- Home

- »

- Medical Devices

- »

-

Ophthalmic Ultrasound Devices Market Report, 2028GVR Report cover

![Ophthalmic Ultrasound Devices Market Size, Share & Trends Report]()

Ophthalmic Ultrasound Devices Market Size, Share & Trends Analysis Report By Product (A-Scan, B-Scan), By Mobility (Portable, Standalone), By End-use (Ophthalmic Clinic, ASC, Hospital), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-3-68038-457-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2016 - 2020

- Industry: Healthcare

Report Overview

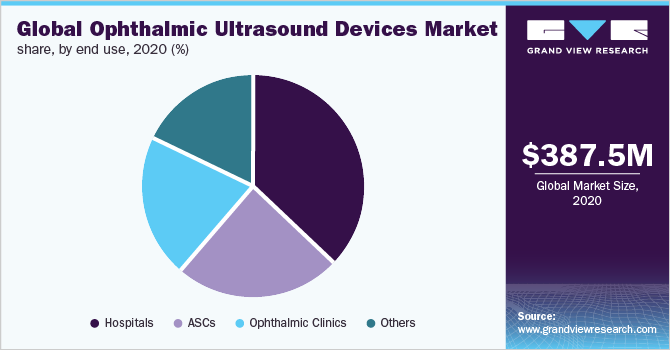

The global ophthalmic ultrasound devices market size was valued at USD 387.50 million in 2020 and is projected to expand at a compound annual growth rate (CAGR) of 8.36% by 2028. The growing prevalence of ophthalmic disorders, such as diabetic retinopathy, cataract, and others, coupled with frequent product launches are the factors anticipated to drive the market growth. The availability of efficient reimbursement policies, such as Medicare and Medicaid, is anticipated to support market growth. The WHO announced COVID-19 as a worldwide pandemic in March 2020. The COVID-19 pandemic had an unprecedented impact on the market. Routine healthcare activities were eluded to prevent patients from contracting virus, also ophthalmology services were predominantly impacted hence decrease in routine clinical care was observed that ultimately reduced the product demand. This led to a considerable loss in revenue and permanent or temporary closure of single ophthalmic practice institutions.

The volume of cataract surgeries is increasing considerably across the globe. According to the National Eye Institute projections, the number of people suffering from cataracts in the U.S. is expected to reach about 40 million in 2030. Cataract surgeries, the only effective treatment for the condition, are performed only after ocular ultrasound imaging and are done post-surgery to make sure that the lens is perfectly placed, indicating the potential of ocular ultrasound devices. Various initiatives to increase the reach of cataract treatment in the rural parts of developing economies are anticipated to boost the product demand during the forecast period.

Growing incidence of lifestyle- and age-related ophthalmic conditions and an increasing number of diabetic retinopathy in developed as well as developing regions are expected to enhance the product demand. Diabetic retinopathy is the most common diabetic eye disorder and a leading cause of blindness. As the number of individuals living with diabetes rises, so does the number of people with impaired vision. According to the CDC, diabetic retinopathy is observed in 1 in 3 diabetic patients. Hence, rising cases of diabetes are expected to drive product adoption.

Shortage of ophthalmic surgeons includes longer waiting times, which results in increased preference for alternative treatment procedures over ocular surgeries. Around 10,000 ophthalmologists were performing about 4 million cataracts surgeries in 2019 across the U.S. In addition, cataract cases are estimated to double during the forecast period, which will expressively increase the number of surgeries. Thus, the shortage of ophthalmic surgeons is predicted to limit the market growth during the forecast period.

Product Insights

Based on product, the market is segmented into A-scan, B-scan, combined, pachymeter, and ultrasound biomicroscope. The A-scan product segment held the largest market share of 29.6% in 2020. High usage of A-scan devices for pre-operative visualization of a detached retina in cases, such as vitreous hemorrhage, peri-orbital trauma, or lens opacification, is one of the major factors anticipated to foster the segment growth. A-scan provides huge benefits in cataract surgeries, thereby creating high demand. Furthermore, A-scan uses the latest transducer and electronic technologies for tremendous reliability and accuracy in ophthalmology practices. Hence, the segment is expected to exhibit a lucrative growth rate over the forecast years.

The B-scan segment is expected to grow at a CAGR of 8.30% during the forecast period. The increasing reach of these compact, affordable, lightweight, and multifunctional devices is expected to fuel the segment growth. The B-scan ultrasound system is two-dimensional as well as a cross-section brightness scan. This product is majorly used to evaluate orbital pathology as well as the posterior segment, mainly when the direct view is not possible and ocular media are cloudy. Rising usage of B-scan is anticipated to augment the segment growth.

Mobility Insights

Based on mobility, the market is classified into standalone and portable/handheld devices. The standalone devices segment held the largest revenue share of more than 54% in 2020 owing to the factors, such as affordability and easy availability & handling. With high demand for portable devices, major players are offering exchange offers on standalone devices, to secure a higher market position.

The portable devices segment is anticipated to grow at the fastest CAGR during the forecast period. Space constraints in ophthalmologist clinics, frequent introduction of portable ocular ultrasounds with advanced features at affordable pricing, and growing standards of healthcare across the globe are expected to aid the growth of this segment.

End-use Insights

Based on end-use, the global market is segmented into Ambulatory Surgical Centers (ASCs), hospitals, and ophthalmic clinics. The hospitals segment accounted for the largest market share of more than 35% in 2020. Favorable government policies for the development of eye care facilities in different geographies are one of the major factors responsible for the largest market share of this segment. Enormous patient pool, availability of advanced technology, and favorable government programs are other key factors predicted to drive the segment growth over the coming years.

The ophthalmic clinics segment had a considerable market share in 2020. The growing number of ophthalmologists in developing countries is expected to have a significant impact on the market growth with a steep rise in the number of ophthalmic clinics. Ease of doing business and favorable government initiatives in various developing countries, such as India, the Netherlands, Thailand, the Philippines, and China, are expected to fuel the segment growth during the forecast period.

Regional Insights

North America dominated the market with the largest revenue share of 38% owing to the high demand for technologically advanced medical devices, such as A-scan, B-scan, and combined devices. This demand is majorly high due to the increased prevalence of diabetes in the region. In addition, the presence of a large number of global players and suppliers is anticipated to drive the market further.

Europe accounted for the second-largest share in 2020. The presence of several ophthalmology societies including the European Society of Cataract and Refracting Surgeons as well as the European Society of Ophthalmology (ESC) to promote the practice and study of modern ophthalmology is one of the major factors responsible for the regional market growth.

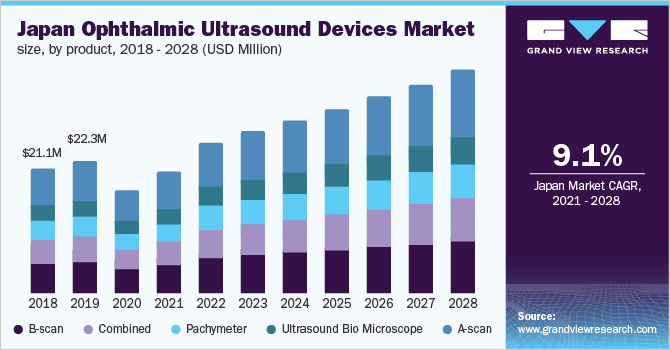

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period owing to high unmet needs along with developing healthcare infrastructure, especially in Japan and India. Furthermore, the presence of domestic manufacturers & suppliers and the prevalence of ophthalmic disorders are expected to drive the regional market. This region has cheaper recruitment costs, access to a diversified & large patient pool, and favorable policies that further boost growth.

Key Companies & Market Share Insights

The leading players are focusing on growth strategies, such as innovations in the existing product, frequent product launches, and mergers& acquisitions. For instance, in March 2019, Quantal medical received U.S. FDA approval for the launch of its product called ABSolu. This product provides A/B/S/UBM ultrasound technology with exceptional image quality in one device. The following are some of the major players operating in the global ophthalmic ultrasound devices market:

-

Halma plc

-

NIDEK CO. Ltd.

-

Quantel Medical

-

Optos

-

Escalon Medical Corp

-

Appasamy Associates

-

MicroMedical Devices

-

DGH Technology

-

Ellex

-

Carl Zeiss Meditech

Ophthalmic Ultrasound Devices Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 449.1 million

Revenue forecast in 2028

USD 787.7 million

Growth Rate

CAGR of 8.36% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2020

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mobility, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Thailand; South Korea; Mexico; Brazil; Colombia; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Halma plc; Nidek Co.Ltd.; Quantel Medical; Optos; Escalon Medical Corp.; Appasamy Associates; MicroMedical Devices; DGH Technology; Ellex; Carl Zeiss Meditech

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global ophthalmic ultrasound devices market report on the basis of product, mobility, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

A-Scan

-

B-Scan

-

Combined

-

Pachymeter

-

Ultrasound Bio Microscope

-

-

Mobility Outlook (Revenue, USD Million, 2016 - 2028)

-

Standalone

-

Portable

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Ambulatory Surgical Centers

-

Ophthalmic Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic ultrasound devices market size was estimated at USD 387.50 million in 2020 and is expected to reach USD 449.1 million in 2021.

b. The global ophthalmic ultrasound devices market is expected to grow at a compound annual growth rate of 8.36% from 2021 to 2028 to reach USD 787.7 million by 2028.

b. A-scan segment dominated the ophthalmic ultrasound devices market with a share of 29.6% in 2020. This is attributable to the growing demand for technologically advanced A-scan instruments and increasing usage of A-scan devices for pre-operative visualization of a detached retina.

b. Some key players operating in the ophthalmic ultrasound devices market include Halma plc, NIDEK CO. LTD., Quantel Medical, Optos, Escalon Medical Corp, Appasamy associates, MicroMedical devices, DGH technology, Ellex, Carl Zeis Meditech.

b. Key factors that are driving the ophthalmic ultrasound devices market include technological advancements, increasing cases of ophthalmic disorders, and rising cases of diabetic retinopathy all across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."