- Home

- »

- Animal Health

- »

-

Pet Dental Health Market Size, Share & Trends Report, 2030GVR Report cover

![Pet Dental Health Market Size, Share & Trends Report]()

Pet Dental Health Market Size, Share & Trends Analysis Report By Animal Type (Cats, Dogs), By Type (Products, Services), By Indication (Gum Disease, Dental Calculus), By Distribution Channel, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-982-7

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Pet Dental Health Market Size & Trends

The global pet dental health market size was estimated at USD 6.18 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.25% from 2023 to 2030. The increasing prevalence of numerous pet dental diseases, rising awareness among pet parents to prevent painful dental conditions, the growing number of veterinary dental check-ups & procedures, strategies implemented by key companies, the launch of advanced pet oral care products, and rising pet ownership rates are some of the key factors driving the growth of the market. According to the American Veterinary Medical Association (AVMA), periodontal diseases are the most common dental conditions visibly evident among pets over 3 years old.

More than 80% of dogs are diagnosed to have active dental diseases after reaching age three, according to VCA Animal Hospitals. Maintaining the dental health of pets with necessary oral care products and routine dental cleaning, and other treatments are very crucial in improving animals’ overall health and behavior. These factors are expected to be profitable opportunities for market growth. The COVID-19 pandemic has caused the pet dental health market to downturn, especially during the year 2020. This unfavorable impact is majorly owing to the declaration of lockdowns in various regions, which resulted in the closure and restricted access to veterinary services.

This circumstance has created hurdles among pet owners in accessing better veterinary dental care due to the cancellation and forced limitation of veterinary dental appointments. According to the American Veterinary Medical Association, veterinary services during the pandemic have been a great challenge for veterinarians globally. The veterinary practices’ productivity declined by 25% in the U.S., driven by the pandemic in 2020. However, veterinary practices being an essential healthcare business in the country, the services rebounded starting in 2021 as the activities resumed gradually.

The market’s major players have faced certain challenges in maintaining their veterinary oral care product supply due to the uncertainty of distribution channels. However, government agencies and key market players have taken several measures to maintain their animal healthcare business throughout the pandemic. For instance, Virbac stated in the 2020 annual report that during the year, the company did not experience supply difficulties that could have impacted their overall sales, however, the production sites were unable to operate at 100% capacity, which caused delivery difficulties. The company’s strategies for crisis supply chain management have increased its revenue in the following years.

Some of the other key factors driving the pet market include the growing adoption of pet insurance with dental care coverage, return to normality post-pandemic with enhanced e-commerce sites, increased pet healthcare expenditure, R&D initiatives in the veterinary dental industry by major companies, and expansion of oral care product offerings. For instance, according to the American Pet Products Association, the U.S. pet care expenditure raised from USD 90.5 billion to 136.8 billion from 2018 to 2022. The vet care and product sales are estimated at 35.9 billion spent, which includes pet dental care. Hence, the rising annual expenditure for pet healthcare is a significant factor in the market growth.

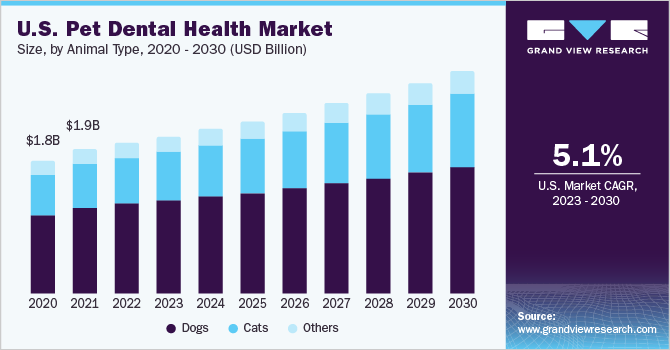

Animal Type Insights

The dog segment accounted for the largest revenue share of over 55% in 2022owing to the increasing dog adoption rates and significant dental disease prevalence estimated among them. The growing population rate of dogs in every region is greatly boosting the growth of the market. According to the American Kennel Club (AKC), the number of dog-owning households increased from 50% in 2018 to 54% in 2021 in the U.S. As per the 2022 FEDIAF European Pet Food Industry, 90 million households (which is 46%) in Europe owned a pet, and the dog population rate in the region was estimated to be 92.9 million in 2021. In addition, the COVID-19 pandemic has encouraged most people in the world to adopt dogs for psychological comfort. The cat segment is anticipated to grow at the fastest CAGR of around 7% during the forecast period.

This is owing to the increasing awareness among pet parents concerning symptoms of dental conditions in their cats. The growing prevalence of gingivitis in cats is another factor that is boosting segmentgrowth. For instance, according to Cornell Feline Health Center, the prevalence of gum diseases, such as gingivitis and periodontitis, is estimated between 50% to 90% among the feline population. Such dental diseases can also be caused by other infectious conditions, such as feline leukemia virus, diabetes mellitus, feline immunodeficiency virus, autoimmune diseases, and kidney diseases. Hence, regular plaque removal with oral care techniques and routine teeth cleaning is widely performed, which significantly impacts segment growth.

Type Insights

The product segment held a significant market share and is expected to grow at the fastest CAGR of 7.3% over the forecast period. This is majorly owing to the growing awareness among pet parents regarding animal dental care. A wide range of pet oral care products, such as enzymatic toothpaste & brushes, oral care solutions, dental care powder, foods, treats, & chews, and dental wipes, among others, is available for maintaining pets’ oralhealth. Rapid advancements in the veterinary industry have unveiled several novel products in the market by major key players. Despite the pandemic, some of theindustry players have seen significant growth in oral care product sales through e-commerce supply.

For instance, Tropiclean saw a 15% rise in its pet dental care products in 2020 compared to its sales in 2019.The services segment held the largest market share in 2022. This is owing to the wide range of dental care diagnostic and treatment services offered by various veterinary practices. Dental health plays a major role in pets’ overall health and behavior, therefore, routine dental check-up once a year is crucial among pets. The key factor to manage dental disorders is prevention; hence, cleaning the plaque formation with regular teeth cleaning and brushing is necessary. The American Animal Hospital Association recommends routine oral examinations and dental cleanings to remove tartar and prevent gum diseases.

Indication Insights

The gum diseases indication segment held the largest market share of over 35% in 2022 of the global revenue. This is owing to the large prevalence rate of gum diseases, such as periodontitis and gingivitis, diagnosed among companion animals. Periodontal diseases are caused by mouth bacteria and are widely progressive. They damage the gums, teeth, maxilla, mandible bones, and other facial structures. Since the disease initiates beneath the gum area, the evident signs and symptoms are only observed once it is progressed. Nearly 80% of dogs and 70% of cats above the age of 3 years have active gum diseases. This attributes to the largest share registered by the segment in the market.

The dental calculus segment is expected to grow at the fastest CAGR of 7.6% over the forecast period owing to its prevalence among domestic dogs. Dental calculus can be removed only through a professional veterinary dentist by dental teeth cleaning and polishing. However, regular teeth brushing can minimize the plaque build-up in animals’ teeth to prevent the progression of calculus followed by major gum diseases. Dental chews help in removing dental calculus over the tooth surface. This widespread pet oral problem can lead to periodontal diseases if not prevented at early stages with routine brushing and maintained oral hygiene.

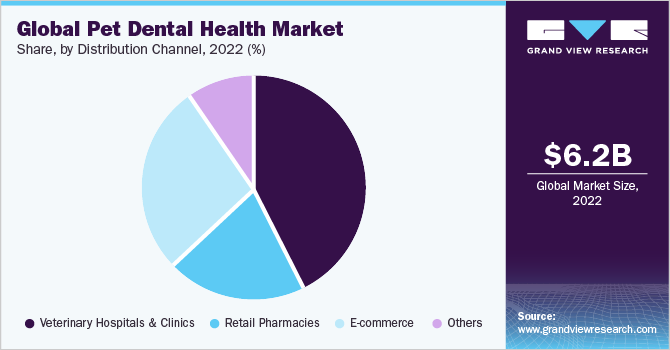

Distribution Channel Insights

The veterinary hospitals & clinics segment held the largest market share of over 40% in 2022 by the distribution channel segment. This is owing to a growing number of veterinary hospitals and clinics globally with advanced infrastructures. Veterinary clinics and hospitals are very crucial for pet dental healthcare as they provide professional dental treatments with registered veterinary dentists. The growing number of veterinary professionals is another factor driving the segment growth in the market. According to the American Veterinary Medical Association, the number of veterinary professionals in the U.S. reached 121,461 in 2021.

The other distribution channels, such as e-commerce websites, are widely contributing to the growth of the market. With an increased number of households owning companion animals, their demand for convenient access to pet oral care products is rising. There are various brands of oral care toothbrushes and pastes, oral care water additives, rinses, wipes, dental care foods & treats, chews, and others available for dental care application in pet animals.The online sales of these products have grown widely during the COVID-19 pandemic. E-commerce/online stores have become a convenient and easily accessible platform for pet dental care products.

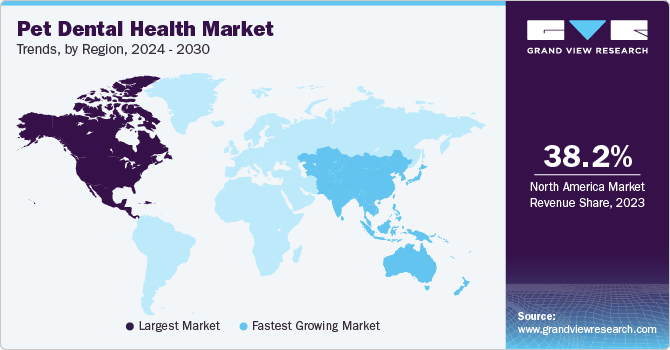

Regional Insights

North America held the largest share of more than 35% in 2022. The high share of the region is due to the significant presence of key players, the adoption of various strategies initiated by key companies to increase market penetration, easy treatment availability, rising diagnostic rates, and increasing pet population & expenditure. The growing number of veterinary clinics with licensed and trained veterinary dentists in the countries is another factor boosting the growth of the market. According to the AVMA, in 2020, nearly 118,624 licensed veterinarians were estimated in the U.S., which majorly catered to pet animal patients.The Europe region holds the second-largest share of the market.

This is owing to the presence of major key players, such as Virbac, and Dechra Pharmaceuticals plc., in European countries. The Asia Pacific region is estimated to grow at the fastest CAGR of around 8% over the forecast years. This is attributed to the rising animal healthcare expenditure & disposable income in key markets and increasing awareness about pet dental diseases in developing countries. The growing demand for proper and timely diagnosis with routine dental clean-ups and pet humanization in developing countries like India is further boosting the region’s growth.

Key Companies & Market Share Insights

The industry is fairly competitive. Leading players deploy various strategic initiatives that include competitive pricing strategies, partnerships, product and service expansion, sales & marketing initiatives, and mergers & acquisitions. For instance, in August 2022, the Colgate-Palmolive Company decided to purchase 3 dry pet food production facilities from Red Collar Pet Foods for USD 700 million to assist the global expansion of its Hill's Pet Nutrition business. Such initiatives by companies and animal dental health organizations are fueling the opportunity for market growth.Some of the prominent players in the global pet dental health market include:

-

Virbac

-

Colgate- Palmolive Company

-

Dechra Pharmaceuticals plc

-

Nestlé Purina Pet Care

-

Vetoquinol SA

-

Nylabone (Central Garden & Pet Company)

-

Barkbox

-

imRex Inc.

-

Basepaws, Inc.

-

Animal Microbiome Analytics, Inc.

-

Dentalaire, International.

-

Pedigree (Mars Incorporate)

-

PetIQ, LLC.

-

Animal Dental Clinic

-

Petzlife UK

Pet Dental Health Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.53 billion

Revenue forecast in 2030

USD 9.98 billion

Growth rate

CAGR of 6.25% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million/billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, animal type, indication, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; UK; France; Spain; Germany; Italy; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Virbac; Colgate- Palmolive Company; Dechra Pharmaceuticals plc; Nestlé Purina Pet Care; Vetoquinol SA; Nylabone (Central Garden & Pet Company); Barkbox; imRex Inc.; Basepaws, Inc.; Animal Microbiome Analytics, Inc.; Dentalaire, International.; Pedigree (Mars Incorporate); PetIQ, LLC.; Animal Dental Clinic; Petzlife UK

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Dental Health Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the pet dental health market based on type, animal type, indication, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Products

-

Oral Care Products

-

Tooth Pastes & Brushes

-

Oral Care Solutions

-

Foods & Treats

-

Dental Chews

-

Dental Powder

-

Others

-

-

Medicines

-

Equipment

-

-

Services

-

Diagnosis

-

Treatment

-

Dental Cleaning

-

Surgery

-

Root Canal Therapy

-

Others

-

-

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Gum Disease

-

Endodontic Diseases

-

Dental calculus

-

Oral tumor

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Retail Pharmacies

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global pet dental health market size was estimated at USD 6.18 billion in 2022 and is expected to reach USD 6.53 billion in 2023.

b. The global pet dental health market is expected to grow at a compound annual growth rate (CAGR) of 6.25% from 2023 to 2030 to reach USD 9.98 billion by 2030.

b. North America dominated the pet dental health market with a share of over 35% in 2022. This is attributable to the increasing pet healthcare expenditure and the large number of veterinary practice establishments in the region.

b. Some key players operating in the pet dental health market include Virbac; Colgate- Palmolive Company; Dechra Pharmaceuticals plc; Nestlé Purina Pet Care; Vetoquinol SA; Nylabone (Central Garden & Pet Company); Barkbox; imRex Inc.; Basepaws, Inc.; Animal Microbiome Analytics, Inc.; Dentalaire, International.; Pedigree (Mars Incorporate); PetIQ, LLC.; Animal Dental Clinic; Petzlife UK.

b. Key factors that are driving the pet dental health market growth include the growing prevalence of numerous pet dental diseases, such as periodontitis, and rising awareness among pet parents coupled with the increasing number of routine veterinary dental check-ups and treatments.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."