- Home

- »

- Beauty & Personal Care

- »

-

Organic Makeup Remover Market Size Report, 2020-2027GVR Report cover

![Organic Makeup Remover Market Size, Share & Trends Report]()

Organic Makeup Remover Market Size, Share & Trends Analysis Report By Distribution Channel (Hypermarket & Supermarket, Pharmacies & Drug Stores, E-commerce), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-147-3

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Consumer Goods

Report Overview

The global organic makeup remover market size was valued at USD 158.7 million in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2020 to 2027. The growing acceptance of makeup remover in the daily skincare regime, coupled with the increasing propensity of consumers towards organic products, has been driving the market. People are looking for organic makeup removers that easily remove cosmetics, dirt, and impurities without any adverse impact on the skin. Increasing awareness regarding the harmful chemical ingredients present in the conventional organic makeup removers, such as denatured alcohols, parabens, phthalates, mineral oils, phenoxyethanol, formaldehyde, polysorbates, and other types of surfactants, solubilizes, and emulsifiers, which are skin irritants and can sometimes cause burning sensation around eyes and face, has goaded people to switch to safe and effective organic options for removing makeup.

Additionally, many of the brands in this domain including Vapour Clarity and La Foglia come with bioactive extracts and essential oil ingredients, such as Avocado oil, jojoba seed oil, castor seed oil, and horsetail extract, which offer nourishment to the skin without any side effects besides cleaning the makeup diligently. Organic makeup remover products such as makeup remover wipes, natural cleansing oils, and micellar water are the most widely used products among consumers.

Companies offering organic beauty care products have been meticulously focusing on green processing and practices by using eco-friendly packaging methods, ingredient labeling, and certification labeling to maintain transparency amongst consumers and pique their interest. For instance, in March 2019, Organic Harvest, a certified beauty and cosmetics brand, launched Organic Micellar Water in the facial care segment, containing aloe vera extracts. The product is 100% organic certified, vegan, and cruelty-free. Similarly, in January 2020, MARA Beauty launched Algae Enzyme cleansing oil in the skincare category, which includes moringa, chia, squalene oils, and fruit enzymes such as papaya, pumpkin, pineapple, and grapefruit.

Enthused by the market growth in e-commerce space, many startups and small-cap brands prefer investing in social media and e-commerce retailing to expand customer offerings by tapping into new markets. There are different offers, sales, discounts, and loyalty programs on the company’s website or e-retailers, such as Nykaa and Amazon, to attract consumers. For instance, CAUDALIE, an organic and natural skincare brand that offers organic makeup remover products, provides a membership program called The MYCAUDALIE Loyalty Programme that allows customers to buy products to collect points, which can be further exchanged for gifts or value-added benefits.

The ongoing COVID-19 pandemic has severely impacted the beauty and personal care industry owing to interrupted lockdown measures and stay at home policy by most of the countries. Demand for organic skincare products has been declining due to the shift in consumer preferences from buying premium products to using conventional alternatives that are cheap and widely available. In addition, due to lockdown measures, people have been refraining from regular makeup practices, which is one of the immediate reasons for the decline of makeup remover products globally. However, companies have been involving in customer engagement programs and investing significantly in e-commerce retailing due to store closures around the globe to resuscitate the market. Product demonstration videos and online consultation have been trending to gain traction among consumers.

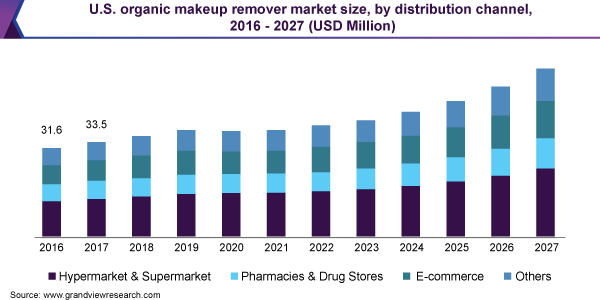

Distribution Channel Insights

The hypermarket and supermarket segment dominated the market and accounted for 40.8% share of the global revenue in 2019. These stores have been focusing on offering natural and chemical-free categories set up to attract the customers and provide them a facility to choose from numerous brands before making a purchase. For instance, in January 2017, Beauty Counter, a multilevel marketing company and retailer, decided to eliminate 1400 chemicals banned or restricted in personal care products by the European Union. Additionally, in 2019, retailers such as Ahold Delhaize, Bed Bath & Beyond, CVS Health, Dollar General, Rite Aid, Staples, Target, Walgreens, and Whole Foods Market decided to adopt clean beauty initiative and promote organic products on the shelves.

The e-commerce distribution channel segment is expected to witness the fastest growth over the forecast period. The rising internet penetration and targeting marketing done by the companies to reach all consumer touchpoints are likely to fuel the growth of this segment. For instance, in August 2019, Organic Harvest, an organic personal care brand, launched an online campaign #fixwithsix on the occasion of completing six years. The brand encouraged people to adopt six actions through its e-commerce platform, such as plant trees, use organic personal care products for skin, use reusable or cloth/jute bag for shopping, de-digitize to reduce harmful effects, and adopt organic products. This led to the participation of millennial consumers and was appreciated by sustainable consumers.

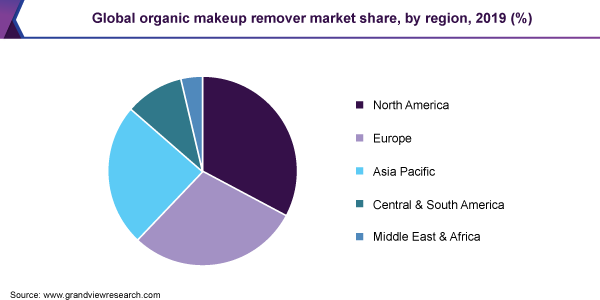

Regional Insights

North America dominated the market for organic makeup remover and accounted for 32.8% share of the global revenue in 2019. The presence of organic certification programs for the beauty and cosmetics industry, such as the National Organic Program (NOP) by the U.S. Department of Agriculture (USDA) and the NSF/ANSI 305: Personal Care Products Containing Organic Ingredients by the NSF International, define ingredient transparency categories, such as more than 70% organic ingredients, 95% organic ingredients, and 100% organic to maintain consumer transparency in the region, which is likely to boost demand for the organic products.

Asia Pacific is expected to be the fastest-growing regional market for organic makeup remover over the forecast period. The inclination of consumers towards organic products is expected to shoot up demand for such products, especially in developing countries such as India and China. Many startups have been tapping into organic skincare products, which is expected to stimulate the acceptance of many green skincare products, including organic makeup removers. For instance, Dr. Sheth’s organic skincare brand provides a wide product portfolio in the facial care range comprising organic cleansers and removers, such as daily care cleanser and remover and Moringa and Vitamin C cleansing oils.

Key Companies & Market Share Insights

The market for organic makeup remover is highly fragmented owing to the presence of a number of international and domestic market participants. Key players focus on strategies, such as innovation and new product launches, to enhance their portfolio and attract millennial customers. For instance, in August 2020, Lotus Herbals, a premium cosmetics company, announced the acquisition of Vedicare Ayurveda, which is an organic skincare and makeup company. The latter company markets its products under a brand name of SoulTree, which offers certified organic ayurvedic wellness and beauty products to consumers through both online and offline channels. Some prominent players in the global organic makeup remover market are:

-

MYCAUDALIE

-

La Foglia

-

Foxbrim Naturals

-

VAPOUR BEAUTY

-

Organyc

-

Estelle&Thild

-

Grown Alchemist

-

Caudalie

-

Sky organics

-

Madara

-

Nature’s Brands, Inc.

-

INIKA

-

RMS Beauty

Organic Makeup Remover Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 157.4 million

Revenue forecast in 2027

USD 255.2 million

Growth Rate

CAGR of 6.1% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; U.K.; Germany; France; China; India; Brazil

Key companies profiled

CAUDALIE; La Foglia; Foxbrim Naturals; VAPOUR BEAUTY; Organyc; Estelle&Thild; Grown Alchemist; Caudalie; Sky organics; Madara; Nature’s Brands, Inc.; INIKA; RMS Beauty

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global organic makeup remover market report on the basis of distribution channel and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Hypermarket and Supermarket

-

Pharmacies and Drug Stores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global organic makeup remover market size was estimated at USD 158.7 million in 2019 and is expected to reach USD 157.4 million in 2020.

b. The global organic makeup remover market is expected to grow at a compound annual growth rate of 6.1% from 2020 to 2027 to reach USD 255.2 million by 2027.

b. North America dominated the organic makeup remover market with a share of 32.8% in 2019. This is attributed to the increasing number of organic personal care products manufacturers in the region. The presence of organic standards and certification programs by the Government is among the primary reason driving regional growth.

b. Some key players operating in the organic makeup remover market include MYCAUDALIE, La Fogila, Foxbrim Naturals, VAPOUR BEAUTY, Organyc, Estelle&Thild, Grown Alchemist, Caudalie, Sky organics, Madara, Nature’s Brands, Inc., INIKA, and RMS Beauty.

b. Key factors that are driving the organic makeup remover market growth include growing acceptance of makeup remover in the daily skincare regime coupled with an increased propensity of consumers towards organic products and awareness regarding the side effects of using conventional makeup removers which contain chemical ingredients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."