- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Para-aramid Fibers Market Size And Share Report, 2030GVR Report cover

![Para-aramid Fibers Market Size, Share & Trends Report]()

Para-aramid Fibers Market Size, Share & Trends Analysis Report By Application (Security & Protection, Optical Fibers, Friction Material, Rubber Reinforcement, Tire Reinforcement), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-784-1

- Number of Pages: 79

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Para-aramid Fibers Market Size & Trends

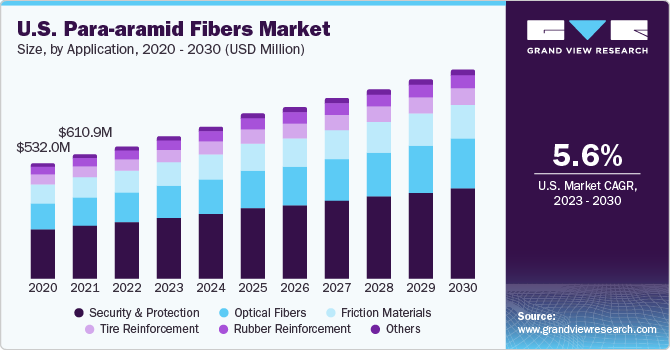

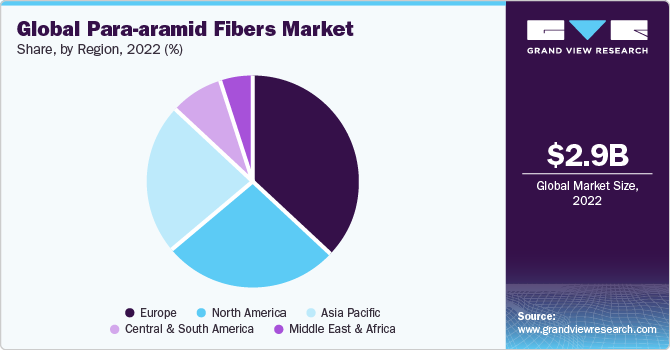

The global para-aramid fibers market size was valued at USD 2.9 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. The market is expected to witness substantial growth owing to its superior properties including high strength and rigid molecular structure, which drives product use in security and protection applications. Increasing demand for protective headgear, eye protection equipment, and safety harnesses is anticipated to propel product demand over the coming years. The product is supplied through wholesalers, retailers, direct agreements between players and distributors, or through third-party supply agreements. E. I. du Pont de Nemours Company and Teijin Ltd. are major product manufacturers and suppliers across the globe that are forward-integrated across the value chain.

Various companies are involved in the development of low-cost and technologically advanced aramid fiber products. Hand lay-up, vacuum bagging, vacuum infusion, RTM, RTM light, press molding, filament winding, and pultrusion are some of the methods adopted for product manufacturing.

The threat of substitutes is anticipated to remain medium over the forecast period. Carbon and glass fibers can be used as alternatives to aramid fibers depending on the requirements of various application segments. In addition, most end users prefer aramid-based products over other synthetic fibers on account of their excellent chemical, mechanical, and thermal properties.

Product manufacturers face numerous challenges, elevated manufacturing costs, and low production efficiency, deter growth. Factors including high production cost, high initial investment, and inconsistent raw material supply are also expected to hamper market growth, thereby discouraging the entry of new players in the market.

Application Insights

Security and protection was the largest segment with a share of 39.01% in 2022 and is expected to reach a value of USD 1.8 billion by 2030. Para-aramid-based products have registered high demand from security and protection applications owing to growing concerns over personnel protection in military and industrial sectors.

The optical fibers segment is expected to grow at the fastest CAGR of 7.0% over the forecast period since they are used as strength providers in the design and manufacturing of fiber optic cables owing to their low weight, flexibility, dielectricity, and handling. Optical fiber applications include aerial dielectric self-supporting cables, premise cables, water-blocking yarns, and fiber to the home (FTTH), which find extensive use in the product.

Para-aramid fibers are extensively used as an alternative to asbestos in friction and sealing products. They are widely used in friction plates and pads due to superior benefits such as extended life, non-glaze/smear on the surface of the lining, fade resistance, and non-aggressive wear on drums and discs. This is expected to drive demand over the forecast period.

The use of aramid fibers in tires provides benefits such as higher performance, increased safety, higher comfort, and reduced fuel consumption. Superior fatigue resistance provided by the product in racing car tires is expected to drive the substitution of traditionally used materials such as polyester, steel, and polyamide, thereby benefitting the industry.

Aramid fibers are also used in aerospace components, including fairings, primary wings, fuselage, landing gear doors, leading and trailing edge panels on the wings, flight control surfaces, and vertical and horizontal stabilizers. They are used mainly in components that are subject to impact resistance, high stress, and low weight on account of superior performance characteristics.

Regional Insights

Europe held the largest market share of 36.9% in 2020 with a share and the trend is expected to continue until the end of the forecast period. Demand for high bandwidth fiber optic cables for data services and communication is expected to have a positive influence on market growth.

Asia Pacific is expected to grow rapidly in 2022 over the forecast period. This can be attributed to the security and protection measures in various industries such as healthcare/medical, mining, oil and gas, manufacturing, building and construction, and military.

The para-aramid fibers market in China is estimated to exhibit significant growth over the forecast period, on account of rapid industrialization and continuous infrastructure development supported by government efforts. In addition, increasing R&D and other activities by major players in the country is anticipated to boost product demand through 2030.

Stringent regulations laid down by various regulatory bodies, such as the Health and Safety Executive (HSE), the American National Standards Institute (ANSI), and state bodies pertaining to security and protection measures of workers in various industries are expected to drive the regional markets. Increasing efforts undertaken by major companies in North America are also expected to benefit industry growth.

Key Companies & Market Share Insights

Key players are executing various strategies such as partnerships, mergers and acquisitions, new product development, and agreements with tier 1 and tier 2 players to gain a competitive edge. Various initiatives by prominent participants, such as technology innovations and research and development, are projected to increase the competition in the market over the forecast period

Key Para-aramid Fibers Companies:

- Teijin Ltd.

- Yantai Tayho Advanced Materials Co. Ltd.

- E. I. du Pont de Nemours and Company

- Hyosung Corp.

- Toray Chemicals South Korea, Inc.

- Kermel S.A.

- Kolon Industries, Inc.

- Huvis Corp.

- China National Bluestar (Group) Co., Ltd.

- SRO Aramid (Jiangzu) Co., Ltd.

Recent Developments

-

In April 2023, DuPont launched Kevlar EXO aramid fiber, featuring first-in-class ballistic and thermal resistance of up to 500 deg C, which is more lightweight and flexible. Kevlar EXO is also stated to have a life of five years by DuPont.

-

In June 2022, Teijin Aramid B.V. launched a new fiber-based Woven Matrix concept simplifying the production of a variety of ballistic protection products using the high-performance para-aramid Twaron. This makes it possible to integrate the binding resin over the weaving process rather than the additional pre-pregging process, which helps develop ballistic resistance in the absence of the pre-pegging process, increasing the market reach of Teijin.

-

In July 2020, Teijin Aramid B.V. announced its usage of premium high-performance para-aramid fiber Technora in NASA’s Mars Perseverance Rover, showcasing the reliability of its product in space exploration. Technora is a crucial component of the landing parachute of the Rover, which is anticipated to withstand an inflation load of 31,751 kg at the environmental temperature of -63 deg C on Mars.

-

In May 2020, Ulsan City and Hyosung Advanced Materials announced the signing of an MOU pertaining to the investment of USD 47.8 million for the expansion of the Aramid factory in Ulsan City, stating Hyosung’s economic contribution to Ulsan and Ulsan’s administrative support to Hyosung’s Aramid factory. Hyosung aims to secure greater competitiveness in product quality and cost as well as improve world market share.

Para-Aramid Fibers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,124.1 million

Revenue forecast in 2030

USD 4,488.3 million

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million, Volume in Kilo Tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; Australia; Thailand; South Korea; Brazil; Saudi Arabia

Key companies profiled

Teijin Ltd.; Yantai Tayho Advanced Materials Co. Ltd.; E. I. du Pont de Nemours and Company; Hyosung Corp.; Toray Chemicals South Korea, Inc.; Kermel S.A.; Kolon Industries, Inc.; Huvis Corp.; China National Bluestar (Group) Co., Ltd.; SRO Aramid (Jiangzu) Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Para-aramid Fibers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global para-aramid fibers market based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Security & Protection

-

Optical Fibers

-

Friction Materials

-

Rubber Reinforcement

-

Tire Reinforcement

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global para-aramid fibers market size was estimated at USD 2.9 billion in 2022 and is expected to reach USD 3,124.1 million in 2023.

b. The global para-aramid fibers market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 4,488.3 million by 2030.

b. Security & protection application dominated the para aramid fiber market with a share of 39.1% in 2022 owing to increasing concerns about personnel security in the military and industrial sectors.

b. Some of the key players operating in the para-aramid fibers market include Teijin Ltd., Yantai Tayho Advanced Materials Co. Ltd, E. I. du Pont de Nemours and Company, Hyosung Corp., Toray Chemicals South Korea, Inc., and Kermel S.A.

b. Key factors that are driving the para-aramid fibers market are its increasing use as an alternative to asbestos and steel in military and aerospace applications for ballistic grade body armor fabric.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."