- Home

- »

- Animal Health

- »

-

Pet Obesity Management Market Size & Share Report, 2030GVR Report cover

![Pet Obesity Management Market Size, Share & Trends Report]()

Pet Obesity Management Market Size, Share & Trends Analysis Report By Product (Therapeutic Food, Supplements), By Animal Type (Dogs, Cats, Other Animals), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-888-6

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Pet Obesity Management Market Trends

The global pet obesity management market size was estimated at USD 9.58 billion in 2023 and is projected to grow at a CAGR of 5.94% from 2024 to 2030. The market growth is primarily being driven by the increasing global prevalence of pet obesity, rising availability & adoption of pet insurance coverage, ever-increasing population of pets globally, and supportive initiatives undertaken by industry players, as well as governmental & nongovernmental organizations. For instance, in August 2023 Mars Inc. proposed investing Rs 800 crore (USD 95.94 million) for the phase-II expansion of its Telangana plant for the production of popular pet food brands like Pedigree and Whiskers with a previous investment of Rs 200 (USD 23.98 million) crore. The Telangana government and Mars Inc. have formed a comprehensive partnership to enhance initiatives focused on pet care & nutrition in India.

Since the outbreak of the COVID-19 pandemic, 33% of pet parents with overweight pets have reported that their pets gained weight as a result of the pandemic. This has increased demand for pet obesity treatment products. However, the majority of pet parents (73%) felt comfortable admitting to others that their pet is overweight without seeking medical advice. Furthermore, findings from a recent analysis by Hill's Pet Nutrition in collaboration with Kelton Global demonstrated that pet obesity and overweight have been rising for years. Moreover, COVID-19 has made this problem worse. Veterinarians report that over 71% of pet professionals believe that the outbreak has affected pet food habits. To keep pets busy while owners worked from home, they overfed their pets.

In addition, according to senior veterinarian Dr. Kitty Cheung, pet obesity has long been a problem in Australia, where 32% of cats and 41% of dogs are obese, according to the Australian Veterinary Association. Industry leaders like Zoetis, Inc.; Mars Incorporated, Hill's Pet Nutrition, Inc., Nestlé S.A, Virbac S.A., Dechra, Neogen Corporation, NOW Foods Drools Pet Food Pvt. Ltd., Delicate Care, Vivaldis Health & Foods Pvt. Ltd. (Sun Pharmaceutical Industries), ProBalance, Masterpet Australia Pty Ltd., VioVet Ltd (Pinnacle Pet Group), Rolf C. Hagen, Inc., etc. are investing significantly in research and development of novel products for obesity and weight management in dogs and cats. A rise in pet obesity globally is a major factor driving lucrative growth in the market. For example, in the U.S., in 2022, 61% of cats and 59% of dogs were overweight or obese, according to the Association for Pet Obesity Prevention (APOP).

Furthermore, a European study published in 2018 stated that upon estimation of Body Mass Index (BMI), 32% of dogs in the study were overweight or obese, 62% were of normal weight, and 6% of the dogs were underweight. Body Fat Index (BFI) chart showed that 56% of the dogs were overweight or obese, however, the owners' assessment of the dogs' Body Condition Scores (BCS) indicated that 22% of the dogs were overweight or obese. Furthermore, pet insurance makes sure that obesity-related issues are compensated for, and that the owners are not paying for associated costs. Acceptance of pet insurance is on rise due to several factors, including the humanization of pets, growing pet population, increasing initiatives by major corporations, rising veterinary care expenses, and growing adoption of pet insurance in underserved areas.

Over the projected period, it is expected that a rise in the number of insured pets would support the growth of pet insurance enrollments globally due to increasing humanization & ownership of pets in many countries. The North American Pet Health Insurance Association (NAPHIA) Organization released its 2022 report, which states that the covered pet population in the U.S. grew by 28.3% in 2021 compared to 2020. This increase was led by a 37% increase in cats and a 26.5% surge in insured dogs, respectively. According to the same source, between 2020 and 2021, the number of insured pets in Canada increased by 22.7%. According to reports, this growth rate was the highest in the last 5 years. Dogs were enrolled for a majority of insurance, followed by cats. Conversely, in February 2023, a pet insurance provider—Trupanion—declared that as of December 31, 2022, 1.54 million people were enrolled in their program—a 31% increase from 2021.

Market Concentration & Characteristics

The market growth stage is high, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to such as advancements, such as the emergence of specialized supplements, flourishing startup culture focusing on developing innovative products for obesity management in pets, the aging pet population, and rising danger of obesity-related conditions.

One major factor propelling market growth is the rising incidence of arthritis in dogs. Animals frequently get arthritis, especially dogs. It can occur as a result of injury, obesity, or aging. For example, according to a Morris Animal Foundation report from October 2023, osteoarthritis affects around 14 million adult dogs in the U.S., making it a major health problem for dog owners. The exact percentages for cats are unknown, although 90% of cats over the age of 12 show X-ray evidence of osteoarthritis. These figures demonstrate the substantial number of animals suffering from this illness.

The market is also characterized by a high level of merger and acquisition (M&A) activities by leading players as well as emerging players. For instance, In August 2022, Colgate-Palmolive Company acquired three dry pet food manufacturing facilities in the U.S. from Red Collar Pet Foods for USD 700 million, a move aimed at bolstering the global expansion of its Hill's Pet Nutrition business.

The market demonstrates a moderate degree of innovation, characterized by ongoing collaboration between market players, launching new products, and supportive initiatives. For instance, in February 2022, Virbac introduced a specialized pet food line for spayed and neutered pets, recognizing the heightened risk of obesity due to metabolic changes post-surgery. This initiative aligns with Virbac's broader strategy to establish a prominent U.S. pet food market presence with Veterinary HPM Pet Nutrition

There is a moderate level of mergers and acquisitions activity within the market, indicating ongoing consolidation and strategic collaborations between industry leaders. In March 2023, for instance, Sun Pharmaceutical Industries Limited signed an agreement to purchase a 60% stake in Vivaldis Health And Foods Private Limited. Vivaldis Health & Foods operates in the companion animal healthcare industry, focusing on trading, distributing, manufacturing, and marketing drugs, food supplements, and OTC products

The market experiences a moderate impact of regulations. Regulatory Authorities, such as the U.S. FDA, EU, European Food Safety Authority (EFSA), Therapeutic Goods Administration (TGA), Food Safety & Standards Authority of India (FSSAI), etc., approve and regulate the drugs intended for animal use. Government initiatives, subsidies, and financial assistance programs, on the other hand, help promote healthy management of obesity in pets. For instance, in India, The Prevention of Cruelty to Animals Act (1960) promotes responsible pet ownership, and pet animals are required to undergo regular healthcare checkups, treatments, & vaccinations. Pet owners who are found guilty of any offense against pet animals are punishable under the 428 and 429 sections of the Indian Penal Code

The risk of substitutes is expected to be high. From region to region and country to country, the type of care, as well as standard of care, varies in both human as well as veterinary medicine. Though globally these products are considered a standardized type of treatment for veterinary use, in some countries, alternate forms of treatments do exist: Substitution treatments like traditional methods (Ayurveda, Chinese Traditional Medicine, etc.), off-label medications, home remedies, etc.

In October 2023, Hill's Pet Nutrition officially opened a state-of-the-art manufacturing plant in Tonganoxie, Kansas. The 365,000-square-foot smart facility is dedicated to boosting production capacity for canned pet food, facilitating the growth of Hill's Science Diet and Prescription Diet brands

Product Insights

The therapeutic food segment held the highest market share of 89.49% in 2023 owing to increased awareness of pet obesity, a higher level of nutritional education among pet owners, the influence of veterinary recommendations, the availability of specialized pet foods, and a rise in demand for therapeutic foods for obesity management in pets. Similarly, the constnat launch of novel therapeutic pet foods has enhanced availability and accessibility in the market. This, coupled with effective distribution channels, makes it easier for pet owners to access and incorporate these specialized diets into their pets' daily nutrition. For instance, in March 2023, Nestlé Purina PetCare introduced the OM Metabolic Response+Joint Mobility Canine Formula under the Purina ProPlan Veterinary Diet brand. This dry formula addresses pet obesity by reducing specific pro-inflammatory cytokines. In addition, it is formulated to assist dogs in shedding excess fat while minimizing the loss of muscle mass.

Launching this therapeutic diet aligns with the company's commitment to providing innovative and effective solutions for pet health, specifically targeting weight management and joint mobility. Furthermore, as veterinary science advances and recognizes the importance of nutrition in managing obesity-related health conditions, there is a greater chance of veterinarians recommending therapeutic foods. These formulations often include controlled calorie content, increased fiber, and specific nutrients to support weight management, such as L-carnitine. Some therapeutic pet foods contain L-carnitine, an amino acid that plays a role in fat metabolism. L-carnitine may help pets convert fat into energy, potentially supporting weight loss. For example, Purina Pro Plan Veterinary Diets offers “OM Overweight Management Dry Canine Formula,” specifically designed to assist dogs in losing body fat while preserving lean muscle mass. This dog food is a veterinary-recommended solution to support weight management in dogs.

Animal type Insights

By animal type, the dogs segment held the highest market share in 2023. Dogs are the most widely adopted pets in the world, and the American Pet Products Association's National Pet Owners Survey indicates that 69.0 million American households have dogs. Companies are offering new dog supplements, which are expected to fuel market growth over the forecast period. For instance, Royal Canin has launched an obesity management dry food formulated to reduce excessive body weight in dogs. High protein content in the food helps maintain muscle mass during a weight loss program. Furthermore, a rising rate of obesity in dogs contributes to demand for obesity management products. Pet owners are becoming more aware of associated health risks when their pets are overweight, leading to a higher demand for effective solutions.

The other animals segment is expected to register the highest CAGR during the forecast period. Obesity is a common health issue in small animals, including rabbits and guinea pigs. As pet owners become more aware of the risks associated with obesity in smaller pets, demand for specialized supplements tailored to their unique needs is also increasing. Furthermore, pet supplement manufacturers are developing specialized formulations to address unique nutritional requirements and challenges in small animals. These formulations often consider factors such as metabolism, calorie intake, and specific health concerns related to weight management in smaller pets.

Ongoing research and development in pet supplement industry led to the development of innovative formulations designed specifically for small animals. For instance, Small Pet Select offers a Rabbit Essentials Adult Rabbit Food with 14% protein content, making it a suitable option for obesity management in rabbits. Similarly, Supreme Petfoods provides a weight loss diet for overweight rabbits, which includes Timothy hay, a natural source of fiber and protein with appealing flavors & textures, which caters to the preferences of small pet owners, driving market growth

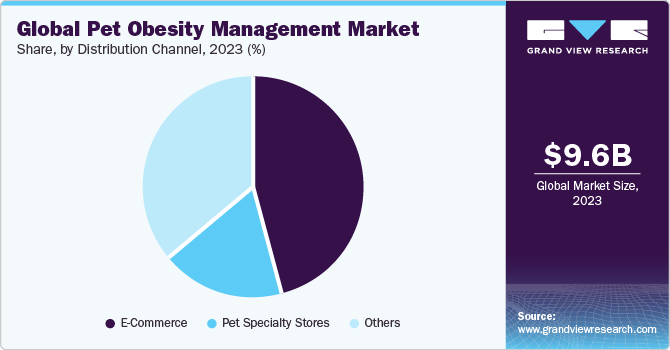

Distribution Channel Insights

The E-commerce segment led the market in 2023. This segment is anticipated to witness growth due to the extensive online availability of pet food and supplements for various pets, coupled with rising customer loyalty fostered by subscribe and save programs. Major reputable online suppliers of pet supplements catering to dogs, cats, fish, and birds include Chewy; Petco Animal Supplies, Inc.; BestVetCare.com; and Amazon. E-commerce platforms offer a wider selection of obesity management supplements, including niche and specialty products that may not be available in physical stores. Post-pandemic, the e-commerce supply of pet food and supplement products significantly increased. Such online websites have become a convenient option for pet parents to purchase supplements for pet obesity management.

These platforms provide various products in different ranges and quantities at competitive prices. In addition, they allow customers to compare the specifications of products before purchasing them. They also enable consumers to shop faster in the most efficient way. Pet specialty stores focus exclusively on pet-related products. Leading companies are increasing their market presence by establishing a strong distribution network, which is expected to drive segment growth. Pet specialty stores have a range of advantages, including expert guidance, specialized inventory, quality assurance, tailored solutions, educational opportunities, convenient access to other pet products, community engagement, local support, a firsthand shopping experience, and customer loyalty programs. These factors contribute to a positive and holistic shopping experience for pet owners seeking obesity management supplements.

The other distribution channels segment includes hypermarkets, supermarkets, vet clinics, etc. The penetration and availability of pet obesity management supplements in hypermarkets & supermarkets play a significant role in driving market growth. For instance, in August 2023, Pet Honesty launched its line of pet health supplements at PetSmart, a leading pet retailer in the U.S. Recognized as a leader in the development of nutritional supplements for pets, Pet Honesty's products are currently available at the top three pet retailers in the country, namely Petco, Pet Supplies Plus, and PetSmart. Moreover, the brand has a widespread presence in local and specialized pet stores, as well as in Tractor Supply Company, enabling it to reach pet parents in more than 7,000 locations across the U.S., both in physical stores and online.

Various brands of pet supplements for obesity management, therapeutic diets, and other dietary foods from top players are available in hypermarkets and supermarkets for pets. Hypermarkets and supermarkets often engage in promotional activities, such as discounts, special offers, and loyalty programs. These promotions can incentivize pet owners to try obesity management supplements, leading to increased sales. Furthermore, major pet care brands often invest in promoting their products in hypermarkets & supermarkets, leading to increased visibility and awareness among pet owners. This can influence their purchasing decisions and lead to higher sales of obesity management supplements in these retail outlets.

Regional Insights

The North America pet obesity management market held the largest share of 40.21% in 2023 due to a high prevalence of obesity in dogs & cats in the region. A 2022 survey stated that more than 50% of the North American canine population is obese, and 40% to 45% of dogs aged between 5 years & 11 years are overweight. This excess weight in dogs can further lead to a risk of developing obesity. Major factors causing this are overfeeding and lack of exercise. Many public-private partnerships are emerging in the region, focusing on creating and implementing initiatives to improve companion animal health. Various awareness campaigns are being initiated to create awareness among pet owners to initiate timely management of obesity before it leads to further complications.

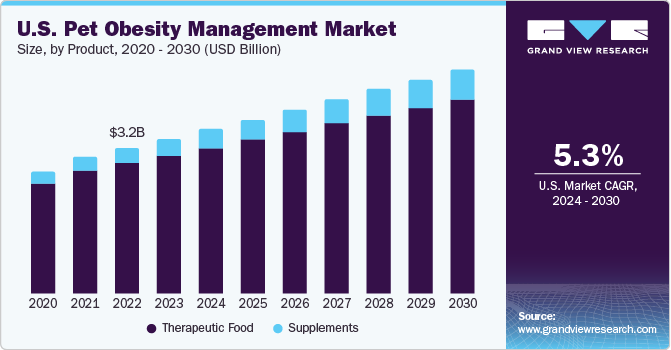

U.S. Pet Obesity Management Market Trends

The pet obesity management market in the U.S.is expected to have significant growth over the forecast period market as pet obesity is considered an epidemic in the country. American Animal Hospital Association (AAHA), in collaboration with the North American Veterinary Community (NAVC), published a report in 2020 on the connection between excess weight and the diagnosis & treatment of osteoarthritis. According to the study, in 2019, nearly 51% of the 1.9 million adult dogs that visited Banfield Pet Hospitals across the U.S. were overweight. The study further inferred that only 10% of these dogs successfully reduced weight to the recommended range, whereas 40% gained weight over 12 months. Considering these figures, the AAHA declared pet obesity in the U.S. an epidemic. 64% of pugs were overweight, topping the list of most overweight breeds.

Europe Pet Obesity Management Market Trends

Europe pet obesity management market held the second-largest share of the global revenue in 2023. The region is expected to experience consistent growth over the forecast period due to favorable government regulations. Pet food in the EU is subject to the same rules as animal feed, which is expected to comply with all applicable EU regulations. Ensuring feed product compliance is the feed business operator's (FBO) responsibility. EU law states that products in the pet food, supplement, or treat categories can be marketed to all 27 EU countries if an ingredient is a legal entity within the European Economic Area.

The pet obesity management market in the UK is estimated to grow exponentially over the coming years.Apart from traditional drugs and supplements, gadgets for the management of pet obesity are emerging in the UK. For instance, the veterinary R&D activities undertaken across the country are developing new animal care products. This helps build a knowledge base in the industry to create novel products for efficient pet care. The UK-based company, PitPat developed an activity monitor for dogs. This device is attached to the dog's collar, and it measures the amount of exercise the dog is getting, which can be monitored by the owner remotely. The implementation of such technologies is a crucial factor in boosting the UK market and promoting further innovation in this field.

Asia Pacific Pet Obesity Management Market Trends

Asia Pacific pet obesity management marketis anticipated to witness significant growth in future. China dominated the regional market in 2023, and India is anticipated to grow at the fastest CAGR from 2024 to 2030. The regional market is characterized by a diverse landscape influenced by specific national characteristics. The aging pet population in Japan strongly impacts market growth; elderly dogs and cats are more susceptible to obesity-related illnesses.

The market for pet obesity management in India is expected to grow significantly over the forecast years, as more pet owners seek quality animal healthcare. This can be attributed to increased knowledge of the importance of animal health and an increasing spending power on animals by owners.

Latin America Pet Obesity Management Market Trends

Latin America pet obesity management marketis projected to grow considerably over the coming years. A prevalent issue in Latin America is the lack of knowledge among pet owners on the significance of controlling pet obesity. According to a study conducted in Brazil, although a sizable dog owner population acknowledged that their dogs were overweight, very few sought expert help to manage their obesity. Mexico also has a disparity between estimated and reported dog obesity rates, highlighting the need for pet owner education.

The pet obesity management market in Brazil is driven by the need for the management of pet obesity by trained professionals. A 2020 study published in PLOS ONE examined the understanding of pet owners in Brazil about pet obesity. The research concluded that out of the study population, 52% of dogs were of ideal weight, 34% were overweight, and 14% were obese. Nearly 96% of pet owners agreed that their dogs were overweight; however, only 20% felt the need for trained professionals to manage obesity, expressing concerns about high potential treatment costs. This highlights the fact that proper education about the importance of trained professionals can lead to effective management of pet obesity and contribute to market growth.

Middle East & Africa Pet Obesity Management Market Trends

The MEA pet obesity management market growth is influenced by several characteristics unique to its countries, such as Saudi Arabia, Kuwait, the United Arab Emirates, and South Africa.

The pet obesity management market in South Africa is driven by the rising awareness about obesity as a major health issue, as overweight pets are more prone to numerous ailments. To encourage appropriate management, October is designated as Pet Obesity Month in South Africa. Despite such efforts, there is still a serious issue known as the Fat Gap, when pet parents frequently mistake their overweight pets as normal or healthy. Obesity is deemed the top health risk for pets in South Africa, driving the country's market, and further influencing pet parent behavior. Pets with excess weight are more likely to suffer from illnesses and may have shorter lives of up to 2.5 years. Over 20 diseases, including cancer, heart disease, rheumatoid arthritis, skin issues, and urinary tract issues, have been connected to obesity in pets.

Key Pet Obesity Management Company Insights

The market is fragmented and competitive owing to the presence of several small and large market players. These companies offer various pet obesity management solutions, such as therapeutic pet food designed for tackling obesity, supplements, and custom product manufacturing, to capture a greater share of the overall market. In addition, market players implement various strategic initiatives, such as mergers & acquisitions, partnerships, & collaborations, to support their growth objectives. For instance, in September 2022, Mars entered into a partnership agreement with Instacart to provide expedited delivery services for over 40 popular Mars brands through Instacart's retail associates. Among the cherished products included in this collaboration were M&M's, SNICKERS, BEN'S ORIGINAL, SEEDS OF CHANGE, PEDIGREE, and IAMS. The partnership aims to facilitate same-day delivery of these preferred items.

Key Pet Obesity Management Companies:

The following are the leading companies in the pet obesity management market. These companies collectively hold the largest market share and dictate industry trends.

- Mars Inc.

- Hill's Pet Nutrition, Inc.

- Nestlé S.A.

- Drools Pet Food Pvt. Ltd.

- FARMINA PET FOODS

- NOW Foods

- Virbac S.A.

- VioVet Ltd (Pinnacle Pet Group)

- Rolf C. Hagen, Inc.

- Dechra

- Vivaldis Health & Foods Pvt. Ltd. (Sun Pharmaceutical Industries)

- ProBalance

- Masterpet Australia Pty. Ltd.

- Neogen Corporation

- Delicate Care

Recent Developments

-

In March 2023, Sun Pharmaceutical Industries Limited signed an agreement to purchase a 60% stake in Vivaldis Health And Foods Private Limited. Vivaldis Health & Foods operates in the companion animal healthcare industry, focusing on trading, distributing, manufacturing, and marketing drugs, food supplements, and OTC products

-

In February 2022, Mars Petcare, a division of Mars Incorporated, officially entered into a binding agreement to purchase Champion Petfoods, a prominent global pet food manufacturer. The acquisition was set to be completed by an investor consortium primarily led by Bedford Capital and the Healthcare of Ontario Pension Plan

-

In October 2022, Pinnacle Pet Group acquired Crum & Forster Pet Insurance Group's operations in the UK, encompassing Pet Protect and VioVet

Pet Obesity Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.25 billion

Revenue forecast in 2030

USD 14.50 billion

Growth rate

CAGR of 5.94% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Mars Inc.; Hill's Pet Nutrition, Inc.; Nestlé S.A.; Drools Pet Food Pvt. Ltd.; FARMINA PET FOODS; NOW Foods; Virbac S.A.; VioVet Ltd. (Pinnacle Pet Group); Rolf C. Hagen, Inc.; Dechra; Vivaldis Health & Foods Pvt. Ltd. (Sun Pharmaceutical Industries); ProBalance; Masterpet Australia Pty. Ltd.; Neogen Corp.; Delicate Care

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Obesity Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pet obesity management market report based on product, animal type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Food

-

Supplements

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pet Specialty Stores

-

E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global pet obesity management market size was estimated at USD 9.58 billion in 2023 and is expected to reach USD 10.25 billion in 2024.

b. The global pet obesity management market is expected to grow at a compound annual growth rate of 5.94% from 2024 to 2030 to reach USD 14.50 billion by 2030.

b. North America dominated the pet obesity management market with a share of 40.21% in 2023. This is attributable to rising pet ownership and rise in prevalence of obesity in pets.

b. Some key players operating in the pet obesity management market include Mars Incorporated, Hill's Pet Nutrition, Inc., Nestlé S.A, Drools Pet Food Pvt. Ltd., FARMINA PET FOODS, NOW Foods, Virbac S.A., VioVet Ltd (Pinnacle Pet Group), Rolf C. Hagen, Inc., Dechra, Vivaldis Health & Foods Pvt. Ltd. (Sun Pharmaceutical Industries), ProBalance, Masterpet Australia Pty Ltd., Neogen Corporation, Delicate Care and FARMINA PET FOODS.

b. Key factors that are driving the market growth include growing global prevalence of pet obesity, rising availability & adoption of pet insurance coverage, the ever-increasing population of pets globally, and supportive initiatives taken by industry players, as well as governmental & nongovernmental organizations

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."