- Home

- »

- Pharmaceuticals

- »

-

Organ Transplant Immunosuppressant Drugs Market Size Report, 2026GVR Report cover

![Organ Transplant Immunosuppressant Drugs Market Size, Share & Trends Report]()

Organ Transplant Immunosuppressant Drugs Market Size, Share & Trends Analysis Report By Drug Class (Calcineurin Inhibitors, Antibodies), By Transplant, By Distribution Channel, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-786-5

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Healthcare

Industry Insights

The global organ transplant immunosuppressant drug market size was estimated at USD 4.64 billion in 2018 and is anticipated to grow at a CAGR of 3.3% over the forecast period. Increasing demand for transplantation and technological advancements in organ transplants & tissue engineering are some of the key factors driving this market. However, the high cost of transplantation and the low availability of organs are inhibiting market growth.

Organ transplantation is a medical procedure to replace a missing or damaged organ by removing it from the donor and placing it in the body of the recipient. The transplantation can be done either when the donor and the recipient are at the same location or the organs are transported from the donor location to the recipient. Successful transplantation has been performed for the kidneys, liver, heart, lungs, pancreas, thymus, and intestine. Kidney transplants are the most common, followed by liver transplants and then heart transplants.

There is a huge demand for organ transplants that will further boost the market growth. According to the Health Resources & Services Administration and the U.S. Department of Health and Human Services, 36,528 transplants were performed in 2018 and more than 113,000 people needed transplants as of January 2019.

Medication associated with transplantation is one of the most multifaceted and challenging areas of modern medicine. Most of the drugs are prescribed for transplant rejection and associated problems. In transplant rejection, there is an immune response to the transplanted organ by the body, which often leads to transplant failure and the requirement for immediate removal of the organ from the recipient. Reduction of transplant rejection can be possible through the use of immunosuppressant drugs and serotyping for the determination of the donor-recipient compatibility.

Drug Class Insights

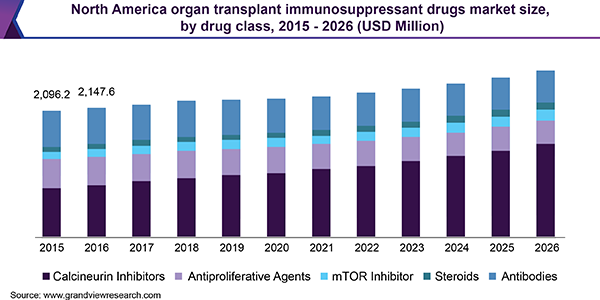

Among the drug classes, the calcineurin inhibitors are expected to dominate the global organ transplant immunosuppressant drugs market through the forecast period. There are majorly two drugs in this drug class, Prograf (tacrolimus) and Neoral/Sandimmune (cyclosporine). Although these effective immunosuppressants have been used in renal transplant recipients for more than 20 years, they hold extensive toxicity profiles.

The market is witnessing an increasing number of pipeline studies for organ transplant rejection which is further expected to drive the market. In November 2018, Veloxis Pharmaceuticals in association with Temple University began a phase IV clinical trial of tacrolimus for use in kidney transplant recipients, and its completion was expected by August 2019. The increasing use of mTOR inhibitors and other novel immunosuppressive agents are evolving strategies that aim to decrease lifelong exposure to corticosteroids and calcineurin inhibitors and improve long-term results.

Transplant Type Insights

Based on transplants, the market has been segmented into the kidney, liver, heart, lung, pancreas, and other transplants. Kidney transplant held the largest market share in the transplanted segment and is expected to retain its leading position through the forecast period. This can be attributed to increasing demand and relatively better organ availability than other transplants. Additionally, kidney transplants are found to be more cost-effective than extended periods of dialysis.

According to the current rate of adoption and future growth prospects, liver and heart transplants are also expected to witness high demand respectively. Heart transplantation is currently regarded as the gold standard of treatment as it has revolutionized end-stage heart failure therapy. Similarly, liver transplantation has become a life-saving procedure for patients with chronic end-stage liver disease and selected patients with acute liver failure (ALF) and alcoholic liver disease (ALD).

Distribution Channel Insights

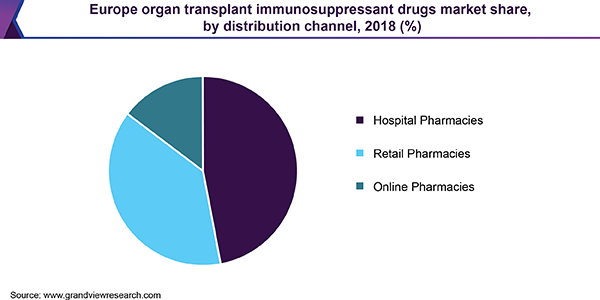

Hospital pharmacies and retail pharmacies generate the highest revenue in this segment. High penetration of these distribution channels for immunosuppressant drugs can be attributed to their large market shares in 2018. Furthermore, consumers prefer these distribution channels because hospital pharmacies offer easy and rapid access, while retail pharmacies usually have sufficient products in stock.

Online pharmacies are expected to witness the fast growth rate in the segment through the forecast period. One of the major factors responsible for this is the growing popularity of eCommerce channels for obtaining prescribed immunosuppressant drugs. Online pharmacies provide a wide range of options and in-depth information about these drugs, due to which an increasing consumer preference for online channels is expected over the forecast period.

Regional Insights

North America has the largest market share among all the regions as of 2018 and is expected to dominate the market through the forecast period. High healthcare expenditure, established R&D infrastructure, favorable healthcare reimbursement policies, and huge demand for organ transplants are the factors driving the market in this region. According to the Health Resources & Services Administration and the U.S. Department of Health and Human Services, over 113,000 people needed transplants as of January 2019 in the U.S., and only 36,528 transplants were performed in 2018.

The Asia Pacific is projected to demonstrate the fastest growth during the forecast period. The industry is witnessing increasing revenue generation from calcineurin inhibitors and mTOR inhibitors in this region. Encouraging initiatives about the increasing investments by the governments and manufacturers in the healthcare sector and plenty of unexplored opportunities are the key factors propelling the growth in this region.

Organ Transplant Immunosuppressant Drugs Market Share Insights

The key companies operating in this space are Astellas Pharma, Inc., Sanofi Genzyme, Accord Healthcare Ltd., Novartis AG, Mylan Laboratories, Inc., Dr. Reddy’s Laboratories Ltd., F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Veloxis Pharmaceuticals A/S, and Bristol-Myers Squibb Company. Astellas Pharma and Novartis hold the largest market shares in 2018 due to the presence of an extensive product portfolio and wide geographical reach.

However, the companies are facing stiff generic competition, as several marketed products have lost patents and cheaper alternatives to branded drugs are available in the market. Companies are adopting competitive strategies such as regional expansions, new product development, and strategic collaborations to gain an advantage.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2026

Market representation

Revenue in USD Million and CAGR from 2019 to 2026

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Germany, UK, France, Italy, Spain, Russia, Japan, China, India, Australia, South Korea, Singapore, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the reportThis report forecasts revenue growth at global, regional, & country levels, and provides an analysis of the industry trends in each of the sub-segments from 2015 to 2026. For this study, Grand View Research has segmented the global organ transplant immunosuppressant drugs market report based on drug class, transplant type, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2015 - 2026)

-

Calcineurin Inhibitors

-

Antiproliferative Agents

-

mTOR Inhibitor

-

Steroids

-

Antibodies

-

-

Transplant Type Outlook (Revenue, USD Million, 2015 - 2026)

-

Kidney

-

Liver

-

Heart

-

Lung

-

Pancreas

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2026)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2026)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."