- Home

- »

- Next Generation Technologies

- »

-

Passwordless Authentication Market Size & Share Report, 2030GVR Report cover

![Passwordless Authentication Market Size, Share & Trends Report]()

Passwordless Authentication Market Size, Share & Trends Analysis Report By Component, By Product Type (Facial Recognition, Fingerprint, Iris), By Authentication Type, By Portability, By End-user, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-996-6

- Number of Pages: 117

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

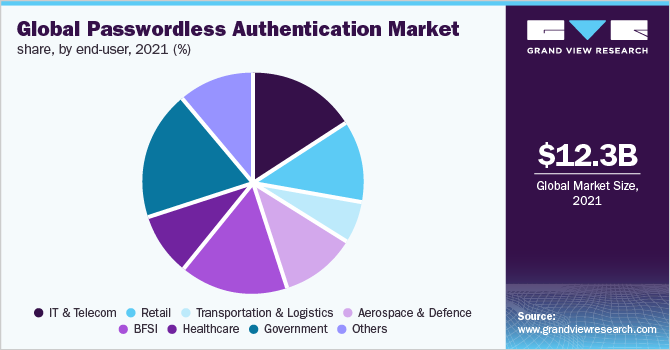

The global passwordless authentication market size was valued at USD 12.26 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 18.2% from 2022 to 2030. Passwordless authentication is a security method that uses personal identifying numbers, security tokens, and an individual's unique biological traits such as voice analysis, iris recognition, fingerprint recognition, face recognition, and others. Passwordless authentication methods continue to gain popularity due to enhanced security and the convenience of accessing data from anywhere. For instance, in June 2022, WinMagic announced the release of MagicEndpointTM, its passwordless authentication and encryption solution. WinMagic entered the passwordless market with MagicEndpoint, delivering authentication and encryption solutions that secure data and users. The solution enables CISOs and other technology and IT security professionals to quickly implement passwordless authentication, satisfying their cyber security requirements while eliminating password friction and lowering password management expenses.

Passwordless technology modifies the core security architecture by relocating verification to the device rather than transmitting credentials over an online connection. While traditional multi-factor authentication (MFA) adds protection and usability to the authentication process, it is not as sophisticated as passwordless systems. Organizations often attempt to strike a balance between workforce access security and user experience while also managing supply chain security, which is critical for B2B financial infrastructure.

Such security solutions remain the need of the hour in the market. Many companies remain focused on meeting the digitalization and financial infrastructure challenges faced by SMEs. For instance, in June 2022, SecureAuth Corporation, a provider of identity access management security solutions, launched Arculix, a next-generation passwordless authentication and identity orchestration platform. The new platform enables enterprises to develop frictionless and safe experiences for IDs everywhere.

According to Verizon’ June 2022 data breach investigations report (DBIR), weak and repeated passwords account for around 81% of hacking-related breaches. Over 90% of people duplicate passwords between work and personal accounts, making the banking sector lean toward passwordless authentication as an additional layer of security for their customers' accounts. There are various approaches for IT to reduce risk, and professional security professionals are mainly focused on this. As authentication is weak, passwordless authentication systems in the banking sector are being used significantly as the risk of weak or stolen passwords grows.

Component Insights

The hardware segment led the market in 2021, accounting largest revenue share of over 63%. Users can utilize hardware-based security devices to perform multi-factor authentication using cryptographically secure hardware. Hardware in passwordless authentication comprises biometric systems, smart cards, tokens, key fobs, wristbands, and mobile solutions. Enterprises can easily use their applications and hardware while knowing that their data is secure and compatible with global security requirements.

For instance, in October 2021, Yubico, a manufacturer of hardware authentication devices, revealed the YubiKey Bio, the company's first key to biometric authentication for passwordless logins and multi-factor authentication. The company's new hardware key includes a fingerprint reader for password-free authentication.

Passwordless authentication software solutions include IBM's IBM security verify software, Fujitsu's AuthConductor, and Thales' SafeNet Authentication Client. Businesses use authentication software to safeguard their business and consumer data in mainframe computers, data servers, workstations, Wi-Fi routers, facility entrances, and other places.

For instance, in April 2021, HID global corporation announced the full release of WorkforceID Authentication, a software-as-a-service solution. The solution provides companies with a cloud solution for issuing, managing, and using digital identity credentials for physical and logical access control. HID WorkforceID Authentication enables organizations to simplify, streamline, and secure logins by all users to all apps within the enterprise environment, with simple integration to Microsoft's on-premise or cloud Active Director environments.

Product Type Insights

The fingerprint authentication segment led the market in 2021, accounting for over 29% of global revenue. This is attributable mainly to the factors such as the rise in identity threats, the pervasive use of fingerprint sensors for authentication in consumer electronics, the increasing usage of biometric authentication in government offices, and the advent of touchless fingerprint technology solutions. Fingerprints modernize the authentication stack, making digital banking more manageable and secure. Furthermore, effectively implementing biometric time and attendance systems for assessing employee productivity, work hours, and other aspects boost the segment's growth.

The face recognition segment is anticipated to witness significant growth in the coming years. The substantial increase in the segment's growth can be attributed to the law enforcement sector's increasing use of face recognition technology. Border authorities increasingly utilize facial recognition technology to check travelers' identities, particularly at airports. Smartphones are another application where the technology has seen widespread adoption, like unlocking the phone, signing into mobile apps, and verifying payment.

For instance, in September 2022, PixLab, a service provided by Symisc Systems, SUARL, launched FaceIO. This web-based facial authentication framework can be incorporated on any webpage via JavaScript and is developed to authenticate users using face biometrics rather than traditional passwords and login pairs or one-time password (OTP) codes.

Authentication Type Insights

The single-factor authentication segment accounted for the largest revenue share of over 60% in 2021. Single-factor authentication safeguards access to a specific system, such as a website or network, by identifying the party inviting access using only one type of credential. Manufacturers develop more secure biometric solutions with highly sophisticated capabilities that provide scalable identity-based access while minimizing the likelihood of credentials being lost, shared, or stolen.

For instance, in July 2022, Gravitational Inc., an identity-based infrastructure access management solutions developer, released Teleport 10, the newest edition of its Teleport Access Plane service. Passwordless access is a single sign-on infrastructure access technology that removes the necessity for private keys, passwords, usernames, and other secrets in Teleport 10.

The multi-factor authentication is anticipated to witness significant growth in the coming years. The segment's growth is attributed to increased identity theft and breach, increased use of IoT devices, and tighter government regulations. Globally, organizations are using stricter identity verification methods to protect sensitive data housed inside them from fraud. Such theft and fraud incidents serve as a wake-up call for businesses to implement multi-factor authentication solutions and services.

For instance, in September 2022, Advanced Software Products Group. announced the launch of ReACT MFA, a new multi-factor authentication (MFA) tool. ReACT MFA acts as a secondary authentication source, validating end-users and granting allowed access to data, securing resources and making them less vulnerable to attack.

Portability Insights

The fixed segment led the market in 2021, accounting for over 65%. The segment's growth is attributed to the extensive biometric infrastructure utilized for time management and attendance systems, such as in the business sector. For instance, in March 2021, Cisco Systems Inc., a multinational technology conglomerate, introduced passwordless authentication via the security platform Duo. The product is intended to be infrastructure agnostic, laying the foundation for a password-free future while assuring that companies can easily safeguard any mix of cloud and on-premises apps without the need for numerous authentication systems or creating key security gaps.

The mobile segment is anticipated to witness significant growth in the coming years. Mobile authentication solutions use one or more biometric modalities for authentication or identification and use tablets, smartphones, other forms of handhelds, wearable technology, and IoT devices for flexible deployment. Furthermore, Mobile authentication systems are easily moveable because they do not necessitate as comprehensive an installation as fixed authentication systems. These systems often include capabilities such as Wi-Fi and remote operations, which allows a user to operate and monitor the system from locations other than its physical location. These characteristics of the system are responsible for the segment's expansion.

End-user Insights

The government segment led the market in 2021, accounting for over 18% market share. The government is heavily investing in digital programs as internet services become the primary communication between citizens and their governments. The security of government digital services is a significant problem prompting several government agencies to reconsider their national authentication procedures.

In February 2021, The Reserve Bank of India (RBI) published its 'Master Direction on Digital Payment Security Controls', requiring governed businesses in banking, FinTech, payments, and crypto to authenticate user transactions by incorporating 'dynamic or non-replicable' security mechanisms.

The BFSI segment is anticipated to witness significant growth in the forecast years. Financial organizations can scale their passwordless authentication to greater heights by granting users access to more formerly password-protected data. This provides for increased productivity per employee as well as more widespread access. In May 2022, in new cooperation, Bonifii, a financial technology company, added context-awareness passwordless authentication technology enabled by Entersekt, a fintech provider of mobile-based authentication and app security software, to its biometric authentication technique for credit unions, and has chosen a MasterCard affiliate as the authorized open banking provider for MemberPass, its certified biometric digital identity service.

Regional Insights

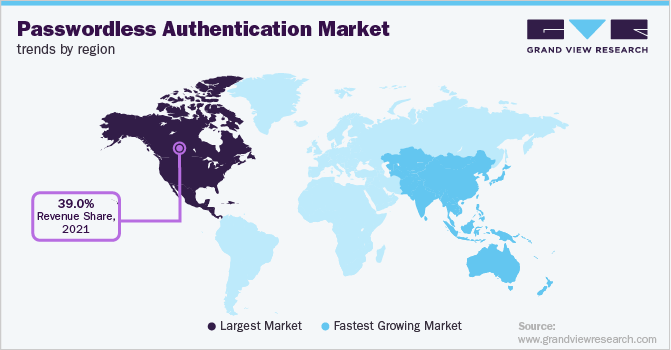

North America dominated the market in 2021, accounting for over 39% share of the global revenue. Various advantages, including improved user experience, increased security, the lower total cost of ownership, and growing investments in developed countries such as the U.S., Canada, and Mexico for implementation of passwordless authentication technology are key factors driving market expansion. Furthermore, growing data security concerns in these countries have fueled the growth of passwordless authentication in this region. The rising adoption of technologies such as the internet of things (IoT) and artificial intelligence in this region is also driving the expansion of the market.

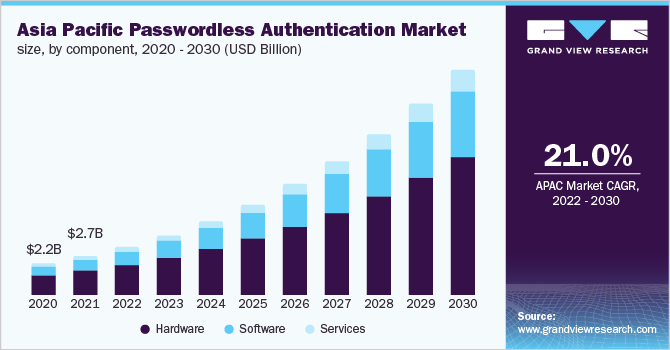

Asia Pacific is anticipated to register the fastest CAGR of 21.0% from 2022 to 2030. This growth can be attributed to the growing smartphone and tablet usage in this region and technology such as facial recognition and fingerprint recognition, which is a significant driver to the growth of the regional passwordless authentication market.

In September 2022, Secret Double Octopus, an Israeli software firm, and PwC. announced a strategic technology alliance to assist enterprises in the Asia-Pacific region in meeting new regulatory requirements for multi-factor authentication (MFA). Secret Double Octopus and PwC India will partner to deploy the Octopus Authentication Platform (OAP), an industry-leading passwordless and desktop MFA offering for organizations, as part of the cooperation.

Key Companies & Market Share Insights

The passwordless authentication industry is generally segmented, with various combinations, as well as medium-sized and new firms, accounting for a sizable global percentage of the entire market. Firms are conducting intensive research and development to bring out newer technologies in the passwordless authentication to minimize data breaches. Furthermore, tactical mergers and acquisitions, joint ventures and partnerships, and expansions are some of the other techniques used by these firms to assure long-term viability in this market.

In June 2022, A tech industry consortium led by Apple Inc., Alphabet Inc., and Microsoft is attempted to increase usage of a secure alternative to the standard password. According to agreements reached this year, a new standard known as Fast IDentity Online (FIDO) will be implemented into major operating systems such as Chrome OS, iOS, macOS, Windows 11, and Android. Users will be able to opt into the new protocols, which will allow them to log in securely without a password. Some prominent players in the global passwordless authentication market include:

-

ASSA ABLOY

-

DERMALOG Identification Systems GmbH

-

East Shore Technology, LLC

-

Fujitsu

-

HID Global Corporation

-

M2SYS Technology

-

Microsoft

-

NEC Corporation

-

Safran

-

Thales.

Passwordless Authentication Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 14.62 billion

Revenue forecast in 2030

USD 55.70 billion

Growth Rate

CAGR of 18.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Components, product type, authentication type, portability, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil

Key companies profiled

Fujitsu; NEC Corporation; HID Global Corporation; M2SYS Technology; Thales; Safran; DERMALOG Identification Systems GmbH; East Shore Technology, LLC; ASSA ABLOY; Microsoft

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Passwordless Authentication Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global passwordless authentication market report based on component, product type, authentication type, portability, end-user, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Product Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fingerprint Authentication

-

Palm Recognition

-

Iris Recognition

-

Face Recognition

-

Voice Recognition

-

Smart Card

-

Others

-

-

Authentication Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Single-factor Authentication

-

Multi-factor Authentication

-

-

Portability Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fixed

-

Mobile

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & Telecom

-

Retail

-

Transportation & Logistics

-

Aerospace & Defence

-

BFSI

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global passwordless authentication market size was estimated at USD 12.26 billion in 2021 and is expected to reach USD 14.62 billion in 2022.

b. The global passwordless authentication market is expected to grow at a compound annual growth rate of 18.2% from 2022 to 2030 to reach USD 55.70 billion by 2030.

b. North America dominated the passwordless authentication market with a share of 40.1% in 2021. This is attributable to the plenty of investments in developed countries such as the U.S., Canada, and Mexico for implementing passwordless authentication technology.

b. Some key players operating in the passwordless authentication market include Fujitsu, NEC Corporation, HID Global Corporation, M2SYS Technology, Thales., Safran, DERMALOG Identification Systems GmbH, East Shore Technology, LLC, ASSA ABLOY, Microsoft.

b. Key factors that are driving the passwordless authentication market growth include the rise in identity threats, the pervasive use of fingerprint sensors for authentication in consumer electronics, the increasing usage of biometric authentication in government offices, and the advent of touchless fingerprint technology solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."