- Home

- »

- Digital Media

- »

-

OTT Devices And Services Market Size & Share Report, 2030GVR Report cover

![Over The Top Devices And Services Market Size, Share & Trends Report]()

Over The Top Devices And Services Market Size, Share & Trends Analysis Report By Type, By Device, By Service Type, By OTT Business Models, By Platform, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-496-3

- Number of Pages: 160

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overviews

The global over the top devices and services market size was valued at USD 190.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.3% from 2023 to 2030. The demand for OTT devices is expected to reach 482.45 million units by 2030. The substantial growth of the media and entertainment industry and the rising demand for high-quality streaming content on smart devices are the major factors driving market growth. OTT media services offer higher accessibility, connectivity, convenience, and portability, compared to traditional cable and satellite services. The deployment of advanced technologies such as voice command control, gesture input, and more by OTT service providers is a critical market driver.

Moreover, the provision of customized content has created immense attractiveness for the industry and is expected to accelerate revenue generation over the forecast period. Content producers are introducing new content across diverse genres to meet viewers’ demands. These producers are collaborating with OTT platforms to create exclusive and exciting collaborations.

Additionally, OTT service providers offer exclusive smartphone applications with enhanced features for streaming. This factor is a key market driver. For instance, leading streaming platforms such as Netflix, Disney + Hotstar, Amazon Prime, and others have developed their own applications for smart TVs and smartphones to offer their services. Furthermore, the demand for OTT devices is credited to their advanced features such as voice command, gesture control, and auto-download, which greatly appeal to users.

The implementation of Artificial Intelligence (AI) by OTT service providers is a prominent trend inducing immense market growth potential. The utilization of such technologies for analyzing customer preferences, as well as offering customized and premium content, has been the prime focus of industry participants in the past few years. Moreover, continued innovations in the communication infrastructure and rising internet penetration have resulted in an enormous demand for OTT services across the globe.

Numerous typical media houses that own the rights to vast libraries of television content and legacy movies are amplifying and reinvigorating their growth via OTT-based distribution models. Additionally, several pay-TV operators have started offering their individual subscription-based services. DISH Network Corporation’s Sling TV and AT&T Inc.’s DirecTV are some of the popular examples of standalone and affordable services in the U.S.

Similarly, the launch of OTT services by Sky Group Limited in European countries has promoted the industry’s regional penetration at a broader level, leading to strong revenue generation. The increasing willingness of subscribers to pay for premium content has encouraged OTT service providers to introduce “freemium” models, which provide free access to selected content for acquiring new subscribers. They are also offering premium services and content to paying subscribers to increase their average revenue per user.

Several market players, such as Hulu and Amazon Prime, are launching ‘lite pay-tv’ services to offer linear channels at lower prices compared to traditional ones. For instance, in 2022, Amazon.com Inc.’s Prime video subscription platform began offering TV channel subscriptions for a small fee on a user’s existing subscription. Such efforts by industry participants have led to the considerable expansion of the OTT subscriber base in recent years.

Type Insights

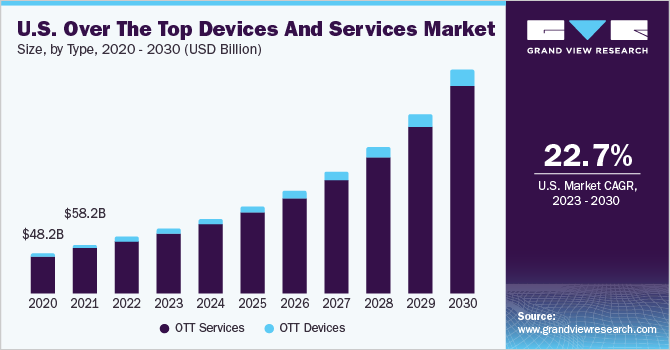

The OTT services segment accounted for the largest market share of around 94% in 2022. The segment dominance can be credited to the growing internet penetration that enables users to subscribe to OTT services and stream their favorite content. The ongoing trend among internet providers in developing countries to provide low-cost internet services is boosting the use of OTT devices and services. Moreover, there was a substantial increase in demand for OTT services during the COVID-19 pandemic, as people wanted advertisement-free entertainment while under government-issued lockdowns.

The OTT devices segment is anticipated to witness a steady CAGR of 22.7% over the forecast period. The growth of the segment can be attributed to the ease of access to OTT content and affordability. An OTT device enables users to access OTT services and platforms even on non-smart devices. Furthermore, the trend of portability coupled with increased usage of small-sized plug-and-play OTT devices is expected to boost segment growth.

Device Insights

The streaming sticks segment accounted for a revenue share of around 47% in the OTT devices market in 2022. Streaming sticks have gained immense popularity over the past few years due to their compact size and cost-effectiveness. Manufacturers are focusing on introducing products with unique features at a lower cost, to strengthen their foothold in the market. Such features cater to the rapidly changing consumer needs globally, consequently broadening the customer base and accelerating product demand.

The streaming media players segment is expected to expand at a CAGR of 22.2% from 2023 to 2030. An increasing number of product innovations are expected to induce immense potential for the growth of the OTT devices market over the forecast period. The North American and European countries were among the first adopters of these devices due to well-established high-speed internet infrastructure. Moreover, the ease & cost-benefit of installing streaming media players on older television units is anticipated to be a driving factor for the segment.

Service Type Insights

In 2022, the OTT media services segment accounted for the largest market share of 86.5% in the OTT services market. The high penetration & use of smartphones, tablets, and other advanced handheld devices with interactive displays is expected to contribute to the growth, as OTT services are now compatible with most mobile devices. The segment’s dominance is due to the content available in languages, including English, Spanish, French, etc. across various OTT service platforms. The advent of 5G is expected to aid segment growth during the forecast period as it enables high-quality, seamless streaming.

The OTT communication services segment is expected to progress at a significant CAGR of around 24% during the forecast period. The segment's growth can be credited to the high penetration and secure application programming interface. For instance, WhatsApp, the popular OTT communication services application by Meta Platforms, Inc., claims to have end-to-end encryption for secure messaging and data protection. Moreover, as OTT communication services operate over the Internet, they usually do not impose a data or activity limit on their users, which has resulted in their increasing demand.

OTT Business Model Insights

The ad-based video-on-demand (AVOD) segment is expected to witness a growth rate of 25.4% during the forecast period. AVOD OTT platforms have attracted substantial attention in recent years as they are free to use, which has supported revenue generation. Additionally, developed economies such as the U.S. are expected to witness several powerful AVOD platform launches in the coming years due to the growing trend of OTT-based content consumption. This, in turn, is anticipated to drive the segment growth.

In 2022, the subscription video-on-demand (SVOD) segment accounted for the largest market share of 57.6% in the global OTT devices and services market. The segment’s growth is primarily attributed to the provision of an optimal balance of value to both the customer and the company. For instance, in March 2023, Forbes Home claimed that around 78% of households in the U.S. have an active subscription to one or more streaming services.

A dramatic upsurge in the number of subscriptions to video streaming platforms, such as Netflix, Amazon Prime Video, and Disney+, has been a critical factor supporting the growth of the SVOD business model. Additionally, the implementation of a fixed price model by SVOD platforms attracts a humongous customer base, which was seen especially during the COVID-19 pandemic, as individuals were engaged in watching a high amount of streaming content.

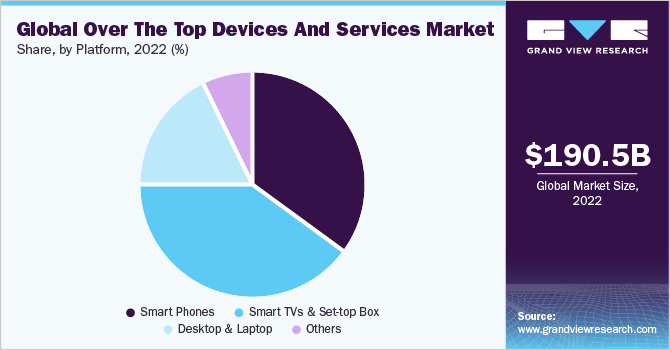

Platform Insights

In 2022, the smartphone segment accounted for a significant market share of around 34% in the global OTT devices and services market. Continuous innovations in smartphone devices have resulted in the development of advanced apps that allow easy downloads, access to live videos and music, and streaming of live content on smartphones, irrespective of location and time.

Due to the significant growth in mobile video viewership across the globe, OTT service providers, such as Netflix, are increasingly prioritizing mobile features for their customers and have introduced mobile-only subscription tiers in countries with high viewership, such as India. Additionally, OTT video providers are constantly adding enhanced features to improve the in-app experience, resulting in an increase in the number of subscriptions, thus fueling segment growth.

The smart TVs & set-top box segment accounted for the largest market share of over 40% in 2022. The segment's growth is attributed to the rapid adoption of smart TVs and set-top boxes with inbuilt OTT applications. Furthermore, these devices have multiple input ports, such as USB and HDMI that support external OTT devices, which is anticipated to be an important factor in customer purchasing decisions. Additionally, as smart TVs and set-top boxes are capable of downloading applications, including OTT apps, the segment is expected to grow positively.

Regional Insights

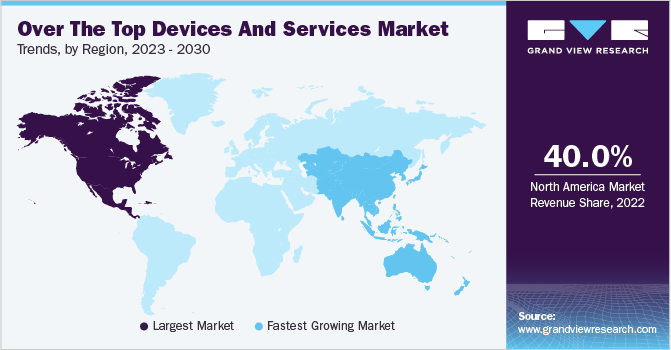

North America accounted for the largest market share of around 40% in 2022 and is anticipated to maintain its dominance over the forecast period. The regional growth can be credited to developed economies, such as the U.S. and Canada, making significant investments and developments in new technologies. The region also has a high level of Internet and smartphone penetration that is anticipated to factor in positive market growth.

Moreover, internet service provider companies in the region are making necessary investments in advanced and reliable network infrastructure for the continuously growing data traffic. Moreover, due to higher disposable income levels, consumer willingness to pay for premium content or a subscription is much higher in the region, supporting regional market growth.

On the other hand, the Asia Pacific region is anticipated to expand at the highest CAGR of 25.6% over the forecast period from 2023 to 2030 in the over the top devices and services market. The region has witnessed a significant influx of international OTT service providers who are aiming to capitalize on the increasing traction of subscription OTT among consumers.

Countries such as China and India are some of the major contributors to regional revenue, owing to the continuously growing number of subscribers. The rising mobile video viewership in developing countries has enabled leading OTT service providers to implement mobile-based subscription models in the region. This factor is further expected to create lucrative growth opportunities for the Asia-Pacific regional market.

Key Companies & Market Share Insights

Key players in the market use strategies such as partnerships, acquisitions, joint ventures, innovations, R&D, and geographical expansions, to solidify their industry position. Companies are also focusing on improving their product offerings to suit the changing needs of consumers to stay competitive. For instance, in February 2023, Netflix, Inc. entered a partnership with General Motors, wherein Netflix will increase the presence of electric vehicles in Netflix-produced TV shows and movies for a year. Some of the prominent players operating in the global over the top devices and services market are:

-

Akamai Technologies

-

Amazon.com, Inc.

-

Apple, Inc.

-

Brightcove Inc.

-

Disney + Hotstar

-

Google LLC

-

Limelight Networks Inc.

-

Netflix, Inc.

-

Microsoft Corporation

-

Roku, Inc.

-

WarnerMedia Direct, LLC (HBO Max)

-

Hulu, LLC

-

Tencent Holdings Ltd.

-

PCCW Enterprises Limited

Over The Top Devices And Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 235.7 billion

Revenue forecast in 2030

USD 1,079.1 billion

Growth Rate

CAGR of 24.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD billion, volume in million units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, device, service type, OTT business models, platform, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Netherlands; China; Japan; India; South Korea; Australia; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Akamai Technologies; Amazon.com, Inc.; Apple Inc.; Brightcove Inc.; Disney + Hotstar; Google LLC; Hulu LLC; Limelight Networks, Inc.; Microsoft Corporation; Netflix, Inc.; PCCW Enterprises Limited; Roku, Inc.;Tencent Holdings Ltd., WarnerMedia Direct, LLC (HBO Max)

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Over The Top Devices And Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global over the top devices and servicesmarket report based on type, device, service type, OTT business models, platform, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

OTT Services

-

OTT Devices

-

-

Device Outlook (Revenue, USD Billion; Volume, Million Units, 2018 - 2030)

-

Streaming Media Players

-

Streaming Sticks

-

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

OTT Media Services

-

OTT Communication Services

-

-

OTT Business Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

AVOD (Ad-based Video on Demand)

-

SVOD (Subscription Video on Demand)

-

TVOD (Transactional Video on Demand)

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Phones

-

Smart TVs & Set-top Box

-

Desktop & Laptop

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global over the top devices and services market size was estimated at USD 190.5 billion in 2022 and is expected to reach USD USD 235.7 billion in 2023.

b. The global over the top devices and services market is expected to grow at a compound annual growth rate of 24.3% from 2023 to 2030 to reach USD USD 1,079.1 billion by 2030.

b. North America accounted for the largest market share of over 40% in 2022 and is anticipated to maintain its dominance over the forecast period. The regional growth can be credited to developed economies, such as the U.S., making significant investments and developments in new technologies.

b. Some key players operating in the OTT devices and services market include Akamai Technologies; Amazon.com, Inc.; Apple Inc.; Brightcove Inc.; Disney + Hotstar; Google LLC; Hulu LLC; Limelight Networks, Inc.; Microsoft Corporation; Netflix, Inc.; PCCW Enterprises Limited; Roku, Inc.; Tencent Holdings Ltd., and WarnerMedia Direct, LLC (HBO Max) among others

b. Key factors that are driving the over the top devices and services market growth include the proliferation of OTT service platforms, substantial growth of the media & entertainment industry and the increasing demand for high-quality streaming content over smart devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."