- Home

- »

- Medical Devices

- »

-

Orthopedic Biomaterials Market Size & Share Report, 2030GVR Report cover

![Orthopedic Biomaterials Market Size, Share & Trends Report]()

Orthopedic Biomaterials Market Size, Share & Trends Analysis Report By Type (Ceramics & Bioactive Glasses, Polymers, Calcium Phosphate Cements), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-152-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global orthopedic biomaterials market size was estimated at USD 19.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. The increased prevalence of musculoskeletal disorders and chronic skeletal conditions is fueling the growth. The growing proportion of the geriatric population particularly vulnerable to these illnesses is expected to further fuel the growth. According to an article released by the World Health Organization in October 2022, the number of people aged 60 years and above was more than children younger than 5 years in 2020. Moreover, by 2050 the proportion of the population aged 60 years and above is expected to reach 22%.

According to the National Safety Statistics, sports injuries increased by 20% in 2021 after a decline of 27% in 2020. In addition, an article published in the Times of India in September 2022 suggests that football and cricket players are suffering 500% more knee injuries whereas 400% more people are inflicted by anterior cruciate ligament injuries. This increasing number of athletic injuries is likely to contribute to the growth of the orthopedic biomaterials market.

The increasing prevalence of orthopedic diseases and musculoskeletal problems is driving the demand for orthopedic surgeons. For instance, according to a study published in PubMed Central in December 2021, an increase of 1.6% was observed in the number of unique orthopedic surgeons from 2012 to 2020. This can help improve medical services and consequently contribute to the growth of the market.

The need for next-generation orthopedic biomaterials, which are specifically designed to fulfill the requirements of a particular orthopedics operation, is on the rise globally. Other Medicare costs, including hospital fees, operating costs, and implant costs, must also be considered as the costs of orthopedics practices are rising. The lack of proper reimbursements has pressured the manufacturers to reduce their prices for these materials, which can restrict the market growth.

The COVID-19 has also negatively impacted the market for orthopedic biomaterials. Since the pandemic resulted in the disruptions of logistics & supply chain, it impacted the production and distribution in this market. In addition, since people were compelled to their homes for a longer time and all elective surgeries were postponed, the demand for orthopedic biomaterials also decreased.

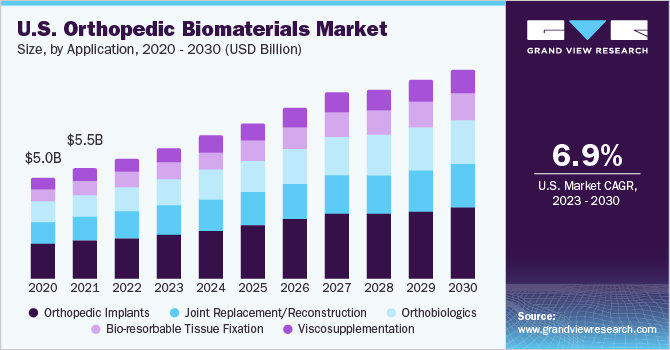

Application Insights

Based on application, the market is segmented into orthopedic implants, joint replacement/reconstruction, orthobiologics, viscosupplementation, and bio-resorbable tissue fixation. The orthopedic implants segment held the largest revenue share in 2022 owing to therising incidences of disc degenerative conditions and bone fractures coupled with increasing trauma cases. According to an article published by WHO in July 2022, nearly 1.71 billion people around the globe suffer from musculoskeletal conditions.

The orthobiologics segment is expected to grow at the fastest CAGR over the forecast period owing to the increasing number of bone repair and reconstruction surgeries worldwide as a result of the rise in obesity and trauma cases. According to an article published by WHO in June 2022, road accidents kill approximately 1.3 million people worldwide and approximately 20 to 50 million people suffer from non-fatal injuries.

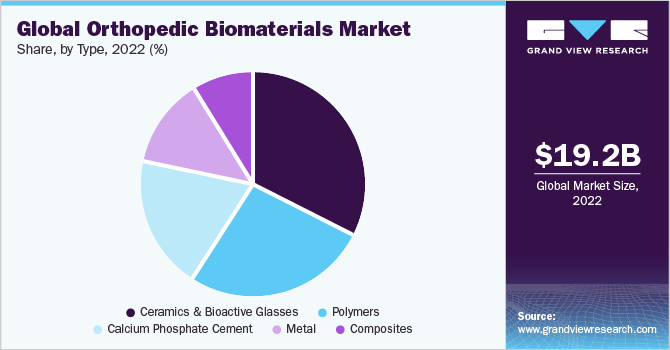

Type Insights

Based on type, the orthopedic biomaterials market is segmented into ceramics & bioactive glass, polymers, calcium phosphate cement, metal, and composites. The ceramics & bioactive glass segment accounted for the largest revenue share of 32.7% in 2022owing to the increased adoption of ceramics in the repair of hard tissues in various procedures. Bioactive glasses are one of the most preferred hard materials used in the treatment of soft tissue damage. These substances were originally designed to facilitate the treatment of damaged bones; however, they also help in the repair and regeneration of various wounds and delicate structures of the body which is driving their demand.

The polymer biomaterials segment is expected to grow at the fastest CAGR of 8.3% during the forecast period on account of the extensive use of polymers as bone cement and load-bearing surfaces for total joint arthroplasties. In addition, the availability of advanced polymers and biopolymers for various applications like orthobiologics and bio-resorbable tissue fixation has surged the demand for polymers globally.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 36.55% in 2022. This growth can be attributed to the rise in the number of patients requiring knee replacement and other joint-related orthopedic procedures. Quick adoption of advanced products for bone void filling and implant load-bearing purposes is anticipated to drive the regional market further.

Asia Pacific is expected to grow at the fastest CAGR of 9.4% during the forecast period. Key factors driving the regional market include the rising prevalence of bone degenerative diseases and bone disorders in low- and middle-income countries. Moreover, continuously increasing healthcare expenditure coupled with improving healthcare infrastructure is expected to serve as a high-impact rendering driver to the market in this region.

Key Companies & Market Share Insights

The expansion of target patients has created a pool of opportunities for players in this market. Various global and local players in the market are constantly focusing on catering to the needs of the growing number of patients. The key players in the market are emphasizing the development of new and advanced products, mergers and acquisitions, partnerships, and approvals to gain more share in the market. For instance, in January 2021, DSM Biomedical and NC Biomatrix signed a memorandum of understanding, to develop a technologically advanced device for the treatment of back pain. Some prominent players in the global orthopedic biomaterials market include:

-

DSM Biomedical

-

Evonik industries AG

-

Stryker Corp

-

Depuy Synthes Inc

-

Zimmer Biomet

-

Invibo Ltd.

-

Globus Medical

-

Exactech, Inc.

-

Matexcel

-

AdvanSource

-

Biomaterials Corp

-

CAM Bioceramics B.V.

-

Heraeus Holding

Orthopedic Biomaterials Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 21.15 billion

Revenue forecast in 2030

USD 35.90 billion

Growth rate

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

DSM Biomedical; Evonik Industries AG; Stryker Corp.; DePuy Synthes Inc.; Zimmer Biomet; Invibio Ltd.; Globus Medical; Exactech, Inc.; Matexcel; AdvanSource Biomaterials Corp.; CAM Bioceramics B.V.; Heraeus Holding

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

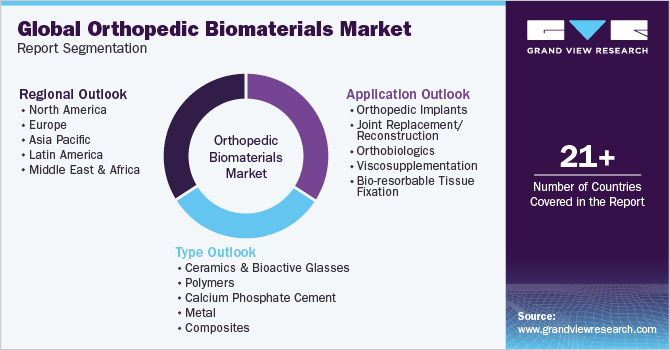

Global Orthopedic Biomaterials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global orthopedic biomaterials market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramics & Bioactive Glasses

-

Polymers

-

Calcium Phosphate Cement

-

Metal

-

Composites

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Implants

-

Joint Replacement/Reconstruction

-

Orthobiologics

-

Viscosupplementation

-

Bio-resorbable Tissue Fixation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic biomaterials market size was estimated at USD 19.2 billion in 2022 and is expected to reach USD 21.15 billion in 2023.

b. The global orthopedic biomaterials market is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 35.9 billion by 2030.

b. Ceramics & bioactive glass biomaterials dominated the orthopedic biomaterials market with a share of 32.7% in 2022. This is attributable to the increased adoption of ceramics in the repair of hard tissues in various procedures.

b. Some key players operating in the orthopedic biomaterials market include DSM Biomedical; Evonik Industries AG; Stryker Corp.; DePuy Synthes Inc.; Zimmer Biomet; Invibio Ltd.; Globus Medical; Exactech, Inc.; Matexcel; AdvanSource Biomaterials Corp.; CAM Bioceramics B.V.; and Heraeus Holding.

b. Key factors that are driving the orthopedic biomaterials market growth include increasing the incidence of musculoskeletal ailments and chronic skeletal conditions are boosting the product demand, thereby augmenting the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."