- Home

- »

- Power Generation & Storage

- »

-

Organic Rankine Cycle Market Size & Share Report, 2030GVR Report cover

![Organic Rankine Cycle Market Size, Share & Trends Report]()

Organic Rankine Cycle Market Size, Share & Trends Analysis Report By Application (Waste Heat Recovery, Biomass, Geothermal, Solar Thermal, Oil & Gas), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-071-2

- Number of Pages: 152

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Energy & Power

Organic Rankine Cycle Market Size & Trends

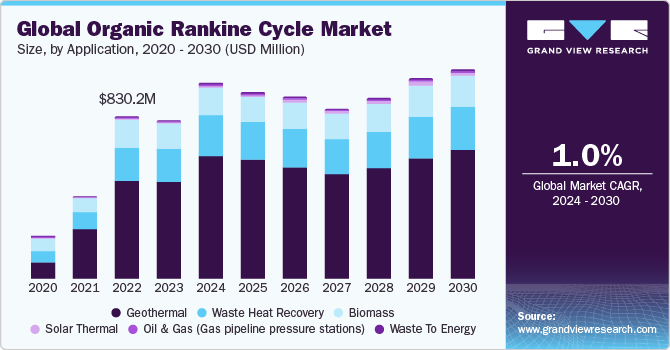

The global organic rankine cycle market size was estimated at USD 812.13 million in 2023 and is expected to grow at a CAGR of 1.0% from 2024 to 2030. Climate change concerns have been witnessed worldwide, leading governments of most countries to implement stringent emission norms related to various industries. Moreover, countries are moving toward limiting their future carbon footprint by making favorable policies and regulations to enhance renewable energy deployment. Most countries’ governments focus on energy efficiency, majorly at the industrial level. Furthermore, major countries such as the U.S. and Canada provide financial incentives to companies to deploy energy efficiency initiatives and practices at power plants and manufacturing facilities.

These factors support the deployment of organic rankine cycle (ORC) technology at the industrial level for low-temperature applications due to the enforcement of stringent norms and financial incentives. In addition, the rise in deployment of renewable power technologies, such as geothermal, biomass, and solar thermal, will increase the usability of ORC technology in the forecast period. The U.S. has been one of the leading countries in market development and deployment on a global level. The presence of geothermal resources has driven the ORC market in the country, owing to which, the geothermal segment dominated the U.S. ORC market. ORMAT is the major industry player that has been active in the country. It provides ORC equipment and EPC services for developing geothermal ORC projects.

Furthermore, the company owns and manages approximately 622 MW of geothermal and recovered energy generation projects nationwide. In addition, the geothermal ORC application segment is expected to grow over the forecast period with the development of new projects and the extension of generation capacity in the existing projects. For instance, in October 2023, Ormat Technologies, a prominent renewable energy company, expanded its footprint in the U.S. with a USD 271 million purchase of geothermal and solar assets from Enel Green Power North America. This development includes the strategic acquisition of two operational geothermal plants and a unique hybrid facility combining solar PV, geothermal, and solar thermal plants, along with two standalone solar assets and two other assets with development potential.

Market Concentration & Characteristics

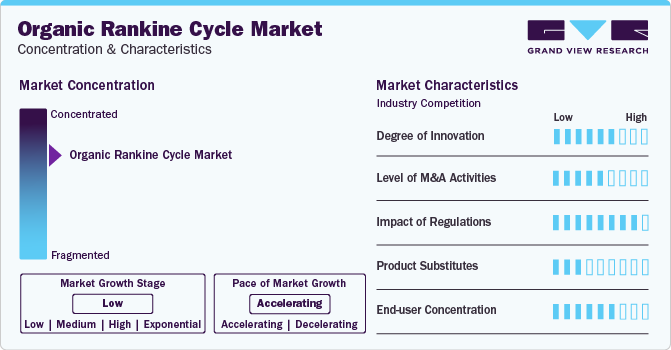

The market is consolidated in nature, wherein, a few major companies, such as Ormat, Turboden, and Exergy accounted for the majority of the share in the global market in 2023. In July 2023, Turboden was selected by LEC in collaboration with ENGIE Solutions GCC to deploy a 10 MW waste heat recovery ORC system at the Fujairah cement plant in UAE. Many organizations focus on saving energy and implementing sustainable practices to reduce environmental impact. These systems are valuable in situations where energy efficiency, cost savings, and sustainability are priorities.

Furthermore, ORC technology provides long-term economic benefits through lower equipment downtime. These major factors drive the usage of ORC technology in low-temperature geothermal, biomass, and heat recovery applications in various industries worldwide.

Application Insights

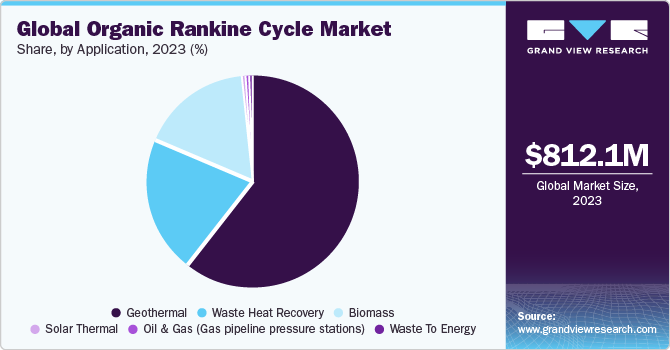

The geothermal segment accounted for a revenue share of more than 60.80% of the global market in 2023. The primary factor contributing to the segment's dominance is the substantial megawatt capacity of these projects, which typically exceeds 10 MW, setting them apart from other application segments like biomass, waste heat recovery, and solar thermal. On the other hand, ORC-based projects in different application sectors often reach a different capacity than 10 MW and typically remain below 1 to 2 MW in size.

Waste heat recovery emerged as the second-largest segment in the market owing to a rise in the focus on energy efficiency, which resulted in the industrial sector identifying suitable and potential ways to utilize available energy more efficiently. These factors have resulted in the launch of several large-scale projects for ORC-based waste heat recovery worldwide. For instance, in July 2023, Turboden S.p.A., in partnership with ENGIE Solutions GCC, was chosen by LEC to manufacture and deploy a 10 MWe WHR ORC system at the Fujairah cement plant, in UAE. Moreover, rising awareness and increasing adoption are anticipated to support the segment growth during the forecast period.

Regional Insights

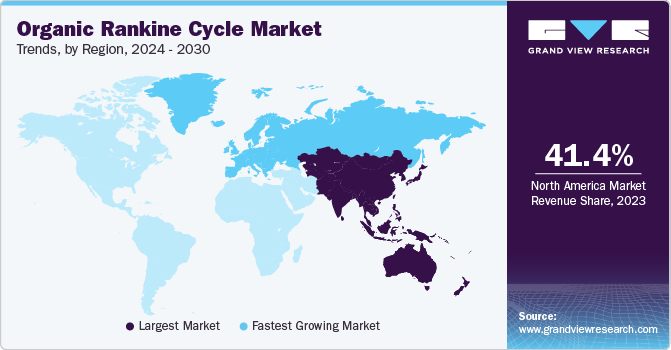

The organic rankine cycle market in North America accounted for the largest market share of 41.34% in 2023. The U.S. dominated the North America regional market owing to its substantial geothermal potential. In addition, the country has consistently pursued proactive measures to promote utilizing this geothermal potential for power generation applications over an extended period.

U.S. Organic Rankine Cycle Market Trends

The U.S. organic rankine cycle market is expected to witness significant growth over the coming years. The waste heat recovery segment for the U.S. ORC market has been driven by a rise in energy efficiency awareness and support programs by the U.S. Department of Energy. This factor has resulted in the industrial sector opting for waste heat recovery projects. However, the adoption factor for ORC technology in the waste heat recovery market in the U.S. is less owing to the high cost of ORC deployment compared to other available waste heat recovery technologies. Moreover, the ongoing advancements in ORC technology are expanding its application across various industries. For instance, in September 2023, Salgenx, a renewable energy solutions company, introduced an innovative heat pump technology for RO desalination systems. It incorporated ORC to power the pressurization pumps, making desalination more cost-effective and energy-efficient. In addition, biomass and waste heat recovery for low-temperature applications is expected to increase in the country over the forecast period, owing to the government's rising energy efficiency efforts. These factors are expected to drive market growth in the country. They will consolidate the position of the U.S. in the global as well as North American market over the forecast period.

The organic rankine cycle market in Canada accounted for a moderate share of the North America market in 2023 due to the availability of abundant biomass resources that are suitable for ORC technology, such as sawmills. In addition, the country holds potential for waste heat recovery projects suitable for ORC application. These factors are expected to drive market growth in Canada.

Europe Organic Rankine Cycle Market Trends

The Europe organic rankine cycle market is expected to have significant growth in the coming years. Europe has been one of the front-runners in the world, in terms of implementing favorable policies and support mechanisms, to ensure the growth of renewable energy and energy-efficient projects. It has led Europe to account for a dominant share of the global ORC market.

The organic rankine cycle market in Turkey accounted for the largest share of 59% in Europe in 2023. The abundant geothermal potential within the nation stands as the driving factor for the growth of the ORC market. The government has taken aggressive steps to enhance renewable power in the country by making favorable policies and utilizing financial support mechanisms. These support programs have led to the growth of the geothermal segment of the local market.

The Italy organic rankine cycle market is expected to grow at the highest CAGR of 1% from 2024 to 2030. The market growth in the country is driven by the presence of key companies, such as Turboden, Enel Spa, and Exergy, which hold a considerable market share in the ORC market globally. It has led to the adoption of ORC technology in waste heat recovery, biomass, and solar thermal applications in Italy.

Asia Pacific Organic Rankine Cycle Market Trends

The Asia Pacific organic rankine cycle market is projected to register a lucrative CAGR from 2024 to 2030. The waste heat recovery segment is estimated to experience significant growth during the forecast period. This can be attributed to the rise in focus of major Asia Pacific countries, such as Japan, China, India, and Australia, toward implementing energy efficiency projects.

The organic rankine cycle market in China accounted for the largest share of 4.5% in Asia Pacific owing to a rise in the number of small-scale ORC-based waste heat recovery projects in the country. These projects have been deployed by many companies operating in the country, such as Tangshan Xiangtai Metal Products Co. Ltd., Jiangsu Xingda Iron and Steel Group Co. Ltd., and Chizhou Shitai County Jin Xin Calcium Industry Co. Ltd. These developments are expected to increase the country's adoption of ORC-based waste heat recovery projects. It will make the waste heat recovery segment dominate the market in China.

The Japan organic rankine cycle market is expected to grow at a CAGR of 4.8% from 2024 to 2030. The waste heat recovery segment is gaining traction as a few large-scale ORC-based waste heat recovery projects have been commissioned in the country, while some are in the pipeline. In February 2022, Mitsubishi Heavy Industries Marine Machinery and Equipment Co., Ltd. and Mitsubishi Heavy Industries, Ltd. successfully tested 100kW class cryogenic organic Rankine cycle energy generation using the world’s first next-gen oilless cryogenic turbine generator an increase in GHG emissions (0.1%) with most of the GHG emissions from the transportation sector in the country.

Central & South America Organic Rankine Cycle Market Trends

The organic rankine cycle market in Central & South America accounted for the largest share of 1.2% in 2023 owing to the presence of gas-based power plants in the region and rising importance of energy efficiency across industries.

The organic rankine cycle market in Brazil is expected to witness steady growth over the forecast period. A rising number of carbon removal projects to achieve carbon-neutral status is also expected to act as a driver for market growth in Brazil in the coming years.

Middle East & Africa Organic Rankine Cycle Market Trends

The Middle East & Africa organic rankine cycle market accounted for the largest share of 1.15% in 2023. The regional market has been majorly in South Africa and Kenya. None of these countries have implemented large-scale ORC-based projects in the region since 2022. The geothermal application segment dominates the market for ORC development in the region. The African region has a vast geothermal potential that can be utilized for power generation applications. As per the International Energy Agency, countries, such as Kenya and Ethiopia are expected to have an installed base of 932.16 and 178.5 MW of geothermal power projects by 2025. These factors will lead to the development of the geothermal application segment for the ORC market in the region.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In September 2023, Enogia, a subsidiary of the South Korean conglomerate STX, signed a technology development agreement with STX Engine for the development and supply of a compressor as part of a project to develop and test an exhaust gas sequestration system for ship engines, which specializes in the global manufacturing of marine and industrial engines

-

In December 2023, TITAN and ORCAN ENERGY AG announced a partnership to explore the development and deployment of modular clean energy by leveraging ORCAN ENERGY AG’s modular technology

-

In July 2023, Turboden S.p.A. was selected by LEC in collaboration with ENGIE Solutions GCC to manufacture and deploy a 10 Mwe waste heat recovery organic Rankine cycle WHR ORC system at the Fujairah cement plant, UAE

Key Organic Rankine Cycle Companies:

The following are the leading companies in the organic rankine cycle market. These companies collectively hold the largest market share and dictate industry trends.

- Turboden S.p.A.

- Exergy International Srl

- Zhejiang Kaishan Compressor Co., Ltd.

- Enogia SAS

- Triogen

- Calnetix Technologies, LLC

- ABB

- Atlas Copco AB

- TAS Energy Inc. (TAS)

- Elvosolar, A.S.

Organic Rankine Cycle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.01 billion

Revenue forecast in 2030

USD 1.07 billion

Growth rate

CAGR of 1.0% from 2024 to 2030

Historical data

2018 - 2023

Base year

2023

Forecast period

2024 - 2030

Quantitative Units

Volume in MW, Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; Turkey; Italy; China; Japan; Thailand

Key companies profiled

Turboden S.p.A.; Exergy International Srl; Zhejiang Kaishan Compressor Co., Ltd.; Enogia SAS; Triogen; Calnetix Technologies, LLC; ABB; Atlas Copco AB; TAS Energy Inc. (TAS); Elvosolar, A.S.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Rankine Cycle Market Report Segmentation

This report forecasts revenue, capacity, and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the organic rankine cycle market report based on application and region:

-

Application Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Waste Heat Recovery

-

Petroleum Refinery

-

Chemical

-

Glass

-

Cement

-

Metal Production and Casting (Iron & Steel)

-

-

Biomass

-

Geothermal

-

Solar Thermal

-

Oil & Gas (Gas pipeline pressure stations)

-

Waste To Energy

-

-

Regional Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Turkey

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

Thailand

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global organic rankine cycle market size was valued at USD 812.13 million in 2023 and is expected to reach USD 1.01 billion in 2024.

b. The global organic rankine cycle market is expected to grow at a compound annual growth rate (CAGR) of 1.0% from 2024 to 2030 to reach USD 1.07 billion by 2030.

b. The geothermal segment accounted for the largest share of 60.80% in the global ORC market in 2023. The major reason for the dominance of the geothermal segment is due to the large-scale megawatt capacity of these geothermal projects as compared to other application segments such as biomass, waste heat recovery, and solar thermal.

b. The organic rankine cycle market is a concentrated market where major companies such as Ormat, Turboden, and Exergy account for more than 75% of the market share in the global ORC market in 2023.

b. The rise in the adoption of renewable energy and the longer life cycle of ORC coupled with low O&M cost are some of the major factors driving the growth of the ORC market globally.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."