- Home

- »

- Consumer F&B

- »

-

Packaged Burgers Market Size, Industry Report, 2020-2027GVR Report cover

![Packaged Burgers Market Size, Share & Trends Report]()

Packaged Burgers Market Size, Share & Trends Analysis Report By Product (Frozen, Fresh), By Patty (Veg, Non-veg), By Distribution Channel, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-977-7

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Consumer Goods

Report Overview

The global packaged burgers market size was valued at USD 3.02 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2020 to 2027. Increasing demand for convenience food across the world has been fueling market growth. Rapid urbanization, changing lifestyles, shifting food consumption behavior, and hectic schedules of the consumers have been boosting the sales of various ready-to-eat foods, such as packaged burgers. With the rising demand for ready-to-cook and ready-to-eat meal products, demand for the product has been witnessing significant growth in the urban areas, where the working population finds less time to cook meals. Long shelf life and easy to cook features of the product are pushing the demand among the consumers. As a result, several companies are offering innovative products using sustainable packaging, organic ingredients, and single-serving food products.

Aggressive promotions and marketing strategies are expected to boost the growth of the market over the forecast period. However, the presence of preservatives in the products may restrict the reach of packaged burgers to health-conscious consumers. The exposure to diverse cultures and cuisines, increased spending on food owing to higher purchasing power, and the lack of time to prepare food at home are the key factors driving the demand for convenience foods, and thus fueling the market growth. In addition, an increasing number of dual-income households across the world have been boosting product demand.

As per the survey of YouGov PLC, more than 55% of the households in the U.S. were dual-income households in 2018. Similarly, according to the Modern Families Index 2019, over 75% of the households in the U.K. were dual earners. This increased number of dual-earner families in the countries across the world is expected to fuel the demand for packaged burgers in the upcoming years.

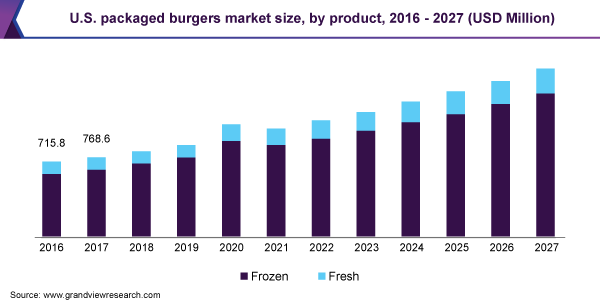

Product Insights

Frozen packaged burgers held the largest share of more than 80.0% in 2019. Among the frozen fast foods, burgers are the second most favored after frozen pizza. The frozen products have gained remarkable popularity owing to their longer shelf life. These products usually can last for six to eight months in the freezer. Meat-based products such as beef and turkey burgers are the most common options of frozen products. However, with the increasing demand for vegan products, the plant-based frozen packaged burger is gaining shelf space over the years.

Furthermore, the advancement of retail channels, such as hypermarkets, supermarkets, and convenience stores, has been fueling the growth of frozen products. Increased availability of frozen products with better-for-you ingredients has boosted the demand for the products. Companies have been offering frozen products that address the specific dietary requirements, such as high in protein, vegan, dairy-free, and gluten-free, in order to expand their consumer base.

Distribution Channel Insights

Supermarkets and hypermarkets accounted for the largest share of more than 50.0% in 2019. The availability of a wide array of products discounted prices, and convenience of getting everything at one place are the key factors driving the product sales through this distribution channel across the world. As a result, producers in the packaged burger industry have been focusing on retail expansion by selling their foods through nationwide supermarket and hypermarket chains.

The online distribution channel is expected to witness the fastest growth during forecast years with a CAGR of 9.0% from 2020 to 2027. The convenience of shopping and rising penetration of online shopping portals have been fueling the growth of the online distribution channel. Companies have been partnering with online retailers to expand their consumer reach. For instance, Impossible Foods Inc. has a partnership with Kroger, which allows consumers to order their products from the online portal of Kroger.

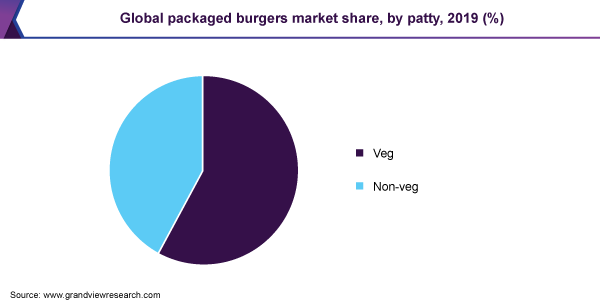

Patty Insights

Veg patty-based packaged burger held more than 55.0% share of the global revenue in 2019. Consumers across the world have been changing their eating habits to reduce the negative impact on the environment. As a result, a large number of consumers have switched to plant-based food from meat-based food. With the increasing availability of the plant-based or vegan packaged burgers, the sales of the product have surged notably over the past few years.

Companies such as Impossible Foods Inc. and Beyond Meat, which are dedicated to plant-based products, have remarkable popularity among the consumers seeking sustainable foods. These companies are offering meat alternatives that deliver similar texture, flavor, and mouthfeel experience like meat.

According to the Good Food Institute, 11.9% of the U.S. households bought plant-based meat in 2019, increased from 10.5% in the previous year. The coronavirus outbreak and lockdown have surged the sales of plant-based packaged foods. In January 2020, Tofurky, a U.S.-based vegan food producer, introduced a vegan beef-style burger in the U.S. The product is made with vegetable protein, soy protein, and wheat gluten and is available in over 600 Target stores. Similarly, in April 2019, Nestlé launched Garden Gourmet plant-based packaged burger in Europe and the U.S. The product contains soy and wheat protein and plant extracts that give it a beefy look.

Regional Insights

Europe held the largest share of over 40.0% in 2019. Processed food is one of the leading trends in the region. Consumers of this region are seeking for sustainable food production, healthy diets, transparency, food safety, and convenience. Considering the growing trend, many producers have started redefining foods and catering to healthier options for health-conscious consumers. Several companies have been offering whole-grain bread, along with the access to the vegan options to the buyers.

Asia Pacific is expected to witness the fastest growth during forecast years with a CAGR of 10.0% from 2020 to 2027. China, Australia, Japan, South Korea, Hong Kong, Singapore, and India are the prominent markets that are likely to pose a wide growth opportunity for the market in the upcoming years. Competitors including Impossible Foods Inc. have been expanding their reach in the region. Some regional players such as Otsuka Foods are also gaining traction in the region by introducing plant-based packaged burgers.

Key Companies & Market Share Insights

The industry is characterized by the presence of a large number of international and regional players. Players have been introducing new products in order to gain a competitive advantage in the market. Furthermore, key players are expanding their businesses in the emerging markets of Asia Pacific to capture growth opportunities. For instance, in September 2019, Impossible Foods Inc. started distributing its products through grocery stores, such as Wegmans and Fairway Market. The company announced plans to expand its retail presence in the leading grocery chains in key regions by launching the Impossible Burger. Some of the prominent players in the packaged burgers market include:

-

Beyond Meat

-

BUBBA foods, LLC

-

Kellogg’s

-

The Kraft Heinz Company

-

Nestlé

-

Paragon Quality Foods

-

Impossible Foods Inc.

-

Cremonini S.p.A.

-

Premium Brands Holdings Corporation

-

DR. PRAEGER'S SENSIBLE FOODS

Packaged Burgers Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 3.68 billion

Revenue forecast in 2027

USD 5.58 billion

Growth Rate

CAGR of 8.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, patty, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; Australia; Brazil

Key companies profiled

Beyond Meat; BUBBA foods, LLC; Kellogg’s; The Kraft Heinz Company; Nestlé; Paragon Quality Foods; Impossible Foods Inc.; Cremonini S.p.A.; DR. PRAEGER'S SENSIBLE FOODS; Premium Brands Holdings Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global packaged burgers market report on the basis of product, patty, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Frozen

-

Fresh

-

-

Patty Outlook (Revenue, USD Million, 2016 - 2027)

-

Veg

-

Non-veg

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

China

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global packaged burgers market size was estimated at USD 3.02 billion in 2019 and is expected to reach USD 3.68 billion in 2020.

b. The global packaged burgers market is expected to grow at a compound annual growth rate of 8.0% from 2020 to 2027 to reach USD 5.58 billion by 2027.

b. Europe dominated the packaged burgers market with a share of more than 40% in 2019. This is attributable to the strong demand for processed food in the key countries of Western Europe.

b. Some key players operating in the packaged burgers market include Beyond Meat, BUBBA foods, LLC, Kellogg NA Co., The Kraft Heinz Company, Nestlé, Paragon Quality Foods, Impossible Foods Inc., Cremonini S.p.A., DR. PRAEGER'S SENSIBLE FOODS, and Premium Brands Holdings Corporation.

b. Key factors that are driving the market growth include increasing demand for convenience food, rapid urbanization, changing lifestyles, shifting food consumption behavior, and hectic schedule of the consumers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."