- Home

- »

- Medical Devices

- »

-

Patient Positioning Systems Market Size, Share Report, 2030GVR Report cover

![Patient Positioning Systems Market Size, Share & Trends Report]()

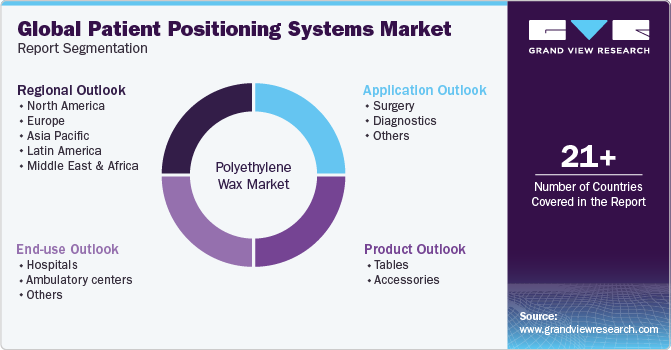

Patient Positioning Systems Market Size, Share & Trends Analysis Report By Product (Tables, Accessories), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-066-8

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Patient Positioning Systems Market Trends

The global patient positioning systems market size was estimated at USD 1.46 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.01% from 2024 to 2030. Growing geriatric population is a major factor contributing to the market growth. According to the WHO article published in October 2022, it is projected that 1 in 6 people globally will be aged 60 years or older in 2030, representing an increase from 1 billion in 2020 to an estimated 1.4 billion by 2030.

In addition, by 2050, the global population of individuals aged 60 years and older is expected to double, reaching a total of 2.1 billion. Increasing prevalence of cancer, rising awareness among the patient population, and surging expenditure on diagnostic procedures are factors expected to drive the market growth in the forecast period.

The demand for precise and adaptable positioning during diagnostic and therapeutic procedures increases with the increasing prevalence of diverse cancer types. According to the American Cancer Society article published in January 2023, U.S. is expected to see 1,958,310 new cancer cases and 609,820 cancer-related deaths in 2023. Especially prostate cancer witnessed a 3% annual increase in incidence from 2014 to 2019, reversing a two-decade decline and resulting in an additional 99,000 cases. However, cancer trends were more favorable in men than women. Lung cancer in women experienced a slower decline compared to men (1.1% vs. 2.6% annually) from 2015 to 2019. Uterine corpus and breast cancers continued to rise, along with liver cancer and melanoma, which stabilized in older men and declined in younger men. This complicated model of cancer incidence significantly acts as a growth driver for theglobal market.

Hospitals are boosting the patient positioning equipment market growth through investments in upgrading operating rooms. For instance, in October 2023, approval by the Illinois Health Facilities and Services Review Board for (Hospital Sisters Health System) HSHS St. Mary’s Hospital’s USD 90 million infrastructure renovation signals a broader trend in healthcare modernization. Moreover, in December 2023, the University of Florida College of Medicine received USD 3.5 million for transformative projects, including creating a digital replica of operating rooms. This substantial investment aligns with the broader trend of hospital enhancements, specifically in upgrading operating rooms, thereby propelling growth in the global market.

Patient positioning systems are anticipated to experience increased market demand, driven by a surge in awareness and a concurrent rise in spending on diagnostic procedures.According to the National Health Services (NHS) article published in May 2023, in the period spanning from February 2022 to January 2023, a total of 43.4 million imaging tests were recorded in the UK.Furthermore, the UK has witnessed numerous awareness campaigns focused on early cancer diagnosis, particularly the National Awareness and Early Diagnosis Initiative (NAEDI). This is anticipated to contribute to a heightened demand for patient positioning systems.

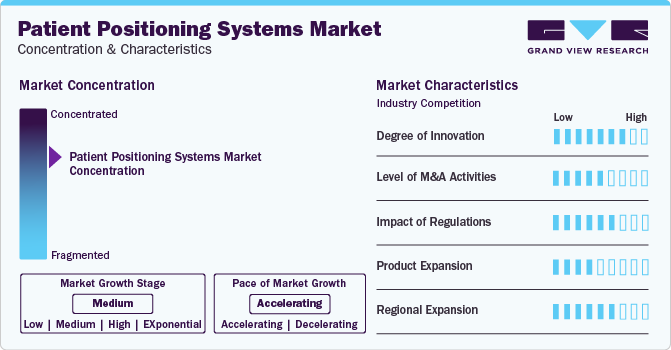

Market Concentration & Characteristics

The market has experienced a significant degree of innovation, with advancements in design, materials, and technology enhancing precision and adaptability in various medical procedures. This innovation is evident in developing well-designed and patient-friendly positioning solutions, contributing to improved healthcare outcomes and patient experiences.

Several market players, such as Medtronic, Hill-Rom Holdings, Inc., and Stryker Corporation, are involved in merger and acquisition activities. Through M&A activity, these companies expand their geographic reach and enter new territories.

Regulatory factors including medical device regulations, patient safety standards, documentation requirements, and hygiene standards have an impact on the market. Thes factors impact the development, manufacturing, and sales of patient positioning systems.

Patient positioning systems have experienced significant product expansion driven by applications and design advancements. This means developing new and improved things to help doctors and nurses care for patients' better health during medical procedures. They are used for a wider range of treatments, making healthcare even better for everyone.

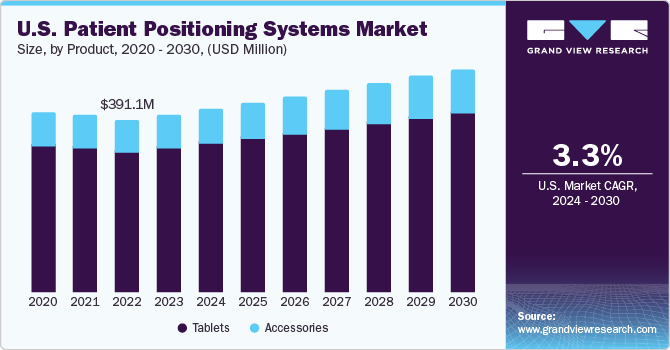

Product Insights

Based on product, the tables segment led the market with the largest revenue share of 80.1% in 2023. Tables in patient positioning systems offer versatile support during medical procedures, enhancing precision and ease for healthcare providers. The integration of advanced features and materials contributes to increased adoption. According to the Nurseslabs article published in September 2023, Patient positioning tables provide a stable platform for various medical interventions, ensuring comfort and procedural efficiency. These tables often incorporate adjustable features to accommodate diverse procedures, making them a cornerstone in modern healthcare settings.

The accessories segment is anticipated to witness a fastest CAGR over the forecast period. The demand for accessories is propelled by continuous innovation, with add-ons like well-designed cushions and adaptors enhancing positioning accuracy.Accessories are pivotal in treating patient positioning, providing supplementary support and customization. Innovations in accessories contribute to improved patient experiences and optimized healthcare outcomes.The importance of patient-centric design further propels the adoption of accessories, as they play a vital role in enhancing the overall patient experience.

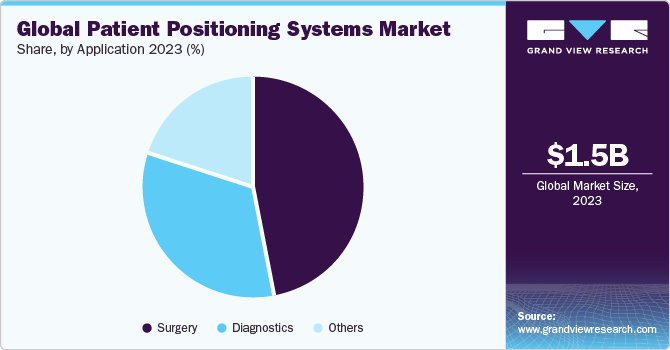

Application Insights

In terms of application, the surgery segment led the market with the largest revenue share of 45.58% in 2023, increasing surgical procedures globally drive the demand for patient positioning systems in surgery, according to the NCBI article published in February 2022, remarkable figure of about 234 million major surgical operations conducted globally. This significant number highlights the rising demand for advanced positioning solutions to ensure optimal positioning precision during surgeries.

The diagnostics segment is estimated to register the fastest CAGR over the forecast period, owing to rising global investment in diagnostics and imaging procedures.The increasing need for diagnosing chronic diseases and the expanding aging population are anticipated to drive the demand for diagnostics, fostering market growth. According to the American Academy of Orthopaedic Surgeons article published in November 2023, diagnostic imaging techniques, such as X-rays, CT scans, and MRI scans, act as key growth drivers. These imaging tools rely on precise patient positioning to ensure accurate visualization of internal structures, contributing to improved diagnostic outcomes. The demand for advanced positioning systems aligns with the need for enhanced precision in diagnostic procedures, influencing the growth of the diagnosis segment in the market.

End-use Insights

Based on end-use, the hospitals segment led the market in 2023 with the largest revenue share of 54.94%. The increasing volume of surgical and diagnostic procedures, emphasizing the need for precise and adaptable patient positioning. Hospitals are integral for ensuring optimal conditions during surgeries and diagnostics. Their use contributes to improved outcomes and operational efficiency in hospital settings.Hence, various companies are actively dedicating extensive resources, encompassing revenue and marketing strategies, to promote their products and services within the hospital sector.

The ambulatory centers segment is estimated to register a significant CAGR over the forecast period. The shift towards outpatient care and minimally invasive procedures boosts the demand for patient positioning systems in ambulatory centers, where efficiency and patient comfort are dominant. According to the Medisys Data Solutions Inc. article published in October 2023, Ambulatory Surgery Centers (ASCs) have proven effective in cost control and savings, coupled with enhanced quality and customer services. ASCs offer a more cost-effective care setting than Hospital Outpatient Departments (HOPDs), resulting in a significant annual cost reduction exceeding USD 38 billion for outpatient surgery procedures.

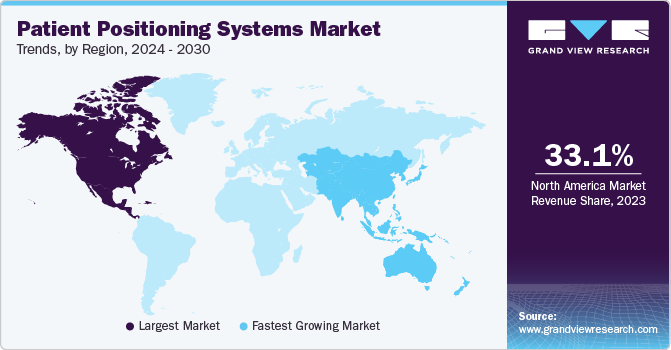

Regional Insights

North America dominated the market with the revenue share of 33.1% in 2023, owing to the increasing prevalence of chronic and lifestyle-related diseases and the presence of advanced healthcare infrastructure. Moreover, the U.S. benefits from the local presence of key market players like Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron, LLC; and SchureMed, further contributing to market expansion. According to CDC article published in December 2022, the prevalence of chronic diseases among adults in the U.S., with 6 in 10 affected and 4 in 10 having multiple conditions, underscores the substantial health challenges. These chronic diseases, leading causes of death and disability, are significant drivers of the nation's annual healthcare costs totaling USD 4.1 trillion.

Europe is expected to hold the second-largest revenue share in the global market. One of the primary factors driving this growth is an increase in the geriatric population, a high number of patients with cancer, and advanced healthcare infrastructure. According to the EU science hub article published January 2022, the prevalence of approximately four million new cancer cases and 1.9 million cancer-related deaths in Europe during 2020 underscores the significant impact of cancer in the region. These statistics, coupled with the disproportionate burden on Europeans, with 25% of global cancer cases occurring in Europe despite comprising only one tenth of the world population.

Asia-Pacific region is estimated to grow at the fastest CAGR during the forecast period. The growth of this region is attributed to factors such as rapidly developing healthcare infrastructure, increased demand due to rising prevalence of chronic disease and favorable government initiatives in the region. In addition, increasing number of surgeries conducted in countries like China and India is also boosting the market growth.

Key Patient Positioning Systems Company Insights

Medtronic, Hill-Rom Holdings, Inc., and Stryker Corporation are some of the dominant players operating in the market. These companies are engaged in strategies such as acquisitions, partnerships, collaborations and product launches to maintain their market share. Investing and implementing continuous innovation help these companies to dominate the market.

Mizuho OSI, LEONI AG, and OPT SurgiSystems Srl are some of the emerging market players functioning in the market. These players are engaged in partnerships, employ customer acquisition strategies, and develop innovative products to compete with the leading players.

Key Patient Positioning Systems Companies:

The following are the leading companies in the patient positioning systems market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these patient positioning systems companies are analyzed to map the supply network.

- Medtronic

- Hill-Rom Holdings, Inc.

- Stryker Corporation

- Medline Industries

- Skytron, LLC

- Smith & Nephew

- STERIS plc

- Mizuho OSI

- LEONI AG

- OPT SurgiSystems Srl

Recent Developments

-

In September 2023, FluidAI Medical, a top AI startup, is partnering with Medtronic Canada to advance Canadian healthcare with the Continuous Connected Patient Care project. The collaboration aims to revolutionize healthcare through their Stream Platform for post-surgical monitoring, showcasing a significant integration of artificial intelligence

-

In February 2023, GMG Medical Equipment in San Diego is assisting hospitals by supplying commercial-grade medical beds tailored for outpatient care and individuals transitioning from hospital stays

-

In March 2023, Stryker has introduced SmartMedic, India's inaugural ICU bed upgrade platform, aiming to elevate patient care and ensure safety for caregivers

-

In June 2023, Baxter International Inc. has introduced the Hillrom Progressa+ bed for the ICU in the U.S., focusing on innovation in connected beds for med-surg and intensive care units. This advanced bed incorporates new technology and features to facilitate nursing care and promote patient recovery

Patient Positioning Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.52 billion

Revenue forecast in 2030

USD 1.92 billion

Growth rate

CAGR of 4.01% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Medtronic; Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron; LLC; Smith & Nephew; STERIS plc; Mizuho OSI; LEONI AG OPT; SurgiSystems Srl

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Positioning Systems Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global patient positioning systems market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tables

-

Surgical Tables

-

Examination Tables

-

Radiolucent Imaging Tables

-

-

Accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgery

-

Diagnostics

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Ambulatory centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global patient positioning systems market size was estimated at USD 1.46 billion in 2023 and is expected to reach USD 1.52 billion in 2024.

b. The global patient positioning systems market is expected to grow at a compound annual growth rate of 4.01% from 2024 to 2030 to reach USD 1.92 billion by 2030.

b. North America dominated the patient positioning systems market with a share of over 33.10% in 2023. This is attributable to the rising prevalence of chronic and lifestyle-related diseases and the presence of sophisticated healthcare infrastructure.

b. Some key players operating in the patient positioning systems market include Medtronic; Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron, LLC; OPT SurgiSystems Srl; SchureMed; Smith & Nephew; STERIS plc; and Leoni.

b. Key factors that are driving the patient positioning systems market growth include the growing geriatric population, increasing prevalence of cancer, rising awareness among the patient population, and surging expenditure on diagnostic procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."