- Home

- »

- Animal Health

- »

-

Pet Sitting Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Pet Sitting Market Size, Share & Trends Report]()

Pet Sitting Market Size, Share & Trends Analysis Report By Pet Type (Dogs, Cats), By Service Type (Care Visits, Drop-in Visits), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-885-5

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Pet Sitting Market Size & Trends

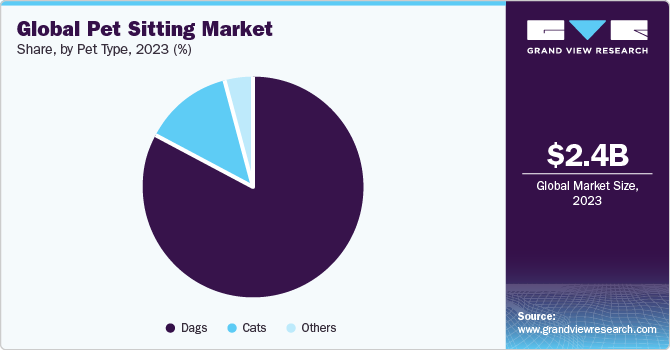

The global pet sitting market size was estimated at USD 2.38 billion in 2023 and is projected to grow at a CAGR of 11.73% from 2024 to 2030. The market is primarily driven by factors like increasing expenditure on pets, rising pet humanization, expanding pet service offerings, and growing adoption of subscription-based pet services.

According to a 2022 survey by Pet Sitters International (PSI), their members provide services for a variety of pets: cats (96%), dogs (95%), birds (73%), freshwater fish (70%), reptiles (59%), etc. Moreover, according to the American Pet Products Association, Inc., pet parents spent an estimated USD 37 billion on vet care and product sales in 2023. This number is notably greater than the USD 35.9 billion vet care & product sales estimated in 2022.

The market suffered greatly due to the onset of COVID-19, as a result of the temporary halting of all of the nonessential services, such as pet care, pet grooming, pet sitting, and pet travel, and limitations on pet care service providers due to the social distancing norms. For instance, a prominent player in the global market, A Place for Rover, Inc., had to lay off 41% of its workforce due to financial losses during the COVID-19 pandemic. Wag! Group, another leading company, reported a staggering 63% booking decline in 2020 due to the lockdown. However, the post-pandemic scenario saw a positive growth shift for pet sitting businesses.

The rising spending on pets is a key market driver.Pet owners are spending more on the welfare of pets. This has led to an increase in the overall expenditure for animal care, including pet sitting. According to the American Pet Products Association (APPA), pet parents in the U.S. spent USD 136.8 billion on their companion animals in 2022. This was notably greater than the expenditure during 2021, estimated at USD 123.6 billion, and projected to reach USD 143.6 billion in 2023. In 2022, U.S. pet parents spent USD 11.4 billion on other services, including pet sitting, boarding, grooming, training, insurance, walking, and all services outside of veterinary care. This indicates a surge in expenditure on services, such as grooming, boarding, training, and pet sitting services.

Market Concentration & Characteristics

The market exhibits a low market concentration. Pet care preferences vary significantly, since the market is fragmented, there is very little rivalry between companies in the pet sitting industry, despite the strong risk of substitutes. Businesses that provide pet sitting services may concentrate in particular markets or regions, which reduces direct competition and promotes collaboration between service providers. However, as the industry expands and gets more consolidated, there might be more competition, which would compel pet sitting companies to gain a competitive edge through innovation, specialization, and strategic alliances.

In terms of growth stage, the market is positioned at a low to medium level, characterized by consistent but significant expansion. Factors such as the growing trend of treating pets as integral family members, rising adoption of pet sitting services, and increasing awareness among pet owners fuel the market growth. Pet owners now have more options to choose from, making it easier to find suitable care for their pets. For instance, according to the Trusted Housesitters website, there are 260 house & pet sitters listed from Denmark. These numbers represent individuals rather than companies specifically focused on pet sitting services. The presence of a considerable number of individual pet sitters in Denmark signifies a booming and dynamic market, characterized by personalized care, community engagement, and diverse options for pet owners.

Due to the regular utilization of the services such as grooming, the market is expanding at an accelerated rate. For instance, according to Old Farm Veterinary Hospital, Grooming should be done at least periodically for long-haired dogs with thick undercoats or double coats, these dogs shed periodically, so have to be groomed, combed, shaved, and de-matted at least every three months. The frequency of grooming increases if the dog is prone to matting and knots. On the other hand, silky-coated dogs require regular haircuts to maintain the health of their coats and avoid matting. Dogs can survive two to three months with a short trim, but to avoid matting, owners should have their dog groomed every four to six weeks if the groomer leaves more than an inch of fur on the dog after a cut.

The market demonstrates a moderate degree of innovation, characterized by ongoing collaboration between market players, and supportive initiatives. For instance, in December 2023, Eight new Joint Venture Partners (JVPs) have joined Vets for Pets (Pets at Home) since 2023. This enables veterinarians, Registered Veterinary Nurses (RVNs), and practice managers to manage their practices while taking advantage of Vets for Pets' assistance & direction. Moreover, certain businesses provide advanced dog training services that enhance a dog's abilities by teaching tricks and enrolling in agility classes.

Within the market, there exists a moderate level of mergers and acquisitions activity, indicative of ongoing consolidation and strategic partnerships among industry players. These transactions are often driven by the desire to expand market reach, access new technologies or expertise, and achieve economies of scale. In January 2023, for instance, Wag! Group Co. acquired Dog Food Advisor's assets from Clicks and Traffic LLC to expand Wag!'s presence in the pet market for foods and treats.

The market experiences a low to moderate impact of regulations. Different regions have different laws regarding animal welfare, which presents opportunities as well as challenges for pet sitting companies. To guarantee the moral treatment and welfare of the animals in their care, compliance with laws such as the Animal Welfare Act (AWA) in the U.S. is essential. Respecting these guidelines protects the credibility and reputation of pet sitting companies in addition to ethical values. To guarantee complete compliance and reduce legal risks, it is necessary to carefully monitor and comprehend the intricacies of regulations in various jurisdictions.

The risk of substitutes is expected to be moderate to high. The market for pet sitting is highly vulnerable to competition from other services, such as boarding facilities, private pet sitters, or entrusting friends and family with pet care. Traditional pet sitting businesses face competition from pet owners who choose alternatives based on personal relationships, cost, or convenience. For instance, Pet grooming at A Place for Rover, Inc. is approximately USD 70 per night, whereas Swifto Inc. charges approximately USD 110 per night. The risk of substitutes increases as a result of these cost variations. Pet sitting companies need to set themselves apart from competitors by providing distinctive value propositions, customized services, and top-notch care that are difficult for competitors to match to lessen the threat of substitutes.

In January 2023, Fetch! Pet Care announced new franchise opportunities to expand across the U.S. apart from the current 130 locations. High levels of regional growth operations in the market are caused by similar initiatives by major competitors in the global market.

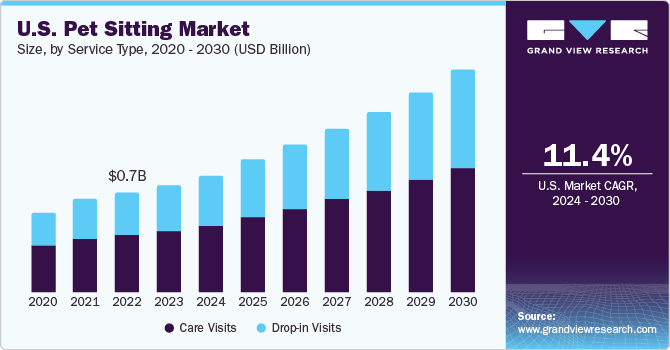

Service Type Insights

Based on service type, the care visits segment led the market with the largest revenue share of 57.03% in 2023. The main reason for this large share is that pet owners generally opt for pet sitting when they are unavailable to care for the pet for a long period. In these cases, the owner expects and needs a trained individual who can care for the pet. Based on the type of pets and their nature, some require attention for much longer durations. Generally, these care visits last for a few hours. A typical shift lasts approximately 9 to 10 hours, while an extended shift can last up to 12 hours. One visit per day is typically scheduled in these care visits. In addition, in care visits, the pet sitter has a lot of bonding time with a pet, which can lead to the pet feeling secure with its new caretaker.

The drop-in visits segment is expected to grow at the fastest CAGR during the forecast period. Typically, a drop-in visit lasts for around 30 minutes. The pet sitter comes & feeds, gives medications, lets the pet go to the bathroom, plays with them, etc., during this visit. Pets like reptiles, fish, rodents, birds, etc., may not always need a pet sitter for a long period. However, they may need someone to check on them once or twice a day to take care of the feed, water, etc. These drop-in visits are generally done for pets that have low separation anxiety, require specialized/end-of-life care, and are not comfortable in pet boarding places, among other factors.

Pet Type Insights

Based on pet type, the dogs segment led the market with the largest revenue share of 83.16% in 2023. This is because dogs are generally the most preferred type of pets owing to various reasons. According to a 2021 survey by Rakuten, dogs are the most adopted pets, i.e., 32% of the total population in Asia Pacific owns a dog. It is a widely accepted fact that dogs positively impact human health. Many studies suggest dogs can prove to be helps reduce anxiety & stress as well as easing loneliness. According to a blog published by Johns Hopkins Medicine, petting a dog is supposed to reduce the levels of stress hormone cortisol. In addition, around 84% of the Post-traumatic Stress Disorder (PTSD) patients, when paired with a service dog, displayed reduction in their symptoms. Furthermore, around 40% of these patients were able to reduce their prescribed medications.

The cats segment is expected to grow at the fastest CAGR during the forecast period. In the last few years, the popularity of cats has skyrocketed globally. According to a November 2023 article published by OnlyKutts, between 2017 and 2022, China experienced an astonishing 143% rise in the cat population. Furthermore, Indonesia/India/ South Korea has seen a 16%/15%/13% rise in cat population, respectively, from 2017 to 2022.

Regional Insights

North America dominated the pet sitting market with a revenue share of 37.86% in 2023. The region is expected to continue its steady expansion, maintaining its dominant position over the forecast period. This growth is driven by factors such as increased pet ownership, higher spending on pets, and growing concerns for pet health and wellbeing. A report from Rover in March 2022, titled the 'True Cost of Pet Parenthood', highlighted a rising willingness among pet owners to invest in their pets. This shift is reflected in purchasing behaviors, with pet parents increasingly prioritizing pet care and prefers products and services that resonate with their values.

U.S. Pet Sitting Market Trends

The pet sitting market in U.S. is anticipated to grow at the fastest CAGR over the forecast period. The increasing collaboration among pet care service providers in the U.S. is driving the market growth by improving service offerings, enhancing convenience for pet owners, expanding reach & customer base, achieving cost savings, improving quality, and gaining a competitive edge in the market. For instance, in February 2022, Petco Health and Wellness Company, Inc. partnered with Rover.com to offer pet sitting, boarding, and dog walking services to Petco customers. This collaboration enhances Petco's comprehensive ecosystem of pet care offerings by enabling customers to easily access Rover's services for their dogs & cats directly through the petco.com platform.

Europe Pet Sitting Market Trends

The pet sitting market in Europe is expected to grow at the fastest CAGR over the forecast period. Several factors, including a surge in pet ownership, the trend of humanizing pets, and the emergence of specialized & personalized services, propel the expansion of the Europe market. Technological advancements, such as the incorporation of technology into pet sitting services, improved safety protocols, and the availability of insurance coverage, also contribute to market growth. The Europe market is highly fragmented, with numerous individual pet sitters and established pet sitting businesses.

The Germany pet sitting market is anticipated to grow at the fastest CAGR over the forecast period. Germany has experienced a steady increase in pet ownership over the years, with more than 58% of households adopting pets such as dogs, cats, and small mammals. This rise in pet ownership directly correlates with the demand for pet sitting services, as pet owners seek reliable care for their animals while they are away.

Asia Pacific Pet Sitting Market Trends

The pet sitting market in Asia Pacific is expected to register at the fastest CAGR during the forecast period, driven by factors such as increased adoption of pets, rising disposable incomes in countries like China & India, and a growing number of pet sitters. India is expected to lead the growth in the pet market within the APAC region due to rising pet ownership and increased spending on pets, consequently fueling the demand for pet care services, including pet sitting.

The India pet sitting market is estimated to grow at the fastest CAGR of 14.75% during the forecast period. The pet industry in India is experiencing substantial growth, driven by factors such as the increasing trend of pet humanization & rising pet ownership. Pet parents are willing to invest significantly in premium care for their pets, including pet sitting services, with the market showing a 20% growth in the past decade. Despite challenges such as lack of awareness and regulatory hurdles, the Indian pet care market is expected to continue expanding, offering significant opportunities for pet sitting businesses to meet the growing demand for high-quality pet care services. For instance, in September 2023, Patmypets, an Indian platform, revolutionized the pet care industry by offering comprehensive and affordable grooming, training, and boarding services, aiming to meet the needs of pet owners across major cities.

Latin America Pet Sitting Market Trends

The pet sitting market in Latin American is experiencing steady growth, fueled by increasing pet populations, and the humanization of pets. Brazil & Mexico are the two largest pet care markets in the region, accounting for well over USD 2 billion each. Dogs are the most popular pets in Latin America, with Brazil ranking second in terms of dog population and Mexico ranking fourth.

The Brazil pet sitting market is expected to grow at the fastest CAGR during the forecast period, with many pet owners preferring premium products & services, especially for dogs and cats. The country has a strong pet population of around 60 million dogs and 38 million cats, and pet humanization, coupled with the continuance of premiumization, is driving demand for high-quality pet care services. Emerging startups like DOGERO Online Agency for Services for Pets Ltd., based in Brazil, offer a variety of pet services, including pet sitting.

Middle East & Africa Pet Sitting Market Trends

The pet sitting market in the Middle East and Africa is dynamic. The key drivers of the MEA market include rising pet ownership, changing lifestyles, increased travel and tourism, pet humanization, the rise of digital platforms, and awareness of pet welfare issues. There is a growing trend of pet humanization in the MEA region, where pets are increasingly considered members of the family. Pet owners are willing to invest in premium services, including pet sitting, to ensure the wellbeing and comfort of their pets, driving demand for high-quality pet care services.

The South Africa pet sitting market has accelerated rapidly post-pandemic. With the surge in pet ownership during the pandemic, pet owners increasingly require reliable care for their animals, especially as they return to offices & resume pre-pandemic routines.

Key Pet Sitting Company Insights

The market is fairly competitive owing to the presence of a large number of small scale service providers in various countries competing with established service providers. Players in this market are constantly involved in various strategic initiatives, such as regional expansion, mergers & acquisitions, and new service launches, to gain a higher market share. For instance, in November 2023, Dogtopia Enterprises opened its 250th dog daycare center, surpassing 500 overall signed franchise agreements in the U.S.

Key Pet Sitting Companies:

The following are the leading companies in the pet sitting market. These companies collectively hold the largest market share and dictate industry trends.

- A Place for Rover, Inc.

- Pets at Home, Inc.

- Wag! Group Co.

- PetBacker

- Careguide Inc.

- Fetch! Pet Care

- Holidog.com

- PetSmart LLC

- Dogtopia Enterprises

- Swifto Inc.

Recent Developments

-

In September 2022, PetSmart collaborated with interior designers Nate Berkus and Jeremiah Brent by launching a collection of couches, beds, stands, etc., designed specifically for pets and pet parents’ comfort & needs

-

In May 2022, Kimpton Hotels & Restaurants partnered with Wag! offering on-property & at-home walks and drop-ins for guests staying in their hotels across the U.S.

-

In November 2023, a definitive agreement was signed by Rover Group, Inc. to be acquired by Blackstone in a deal estimated to be worth USD 2.3 billion, exclusively in cash

Pet Sitting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.64 billion

Revenue forecast in 2030

USD 5.14 billion

Growth rate

CAGR of 11.73% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, service type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Netherlands; Poland; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

A Place for Rover, Inc.; Pets at Home, Inc.; Wag! Group Co.; PetBacker; Careguide Inc.; Fetch! Pet Care; Holidog.com; PetSmart LLC; Dogtopia Enterprises; Swifto Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Sitting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet sitting market report based on pet type, service type, and region.

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Care Visits

-

Drop-in Visits

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Poland

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global pet sitting market size was estimated at USD 2.38 billion in 2023 and is expected to reach USD 2.64 billion in 2024.

b. The global pet sitting market is expected to grow at a compound annual growth rate of 11.73% from 2024 to 2030 to reach USD 5.14 billion by 2030.

b. North America dominated the pet sitting market with a share of over 37.86% in 2023. This is attributable to the increased pet ownership, higher spending on pets, and growing concerns for pet health and wellbeings.

b. Some key players operating in the pet sitting market include A Place for Rover, Inc., Pets at Home, Inc., Wag! Group Co., PetBacker, Careguide Inc., Fetch! Pet Care, Holidog.com, PetSmart LLC, Dogtopia Enterprises, Swifto Inc.

b. Key factors that are driving the pet sitting market growth include increasing expenditure on pets, rising pet humanization, expanding pet service offerings, and growing adoption of subscription-based pet services

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."