- Home

- »

- Semiconductors

- »

-

Passive & Interconnecting Electronic Components Market Report, 2027GVR Report cover

![Passive And Interconnecting Electronic Components Market Size, Share & Trends Report]()

Passive And Interconnecting Electronic Components Market Size, Share & Trends Analysis Report By Component Type (Passive, Interconnecting), By Application, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-555-7

- Number of Pages: 101

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Semiconductors & Electronics

Report Overview

The global passive and interconnecting electronic components market size was valued at USD 171.3 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2020 to 2027. Passive and interconnecting electronic components are integral parts of electronic devices such as smartphones, computers, gaming consoles, and home appliances. Thus, the significantly growing adoption of smartphones and laptops in developing countries such as India and China is estimated to drive the market for passive and interconnecting electronic components over the forecast period.

The 5G network infrastructure is being deployed rapidly across key countries such as the U.S., China, South Korea, Japan, and the U.K. The upcoming 5G services, coupled with a growing need for high-speed internet connectivity among consumers, have raised the demand for 5G devices across the globe. For instance, according to the GVR analysis, the global annual shipment of 5G devices has reached more than 10.0 million units in 2019 and is projected to grow significantly. Thus, the significant increase in the demand for 5G devices from numerous verticals such as industrial, automotive, and consumer electronics is expected to boost the adoption of passive and interconnecting electronic components from 2020 to 2027.

With a significant adoption of internet of things (IoT) devices, the industrial sector is rapidly transforming. The industrial IoT devices help manufacturing facilities to enhance their overall productivity and operational efficiency by providing ease of operability and minimize the total system downtime. Moreover, with the evolution of the fourth industrial revolution (Industrial 4.0), several manufacturing facilities are implementing several connected devices to streamline the operational processes through remote monitoring. Therefore, robust deployment of IoT devices across many industrial applications such as process automation and motion control is anticipated to augment the growth of the market for passive and interconnecting electronic components over the next seven years.

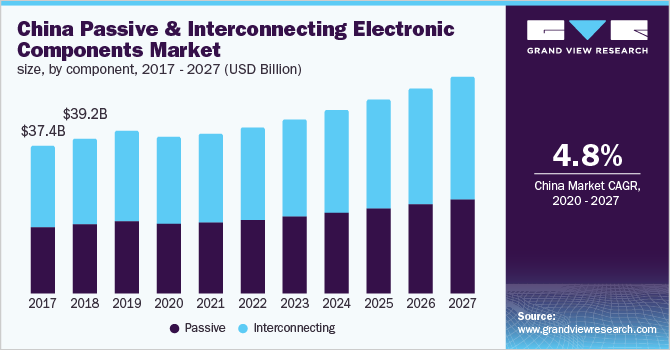

China is one of the key electronic goods exporters across the globe. For instance, China exported more than USD 50.0 billion value of passive electronic components in 2018 to global markets. Moreover, the U.S. is a significant importer of China. However, in 2018, the U.S. imposed around 25.0% import tariffs on electronic products manufactured in China. Additionally, the outbreak of Covid-19 seems to have a negative impact on production and international trades. Thus, the market for passive and interconnecting electronic components is expected to experience a slowdown in the growth from 2020 to 2021.

Passive & Interconnecting Electronics Component Market Trends

Electrical grids include several components such as wires, switches, resistors, capacitors, inductors, and transformers, among others; wherein the smart grid system adds a digital communication and remote-control facilities. Smart grids facilitate two-way communication, aiding end users in energy management, minimizing power disruptions, and transporting the required amount of electricity. The main components of a smart grid include smart meters and a communication channel. Smart meters are capable of enhancing electrical grid efficiency, reliability, and security. Various components such as soft magnetic components are used in smart meters ensure communication between the location of customers and the remote center. As a result, the increasing smart grid initiatives by the government followed by smart meter installations are expected to drive the passive and interconnecting electronic components market considerably over the forecast period.

The global healthcare expenditure is increasing owing to the growing immunodeficiency disorders among the population. There is a growing percentage of geriatric population and the occurrence of diseases such as diabetes, high blood pressure, and so on. As a result, the demand for electronic medical devices to measure blood pressure, sugar levels, and so on, is increasing. The medical device manufacturers are introducing affordable and reliable medical equipment in the market. Various passive and interconnecting electronic components used in all kinds of medical care devices to achieve higher reliability and affordability. Devices such as blood glucose meters and blood pressure monitors incorporate a significant number of passive components. Thus, there is substantial demand for passive and interconnecting electronic components from the medical industry.

The passive and interconnecting electronic components are extensively used in automotive and industrial applications. Numerous manufacturers from sectors such as consumer electronics and medical use passive and interconnecting electronic components in most of their products. The global slowdown in the year 2009 strongly affected all the industries and sectors, specifically the automotive sector, where the production and sales of vehicles significantly declined. As the automotive sector accounts for one of the largest shares in the passive and interconnecting electronic components market, the unfavorable macroeconomic conditions have hampered the growth of the market in a significant way. Although the market showed an upward trend post the weak economic conditions, pre-slowdown levels were not reached immediately. As a result, the market is still experiencing a few setbacks.

Component Type Insights

The capacitor segment held the largest market share exceeding 35.0% in 2019. This is attributable to significant demand for various types of capacitors to be fabricated in consumer electronic devices, industrial, and other applications. Transformers play an essential role in functioning of an electronic device by stepping down the high voltage to the required voltage for the circuit. Therefore, with the growing production of several types of home appliances, industrial digital devices, and other consumer electronic goods, the demand for transformers is projected to see rapid growth during the forecast period.

Interconnecting components include printed circuit boards (PCB), connectors/sockets, switch, relays, and others. In 2019, interconnecting electronic components captured a significant share in the market for passive and interconnecting electronic components and is estimated to witness at a notable growth rate during the forecast period. The growth is attributed to its widespread installation in various electronic devices such as digital cameras, gaming consoles, and others to transmit media, content, and other applications. Moreover, continuing demand for networking and storage devices in data centers is further anticipated to augment the connectors/sockets adoption globally from 2020 to 2027. This, in turn, is anticipated to drive the market for passive and interconnecting electronic components over the forecast period.

Application Insights

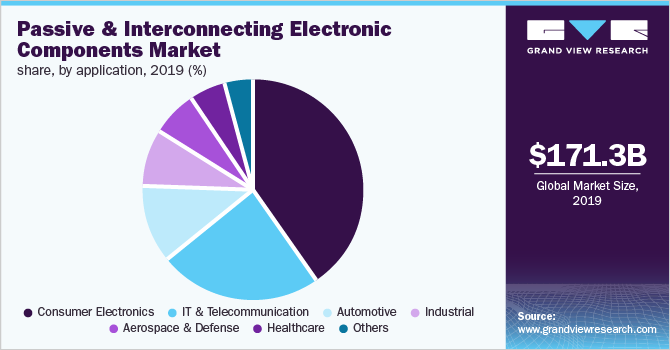

In 2019, the consumer electronics segment held a market share of over 40.0% and is estimated to exhibit a CAGR of 5.2% during the forecast period. The growth is majorly attributed to increasing demand for passive and interconnecting components for several consumer devices, mobile phones, wearable devices, set-top boxes (STB), and home appliances. Moreover, the demand for security cameras, sensor-based devices, and robotics is soaring rapidly across industrial applications such as process automation and remote monitoring. Therefore, it is estimated to boost the passive and interconnecting electronic components market in the next seven years.

The demand for networking devices such as modems, gateways, and repeaters, among others are increasing, especially in office automation and residential application segments. Besides, the deployment for 5G telecom equipment is rapidly emerging as key telecom operators investing heavily in order to provide enhanced bandwidth experience to their customers. Thus, the growing demand for network devices and telecom equipment is expected to surge the IT and telecommunication segment growth in the market for passive and interconnecting electronic components over the forecast period. Furthermore, robust demand for infotainment systems, driver assistance systems, and Global Positioning Systems (GPS), and other electronic systems for automotive applications is anticipated to foster the automotive segment growth from 2020 to 2027.

Regional Insights

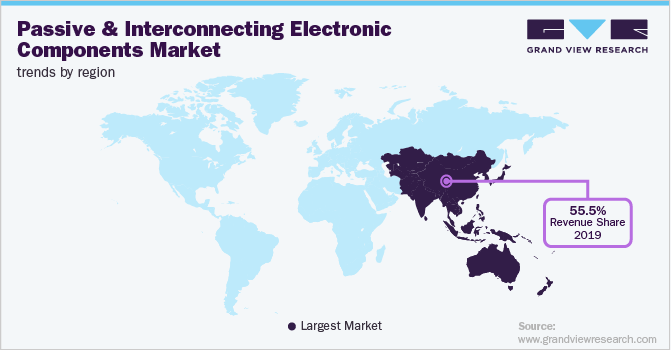

In 2019, Asia Pacific attained a market size of USD 95.1 billion emerging as the dominant region in the entire market for passive and interconnecting electronic components. The growth is majorly driven by the existence of major electronic product manufacturers and exporters in the region. Presence of key consumer electronics manufacturers such as Samsung Electronics Co., Ltd., BBK electronics (Includes brands such as Oppo, Realme, Vivo), Foxconn Technology Group, Xiaomi Corporation is expected to bode well for the regional growth. However, due to the Covid19 outbreak, prominent countries such as China, India, South Korea, and Japan are negatively impacted. The Covid-19 outbreak has affected production and trade (imports and exports) in many countries across the globe.

With the soaring trend for connected cars in the U.S., leading telecom giants such as Verizon Inc.; and AT&T Inc., are investing huge amounts in deploying 5G network infrastructure. This next-generation 5G mobile network is anticipated to provide unified connectivity to vehicles with infrastructures across the country. However, the industrial deployment of 5G is expected to be delayed due to the recent outbreak of Covid-19. Besides, the U.S. government is spending massive amounts on building smart cities countrywide. The deployment of 5G network infrastructure in the coming years is anticipated to increase new installations of telecom equipment and other networking devices, thereby driving the market for passive and interconnecting electronic components.

Indian government has released three key schemes including Component Manufacturing Scheme, Production linked Incentive Scheme, and Modified Electronics Manufacturing Clusters Scheme to promote the overall electronic components and device productions in the country over the coming years. On the other hand, the trade war between the two largest economies – U.S and China – has resulted in the slowest economic growth of China.

Key Companies & Market Share Insights

Key market players are aggressively targeting on developing new and innovative products in order to enhance their overall product portfolios. For instance, in March 2019, AVX Corporation introduced a new series of miniature, surface-mount, and J-lead tantalum capacitors. These capacitors provide improved reliability and volumetric efficiency in high-temperature industrial and automotive applications.

Moreover, leading manufacturers are strategically focused on mergers and acquisitions, which help them to enhance the overall share in the market for passive and interconnecting electronic components. For instance, in November 2019, Yageo Corporation acquired KEMET Corporation worth a value of USD 1.8 billion. This strategy will help Yageo Corporation to expand its geographical presence with KEMET’s 23 manufacturing facilities and 4,000 employees across North America, Asia Pacific, and Europe. Additionally, the strategy will help to enhance the capacitors segment share of Yageo Corporation as KEMET’s major products includes ceramic capacitors, tantalum capacitors, magnetic, sensors and actuators, and electrolytic and film capacitors. Some of the prominent players in the passive and interconnecting electronic components market include:

-

AVX Corporation

-

Vishay Intertechnology, Inc.

-

Mouser Electronics, Inc.

-

Murata Manufacturing Co., Ltd.

-

TDK Corporation

-

Taiyo Yuden Co., Ltd.

-

Samsung Electro-Mechanics

-

Hosiden Corporation

-

Yageo Corporation

-

Nichicon Corporation

-

Panasonic Corporation

-

Fujitsu Component Limited

-

Fenghua (HK) Electronics Ltd.

-

Rohm Co., Ltd.

-

United Chemi-Con

-

TE connectivity

-

Molex Incorporated

Passive And Interconnecting Electronic Components Market Report Scope

Report Attribute

Details

Market Size value in 2020

USD 179.8 billion

Revenue Forecast in 2027

USD 257.3 billion

Growth Rate

5.3%

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Quantitative Units

Revenue in USD billion and CAGR from 2020 to 2027

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; South Korea; Vietnam; Singapore; Brazil

Key Companies Profiled

AVX Corporation; Vishay Intertechnology, Inc.; Mouser Electronics, Inc.; Murata Manufacturing Co., Ltd.; TDK Corporation; Taiyo Yuden Co., Ltd.; Samsung Electro-Mechanics; Hosiden Corporation.; Yageo Corporation; Nichicon Corporation; Panasonic Corporation; Fujitsu Component Limited; Fenghua (HK) Electronics Ltd.; Rohm Co., Ltd.; United Chemi-Con; TE connectivity; Molex Incorporated

Customization Scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Passive And Interconnecting Electronic Components Market SegmentationThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global passive and interconnecting electronic components market report based on component, application, and region:

-

Component Outlook (Revenue, USD Billion, 2016 - 2027)

-

Passive

-

Resistors

-

Capacitors

-

Inductors

-

Transformers

-

Diode

-

-

Interconnecting

-

PCB

-

Connectors/Sockets

-

Switches

-

Relays

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2016 - 2027)

-

Consumer Electronics

-

Mobile Phones

-

Personal Computers

-

Home Appliances

-

Audio and Video Systems

-

Storage Devices

-

Others

-

-

IT & Telecommunication

-

Telecom Equipment

-

Networking Devices

-

-

Automotive

-

Driver Assistance Systems

-

Infotainment Systems

-

Others

-

-

Industrial

-

Industrial automation and motion control

-

Mechatronics and robotics,

-

Power Electronics

-

Photo Voltaic Systems

-

Others

-

-

Aerospace & Defense

-

Aircraft systems

-

Military Radars

-

Others

-

-

Healthcare

-

Medical Imaging Equipment

-

Consumer Medical Devices

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global passive and interconnecting electronic components market size was estimated at USD 171.3 billion in 2019 and is expected to reach USD 179.8 billion in 2020.

b. The global passive and interconnecting electronic components market is expected to grow at a compound annual growth rate of 5.3% from 2020 to 2027 to reach USD 257.3 billion by 2027.

b. Asia Pacific dominated the passive and interconnecting electronic components market with a share of 55.5% in 2019. This is attributable to the presence of major electronic product manufacturers and exporters in the region.

b. Some key players operating in the passive and interconnecting electronic components market include AVX Corporation, Vishay Intertechnology, Inc., Mouser Electronics, Inc., Murata Manufacturing Co., Ltd., TDK Corporation, Taiyo Yuden Co., Ltd., Samsung Electro-Mechanics, Hosiden Corporation., Yageo Corporation, Nichicon Corporation, Panasonic Corporation, and Fujitsu Component Limited.

b. Key factors that are driving the market growth include significantly growing adoption of smartphones and laptops in developing countries such as India and China and growing deployment of 5G network infrastructure across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."