- Home

- »

- Medical Devices

- »

-

Ophthalmic Sutures Market Size And Share Report, 2029GVR Report cover

![Ophthalmic Sutures Market Size, Share & Trends Report]()

Ophthalmic Sutures Market Size, Share & Trends Analysis Report By Type (Synthetic, Natural), By Absorption Capacity, By Application (Corneal Transplant, Cataract), By End Use, By Region, And Segment Forecast, 2022 - 2029

- Report ID: GVR-3-68038-974-6

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Healthcare

Report Overview

The ophthalmic sutures market size was valued at USD 532.8 million in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2022 to 2029. Key factors driving the market are the increasing incidence of various eye diseases and vision loss. Visual impairment is a global health concern that hurts mental and physical health. According to the American Academy of Ophthalmology, approximately 7.32 million people in the U.S. are expected to suffer from primary open-angle glaucoma (POAG) by 2050.

Increasing awareness about eye disorders and increasing incidence of vision problems such as glaucoma, cataract, macular edema, and other neuro-ophthalmic disorders are major driving forces in the market. Glaucoma is a leading cause of irreversible blindness across the globe. The increasing aging population is expected to contribute to the rising burden of glaucoma around the world. According to the American Academy of Ophthalmology, the number of people with glaucoma is expected to reach 111.8 million in 2040, globally.

Technological advancements in ophthalmic surgical devices are expected to boost the market. Development and adoption of new imaging technologies help the surgeon perform procedures in a much better and effective way, making them safer for patients and easier for surgeons. The rise in the success rate of surgeries is likely to increase the adoption of surgical procedures by patients, which will positively impact the demand for ophthalmic sutures in the coming years. Furthermore, several government initiatives and increasing healthcare funding are among the factors likely to propel market growth. For instance, in May 2017, the Glaucoma Research Foundation launched the “Cure is in Sight” program. This campaign has raised USD 15 million to date for glaucoma awareness and research.

Key players in the market are focusing on new product launches, expansions, and mergers and acquisitions for advancing sutures for various ophthalmic surgeries. For instance, in May 2019, Surgical Specialties Corporation launched a new business division, Caliber Ophthalmics. The company, through the launch of the new division, aims to cater to the growing needs of customers across the globe. The new division also plans to open a new manufacturing center in Pennsylvania.

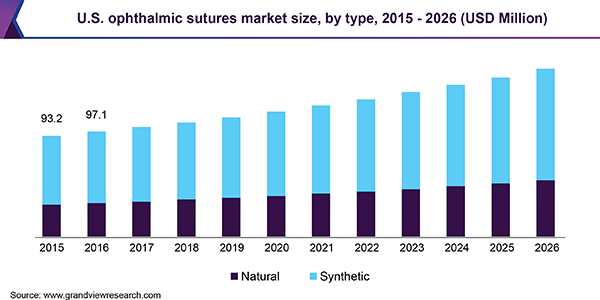

Type Insights

Based on type, the market has been segmented into natural and synthetic ophthalmic sutures. The synthetic sutures segment accounted for the largest market share in 2018. The dominance of the segment is majorly attributed to its high usage, which is driven by its ability to degrade by hydrolysis and therefore less inflammation on wound site. Synthetic sutures are composed of polyester, polypropylene, and polyamide, which increases their durability.

The natural sutures segment is also expected to witness considerable growth over the forecast period. These sutures are of different types such as collagen, surgical cotton, surgical silk, and surgical steel. The high growth rate of the segment is primarily attributed to its benefits such as good knot security, ease of handling, and initial tensile strength. However, natural sutures may cause tissue reactions and increase the chance of surgical site infection, which may restrict the growth of the segment.

Application Insights

By application, the cataract surgery segment accounted for the largest market share in 2018. This is primarily attributed to the increasing prevalence of visual impairment caused by cataracts. Cataract surgery technology and techniques have improved significantly over the last decade. At present, cataract surgery is the most frequently performed ophthalmic surgery in many developed countries. According to the American Society of Ophthalmology, approximately 24.4 million Americans aged 40 years and older were affected by cataract in 2015.

Many government and private initiatives are also likely to propel segment growth. The HelpMeSee initiative, for instance, has been working toward eliminating cataract-caused blindness in countries across Africa, Asia, and South America. Through the training of surgery specialists and developing advanced technologies and equipment, the U.S.-based nonprofit has partnered with over 300 surgery partners in less than a decade.

The corneal transplant surgery segment is expected to grow at the fastest rate during the forecast period. This is primarily driven by the increasing incidence of thinning of the cornea, causing scarring and irregular shape of the cornea. The most common surgical indications of corneal transplants are endothelial corneal dystrophy and keratoconus. Corneal transplantation is an effective treatment for several serious corneal diseases and is primarily aimed at restoring corneal transparency. Technological advancements and improvement in ophthalmic surgical techniques have led to an increase in the number of corneal transplants.

End-use Insights

Based on end-use, the ophthalmic sutures market is segmented into hospitals and ambulatory surgical centers. Ambulatory surgical centers (ASCs) dominated the market in 2018 owing to the increasing number of surgeries being performed in these centers. Most ophthalmic surgeries are performed on an outpatient basis and do not require a hospital stay. Ophthalmologists in the U.S. perform more than 90% of such surgeries in ambulatory surgery centers, annually. Every year, approximately 3.8 million outpatient cataract surgeries are performed in the U.S.

Hospitals also accounted for a considerable share in 2018. This is primarily attributed to the rising incidence of eye disorders such as cataracts, glaucoma, and retinitis. Moreover, increasing government funding and rising private sector investments in healthcare are also driving the growth of the segment.

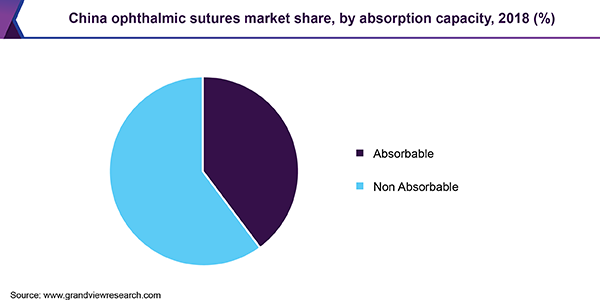

Absorption Capacity Insights

Based on absorption capacity, the market can be segmented into absorbable and non-absorbable ophthalmic sutures. The non-absorbable sutures segment captured the majority market share in 2018 and is expected to retain its lead position over the forecast period. Commonly used non-absorbable sutures may be made of synthetic materials such as polypropylene, nylon, and polyester or natural materials such as silk linen.

Non-absorbable sutures offer mechanical strength for longer durations. These variants are less prone to becoming infected as they lack rough surfaces for things to adhere to. Furthermore, these sutures can be permanently implanted into the body and can be removed after a few days of surgery to reduce the chances of post-operative surgical infection. However, these sutures have the disadvantage of loosening at the knots owing to lack of grip. This could hamper patient preference.

The absorbable ophthalmic sutures segment is expected to register a CAGR of 6.7% during the forecast period. The high growth rate of the segment is majorly attributed to product benefits such as the ability to provide short-term support to the wound until it heals significantly. These sutures undergo degradation and do not lose tensile strength to 60 days. Moreover, it is cost-effective as it is dissolved in the body after a certain period and does not require additional surgery to be removed.

Regional Insights

North America dominated the market in 2018, which can be attributed to the increasing number of ophthalmic surgical procedures being performed and advanced healthcare systems and infrastructure in the region. With the increasing aging population in the U.S., the need for ophthalmic surgery continues to rise. According to WHO statistics, the number of people aged 65 years and older in the country is expected to reach 78 million by 2035, which will have a positive impact on product demand. Moreover, the implementation of advanced technologies for the development of surgical products is augmenting the market in the region.

The Asia Pacific is projected to be the most lucrative region over the forecast period. Increasing healthcare funding by public and private investors, high prevalence of eye-related disorders, and government initiatives to spread awareness about ophthalmic diseases are major factors aiding the market growth. In India, cataract is the principal cause of blindness (62.6%) among people, affecting over 9 million in 2015. The market for ophthalmic sutures in the country is expected to grow at a rapid pace owing to increasing awareness about this condition and a rise in the number of cataract surgeries being performed.

Key Companies & Market Share Insights

Major players are focusing on innovating surgical sutures and launching new products in the market to expand their business portfolio and strengthen their presence. For instance, in 2019, Ethicon developed a coated VICRYL Plus Antibacterial suture. The product is a synthetic absorbable suture composed of a copolymer containing 10% L-lactide and 90% glycolide. Some of the prominent players in the ophthalmic sutures market include:

-

Accutome Inc.

-

Asset Medical Sarl

-

Alcon Inc.

-

Aurolab

-

B Braun Melsungen AG

-

DemeTech Corporation

-

FCI Ophthalmic Inc.

-

Medtronic Plc

-

Rumex International Co.

-

Surgical Specialties Corp

-

Teleflex Incorporated

-

Unilever.

Recent Development

- In November 2022, Alcon completed the acquisition of Aerie Pharmaceuticals, Inc., to strengthen its position in the ophthalmic pharmaceutical market. The acquisition further aims to expand Alcon’s commercial products portfolio.

Ophthalmic Sutures Market Report Scope

Report Attribute

Details

The market size value in 2021

USD 532.8 million

The revenue forecast in 2029

USD 649.0 million

Growth Rate

CAGR of 6.8% from 2019 to 2026

The base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2029

Quantitative units

Revenue in USD million and CAGR from 2022 to 2029

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, absorption capacity, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, U.K., Germany, France, Italy, Spain, China, Japan, India, Australia, South Korea, Mexico, Brazil, Colombia, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Accutome, Inc.; Asset Medical Sarl; Alcon Inc.; Aurolab; B Braun Melsungen AG; DemeTech Corporation; FCI Ophthalmic Inc.; Medtronic Plc; Rumex International Co.; Surgical Specialties Corp; Teleflex Incorporated; Unigene

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2029. For this study, Grand View Research has segmented the global ophthalmic sutures market report based on type, application, absorption capacity, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2029)

-

Natural

-

Synthetic

-

-

Absorption Capacity Outlook (Revenue, USD Million, 2017 - 2029)

-

Absorbable

-

Non-absorbable

-

-

Application Outlook (Revenue, USD Million, 2017 - 2029)

-

Corneal transplantation surgery

-

Cataract surgery

-

Vitrectomy surgery

-

Iridectomy surgery

-

Oculoplastic surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2029)

-

Hospitals

-

Ambulatory surgical centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2029)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic sutures market size was estimated at USD 345.5 million in 2019 and is expected to reach USD 365.9 million in 2020.

b. The global ophthalmic sutures market is expected to grow at a compound annual growth rate of 6.4% from 2019 to 2026 to reach USD 532.8 million by 2027.

b. North America dominated the ophthalmic sutures market with a share of 40.8% in 2019. This is attributable to increasing number of ophthalmic surgical procedures being performed and advanced healthcare systems and infrastructure in the region.

b. Some key players operating in the ophthalmic sutures market include Accutome, Inc.; Assut Medical Sarl; Alcon Inc.; Aurolab; B Braun Melsungen AG; DemeTech Corporation; FCI Ophthalmic Inc.; Medtronic Plc; Rumex International Co.; Surgical Specialties Corp; Teleflex Incorporated; and Unilene.

b. Key factors that are driving the market growth include increasing incidence of various eye diseases and vision loss.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."