- Home

- »

- Biotechnology

- »

-

Personalized Medicine Market Size And Share Report, 2030GVR Report cover

![Personalized Medicine Market Size, Share & Trends Report]()

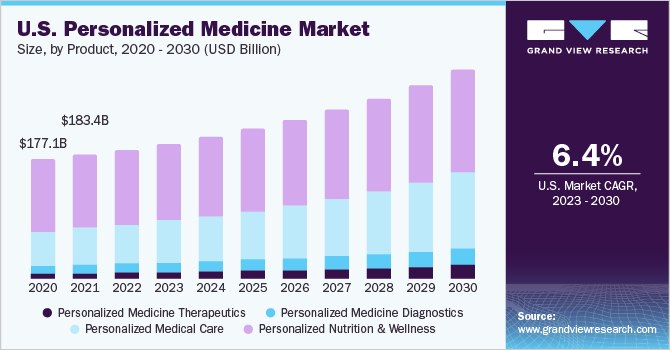

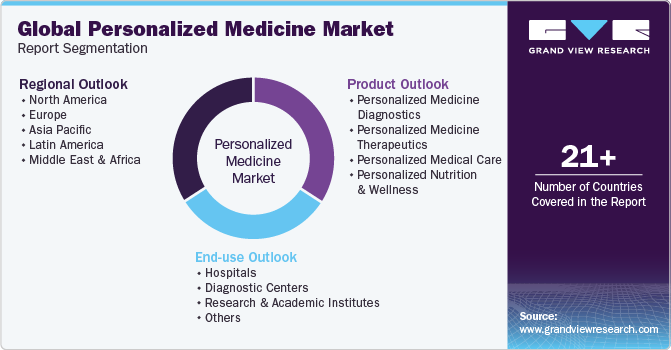

Personalized Medicine Market Size, Share & Trends Analysis Report By Product (Personalized Medicine Therapeutics, Personalized Medical Care, Personalized Nutrition & Wellness), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-443-7

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

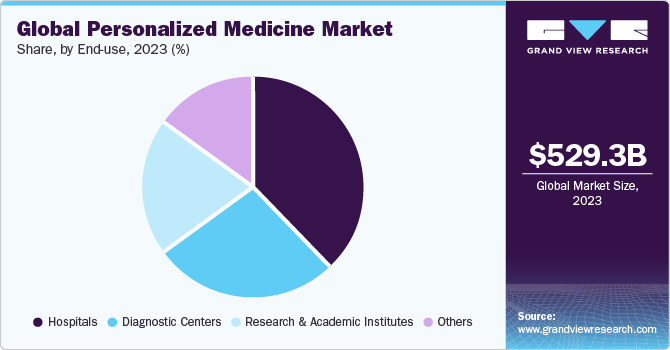

The global personalized medicine market size was valued at USD 538.93 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.20% from 2023 to 2030. The growth of personalized medicine market is attributed to factors such as the growing demand for novel drug discovery to combat growing incidence of cancers and other diseases across the globe. Moreover, numerous collaborations among researchers and market players are also anticipated to have a positive impact on the market growth. For instance, in February 2022, Genomic Medicine Sweden (GMS) and the Centers for Personalized Medicine (ZPM) in Germany, collaborates for a strategic, structural, and content-specific efforts to implement precision medicine in healthcare.

The COVID-19 pandemic outbreak hindered the continuance of research for novel drug discovery. However, technology oriented outcomes in the market like tele medicine came into persistence after the incidence of pandemic situation. Many clinical consultations are facilitated online to increase subject convenience and to avoid spread of contagious infections. Moreover, the COVID-19 pandemic has propelled the demand for personalized medicine in gauging an individual’s immunity to combat COVID-19 infection. For instance, A research study published in Elsevier in 2020 has indicated that COVID-19 infections are linked with gene variants on chromosomes and loss of variants present on the X-chromosome.

The increasing prevalence of rare diseases is also anticipated to boost the demand for growth of the market. The increasing level of understanding and correlation of characteristics of human genome have paved way for efforts on devising various personalized medicine and therapeutic exercises. For instance, in September 2022, a research study carried out at the University of California at Irvine, proposed a novel technique for management of inherited retinal diseases (IRDs) by using precision genome editing that is very specific to individual’s requirements.

Personalized medicine is also increasingly used for applications in companion diagnostics that are precisely designed for determination of viability of subjects to a specific treatment and to gauge the subject’s response to a therapeutic regime. Companion diagnostics play an essential role for devising efficient precision medicine considering micro environment, patient’s genome characteristics, ethnicity and lifestyle choices. There are increasing number of FDA approvals for companion diagnostics due to the rising demand. For instance, in October 2020, Roche achieves the U.S. FDA approval for its expansion of the cobas EGFR Mutation Test to be used for the treatment of non-small cell lung cancer.

The market players are extensively working towards collaborations and acquisitions along with huge capital investments to devise best personalized medicine strategy that could possibly cure a disease. For instance, in July 2022, Certara declares collaboration with Memorial Sloan Kettering Cancer Center (MSKCC) for development of a novel biosimualtion software development for leveraged CAR T-cell therapy dosing for subjects with multiple myeloma.

Product Insights

Personalized nutrition & wellness recorded a dominant market share of 57.82% in 2022. The growth of the segment is due to extensive consumption rate and market penetration. Further, the high rate of over the counter (OTC) sales of nutrition products boost the demand due to lowered regulatory implications. For instance, in March 2022, the American Heart Association features that the nutrition scientists are working towards precision nutrition to combat cardiovascular diseases based on the unique responses for specific foods and nutrients.

The personalized medicine therapeutics segment is projected to record the fastest CAGR of 10.71% over the forecast period. The rise in demand for genomics based therapeutics and the biopharmaceuticals based on specifically sequenced data is primarily attributed to the growth of the segment. Moreover, the emergence of high-end sequencing to effectively reduce the cost of genome sequencing, nurtures the growth of the market.

Regional Insights

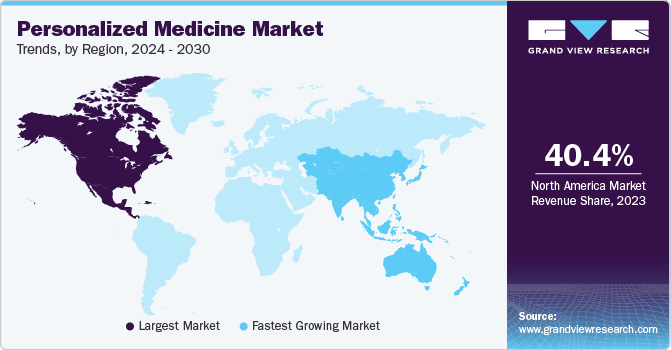

North America accounted for the largest market share of 48.14% in 2022. This is attributive to the support by research institutes and the pharmaceutical giants. Personalized medicine is now preferred for all kinds of diseases and therefore is part of research on any given disease and drug discovery. There are emerging advancements in personalized medicine for diagnostics in the region. For instance, in January 2021, Illumina, Inc. develops the TruSight Oncology 500 (TSO 500) assay that uses nucleic acids from tumor region and capably identifies as many as 523 cancer biomarkers.

Asia Pacific is projected to grow at the fastest CAGR of 8.51% over the forecast period due to increased demand for personalized medicine in diagnostics and the growing demand for novel therapeutic drugs to fight increased incidence of diseases in the region.

Key Companies & Market Share Insights

Key players operating in the market are focused on strategic collaborations, new product launch and geographical expansions where needed in the emerging and favorable regions across the globe. For instance, in February 2023, Roche collaborated with Janssen Biotech Inc. for the creation of companion diagnostics for targeted and personalized therapies. The initiative is expected to strengthen research and innovation prospects in this domain. Some of the prominent key players operating in the global personalized medicine market include:

-

GE Healthcare

-

Illumina, Inc.

-

ASURAGEN, INC.

-

Abbott

-

Dako A/S

-

Exact Sciences Corporation

-

Danaher Corporation (Cepheid, Inc.)

-

Decode Genetics, Inc.

-

QIAGEN

-

Exagen Inc.

-

Precision Biologics

-

Celera Diagnostics LLC.

-

Biogen

-

Genelex

-

International Business Machines Corporation (IBM)

-

Genentech, Inc.

-

23andMe, Inc.

Recent Development

-

In July 2023, 23andMe released a new Simvastatin Medication Insight report, part of a suite of 23andMe reports that look into how genetics can impact the response to certain medications for people, as well as their chance of possible side effects. The Simvastatin Medication Insight report looks at individual responses to simvastatin, a statin drug for lowering blood cholesterol, which is also known by brand names like Zocor and Flolipid

-

In June 2023, Qiagen announced that the ‘QCI Interpret’ software had been selected by the Danish National Genome Center for providing sequencing-based solutions for cancer patients. The variant interpretation and reporting software had been chosen for interpreting oncology results extracted from whole-genome sequencing data. This development is part of Denmark’s personalized medicine strategy for offering WGS as the standard-of-care for relevant patient groups

-

In June 2023, GE Healthcare showcased its latest solutions in the areas of precision care and personalized medicine at the Society of Nuclear Medicine and Molecular Imaging (SNMMI) 2023 annual meeting. In the personalized medicine area, the company launched the SIGNA PET/MR system, which has been designed to aid clinicians in seeing the smallest lesions, research new tracers, and plan more accurate treatment paths for each patient

-

In June 2023, Illumina launched its new PrimateAI-3D AI algorithm, which predicts disease-causing genetic mutations in patients with a high accuracy. The algorithm uses deep neural network architectures and is trained on genome sequences. PrimateAI-3D aims to address the challenges facing the successful implementation of personalized genomic medicine through offering accurate predictions regarding disease-causing variants

-

In April 2023, Precision Biologics announced the publication of its first in-human Phase I clinical trial with its novel monoclonal antibody, NEO-201. The trial was conducted in patients with refractory solid tumors. The NEO-201 was able to reduce immune suppressive cells that can be responsible in reducing the cancer-killing activity for checkpoint inhibitors such as Keytruda

-

In November 2022, Danaher Corporation entered into a strategic partnership with Duke University for its first Danaher Beacon for Gene Therapy Innovation. The Danaher Beacons initiative has been designed to leverage breakthrough science for developing applications and technologies that improve human health, with major focus areas being genomic medicines, precision diagnostics, next-gen biomanufacturing, and data sciences

-

In August 2022, Exagen launched the ‘TiGER’ study for validating a novel and minimally invasive genomic diagnostic test for rheumatoid arthritis, using the AVISE RADR platform. The study will aid in identifying biomarkers in the synovial tissue for drug response in rheumatoid arthritis, helping in the development of personalized medicine for treating the disorder and establishing it as the primary form of care

Personalized Medicine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 567.32 billion

Revenue forecast in 2030

USD 922.72 billion

Growth rate

CAGR of 7.20% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Illumina, Inc.; ASURAGEN, INC.; Abbott; Dako A/S; Exact Sciences Corporation; Danaher Corporation (Cepheid, Inc.); Decode Genetics, Inc.; QIAGEN; Exagen Inc.; Precision Biologics; Celera Diagnostics LLC; Biogen; Genelex; IBM; Genentech, Inc.; 23andMe, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personalized Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global personalized medicine market report on the basis of product, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personalized Medicine Diagnostics

-

Genetic Testing

-

Direct-To-Consumer (DTC) Diagnostics

-

Esoteric Lab Services

-

Esoteric Lab Tests

-

-

Personalized Medicine Therapeutics

-

Pharmaceutical

-

Genomic Medicine

-

Medical Devices

-

-

Personalized Medical Care

-

Telemedicine

-

Health Information Technology

-

-

Personalized Nutrition & Wellness

-

Retail Nutrition

-

Complementary & Alternative Medicine

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personalized medicine market size was estimated at USD 538.93 billion in 2022 and is expected to reach USD 567.32 billion in 2023.

b. The global personalized medicine market is expected to grow at a compound annual growth rate of 7.20% from 2023 to 2030 to reach USD 922.72 billion by 2030.

b. North America dominated the personalized medicine market with a share of 48.14% in 2022. This is attributable to the increasing adoption of NGS methods and healthcare IT systems in clinical workflow along with supportive government policies and funding.

b. Some key players operating in the personalized medicine market include GE Healthcare, Illumina, Inc., ASURAGEN, INC., Abbott, Dako A/S, Exact Sciences Corporation, Danaher Corporation (Cepheid, Inc.), Decode Genetics, Inc., QIAGEN, Exagen Inc., Precision Biologics, Celera Diagnostics LLC, Biogen, Genelex, IBM, Genentech, Inc., 23andMe, Inc.

b. Key factors that are driving the personalized medicine market growth include the advancement of next-generation sequencing, a growing number of companion/associated diagnostics, an increasing number of retail clinics across the developed regions of North America and Europe, an increasing prevalence of cancer, and increasing usage of biomarkers for PM cancer therapy.

b. The personalized nutrition and wellness product segment dominated the personalized medicine market and accounted for the largest revenue share of 57.82% in 2022.

Table of Contents

Chapter 1. Personalized Medicine Market: Methodology and Scope

1.1. Information Procurement

1.2. Information Or Data Analysis

1.3. Market Scope & Segment Definition

1.4. Market Model

1.4.1. Market Study, By Company Market Share

1.4.2. Regional Analysis

Chapter 2. Personalized Medicine Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Personalized Medicine Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Utility Of Human Genome Data For Clinical Research

3.2.1.1.1. Targeted And Personalized Healthcare

3.2.1.2. Technological Advancements To Facilitate R&D For Personalized Medicine

3.2.1.2.1. Emergence Of Advanced Genome Editing Techniques

3.2.1.2.2. Utility Of Novel Databases For Research

3.2.2. Market Restraint Analysis

3.2.2.1. Ethical Issues And Protection Of Individual’s Genomic Data

3.2.2.2. Limited Access To Human Genome Data And Databases

3.2.3. Market Opportunity Analysis

3.3. Industry Analysis Tools

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

Chapter 4. Product Business Analysis

4.1. Personalized Medicine Market: Product Movement Analysis

4.2. Personalized Medicine Diagnostics

4.2.1. Personalized Medicine Diagnostics Market, 2018 - 2030 (USD Billion)

4.2.2. Genetic Testing

4.2.2.1. Genetic Testing Market, 2018 - 2030 (USD Billion)

4.2.3. Direct-To-Consumer (DTC) Diagnostics

4.2.3.1. Direct-To-Consumer (DTC) Diagnostics Market, 2018 - 2030 (USD Billion)

4.2.4. Esoteric Lab Services

4.2.4.1. Esoteric Lab Services Market, 2018 - 2030 (USD Billion)

4.2.5. Esoteric Lab Tests

4.2.5.1. Esoteric Lab Tests Market, 2018 - 2030 (USD Billion)

4.3. Personalized Medicine Therapeutics

4.3.1. Personalized Medicine Therapeutics Market, 2018 - 2030 (USD Billion)

4.3.2. Pharmaceutical

4.3.2.1. Pharamceutical Market, 2018 - 2030 (USD Billion)

4.3.3. Genomic Medicine

4.3.3.1. Genomic Medicine Market, 2018 - 2030 (USD Billion)

4.3.4. Medical Devices

4.3.4.1. Medical Devices Market, 2018 - 2030 (USD Billion)

4.4. Personalized Medical Care

4.4.1. Personlaized Medical Care Market, 2018 - 2030 (USD Billion)

4.4.2. Telemedicine

4.4.2.1. Telemedicine Market, 2018 - 2030 (USD Billion)

4.4.3. Health Information Technology

4.4.3.1. Health Inforamtion Technology Market, 2018 - 2030 (USD Billion)

4.5. Personalized Nutrition & Wellness

4.5.1. Personalzied Nutrtion & Wellness Market, 2018 - 2030 (USD Billion)

4.5.2. Retail Nutrition

4.5.2.1. Retail Nutrition Market, 2018 - 2030 (USD Billion)

4.5.3. Complementary & Alternative Medicine

4.5.3.1. Complementary & Alternative Medicine Market, 2018 - 2030 (USD Billion)

Chapter 5. Regional Business Analysis

5.1. Personalized Medicine Market Share By Region, 2022 & 2030

5.2. North America

5.2.1. SWOT Analysis

5.2.2. North America Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.2.3. U.S.

5.2.3.1. Key Country Dynamics

5.2.3.2. Target Disease Prevalence

5.2.3.3. Competitive Scenario

5.2.3.4. Regulatory Framework

5.2.3.5. Reimbursement Scenario

5.2.3.6. U.S. Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.2.4. Canada

5.2.4.1. Key Country Dynamics

5.2.4.2. Target Disease Prevalence

5.2.4.3. Competitive Scenario

5.2.4.4. Regulatory Framework

5.2.4.5. Reimbursement Scenario

5.2.4.6. Canada Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.3. Europe

5.3.1. SWOT Analysis

5.3.2. Europe Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.3.3. UK

5.3.3.1. Key Country Dynamics

5.3.3.2. Target Disease Prevalence

5.3.3.3. Competitive Scenario

5.3.3.4. Regulatory Framework

5.3.3.5. Reimbursement Scenario

5.3.3.6. UK Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.3.4. Germany

5.3.4.1. Key Country Dynamics

5.3.4.2. Target Disease Prevalence

5.3.4.3. Competitive Scenario

5.3.4.4. Regulatory Framework

5.3.4.5. Reimbursement Scenario

5.3.4.6. Germany Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.3.5. France

5.3.5.1. Key Country Dynamics

5.3.5.2. Target Disease Prevalence

5.3.5.3. Competitive Scenario

5.3.5.4. Regulatory Framework

5.3.5.5. Reimbursement Scenario

5.3.5.6. France Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.3.6. Italy

5.3.6.1. Key Country Dynamics

5.3.6.2. Target Disease Prevalence

5.3.6.3. Competitive Scenario

5.3.6.4. Regulatory Framework

5.3.6.5. Reimbursement Scenario

5.3.6.6. Italy Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.3.7. Spain

5.3.7.1. Key Country Dynamics

5.3.7.2. Target Disease Prevalence

5.3.7.3. Competitive Scenario

5.3.7.4. Regulatory Framework

5.3.7.5. Reimbursement Scenario

5.3.7.6. Spain Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.3.8. Denmark

5.3.8.1. Key Country Dynamics

5.3.8.2. Target Disease Prevalence

5.3.8.3. Competitive Scenario

5.3.8.4. Regulatory Framework

5.3.8.5. Reimbursement Scenario

5.3.8.6. Denmark Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.3.9. Sweden

5.3.9.1. Key Country Dynamics

5.3.9.2. Target Disease Prevalence

5.3.9.3. Competitive Scenario

5.3.9.4. Regulatory Framework

5.3.9.5. Reimbursement Scenario

5.3.9.6. Sweden Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.3.10. Norway

5.3.10.1. Key Country Dynamics

5.3.10.2. Target Disease Prevalence

5.3.10.3. Competitive Scenario

5.3.10.4. Regulatory Framework

5.3.10.5. Reimbursement Scenario

5.3.10.6. Norway Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.4. Asia Pacific

5.4.1. SWOT Analysis

5.4.2. Asia Pacific Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.4.3. Japan

5.4.3.1. Key Country Dynamics

5.4.3.2. Target Disease Prevalence

5.4.3.3. Competitive Scenario

5.4.3.4. Regulatory Framework

5.4.3.5. Reimbursement Scenario

5.4.3.6. Japan Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.4.4. China

5.4.4.1. Key Country Dynamics

5.4.4.2. Target Disease Prevalence

5.4.4.3. Competitive Scenario

5.4.4.4. Regulatory Framework

5.4.4.5. Reimbursement Scenario

5.4.4.6. China Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.4.5. India

5.4.5.1. Key Country Dynamics

5.4.5.2. Target Disease Prevalence

5.4.5.3. Competitive Scenario

5.4.5.4. Regulatory Framework

5.4.5.5. Reimbursement Scenario

5.4.5.6. India Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.4.6. Australia

5.4.6.1. Key Country Dynamics

5.4.6.2. Target Disease Prevalence

5.4.6.3. Competitive Scenario

5.4.6.4. Regulatory Framework

5.4.6.5. Reimbursement Scenario

5.4.6.6. Australia Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.4.7. Thailand

5.4.7.1. Key Country Dynamics

5.4.7.2. Target Disease Prevalence

5.4.7.3. Competitive Scenario

5.4.7.4. Regulatory Framework

5.4.7.5. Reimbursement Scenario

5.4.7.6. Thailand Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.4.8. South Korea

5.4.8.1. Key Country Dynamics

5.4.8.2. Target Disease Prevalence

5.4.8.3. Competitive Scenario

5.4.8.4. Regulatory Framework

5.4.8.5. Reimbursement Scenario

5.4.8.6. South Korea Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.5. Latin America

5.5.1. SWOT Analysis

5.5.2. Latin America Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.5.3. Brazil

5.5.3.1. Key Country Dynamics

5.5.3.2. Target Disease Prevalence

5.5.3.3. Competitive Scenario

5.5.3.4. Regulatory Framework

5.5.3.5. Reimbursement Scenario

5.5.3.6. Brazil Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.5.4. Mexico

5.5.4.1. Key Country Dynamics

5.5.4.2. Target Disease Prevalence

5.5.4.3. Competitive Scenario

5.5.4.4. Regulatory Framework

5.5.4.5. Reimbursement Scenario

5.5.4.6. Mexico Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.5.5. Argentina

5.5.5.1. Key Country Dynamics

5.5.5.2. Target Disease Prevalence

5.5.5.3. Competitive Scenario

5.5.5.4. Regulatory Framework

5.5.5.5. Reimbursement Scenario

5.5.5.6. Argentina Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.6. MEA

5.6.1. SWOT Analysis

5.6.2. MEA Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.6.3. South Africa

5.6.3.1. Key Country Dynamics

5.6.3.2. Target Disease Prevalence

5.6.3.3. Competitive Scenario

5.6.3.4. Regulatory Framework

5.6.3.5. Reimbursement Scenario

5.6.3.6. South Africa Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.6.4. Saudi Arabia

5.6.4.1. Key Country Dynamics

5.6.4.2. Target Disease Prevalence

5.6.4.3. Competitive Scenario

5.6.4.4. Regulatory Framework

5.6.4.5. Reimbursement Scenario

5.6.4.6. Saudi Arabia Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.6.5. UAE

5.6.5.1. Key Country Dynamics

5.6.5.2. Target Disease Prevalence

5.6.5.3. Competitive Scenario

5.6.5.4. Regulatory Framework

5.6.5.5. Reimbursement Scenario

5.6.5.6. UAE Personalized Medicine Market, 2018 - 2030 (USD Billion)

5.6.6. Kuwait

5.6.6.1. Key Country Dynamics

5.6.6.2. Target Disease Prevalence

5.6.6.3. Competitive Scenario

5.6.6.4. Regulatory Framework

5.6.6.5. Reimbursement Scenario

5.6.6.6. Kuwait Personalized Medicine Market, 2018 - 2030 (USD Billion)

Chapter 6. Competitive Landscape

6.1. Company Categorization

6.2. Strategy Mapping

6.3. Company Market Share Analysis, 2022

6.4. Company Profiles/Listing

6.4.1. GE Healthcare

6.4.1.1. Overview

6.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.1.3. Product Benchmarking

6.4.1.4. Strategic Initiatives

6.4.2. Illumina, Inc.

6.4.2.1. Overview

6.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.2.3. Product Benchmarking

6.4.2.4. Strategic Initiatives

6.4.3. ASURAGEN, INC.

6.4.3.1. Overview

6.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.3.3. Product Benchmarking

6.4.3.4. Strategic Initiatives

6.4.4. Abbott

6.4.4.1. Overview

6.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.4.3. Product Benchmarking

6.4.4.4. Strategic Initiatives

6.4.5. Dako A/S

6.4.5.1. Overview

6.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.5.3. Product Benchmarking

6.4.5.4. Strategic Initiatives

6.4.6. Exact Sciences Corporation

6.4.6.1. Overview

6.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.6.3. Product Benchmarking

6.4.6.4. Strategic Initiatives

6.4.7. Danaher Corporation (Cepheid, Inc.)

6.4.7.1. Overview

6.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.7.3. Product Benchmarking

6.4.7.4. Strategic Initiatives

6.4.8. Decode Genetics, Inc.

6.4.8.1. Overview

6.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.8.3. Product Benchmarking

6.4.8.4. Strategic Initiatives

6.4.9. QIAGEN

6.4.9.1. Overview

6.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.9.3. Product Benchmarking

6.4.9.4. Strategic Initiatives

6.4.10. Exagen Inc.

6.4.10.1. Overview

6.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.10.3. Product Benchmarking

6.4.10.4. Strategic Initiatives

6.4.11. Precision Biologics

6.4.11.1. Overview

6.4.11.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.11.3. Product Benchmarking

6.4.11.4. Strategic Initiatives

6.4.12. Celera Diagnostics LLC

6.4.12.1. Overview

6.4.12.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.12.3. Product Benchmarking

6.4.12.4. Strategic Initiatives

6.4.13. Biogen

6.4.13.1. Overview

6.4.13.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.13.3. Product Benchmarking

6.4.13.4. Strategic Initiatives

6.4.14. Genelex

6.4.14.1. Overview

6.4.14.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.14.3. Product Benchmarking

6.4.14.4. Strategic Initiatives

6.4.15. IBM

6.4.15.1. Overview

6.4.15.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.15.3. Product Benchmarking

6.4.15.4. Strategic Initiatives

6.4.16. Genentech, Inc.

6.4.16.1. Overview

6.4.16.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.16.3. Product Benchmarking

6.4.16.4. Strategic Initiatives

6.4.17. 23andMe, Inc.

6.4.17.1. Overview

6.4.17.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

6.4.17.3. Product Benchmarking

6.4.17.4. Strategic Initiatives

List of Tables

Table 1 List of abbreviations

Table 2 Global personalized medicine market, by region, 2018 - 2030 (USD Billion)

Table 3 Global personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 4 North America personalized medicine market, by country, 2018 - 2030 (USD Billion)

Table 5 North America personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 6 U.S. personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 7 Canada personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 8 Europe personalized medicine market, by country, 2018 - 2030 (USD Billion)

Table 9 Europe personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 10 Germany personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 11 UK personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 12 France personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 13 Italy personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 14 Spain personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 15 Denmark personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 16 Sweden personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 17 Norway personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 18 Asia Pacific personalized medicine market, by country, 2018 - 2030 (USD Billion)

Table 19 Asia Pacific personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 20 Japan personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 21 China personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 22 India personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 23 South Korea personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 24 Thailand personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 25 Australia personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 26 Latin America personalized medicine market, by country, 2018 - 2030 (USD Billion)

Table 27 Latin America personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 28 Brazil personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 29 Mexico personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 30 Argentina personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 31 MEA personalized medicine market, by country, 2018 - 2030 (USD Billion)

Table 32 MEA personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 33 South Africa personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 34 Saudi Arabia personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 35 UAE personalized medicine market, by product, 2018 - 2030 (USD Billion)

Table 36 Kuwait personalized medicine market, by product, 2018 - 2030 (USD Billion)

List of Figures

FIG. 1 Market research process

FIG. 2 Information procurement

FIG. 3 Primary research pattern

FIG. 4 Market research approaches

FIG. 5 Value chain-based sizing & forecasting

FIG. 6 Market formulation & validation

FIG. 7 Personalized medicine market segmentation

FIG. 8 Market snapshot, 2022

FIG. 9 Market trends & outlook

FIG. 10 Market driver relevance analysis (current & future impact)

FIG. 11 Market restraint relevance analysis (current & future impact)

FIG. 12 PESTEL analysis

FIG. 13 Porter’s five forces analysis

FIG. 14 Global personalized medicine market, for product, 2018 - 2030 (USD Billion)

FIG. 15 Global personalized medicine market, for diagnostics, 2018 - 2030 (USD Billion)

FIG. 16 Global personalized medicine market, for genetic testing, 2018 - 2030 (USD Billion)

FIG. 17 Global personalized medicine market, for Direct-To-Consumer (DTC) testing, 2018 - 2030 (USD Billion)

FIG. 18 Global personalized medicine market, for esoteric lab services, 2018 - 2030 (USD Billion)

FIG. 19 Global personalized medicine market, for esoteric lab tests, 2018 - 2030 (USD Billion)

FIG. 20 Global personalized medicine market, for therapeutics, 2018 - 2030 (USD Billion)

FIG. 21 Global personalized medicine market, for pharmaceutical, 2018 - 2030 (USD Billion)

FIG. 22 Global personalized medicine market, for genomic medicine, 2018 - 2030 (USD Billion)

FIG. 23 Global personalized medicine market, for medical devices, 2018 - 2030 (USD Billion)

FIG. 24 Global personalized medicine market, for personalized medical care, 2018 - 2030 (USD Billion)

FIG. 25 Global personalized medicine market, for telemedicine, 2018 - 2030 (USD Billion)

FIG. 26 Global personalized medicine market, for health information technology, 2018 - 2030 (USD Billion)

FIG. 27 Global personalized medicine market, for personalized nutrition & wellness, 2018 - 2030 (USD Billion)

FIG. 28 Global personalized medicine market, for retail nutrition, 2018 - 2030 (USD Billion)

FIG. 29 Global personalized medicine market, for complementary & alternative medicine, 2018 - 2030 (USD Billion)

FIG. 30 Regional outlook, 2022 & 2030

FIG. 31 North America personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 32 U.S. personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 33 Canada personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 34 Europe personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 35 Germany personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 36 UK personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 37 France personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 38 Italy personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 39 Spain personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 40 Denmark personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 41 Sweden personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 42 Norway personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 43 Asia Pacific personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 44 Japan personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 45 China personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 46 India personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 47 Australia personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 48 Thailand personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 49 South Korea personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 50 Latin America personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 51 Brazil personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 52 Mexico personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 53 Argentina personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 54 MEA personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 55 South Africa personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 56 Saudi Arabia personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 57 UAE personalized medicine market, 2018 - 2030 (USD Billion)

FIG. 58 Kuwait personalized medicine market, 2018 - 2030 (USD Billion)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Personalized Medicine: Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Personalized Medicine: Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- U.S.

- U.S. Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- U.S. Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Canada

- Canada Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Canada Product Outlook (Revenue, USD Billion, 2018 - 2030)

- North America Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe

- Europe Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- UK

- UK Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- UK Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Germany

- Germany Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Germany Product Outlook (Revenue, USD Billion, 2018 - 2030)

- France

- France Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Italy

- Italy Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Spain

- Spain Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Denmark

- Denmark Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Denmark Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Sweden

- Sweden Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Sweden Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Norway

- Norway Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Norway Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Asia Pacific

- Asia Pacific Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Japan

- Japan Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Japan Product Outlook (Revenue, USD Billion, 2018 - 2030)

- China

- China Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- China Product Outlook (Revenue, USD Billion, 2018 - 2030)

- India

- India Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- India Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Australia

- Australia Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Australia Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Asia Pacific Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Latin America

- Latin America Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Brazil

- Brazil Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Brazil Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Mexico

- Mexico Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Mexico Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Argentina

- Argentina Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Argentina Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Latin America Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Middle East & Africa

- Middle East & Africa Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- South Africa

- South Africa Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- South Africa Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Saudi Arabia

- Saudi Arabia Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Saudi Arabia Product Outlook (Revenue, USD Billion, 2018 - 2030)

- UAE

- UAE Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- UAE Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Kuwait

- Kuwait Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Kuwait Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Middle East & Africa Product Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

Personalized Medicine Market Dynamics

Drivers: Advancements In Next-Generation Sequencing Technology

One of the most important factors expected to have a significant impact on the market is how much and to what extent the growth of Next-Generation Sequencing (NGS) will affect the adoption of personalized medicine in the coming seven years. The exponentially decreasing cost of sequencing whole genomes and technological advancements in NGS in a way align with Moore’s law for semiconductors in the field of life sciences. For instance, as per the Medical Device Network article published in 2023, sequencing costs have significantly decreased over time as a result of increased competition and advancements in technology. In addition, leading NGS platform players, such as Illumina and Life Technologies, have stated that the cost of sequencing a whole genome using their technology is currently less than USD 1,000. Thus, due to this reduction in prices, the demand for NGS is expected to grow in clinical diagnostics. Several oncologists believe that in the coming seven years, NGS combined with companion diagnostics can be expected to play a major role in personalized diagnostics and therapeutics. Owing to the development of a regulatory framework for the safety & efficacy of NGSbased lab tests and increasing clinical investigation data on disease heterogeneity, the demand for next-generation sequencing is expected to grow, which is anticipated to serve as a high-impact rendering driver of personalized medicine market over the forecast period

Expanding Portfolio Of Companion/Associated Diagnostics

Companion diagnostics are tests or assays that are specifically designed to identify biomarkers for patient stratification, ensuring that the right patients receive the right therapies at the right time. Many companies are embracing this approach to tailor treatments based on individual patient characteristics, optimizing therapeutic outcomes while minimizing potential adverse effects. Due to the successful launch of companion diagnostics, usage & penetration rates of personalized diagnostics and drugs will greatly depend on the level of adoption of their respective companion. diagnostic tests. In the coming seven years, more than 150 companion diagnostic on-label combinations and a wide array of personalized medicines are expected to be under clinical trials. The adoption of companion diagnostics is expected to increase even further post-FDA approval of novel tests. The expected increase in accuracy of testing and development of their analysis systems are likely to positively impact the market for companion diagnostics as well as personalized therapeutics and diagnostics over the forecast period.

Restraints: Presence Of Nonvalue-Based Personalized Medicine Diagnostics Reimbursement Policy

Several reimbursement structures provided by payors do not take the value provided by personalized medical tests and only incorporate the “cost-plus” approach, thus, there is a lack of complete potential reimbursement for personalized medicine tests in the market. This may hinder market growth as it negatively affects usage and adoption. However, the expected revision of regulatory and reimbursement policy with growing advancements in personalized medical products is expected to reduce the impact of this restraint over the forecast period. Moreover, the lack of consistent reimbursement policies limits incentives for innovation, potentially leading to a slowdown in the development of advanced personalized diagnostics. This uncertainty not only complicates regulatory compliance and adds administrative burdens but also contributes to unequal access to personalized medicine, fostering disparities among patients based on diagnosis and geographic location. The resulting complex landscape poses challenges for market players, potentially stalling the broader adoption of personalized medicine into routine clinical care. Thus, addressing these challenges in reimbursement policies is crucial for creating an environment that fosters innovation, encourages market growth, and ensures equitable access to the transformative potential of personalized medicine in enhancing patient outcomes.

What Does This Report Include?

This section will provide insights into the contents included in this personalized medicine market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Personalized medicine market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Personalized medicine market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the personalized medicine market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for personalized medicine market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of personalized medicine market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Personalized Medicine Market Categorization:

The personalized medicine market was categorized into two segments, namely product (Personalized Medicine Diagnostics, Personalized Medicine Therapeutics, Personalized Medical Care, Personalized Nutrition & Wellness) and regions (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa).

Segment Market Methodology:

The personalized medicine market was segmented into product and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The personalized medicine market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-three countries, namely, the U.S.; Canada; Germany; the UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Personalized medicine market companies & financials:

The personalized medicine market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

GE Healthcare - GE Healthcare operates as a subsidiary of General Electric (GE) Company. It offers medical technologies and solutions to healthcare entities worldwide. Its specialties include cardiology, orthopedics, and ambulatory surgery centers. It offers products for bone health, EP recording, clinical parameters & accessories, Computed Tomography (CT), advanced visualization, diagnostic cardiology, hemodynamic recording, metabolic health, patient monitoring, healthcare IT, mammography, interventional image-guided systems, life sciences, perioperative care, radiography & fluoroscopy, magnetic resonance imaging, molecular imaging, nuclear imaging agents, perinatal care, respiratory care, surgical imaging, and ultrasound. Its FlexFactory platform is a bioprocess platform that uses single-use technology for mAbs production. The company was formerly known as GE Medical Systems and changed its name to GE Healthcare Limited in October 2003.

-

Illumina, Inc. - Illumina, Inc. develops, manufactures, & distributes integrated platforms and systems for sequencing. It is also involved in analyzing and investigating genomic & proteomic information, determining biological function, and gene sequence expression. The company provides NGS genotyping, sequencing, and gene expression analysis platforms. It operates mainly in North America and Europe. It is engaged in developing novel sequencing technologies to reduce the cost of sequencing whole genomes. It offers genomic and molecular diagnostic products & services to cater to the fields of oncology, molecular epidemiology, drug development, microbial genomics, agri-genomics, infectious diseases surveillance, forensic genomics, and translational research involving HLA sequencing & associated applications.

-

Bio-Techne (ASURAGEN, INC.) - The company is engaged in molecular diagnosis that drives patient management in oncology and genetic disorders through clinical testing solutions. It discovers, develops, & commercializes diagnostic products used in clinical laboratories and serves pharmaceutical diagnostic needs. Asuragen’s lines of innovative diagnostic systems are expected to help transform medicine by enhancing clinical outcomes. The products, services, and technologies drive patient management decisions across genetic disease, oncology, & other molecular tests.

-

Abbott - Abbott Laboratories is involved in discovering, developing, manufacturing, and marketing a wide range of healthcare products. The company operates its business through four reportable segments—diagnostic products, established pharmaceutical products, nutritional products, and cardiovascular & neuromodulation products. The diagnostic products segment includes various diagnostic systems and tests. The company markets & sells its products directly to hospitals, clinics, physicians’ offices, commercial laboratories, blood banks, government agencies, and therapeutic companies through its distribution centers, public warehouses, & third-party distributors.

-

Agilent Technologie s (Dako A/S) - The company offers immunohistochemistry products, including antibodies & controls, visualization systems, and ancillaries for immunohistochemistry. It also provides pharmacodiagnostic kits that allow doctors to find the right treatment for the right patient at the right time and molecular pathology products comprising CISH & FISH kits, FISH probes, labeled probes & detection systems, and blotting detection systems, which aid in deciphering the invisible features of cancer at a molecular level to provide diagnosis. The company has collaboration agreements with Bristol-Myers Squibb for the development of pharmDx tests and with Genentech for the regulatory submissions of HercepTest & HER2 FISH pharmDx as companion diagnostics for pertuzumab, as well as a strategic alliance with Epitomics to establish a portfolio of rabbit monoclonal antibodies. Dako A/S has operated as a subsidiary of Agilent Technologies, Inc. since June 2012.

-

Exact Sciences Corporation - Exact Sciences Corporation is a publicly traded organization dealing in molecular diagnostics specifically to provide solutions to the early detection and prevent colorectal cancer. This company is also involved in the development of noninvasive screening tests. It is known for Cologuard test, which is based on stool-based DNA & antibody-based immunochemical test (FIT) for the detection of polyps or precancerous lesions and the four phases of colorectal cancer. It also focuses on the treatment of inflammatory bowel disease.

-

Danaher Corporation (Cepheid, Inc.) - Danaher designs manufactures, and commercializes products and services catering to medical, professional, & commercial applications. The company operates through four segments: diagnostics, life sciences, environmental & applied solutions, and dental solutions. Danaher’s diagnostics segment offers reagents, analytical instruments, software, consumables, and services for physicians’ offices, hospitals, reference laboratories, & other critical care settings to diagnose various diseases. North America generated 38% of diagnostics share in 2016. Danaher’s facilities are in more than 60 countries. Danaher acquired Leica Biosystems Nussloch GmbH in 2005. The company offers products across immunohistochemistry, digital pathology, surgery, clinical microscopy, in situ hybridization, radiology, FISH, and histology equipment & consumables.

-

AMGEN INC (Decode Genetics, Inc.) - Amgen, Inc. was established as Applied Molecular Genetics and later renamed as Amgen. It is a biotechnology company that develops medicines for various conditions. The company relies on genetic tools to understand a disease for the development of medicines for various diseases. It has a presence in nearly 100 countries, and it focuses on six therapeutic fields: cardiovascular disease, nephrology, oncology/hematology, bone health, inflammation, and neuroscience.

-

QIAGEN - QIAGEN is a publicly held biotechnological company operating in over 25 countries, including the U.S., the U.K., Germany, the Netherlands, France, and China. The company has a key business in assay technologies for molecular diagnostics, pharmaceuticals, academics, and applied testing. Its product portfolio includes NGS, molecular diagnostics, animal & veterinary testing, bioinformatics, food & safety testing, human ID & forensics, and life science research. QIAGEN’s commercial partners and importers include Tecnolab, UniMed Ltd, Global Pharmaceutical Solution, and Suyog Diagnostics.

-

Exagen, Inc. - Exagen, Inc. is a privately held diagnostics company. It develops and markets products for diagnostic & prognostic procedures for physicians. In addition, it manufactures products for chronic diseases, organ-related disorders, and therapeutic procedures, especially for arthritis.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Personalized Medicine Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Personalized Medicine Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."