- Home

- »

- Food Safety & Processing

- »

-

Paper Packaging Materials Market Size, Industry Analysis Report, 2022GVR Report cover

![Paper Packaging Materials Market Size & Trend Report]()

Paper Packaging Materials Market Size & Trend Analysis By Product (Liquid Packaging Cartons, Corrugated Cases, Cartons & Folding Boxes), By Application (Beverages, Fast Food, Frozen Food, Diary and Bakery Products) And Segment Forecasts To 2022

- Report ID: 978-1-68038-595-3

- Number of Pages: 81

- Format: Electronic (PDF)

- Historical Data: 2013-2015

- Industry: Consumer Goods

Industry Insights

The global paper packaging materials market size was estimated at USD 287.44 billion in 2015, growing at a CAGR of 4.5% from 2016 to 2022. This market is expected to witness brisk growth on account of increasing demand for flexible paper-based packaging. Emerging regions such as Asia Pacific, Central & South America, and the Middle East are expected to play a vital role in shaping the global industry.

Paper used in flexible packaging includes Kraft paper, greaseproof paper, and parchment paper. Growing population and increasing demand for cheap packaging substitutes drive demand for flexible packaging materials. Flexible packaging includes bags, envelopes, pouches, cellulose, and aluminum foils.

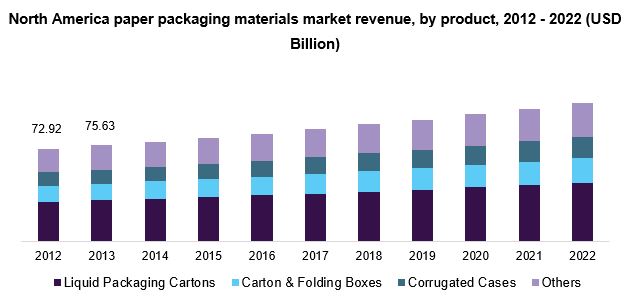

In North America, liquid packaging cartons emerged as a dominant segment in this region in 2015, accounting for 43.1% of the total revenue share. Also, the segment is expected to continue its dominance over the forecast period owing to growing number of beverage manufacturers and the presence of key players in the region.

Growing environmental concerns regarding plastic usage in packaging applications have resulted in a shift in consumer preference towards paper-based options. Stringent regulations and standards set by governments and agencies to safeguard the environment and promote recyclable paper-based options are expected to play a critical role in shaping the market.

Paper packaging material industry is exposed to several regulations regarding deforestation. Such an unfavorable regulatory environment is projected to hinder growth and development. Paper recycling technologies and R&D initiatives to develop superior products are expected to offer ample opportunities for industry participants over the forecast period.

Paper packaging material that is manufactured from raw material like paper, pulp, and other inorganic fibers. The basic function of paper packaging is to provide primary and secondary packaging to the products for safe transportation. Retail packaging developments such as innovative designs provide aesthetic looks to the product, which prove to be a major point of differentiation and point of purchase.

Product Insights

Liquid packaging cartons, folding & carton boxes, corrugated cases, and other products such as sacks and bags are the major product segments. Liquid packaging cartons segment emerged as a dominant segment in 2015 and accounted for 41.7% of the total revenue share. The segment is expected to gain momentum owing to enhancement in novel retail packaging.

Retail packaging developments such as innovative designs are expected to aid the corrugated cases product segment. Cartons & folding boxes, as well as corrugated products, are expected to witness a growth in market share over the forecast period at the expense of other product categories.

Different products are characterized by different applications. Liquid cartons are used for applications such as beverages. Corrugated cases are used during transportation of goods. Cartons & folding boxes are used for smaller items such as electronics, consumer goods, and cosmetics.

Corrugated cases are becoming popular among packaging manufacturers as sustainability becomes a more major concern across the value chain. Several pulp paper manufacturers demand for these products as they are easy to recycle. Moreover, rising popularity of online shopping in the developing as well as developed economies, such as the U.S., Germany, China, and India is expected to boost the segment.

Application Insights

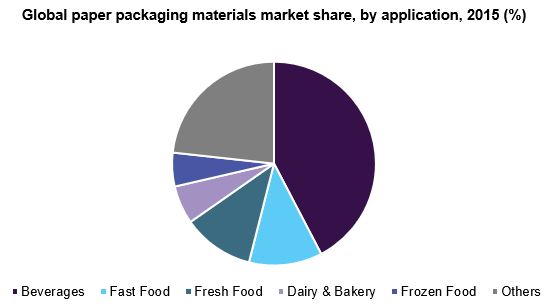

Beverages segment was the dominant application in 2015, accounting for 42.33% of the total revenue share and is expected to continue its dominance over the forecast period. Rising preference for functional foods, broad product portfolio, and easy availability of products is benefitting the segment.

The expansion of organic beverage industries across the developed economies of North America and Europe also help to expand the paper packaging material industry. Owing to rapid expansion of frozen food and the fast food sector in emerging economies, the frozen food application segment is expected to grow at a substantial rate over the forecast period.

Strong demand for convenience foods such as frozen foods and fast foods, particularly in the emerging regions such as Asia Pacific is presumed to assist the regional industry over the forecast period. Such brisk demand growth can be attributed to increasing disposable income, rising standards of living, and growing population.

Fast food segment is expected to grow at a substantial rate over the forecast period owing to rising enhancements in paper packaging materials and marketing techniques. In addition, rapid expansion of fast food chain in emerging economies such as Indonesia, India, and others that uses paper as a packaging material is expected to boost the segment growth.

Regional Insights

Asia Pacific was the largest region that accounted for 36.1% of the total revenue share in 2015 and is expected to continue its dominance over the forecast period. This can be attributed to growing number of manufacturing industries across the region, developing transit packaging sector, and growing consumerism.

Asia Pacific region is expected to witness the highest growth rate over the forecast period. Rising standards of living, increasing disposable income, and rising awareness regarding probiotics usage are the primary attributed reasons for this scenario. Strong demand from countries such as China and Japan is expected to benefit the market in the region.

Europe emerged as the largest market in 2015 and is expected to continue its dominance over the forecast period. High awareness regarding the usage of probiotics, coupled with the presence of a large number of industry participants and inclination toward preventive healthcare, has benefitted the probiotics ingredients market in this region and is expected to continue to do so over the forecast period.

Developed regions such as North America and Europe are anticipated to witness a slightly moderate growth rate over the forecast period due to end-use industry saturation. Emerging regions comprising of Central & South America and the Middle East & Africa are projected to witness strong demand growth over the projected period owing to factors such as growing packaging industry and increasing per capita income.

Paper Packaging Materials Market Share Insights

The industry is highly fragmented in nature and is dominated by regional players. Major players such as Koch Industries, International Paper Company, Holmen AB and DS Smith Plc operate across the value chain and have their own forest reserves. These players indulge in captive consumption of paper packaging materials for several end-user industries such as chemicals and consumer products such as cups, cutlery, and tablecloths.

The paper packaging material market value chain consists of raw material producers, material manufacturer, distributor/suppliers, and end-use industries. The major business players in the industry invest extensively in R&D in order to develop their product portfolio with superior product properties to meet the growing industry demand. Numerous participants also incorporate third-party R&D companies to gain a competitive advantage.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2012 to 2014

Forecast period

2016 - 2022

Market representation

Volume in Kilotons, Revenue in USD Billion, and CAGR from 2016 to 2022

Regional scope

North America, Europe, Asia Pacific, Rest of the World (RoW)

Report coverage

Volume and Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."