- Home

- »

- Healthcare IT

- »

-

Global Patient Registry Software Market Size Report, 2020-2027GVR Report cover

![Patient Registry Software Market Size, Share & Trends Report]()

Patient Registry Software Market Size, Share & Trends Analysis Report By Product, By Software (Standalone, Integrated), By Deployment Model, By Database Type, By Functionality, By End Use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-419-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Healthcare

Report Overview

The global patient registry software market size was valued at USD 1.0 billion in 2019 and is expected to witness a CAGR of 11.7% during the forecast period. Increasing incidence of chronic diseases such as cancer, diabetes, and cardiovascular diseases are fueling the demand for integrated registries for better treatment outcomes and new drug development. The growing adoption of electronic health records (EHR) is further boosting the market for patient registry software.

Regulatory authorities of the developed economies are focusing on the wider implementation of EHR solutions in their healthcare practices in order to improve the delivery of healthcare services. In Europe, spending on patient registry software by healthcare providers is estimated to have grown by 32.0% in 2018 in the last five years. The stringent regulation in order to implement electronic patient record is further fueling the demand for patient registry software. For instance, in May 2019, the German Minister of Health drafted legislation for digital health solutions in Germany. It will help to improve the patient healthcare record, the telemedicine infrastructure, and the implementation of the electronic registry.

Increasing investment in the clinical trials by majority of the biotechnological and pharmaceutical companies is expected to exhibit growth with untapped opportunities. Patient registry data is helpful to track the patients for clinical trials. Moreover, the affected locations for any specific type of disease can also be identified by using the data. Pharmaceutical and medical device companies can be remarkably benefitted from the various patient registries for post-marketing surveillance of the drug and the medical devices. Patient registries help to generate and apply real-world evidence and reduce the cost of post-market research.

Patient registry software also aids in the new drug development especially for rare diseases. In Europe, currently, over 700 rare disease registries (RDR) are actively helping to fetch historical patient data, sample size calculations, and sample size reduction. Moreover, consumption of specific drugs and its outcome can easily be tracked via software. For instance, in June 2019, in order to track the consumption of prescription medical cannabis, CloudPWR partnered with Accela. It will help to tap the volume-based consumption of medical cannabis in order to reduce the misuse. The aforementioned factors are expected to boost the market for patient registry software in the coming years.

Product Insights

On the basis of product, the market for patient registry software is segmented into disease, health service, and product registry. The disease registry is further sub-segmented into cardiovascular, diabetes, cancer, rare disease, asthma, and others. The disease registry segment dominated the market for patient registry software in 2019. The increasing demand to integrate the healthcare system and to curb the disease burden is driving the segment. These registries are also helpful to track patients for clinical trials in order to develop new drugs.

The product registry segment is expected to show lucrative growth over the forecast period. Once a medical device or a drug is approved by a regulatory authority, a registry is required for quality evaluation during the post-approval phase in order to identify any adverse reaction and to enhance the understanding of product safety. Supportive government initiative in order to improve the treatment outcomes is propelling the segment. For instance, in April 2019, Northgate Public Services (NPS) of the U.K. collaborated with the Indian Society of Hip and Knee Surgeons (ISHKS) to launch the Indian Joint Registry (IJP). This is intended to build and maintain the Indian Joint Registry (IJR) to store patient data efficiently and securely. Moreover, this platform is designed to enhance patient outcomes and insight into long term joint and procedural performance.

Software Type Insights

On the basis of software, the standalone segment held the largest revenue share in 2019, owing to its easy to use tools and advanced features. Standalone software applications are meant to address only a specific register such as cardiovascular, rare disease, diabetes, and cancer patient details. Hence, it is highly detailed and data retrieval is also quite easy. Moreover, the automatic upgrade feature of standalone helps to reduce IT overhead costs.

Integrated segment is also expected to show significant growth over the forecast period. Integrated system is an assemblage of software at the national level which helps to track affected geographic locations and evaluate the clinical intervention. It will further help in gaining information on disease burden and the effectiveness of treatment programs. The diverse integrated aspects, plugins, and add-ons of the program are meant to work together seamlessly which is further fueling the growth of the market for patient registry software.

Deployment Model Insights

On the basis of deployment model, the on-premise segment held the largest revenue share in 2019 owing to its data security, easy retrieval, and ease of access. It is also helpful for heavy data file transfers and system upgrades. The preference for these services is mainly due to complete access to information and full control within the premise. Pharmaceutical companies and research organizations usually prefer on-premise solutions due to the confidentiality of their data and customized service options.

Web/cloud-based solution is expected to exhibit lucrative growth over the forecast period owing to its advanced features such as real-time tracking and remote access to data. Moreover, integration in accordance with the standard guidelines is another advantage fueling the demand for this solution. Both government and private organizations are opting for cloud-based software over on-premise nowadays. For instance, in November 2019, Google collaborated with the medical system, Ascension in order to analyze and store millions of patients data from around 150 hospitals in the District of Columbia in its cloud computing platform.

Database Type Insights

The commercial segment dominated the patient registry software market in 2019 owing to its enhanced data security compared to the public database. These databases are in compliance with government standards and coding, which is further boosting the demand. Moreover, this software offers a couple of advantages such as a single point of contact for any business problem, timely software up-gradation, and ease of use. The commercial systems allow data exchange among government research organizations such as CDC and central disease registries as well which is further boosting the growth of the segment.

The public database type is expected to show lucrative growth over the forecast period. The growth can be attributed to the increasing number of research organizations. This database is used for specific research tasks or projects, thus fueling the demand. In addition, the software is voluntarily uncopyrighted and unpatented. For instance, Registry Plus is a public database registry launched by CDC in 2014 for collecting and processing cancer data for any specific project.

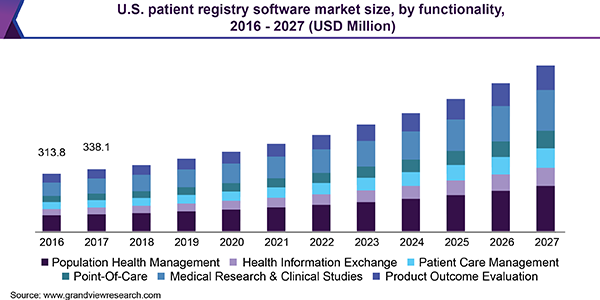

Functionality Insights

On the basis of functionality, population health management dominated the market for patient registry software in 2019. Increasing demand for solutions supporting value-based care delivery by stakeholders has resulted in a shift from Fee-for-Service (FFS) to a Value-based Payment (VBP) model. PHM helps to standardize physician approach, enhance clinical outcomes, and help to lessen the cost of disease management, which is further fueling segment growth.

The medical research and clinical studies segment is expected to show the fastest growth over the forecast period. These registries usually store data of patients with a health challenge. It may include the health status data of the patients for a specific treatment from time to time, which helps to develop a new drug. The point of care segment also has a huge potential in the market for patient registry software owing to its real-time data and cost-efficiency. The aforementioned factors is expected to boost the market for patient registry software with huge untapped opportunities.

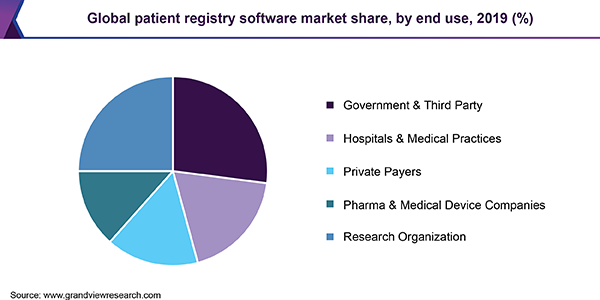

End-use Insights

On the basis of end-use, the market for patient registry software is segmented into government and third parties, hospitals and medical practices, private payers, pharma and medical device companies, and research organizations. The government and third-party segment held the largest revenue share in 2019. The implementation of this software by the government in both developed and developing countries to decrease the disease burden is anticipated to fuel the growth of the market for patient registry software over the forecast period.

The pharma and medical device companies segment is expected to show lucrative growth over the forecast period. Adoption of these softwares by the pharmaceutical, biotech, and medical devices companies to track the real-world patient data is fueling the growth. Moreover, the data is also helpful for clinical trials and to address specific diseases. The research organization segment is also expected to show significant growth owing to initiatives taken by these organizations to curb the increasing disease burden globally.

Regional Insights

North America dominated the global market for patient registry software in terms of revenue share in 2019. Increasing target population coupled with rising prevalence of diseases and need for population-based registries are propelling the growth of the market in this region. Moreover, increasing government initiatives make this region as a major contributor to the market for patient registry software. In order to make patient registry software more user interactive and clinical research-friendly, companies are constantly trying to develop better user-interactive software. For instance, in August 2019, IQVIA launched a new web-based solution for the enrollment of clinical trial information.

Asia Pacific is expected to show lucrative growth over the forecast period. Adoption of electronic medical records has been increasing over the past few years. Rising pressure to curb medical errors, repeated hospital visits, increased diagnostics errors coupled with rising incidences of co-morbidities, and the aging population are major factors driving the market in the region. Furthermore, supportive government initiatives, especially in Japan, China, and South Korea are boosting the growth of the market for patient registry software. For instance, in May 2018, the South Korean Government invested USD 33.4 Million to expand the artificial intelligence system that will intend to analyze a patient’s medical registry for better diagnostics and treatment options. Fujifilm established FUJIFILM VET Systems in Japan in 2019 in order to penetrate the regional cancer registry software market.

Patient Registry Software Market Share Insights

The industry is marked by the presence of various small and large industry players. The market for patient registry software is competitive and highly fragmented. Some of the key market players include Phytel, Inc.; McKesson Corporation; Quintiles; Dacima Software Inc.; ImageTrend, Inc.; IBM; IQVIA. The players are constantly involved in strategic initiatives such as geographical expansion, government collaboration, new product launch, and mergers and acquisitions in order to gain deeper penetration.

For instance, in July 2019, Pulse Infoframe partnered with Immunocore in order to introduce the first global patient registry for Uveal Melanoma. This is a joint effort from the companies and the academic institutions from U.S., Australia, and the U.K. The insights earned through the academic patient registry are expected to deliver better comprehension of the disease and assist further clinical research. In March 2019, Amplitude Clinical launched Amplitude software which is pre-loaded with the patient record, involving accurate case-mix adjustment in order to improve the diagnostic and treatment procedure.

Report Scope

Attribute

Details

Base year for estimation

2019

Actual estimates/Historical data

2016 - 2018

Forecast period

2020 - 2027

Market representation

Revenue in USD Million & CAGR from 2020 to 2027

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S., Canada, Germany, U.K., France, Italy, Spain, Sweden, Japan, China, India, Australia, South Korea, Singapore, Brazil, Mexico, Argentina, South Africa, Saudi Arabia

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global patient registry software market report on the basis of product, software, database type, deployment model, functionality, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Disease Registry

-

Cardiovascular

-

Diabetes

-

Cancer

-

Rare disease

-

Asthma

-

Others

-

-

Health Service Registry

-

Product Registry

-

Medical Device

-

Drug

-

-

-

Software Outlook (Revenue, USD Million, 2016 - 2027)

-

Standalone

-

Integrated

-

-

Deployment Model Outlook (Revenue, USD Million, 2016 - 2027)

-

On-premise

-

Web/Cloud-based

-

-

Database Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Commercial

-

Public

-

-

Functionality Outlook (Revenue, USD Million, 2016 - 2027)

-

Population Health Management

-

Health Information Exchange

-

Patient Care Management

-

Point-Of-Care

-

Medical Research & Clinical Studies

-

Product Outcome Evaluation

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Government & third party

-

Hospitals & medical practices

-

Private payers

-

Pharma & medical device companies

-

Research organization

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."