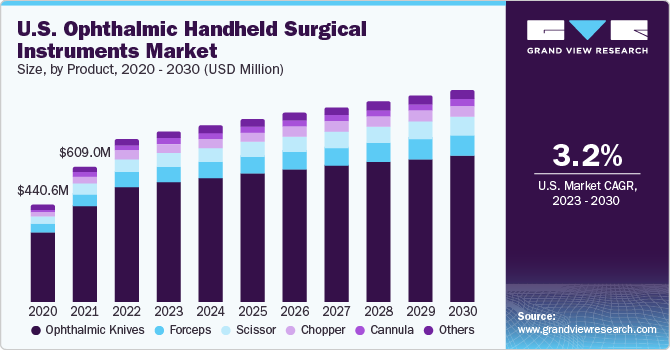

Product Insights

The ophthalmic knives segment dominated the market with the highest revenue share of 70.89% in 2022. This is due to the wide availability of ophthalmic knives in different shapes, sizes, and styles. Currently, two types of knives are used in eye surgeries - disposable and diamond knives. Diamond knives are facing a surge in demand owing to their advantages, such as precision incisions, reusability, cost efficiency, and durability.

Although approximately 28.4 million elective procedures were postponed or canceled worldwide during the COVID-19 outbreak, according to a report published in the British Journal of Surgery in May 2020, this estimate is based on 12 weeks of peak COVID-19-related hospital service interruptions. Therefore, the decrease in performance of ophthalmic surgeries during COVID-19 greatly influenced the market for ophthalmic knives.

The scissors segment is expected to advance at the fastest growth rate of 4.5% during the forecast period. Scissors are the second most commonly found ophthalmic handheld instruments in the surgical kit of ocular procedures. They are widely classified based on application as conjunctival, corneal, general ophthalmic, IOL, iris, stitch, tenotomy, vannas, and strabismus scissors. Regular handheld surgical instrument kits designed for trabeculectomy and extracapsular cataract extraction include approximately 3-6 different types of scissors.

Ophthalmic handheld surgical instruments are made of materials such as titanium and stainless steel that are easily available through local suppliers, thus keeping the threat of market entry at a low level. It is estimated that 3-10 different types of forceps are present in the surgical tray for ophthalmic surgeries, aiding their significant revenue share. Moreover, key industry players are focusing on developing lightweight, durable, and corrosion-resistant forceps. For instance, MicroSurgical Technology developed the Gianetti MICS Capsulorhexis Forceps with a very thin shank and tip, enabling glaucoma surgeries to be performed more precisely.

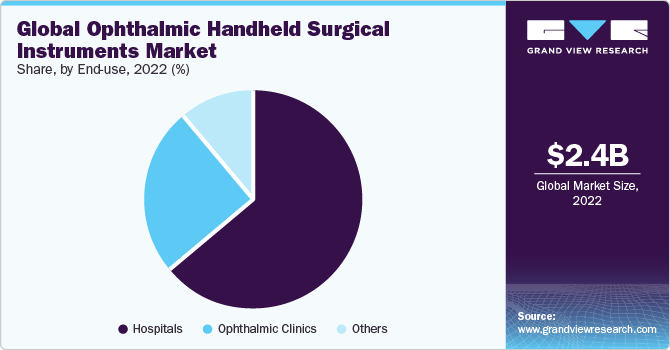

End-use Insights

The hospital segment accounted for the highest revenue share of around 64% in 2022. Procurement of ophthalmic handheld surgical instruments is generally a one-time activity due to their long shelf life. An increasing number of mobile ophthalmic care centers is expected to contribute significantly to the segment’s growth. For instance, the African Eye Foundation has invested USD 16 million to construct a high-class eye care facility to offer comprehensive ophthalmic surgical services to the people of Cameroon in Central Africa.

The U.S. government covers the cost of cataract surgery for patients aged 65 and older. Medicare is responsible for bearing 80% of the total cost of cataract surgeries, including pre- and post-operative examinations, cataract removal, intraocular lens implantation, and protective eyewear after the operation. Thus, hospitals continue to witness high admission rates.

The ophthalmic clinics segment is estimated to register the fastest CAGR of 4.9% over the forecast period. Ophthalmic clinics held the second-largest share in 2022 and are expected to witness the fastest growth over the forecast period. Factors such as introduction of cutting-edge and cost-effective surgical devices and long wait times at hospitals are estimated to enhance segment growth during the forecast period. Ophthalmic clinics also eliminate unnecessary procedures or diagnostic tests, provided they do not affect the quality of clinical care. They provide better inpatient, outpatient, and emergency services for a wide range of eye conditions, which increases the preference for ophthalmic clinics among patients.

The others segment includes research centers, academics, and mobile ophthalmic units. The segment is expected to expand at a healthy CAGR over the projected period. Initiatives such as public awareness programs to alleviate the myths and fear of ocular surgeries among patients and numerous public outreach programs are anticipated to push the growth of this segment. For instance, the CBM Peru program provides cataract surgery services to people living in remote African regions through mobile outreach camps.

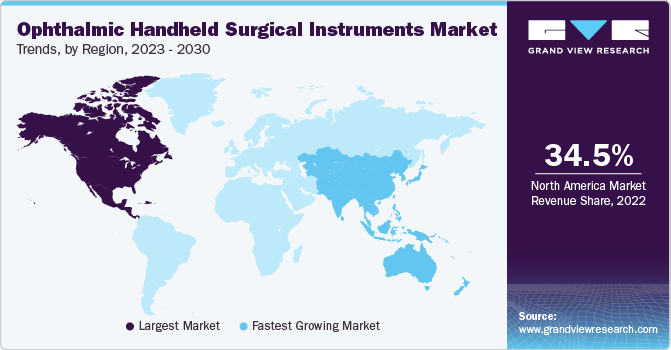

Regional Insights

North America dominated the market and accounted for the largest revenue share of 34.45% in 2022. Factors such as the high prevalence of ocular disorders, the presence of key players, and the presence of efficient reimbursement policies have contributed to its strong revenue share. For instance, healthcare payers such as Medicare and Medicaid consider cataract surgery a medically necessary service and offer it free of charge. Also, with ophthalmic surgery services resuming after the COVID-19-induced break, the demand for handheld surgical instruments is anticipated to rise.

The European market for ophthalmic handheld surgical instruments is expected to experience a significant growth rate during the forecast period. The presence of top-class eye care facilities equipped with advanced technologies is a major factor contributing to the growing procedural volume of ocular surgeries in Europe. According to a Eurostat paper published in 2022, 3.66 million cataract operations that involved the removal of the eye's lens were performed in the EU Member States in 2020.

Asia Pacific is expected to expand at the fastest CAGR of 5.1% during the forecast period. The significant gap between demand and supply for eye surgery services in countries such as India, China, Japan, and other Southeast Asian countries is anticipated to fuel market growth. Large unmet needs are driving service providers to develop and plan new eye care facilities in these regions. For instance, as per the International Agency for the Prevention of Blindness, in Asia, around 17 million people have glaucoma, which is expected to rise to 30 million by 2040.

Key Companies & Market Share Insights

Key players that dominated the global market in 2022 include BVI, Accutome Inc., and Katena Products Inc. These companies are collaborating with healthcare centers to provide a long-term supply of ophthalmic surgical instruments. For instance, in April 2021, Katena Products, Inc. announced the purchase of ASICO, LLC, an industry leader with an experience of about 35 years and a diverse product range of more than 1,500 items, including single-use cannulas and blades, stainless steel and titanium instruments, and a selection of diamond knives.

Major market players are engaged in various strategies such as mergers and acquisitions, product launches, partnerships, and joint ventures. For instance, in May 2022, MellingMedical, a medical device company, and New World Medical, a global medical device company focused on glaucoma treatment, announced an agreement to help address a rise in glaucoma diagnoses among military service members.

Key Ophthalmic Handheld Surgical Instruments Companies:

- Haag-Streit Group

- Appasamy Associates

- Millennium Surgical Corporation

- Katalyst Surgical

- ASICO, LLC

- INKA Surgical Instruments

- Surgical Holdings

Ophthalmic Handheld Surgical Instruments Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.54 billion

Revenue forecast in 2030

USD 3.37 billion

Growth Rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan;China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Haag-Streit Group; Appasamy Associates; Millennium Surgical Corp; Katalyst Surgical; ASICO, LLC; INKA Surgical Instruments; Surgical Holdings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Handheld Surgical Instruments Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global ophthalmic handheld surgical instruments market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Forceps

-

Scissor

-

Chopper

-

Ophthalmic Knives

-

Cannula

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic handheld surgical instruments market size was estimated at USD 2.42 billion in 2022 and is expected to reach USD 2.54 billion in 2023.

b. The global ophthalmic handheld surgical instruments market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 3.37 billion by 2030.

b. North America dominated the ophthalmic handheld surgical instruments market with a share of 34.45% in 2022. This is attributable to the increasing prevalence of ocular disorders, the domicile of major market players, and the presence of efficient healthcare coverage policies.

b. Some key players operating in the ophthalmic handheld surgical instruments market include BVI, Accutome Inc., Katena Products Inc.Haag-Streit Group, Appasamy Associates, Millennium Surgical Corp, Katalyst Surgical, ASICO, LLC., INKA Surgical Instruments, and Surgical Holdings.

b. Key factors that are driving the ophthalmic handheld surgical instruments market growth include increasing patient preference for treatments having long-term effects, growing government funding to conduct mass ocular surgery programs, and improving eye care infrastructure worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."