- Home

- »

- Advanced Interior Materials

- »

-

Paper Products Market Size, Share, Trends, Industry Report, 2025GVR Report cover

![Paper Products Market Size, Share & Trends Report]()

Paper Products Market Size, Share & Trends Analysis Report By Application (Graphic Paper, Sanitary & Household, Packaging Paper, And Other Paper), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-860-2

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Advanced Materials

Report Overview

The global paper products market size was estimated at USD 268.8 billion in 2018 and is expected to register a CAGR of 0.3% from 2019 to 2025. This growth is primarily attributed to the rising demand for packaging paper by major companies in the retail, FMCG, pharmaceutical, and hospitality industries. Increasing technological developments for paper-based products have enabled the manufacturing of processed paper with higher strength and durability than plastic packaging materials.

It has been observed that packaging paper material is gaining acceptance in a wide range of industries, such as food and consumer products. Other factors affecting the market growth are rising awareness about environmental issues like biodegradability, global warming, and health problems created by plastic packaging materials. The Quick Service Restaurant (QSR) industry is also one of the major consumers of paper products.

Thus, the rapid expansion of the QSR market has added to the product demand. Shifting preference for off-premises consumption of food on account of busy schedules is expected to drive the product demand further. In addition, the availability of freshly cooked food in franchises and food trucks has also witnessed an upsurge and has added to the demand. For instance, the global food chain McDonald’s provide all their orders in paper packages.

Recycled packaging paper has become a popular trend to reduce plastic waste. Cardboard, paper, and other materials can be recycled and used for different kinds of product packing and shipment. Leading companies are investing in paper products. For instance, PepsiCo, Inc. has committed to providing 100% recyclable packaging by 2025. Walmart has declared to provide recyclable packaging for all the private level brands.

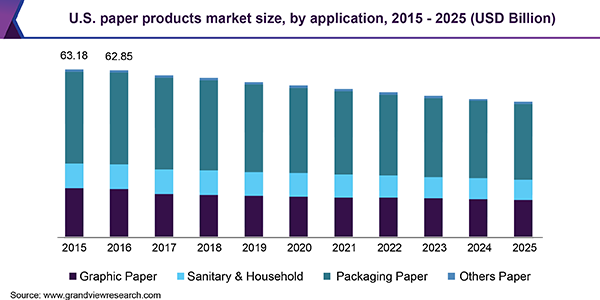

Application Insights

Packaging paper was the largest application segment in 2018. It is further expected to grow at a CAGR of 0.6% from 2019 to 2025. Major factors responsible for the growth include the product features like biodegradability and recyclability. Initially, the packaging segment was dominated by plastic materials. However, innovation in packaging paper technique has disrupted the market as these materials can be manufactured in a cost-efficient method.

Some of the manufacturers offer customizable paper packages to meet the specific needs of the customer. Some of the customized paper bag suppliers are PAPER MART, Barry Packaging, and Etsy, Inc. Printing and writing was the second-largest segment. Offset printing and laser images are the major categories that create product demand in this segment.

Regional Insights

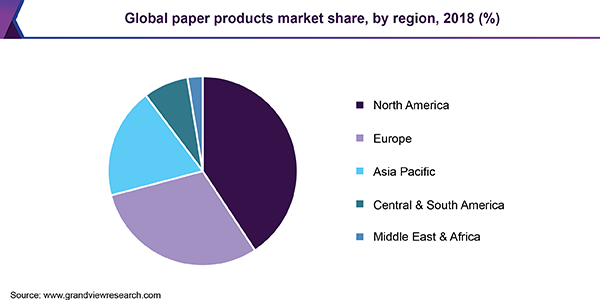

Asia-Pacific was the largest market for paper products in 2018 and accounted for 36.65% of the market share. Key factors behind this growth include growing industrialization across the region. The newsprint category is facing a little slowdown as consumers are shifting towards digital platforms. Asia Pacific is the fastest-growing regional market with a CAGR of 2.3% from 2019 to 2025.

Increasing awareness about the adverse effects of plastic products and growing disposable income, especially in developing countries like China and India, are expected to boost the market growth. Rapid industrialization is also projected to contribute to market development. China, in particular, is the largest market in the Asia Pacific due to the strong presence of key companies, such as Quanzhou Sinowise Machinery Co. Ltd. and Samson Paper Holdings Ltd.

Paper Products Market Share Insights

The market is highly competitive with the presence of many private level brands. Some of the major companies in this market are Kimberly-Clark Corporation; Procter & Gamble; Georgia-Pacific; KP Tissue, Inc.; Essity Aktiebolag (publ); Cascades, Inc.; Irving Consumer Products Limited; Clearwater Paper Corporation; First Quality Enterprises, Inc.; and ST Paper LLC. Companies are focusing on technological advancements, new product development, and market expansion to increase their sales and sustain market competition.

They are also focusing on mergers & acquisitions to expand their product portfolio and geographical presence. For instance, in 2017, Essity Aktiebolag (publ) invested about USD 105 million at a plant in Mexico to increase its tissue offering under the Regio brand. This helped the company in increasing its sales along with production share in the region. Transportation and mileage costs reduce if the manufacturing warehouse is located nearby. The operators are competing on the basis of tender for machinery services, mainly in case of large production projects.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Billion and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

The U.S. Canada, Mexico, Germany, The U.K., France, China, India, Japan, Thailand, Australia, Brazil, Saudi Arabia

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global paper products market report on the basis of application and region:

-

Application Outlook (Volume, Million Tons; Revenue, USD Billion, 2015 - 2025)

-

Graphic Paper

-

Sanitary & Household

-

Packaging Paper

-

Other Paper

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2015 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Thailand

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global paper products market size was estimated at USD 268.3 billion in 2019 and is expected to reach USD 268.9 billion in 2020.

b. The global paper products market is expected to grow at a compounded annual growth rate of 0.3% from 2019 to 2025 to reach USD 275.1 billion in 2025.

b. Asia Pacific dominated the paper products market with a share of 37.7% in 2019. Key factors behind this share include growing industrialization across the region.

b. Some key players operating in the paper products market include Kimberly-Clark Corporation; Procter & Gamble; Georgia-Pacific; KP Tissue, Inc.; Essity Aktiebolag (publ); Cascades, Inc.; Irving Consumer Products Limited; Clearwater Paper Corporation.

b. Key factors driving the paper products market growth include rising demand for packaging paper by major companies in the retail, FMCG, pharmaceutical, and hospitality industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."