- Home

- »

- Animal Health

- »

-

Pet Diabetes Care Market Size, Share & Growth Report, 2030GVR Report cover

![Pet Diabetes Care Market Size, Share & Trends Report]()

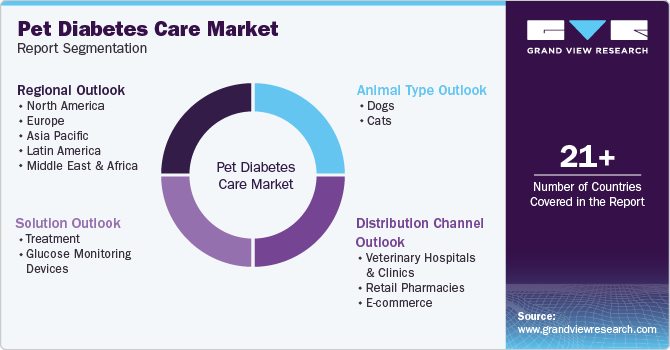

Pet Diabetes Care Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Solution (Treatment, Glucose Monitoring Devices), By Distribution Channel (E-Commerce), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-953-9

- Number of Pages: 139

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global pet diabetes care market size was valued at USD 1.72 billion in 2022 and is expected to expand at a lucrative compound annual growth rate (CAGR) of 8.24% from 2023 to 2030. Factors such as the increased number of pets, growing pet adoption, availability of pet diabetes care devices, the prevalence of various diseases, and rising risks to health remain key drivers of growth. Moreover, the rise in incidences of chronic diseases such as diabetes and cancer among pets, supportive awareness programs, and strategies implemented by key companies are also driving the growth. According to a PetMD article published in April 2022, one in every 300 dogs is diagnosed with diabetes. Older dogs over 7 years of age and obese female dogs have a higher risk of developing diabetes. Some breeds remain prone to diabetes. These include the Australian Terrier, Bichon Frise, Keeshond, Labrador Retriever, Pug, Cairn Terrier, Samoyed, and Spitz, among others.

The COVID-19 pandemic resulted in reduced sales and dampened the growth rate of the pet diabetes care industry, especially in 2020. This effect was primarily brought on by the declaration of lockdown in various nations, as well as limited access to or closing of veterinary services. The market, however, recovered gradually as the underlying reasons for demand remained unchanged. The pandemic also led to increased awareness of pet parents regarding pet health and the uptake of pet insurance, which is expected to support market growth in the near future.

The increasing prevalence of diabetes in pets as well as improving diagnostic rates are projected to fuel the market growth. As per Dr. Jamie Gallagher, veterinary surgeon at the Society for the Prevention of Cruelty to Animals in Hong Kong and the South China Morning Post, diabetes is the second most prevalent endocrine condition in cats, affecting around 1 in 200 cats (or 0.5%) and 1 in 500 dogs. The standard approach for controlling diabetes includes regular testing for blood sugar, insulin injections, and lifestyle changes.

As per the USDA, in 2020, the average life expectancy of dogs was estimated at 14-15 years. On the other hand, the life expectancy of cats was estimated at 15-16 years. This makes the pet population more susceptible to chronic diseases, such as diabetes, leading to a greater demand for insulin & glucose monitoring products. Similar factors are expected to fuel the market growth over the coming years.

Furthermore, increasing product advancements and the availability of diabetes treatment options are also estimated to support market growth. For instance, insulin therapy products suitable for cats with diabetes include Boehringer Ingelheim’s ProZinc (the standard and first insulin therapy approved by FDA, specifically for cats with diabetes), Lente, and insulin glargine. Veterinarians continue to recommend insulin therapy for most pets. This is another key factor driving market growth.

Some other widely prescribed insulin products for pet diabetes are humulin, NPH, and detemir. According to the American Animal Hospital Association, detemir (launched by Novo Nordisk) is a human recombinant (U-100) long-acting insulin, which prolongs insulin absorption.

Animal Type Insights

The dog segment dominated the global pet diabetes care industry by animal type in 2022 due to the rising adoption rates of dogs and the significant disease prevalence. The market is expanding as a result of the rising dog population & expenditure across the globe. In 2020, 45% of American homes had dogs, according to the American Veterinary Medical Association. Similarly, according to the European Pet Food Industry, nearly 88 million households in Europe owned a pet, and the dog population was estimated to be 90 million in 2020. In addition, the COVID-19 pandemic has encouraged most people in the world to adopt companion animals for psychological comfort.

The cat segment is anticipated to register a CAGR of over 8% during the forecast period owing to the increasing awareness among pet owners concerning symptoms of diabetes in their cats. The growing prevalence of diabetes in the cat population is another factor boosting the growth. For instance, according to Boehringer Ingelheim International GmbH, cats are three times more prone to develop diabetes as compared to dogs. In addition, more than half of the cats are obese, thereby carrying a higher risk of developing diabetes. Visual symptoms such as excessive urination, thirst, appetite, and sudden weight loss in diabetic cats are alerting pet parents to undertake timely diagnosis and follow treatments.

Solutions Insights

By solutions, the treatment segment had the largest market share in 2022. Veterinarians prefer insulin therapy as a gold standard treatment for diabetes in pet animals, as it aids in transferring glucose from consumed food to other parts of the body. The necessity for insulin delivery devices such as syringes, needles, and delivery pens remains high in veterinary hospitals and households, as the needles cannot be reused.

The glucose monitoring devices segment is expected to hold a significant market share over the forecast period, owing to the growing diagnosis rate of pets with diabetes and companies launching pet diabetes care devices. As human glucometers are not accurate for animal glucose readings, specific pet glucose monitoring devices have been launched by the key players.

For instance, the AlphaTRAK blood glucose monitoring system by Zoetis is an easy-to-use veterinary kit that helps pet owners to manage their pet’s diabetes condition. In addition, companies are also providing online application software that can be used with these devices to view reliable vital data on smartphones or tablets. For instance, Zoetis launched the PetDialog App, which is used along with the AlphaTRAK monitoring device. These factors are supporting the segmental growth of the market.

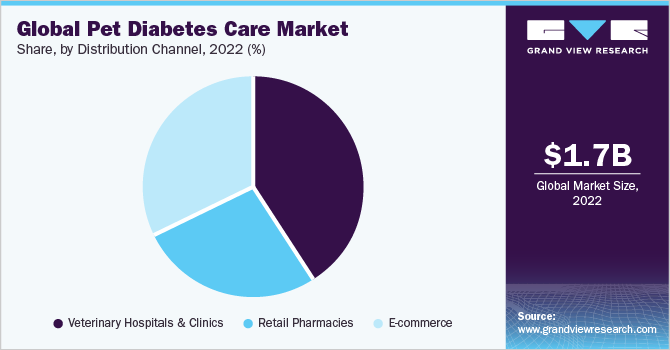

Distribution Channel Insights

Based on the distribution channel, the veterinary hospitals & clinics segment held the largest market share of over 40% in 2022. This is owing to a growing number of veterinary hospitals and clinics with advanced infrastructures. Veterinary clinics and hospitals are also primary centers of care for pet parents and a major source for acquiring medications for sick pets. The growing number of veterinarians is another factor driving the segment growth in the market. According to the Federation of Veterinarians of Europe, the number of veterinarians was approximately 263 million in Europe in 2019.

Other distribution channels such as retail pharmacies and e-commerce websites are extensively contributing to the expansion of the market. Pet glucometers and insulin devices have been growing in demand as the number of diabetic pets increases. In retail veterinary pharmacies, a variety of types of glucose monitors and insulin delivery pens are offered for diabetes applications in companion animals.

During the COVID-19 pandemic, pet diabetic products witnessed significant growth in sales via the internet. E-commerce, or internet stores, have developed into a practical and simple but effective distribution channel for pet care products.

Regional Insights

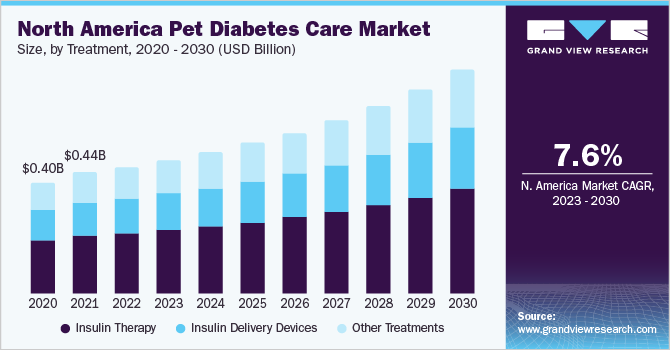

North America held more than 40% of the revenue share of the market in 2022. The high share of the region is due to the significant presence of key players, the adoption of various strategies initiated by key companies to increase market penetration, rising treatment availability, rising diagnostic rates, and increasing pet population & expenditure. The growing number of veterinary clinics with licensed and trained veterinarians in the countries is another factor boosting the growth of the market. According to the AVMA, in 2020, nearly 118,624 licensed veterinarians were estimated in the U.S., which majorly catered to pet animal patients.

The Europe region held the second-largest revenue share of the market for pet diabetes care in 2022. This is owing to the presence of major key players such as Boehringer Ingelheim International GmbH and others in European countries. Asia Pacific is estimated to register a CAGR of over 9% from 2023 to 2030. This is attributable to the rising animal healthcare expenditure & disposable income in key markets and increasing awareness about the disease in developing countries. The growing demand for proper and timely diagnosis of pet diabetes, and pet humanization in developing countries like India, is further boosting the growth of the market.

Key Companies & Market Share Insights

The market is competitive, with the leading players deploying various strategic initiatives, such as competitive pricing, partnerships, solution expansion, sales & marketing initiatives, and mergers & acquisitions. For instance, in August 2020, Boehringer Ingelheim International GmbH launched the 20 ml presentation of prozinc (protamine zinc recombinant human insulin) as a single-dose daily drug for canines associated with diabetes.

Similarly, manufacturers have initiated certain programs to enhance pet diabetes awareness and help pet parents with pet diabetes care products. For instance, in August 2019, Zoetis stated that its Diabetes Pet Care Alliance program is continuously receiving support from its partner companies such as Merck Animal Health and Purina. The program is growing significantly each year since its inception in 2014. Such initiatives by companies and organizations are fueling the opportunity for market growth. Some prominent players in the global pet diabetes care market include:

-

Merck & Co., Inc.

-

Zoetis

-

BD

-

Boehringer Ingelheim International GmbH

-

Trividia Health, Inc.

-

Allison Medical, Inc.

-

UltiMed, Inc.

-

ACON Laboratories Inc.

-

i-SENS, Inc.

-

TaiDoc Technology Corporation

Pet Diabetes Care Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.82 billion

Revenue forecast in 2030

USD 3.16 billion

Growth Rate

CAGR of 8.24% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Animal type, solutions, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Rest of Europe; Japan; China; India; Australia; South Korea; Rest of Asia Pacific; Brazil; Mexico; Rest of Latin America; South Africa; Rest of the Middle East & Africa

Key companies profiled

Merck Animal Health; Zoetis; BD; Boehringer Ingelheim International GmbH; Trividia Health, Inc.; Allison Medical, Inc.; UltiMed, Inc.; ACON Laboratories, Inc.; i-SENS, Inc.; TaiDoc Technology Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Diabetes Care Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global pet diabetes care market report based on animal type, solution, distribution channel, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Treatment

-

Insulin Therapy

-

Insulin Delivery Devices

-

Other Treatments

-

-

Glucose Monitoring Devices

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Retail Pharmacies

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Rest of the Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global pet diabetes care market size was estimated at USD 1.72 billion in 2022 and is expected to reach USD 1.82 billion in 2023

b. The global pet diabetes care market is expected to grow at a compound annual growth rate (CAGR) of over 8.24% from 2023 to 2030 to reach USD 3.16 billion by 2030

b. North America dominated the pet diabetes care market with a share of over 40% in 2022. This is attributable to the increasing pet healthcare expenditure and the constant research & development initiatives in the region

b. Some key players operating in the pet diabetes care market include Merck Animal Health, Zoetis, BD, Boehringer Ingelheim International GmbH, Trividia Health, Inc., Allison Medical, Inc., UltiMed, Inc., ACON Laboratories, Inc., i-SENS, Inc., and TaiDoc Technology Corporation.

b. Key factors that are driving the pet diabetes care market growth include the increasing companion animal population and pet adoption, availability of pet diabetes care devices, the prevalence and rising risk factors of the disease, supportive awareness programs, and strategies implemented by key companies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."