- Home

- »

- Medical Devices

- »

-

Orthopedic Regenerative Surgical Products Market Report, 2030GVR Report cover

![Orthopedic Regenerative Surgical Products Market Size, Share & Trends Report]()

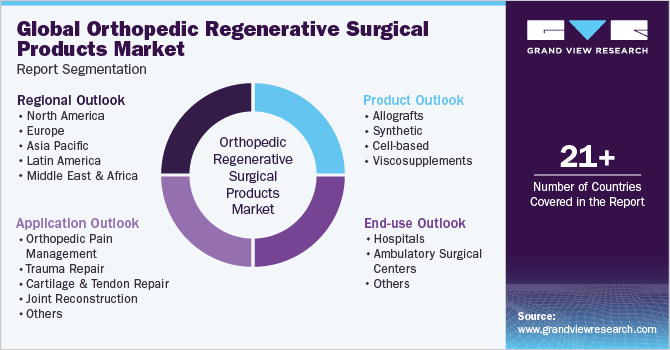

Orthopedic Regenerative Surgical Products Market Size, Share & Trends Analysis Report By Product (Allografts, Viscosupplements), By End-use (Hospitals, ASCs), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-477-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global orthopedic regenerative surgical products market size was estimated at USD 4.14 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.0% from 2023 to 2030. The rising prevalence of orthopedic conditions, such as arthritis, increasing technological advancements, and an increasing number of orthopedic surgeries are key factors fueling market growth. Moreover, growing R&D investments and activities are expected to propel the growth of the market over the forecast period. According to the article by the U.S. National Library of Medicine, in Italy, the clinical study on Platelet Rich Plasma (PRP) Injections was conducted by Azienda Ospedaliero-Universitaria Consorziale Policlinico in April 2021.

The study was focused on knee osteoarthritis treatment in adults aged between 40 to 81 years. Orthopedic ailments, such as osteoarthritis, in the older population are a key factor driving product demand. As per research supported by China's National Natural Science Foundation Council and published in the Lancet journal, across the world, the prevalence of knee osteoarthritis was found to be around 16%. In individuals aged over 40 years and above, the study found a higher prevalence estimated to be approximately 645.1 million people, or 22.9% of the population in 2020. The prevalence is expected to increase during the forecast period owing to obesity, sedentary lifestyles, and an aging population, thus boosting market growth.

Furthermore, several innovations, such as reservoir-type orthobiologics and advanced & miniaturized ortho biologics patches, enable accurate medication dosage delivery. In addition, the demand for orthobiologics is projected to increase during the forecast period owing to the beginning of technology supporting targeted organ medicine delivery. The COVID-19 pandemic negatively impacted the market due to low sales and demand, disruptions in clinical studies, and canceling elective treatments. Organizations also faced operational challenges due to supply chain disruptions, travel restrictions, business closures, employee illness or quarantines, and social distancing protocols.

For instance, in the U.S., public health bodies suggested postponing elective surgeries to meet the demands of coronavirus patients and prevent cross-infection. In addition, patients postponed elective surgeries to mitigate the risk of the COVID-19 virus. Technological advancements and the growing use of emerging technologies, such as viscosupplements, stem cells, and Platelet Rich Plasma (PRP) therapies, along with increasing R&D studies, are projected to fuel the market demand. According to a survey conducted in 2020 and published in the International Journal of Complementary and Alternative Medicine, approximately 7 out of 10 respondents expressed a positive outlook on regenerative medicine therapies for treating musculoskeletal problems.

The response was even more positive among individuals who had personal experience with these therapies. Stem cell and PRP-based therapies are at the forefront of regenerative medication research, focusing on the restoration and repair of damaged tissues, trauma, and osteoarthritis repair. A retrospective study conducted by Amniox Medical in November 2020 revealed that umbilical cord/amniotic membrane particulates were found to delay Total Knee Arthroplasty (TKA) in patients with severe to moderate knee osteoarthritis.

Product Insights

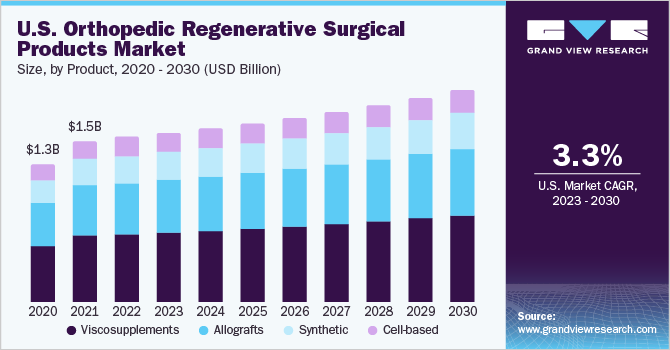

On the basis of products, the market is categorized into synthetic, cell-based, allografts, and viscosupplements products. The viscosupplements segment dominated the market and held the largest revenue share of 42.59% in 2022. The growth is credited to the increased incidence of osteoarthritis and knee pain. Factors, such as obesity, external injury, excessive exercise, genetic predisposition, and aging, further contribute to knee osteoarthritis, thus propelling the product demand. Key players in the market are launching new products to maintain their position. For instance, Seikagaku Corp. introduced viscosupplement single-injection- HyLink, for knee osteoarthritis treatment in Taiwan, in August 2021.

In addition, Fidia Pharma USA Inc. introduced Triluron, a Hyaluronic Acid-based viscosupplement, in the U.S. to treat osteoarthritic patients in December 2019. The allografts segment is anticipated to witness the fastest CAGR of 4.1% during the forecast period owing to the increasing utilization of allografts, including off-the-shelf cartilage, osteochondral allografts, fresh-frozen meniscal allografts, and soft tissue allografts. According to Allograft Company JRF Ortho, allografts offer several benefits, such as enhanced bone healing, reduced surgical time, fewer complications, and faster recovery time. JRF Ortho, a company focused on the sports medicine market, has distributed over 20,000 fresh OCA grafts.

Application Insights

On the basis of applications, the market is segmented into cartilage and tendon repair, orthopedic pain management, joint reconstruction, trauma repair, and others. The joint reconstruction segment dominated the market and held the largest revenue share of 35.66% in 2022 due to the rising adoption of regenerative solutions in joint reconstruction, growing surgical procedures, and technological advancements. For instance, the Clarix line of surgical allografts provided by Amniox Medical, Inc. are used in orthopedic surgeries such as arthroplasty, reconstruction and trauma, and soft-tissue repair.

The cartilage and tendon repair segment is anticipated to grow at a lucrative CAGR of 4.2% during the forecast period. This growth is attributed to various factors, such as the increasing number of older patients, the rising number of trauma cases, and growing applications in sports medicine. For example, MACI, developed by Vericel, is used to treat cartilage defects resulting from injuries caused by overuse, general wear and tear, and muscle weakness in the knee. Despite the challenges posed by the COVID-19 pandemic, MACI generated revenue of approximately USD 94.4 million for the fiscal year ending in December 2020.

End-use Insights

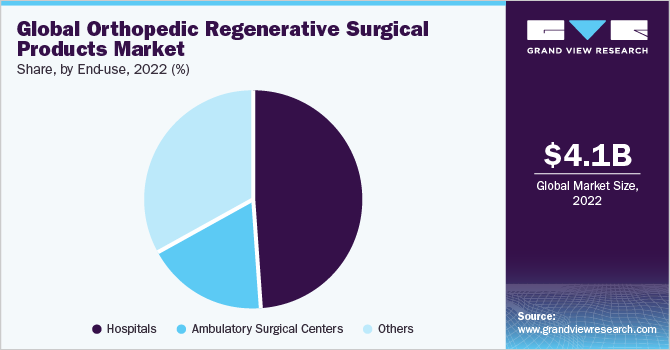

On the basis of end-uses, the market is further segmented into hospitals, ambulatory surgical centers (ASCs), and others. The hospital segment held the largest revenue share of 49.04% in 2022. Hospitals are the primary revenue source for the healthcare sector and an integral part of the industry, which propels innovation and research. The dominance of the hospital segment can be attributed to the fact that the maximum volumes of orthopedic treatments are conducted in hospital settings. For instance, in Germany, the Gelenk Klinik orthopedic hospital performs approximately 2,400 surgical treatments and procedures annually, providing treatment to over 24,000 orthopedic patients each year.

The ASC segment is expected to showcase the fastest CAGR of 4.1% during the forecast period. This growth is attributed to the increasing product usage for treatments and pain management in ASCs. Furthermore, the rising number of ASCs for treating orthopedic patients is expected to fuel market growth over the forecast period. According to the March 2021 statistics from the Centers for Medicare and Medicaid Services (CMS), there are approximately 187 Medicare-certified ASCs in Washington, 817 in California, 457 in Florida, 368 in Georgia, and 442 in Texas. These numbers are projected to increase during the forecast period.

Regional Insights

North America held the largest revenue share of 41.39% in 2022. The region's dominance can be attributed to several factors, including the presence of key players, technologically advanced healthcare facilities in Canada and the U.S., and the increasing geriatric population. According to statistics from July 2020, Canada had approximately 6.8 million individuals aged 65 years or older, with a median age of about 40.9 years. In 2022, Europe held the second-largest revenue share due to the high geriatric population and prevalence of chronic orthopedic ailments. These factors increase the risk of developing orthopedic illnesses, thereby driving the demand for products in the market.

The Asia Pacific market is expected to grow at a lucrative CAGR of 5.4% over the forecast period. The growth can be attributed to several factors, including regional expansion by key players, the development of healthcare infrastructure, and the increasing prevalence of orthopedic ailments, such as osteoarthritis. According to the Ministry of Health and Family Welfare of the Government of India, the prevalence of osteoarthritis conditions in India ranges from 22 to 39 cases out of 100, and it is expected to increase in the coming years. In addition, the Australian Institute of Health and Welfare, under the Government of Australia, reports that approximately 14.28% of adults in Australia have some form of arthritic ailment, with 50% of Australians experiencing moderate to severe pain. All these factors contribute to the region’s growth.

Key Companies & Market Share Insights

Key players in the market are undertaking strategic initiatives, including product development & launches, regional expansion, R&D, and expansion of the distribution network, to maintain a competitive edge. Key players are also undertaking strategies, such as mergers & acquisitions and alliances, to improve their presence in the market. For instance, MiMedx collaborated with the Wake Forest Institute in May 2021 to conduct RD) in regenerative medicine, aiming to advance innovative biologics and regenerative science. This strategic partnership supported the organization's initiative to demonstrate the potential of amniotic tissues in treating chronic conditions, including musculoskeletal ailments. Some prominent players in the global orthopedic regenerative surgical products market include:

-

Anika Therapeutics, Inc.

-

Vericel Corporation

-

Baxter

-

Zimmer Biomet

-

Stryker

-

Smith & Nephew

-

AlloSource

-

Amniox Medical, Inc.

-

VSY Biotechnology

-

Aptissen S.A.

-

MiMedx

-

Arthrex, Inc.

Orthopedic Regenerative Surgical Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.28 billion

Revenue forecast in 2030

USD 5.63 billion

Growth rate

CAGR of 4.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Application, product, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Japan; China; Australia; India; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Vericel Corporation; Anika Therapeutics, Inc.; Zimmer Biomet; Baxter; Stryker; AlloSource; Smith+Nephew; Amniox Medical, Inc.; Aptissen S.A; VSY Biotechnology; MiMedx

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Regenerative Surgical Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global orthopedic regenerative surgical products market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Allografts

-

Amniotic Products

-

Others

-

-

Synthetic

-

Cell-based

-

Viscosupplements

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Orthopedic Pain Management

-

Trauma Repair

-

Cartilage & Tendon Repair

-

Joint Reconstruction

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global orthopedic regenerative surgical products market size was estimated at USD 4.14 billion in 2022 and is expected to reach USD 4.28 billion in 2023.

b. The global orthopedic regenerative surgical products market is expected to grow at a compound annual growth rate of 4.0% from 2022 to 2030 to reach USD 5.63 billion by 2030.

b. North America dominated the orthopedic regenerative surgical products market with a share of more than 41.0% in 2022. This is attributable to the presence of key players, an aging population, and technologically advanced healthcare facilities in the U.S. and Canada.

b. Some key players operating in the orthopedic regenerative surgical products market include Anika Therapeutics, Inc., Vericel Corporation, Baxter, Zimmer Biomet, Stryker, Smith+Nephew, AlloSource, Amniox Medical, Inc., VSY Biotechnology, Aptissen S.A, and MiMedx.

b. Key factors that are driving the orthopedic regenerative surgical products market growth include the rising geriatric population, orthopedic procedures, research activities, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."