- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Physical Vapor Deposition Market Size & Share Report, 2030GVR Report cover

![Physical Vapor Deposition Market Size, Share & Trends Report]()

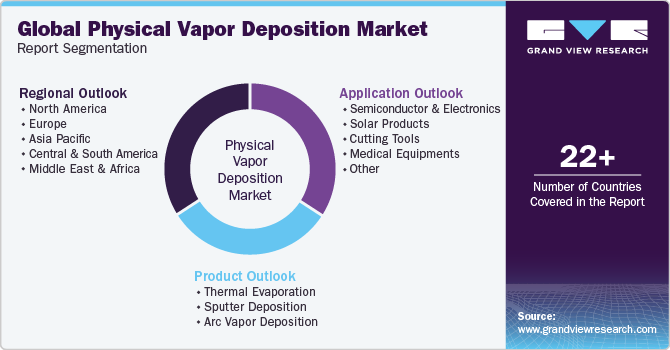

Physical Vapor Deposition Market Size, Share & Trends Analysis Report By Product (Sputter Deposition, Thermal Evaporation), By Application (Solar Products, Cutting Tools), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-085-9

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Bulk Chemicals

Physical Vapor Deposition Market Trends

The global physical vapor deposition market size was estimated at USD 2,996.6 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.6% from 2024 to 2030. The ever-growing semiconductor industry, with its continuous demand for advanced thin-film deposition techniques, acts as a primary growth catalyst. In addition, the rise in medical device manufacturing, driven by the need for enhanced durability and biocompatibility, contributes significantly to the market's upward trajectory. Moreover, the surge in solar energy applications, increasing emphasis on energy-efficient buildings, and the automotive industry's adoption of PVD coatings for improved functionality and aesthetics further fuel market expansion.

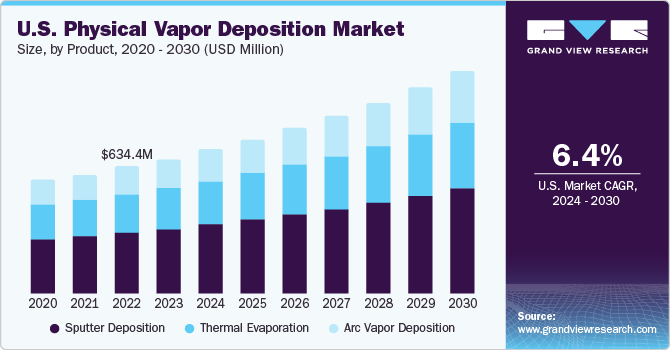

Sputtering is a physical vapor deposition (PVD) technique wherein the molecules or atoms are emitted from the target material by bombardment of high-energy particles due to which they get condensed on the substrate as a thin film. Sputtering can be used for the deposition of various metallic films on wafers, including aluminum, gold, platinum, aluminum alloys, and tungsten, among others. These aforementioned factors are expected to propel the demand for sputter deposition in the coming years. According to the National Health Expenditure Data, U.S. Medicare spending increased by 8.4% to USD 900 billion in 2021.

Moreover, Medicaid spending has increased by 9.2% to USD 734 billion compared to 2020. In 2021, the U.S. spending for medicines increased by 12% due to high demand for COVID vaccines, boosters, treatments, and prescription medication usage was 194 billion daily doses across the U.S. These factors are expected to drive demand for PVD in the medical sector. The product demand in the U.S. is majorly generated by the growing medical equipment industry owing to the rising elderly population. The adoption of advanced PVD techniques, such as magnetron sputtering, is expected to have a positive impact on market growth.

Furthermore, in the medical industry, PVD coatings are widely used to enhance the performance and biocompatibility of medical devices and implants. The coatings improve wear resistance, reduce friction, and provide anti-corrosive properties, contributing to the longevity and functionality of medical instruments and implants. According to the Semiconductor Industry Association, Taiwan, South Korea, Japan, and China accounted for a 72% of the global semiconductor production in 2022, with its previous manufacturing hubs, such as the U.S. and Japan, focusing on the highly profitable countries for exporting their products.

In addition, as of 2022, the region was the largest semiconductor market in the world, with China being the largest consumer of semiconductors in Asia Pacific. In December 2022, Taiwan Semiconducting Manufacturing Co. announced an increase in its investments to enhance its manufacturing capacity in the U.S., signaling a shift in the geographic dynamics of the sector. Thus, the growing semiconductor industry globally is expected to drive product demand. PVD is crucial in the semiconductor industry for precisely depositing thin films on silicon wafers, enabling the fabrication of advanced integrated circuits and microelectronic devices.

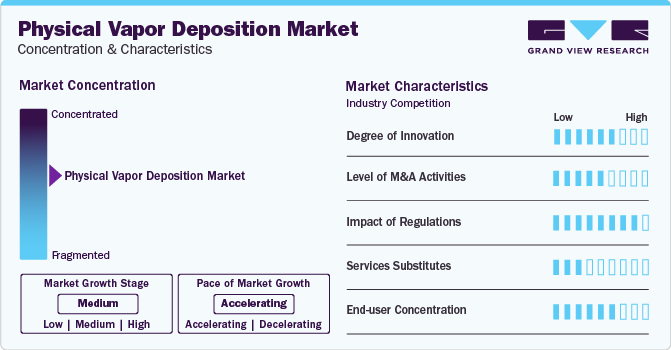

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements. Moreover, companies are adopting various organic and inorganic growth strategies, such as expansions, mergers & acquisitions, investments, and product launches, to strengthen their position in the global industry.

The market is characterized by dynamic and evolving trends that reflect its widespread applications and technological advancements. With a foundation in thin-film deposition, the market spans a diverse range of industries, including semiconductors, electronics, medical devices, aerospace, automotive, and renewable energy.

Moreover, technological innovation remains a hallmark, with ongoing advancements in coating materials and deposition processes, driving improvements in efficiency and precision. The semiconductor industry stands out as a primary driver, demanding sophisticated PVD techniques for the fabrication of integrated circuits and microelectronic devices. In addition, the focus on renewable energy sources, especially in solar applications, fuels the demand for PVD coatings to enhance the efficiency and durability of solar panels. Furthermore, the medical sector increasingly relies on PVD for biocompatible coatings in devices. As industries prioritize surface engineering and environmental considerations, PVD plays a crucial role in providing tailored solutions for wear resistance, corrosion protection, and aesthetic finishes.

The market exhibits a high initial capital investment for establishing PVD coating facilities, contributing to entry barriers, and shaping a competitive landscape. Moreover, the customization and specialization of PVD solutions, along with a global industrial expansion, underscore the diverse and growing nature of this industry, offering stakeholders opportunities for innovation and strategic positioning. Overall, the market is characterized by its adaptability to diverse applications, continual technological evolution, and its integral role in enhancing the performance and longevity of various products across industries.

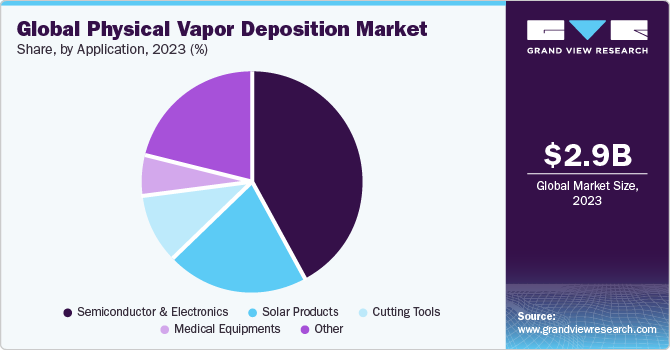

Application Insights

the semiconductor & electronics application segment led the market in 2023. PVD is widely employed to deposit thin films on semiconductor wafers. These thin films are crucial for the fabrication of integrated circuits and microelectronic devices. Common materials deposited include metals and dielectrics. PVD techniques, such as sputtering, are utilized to metalize semiconductor devices. Metal layers are deposited to create conductive paths, interconnects, and contacts within the semiconductor components, facilitating the flow of electrical signals. Moreover, advanced semiconductor devices require precise deposition of interconnects, which are essential for connecting different components on a semiconductor wafer. PVD methods contribute to the creation of these intricate interconnect structures.

PVD is widely employed to deposit anti-reflective coatings on the glass surfaces of solar panels. These coatings minimize reflection and enhance light absorption by the solar cells, improving the overall efficiency of the solar panel. Materials such as silicon nitride (SiNx) are commonly used for anti-reflective coatings. PVD is used to deposit back contacts on the rear side of solar cells. Back contacts play a crucial role in extracting the generated electrical current from the solar cell. PVD ensures precise deposition of conductive materials for efficient electrical performance. These aforementioned factors are expected to propel the physical vapor deposition market over the forecast period.

Product Insights

The sputter deposition product segment led the market and accounted for a share of 47.6% in 2023. Sputter deposition, a widely used PVD technique, offers numerous advantages and finds diverse applications across industries. One key advantage is its ability to deposit thin films with high precision and uniformity on various substrates, enabling the manufacturing of advanced electronic and optical devices. Sputtering allows for the deposition of a wide range of materials, including metals, alloys, and ceramics, enhancing its versatility. The process operates at low temperatures, making it suitable for temperature-sensitive substrates and facilitating compatibility with various materials.

Sputter deposition provides ideal step coverage on complex and three-dimensional structures, making it ideal for semiconductor manufacturing. Moreover, its capability for reactive sputtering allows the deposition of compound films with specific properties. Arc deposition, a form of PVD, boasts several advantages and finds diverse applications in various industries. Its key advantage lies in its ability to generate a high-energy arc plasma, facilitating the deposition of coatings with exceptional adhesion, hardness, and wear resistance.

Arc deposition is well-suited for coating complex and large-scale components due to its high deposition rates and the ability to cover irregular surfaces uniformly. This makes it particularly valuable in the aerospace and automotive industries for enhancing the durability of critical components. In addition, arc deposition excels in depositing thick and dense coatings, providing excellent thermal and electrical conductivity, making it crucial in applications, such as tool and die coatings. Its adaptability to a wide range of materials, including metals and ceramics, further extends its utility across sectors, making it a preferred choice for industries demanding robust and high-performance coatings with advanced material properties.

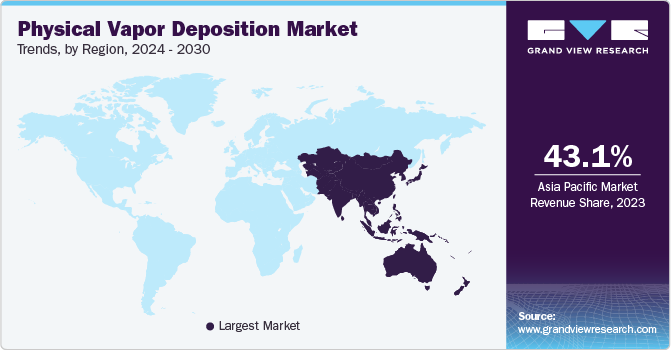

Regional Insights

Asia Pacific dominated the market and accounted for a share of 43.1% in 2023. The region's growing electronics and semiconductor industries are major contributors, with increasing demand for PVD in the fabrication of advanced microelectronic components and semiconductor devices. Moreover, the rapid expansion of solar energy projects, coupled with a focus on renewable energy sources, propels the demand for PVD in the production of efficient and durable solar panels. In addition, the automotive sector's growth and emphasis on enhancing the performance & longevity of automotive components further fuel the adoption of PVD coatings.

Central and South America region is experiencing expanding electronics manufacturing sector, driven by rising consumer demand for electronic devices, fosters the adoption of PVD for advanced thin-film deposition in semiconductor production. Additionally, the focus on sustainable energy solutions fuels the demand for PVD in the solar energy sector, particularly in the fabrication of high-performance solar panels. As Central and South America witness economic development and industrialization, coupled with a growing awareness of advanced manufacturing processes, the PVD market in the region is poised for expansion, offering opportunities for technological innovation and market penetration.

Key Companies & Market Share Insights

Some of the key players operating in the market include Oerlikon Group.

-

Oerlikon Group was established in 1946 and is headquartered in Pfäffikon SZ, Switzerland. The company manufactures and supplies PVD coating equipment. Products manufactured by the company suit many applications including batch & inline systems, mobile phones, laptop metallization, consumer goods, and notebook housing. Its manufacturing facilities are certified by ISO-9001 and ISO/TS 16949 for its quality standards. As of 2022, the company had 182 locations across 37 countries

-

IHI Corporation, formerly known as Ishikawajima-Harima Heavy Industries Co., Ltd., is a prominent Japanese industrial and engineering company. It has a long history dating back to its establishment in 1853. IHI has evolved into a comprehensive heavy industry manufacturer with a global presence, involved in various sectors

Intevac, Inc., Impact Coatings AB, and Denton Vacuum are some of the emerging market participants.

-

Intevac, Inc. was established in 1991 and is headquartered in California, U.S. The company operates its business through two segments, namely thin film equipment segment, which caters to hard disk drives; solar; display panels; and advanced packaging industries and photonics segment, which serves the military industry. It operates through its manufacturing facilities in California and Asia. Intevac performs direct product sales through its sales force; however, indirect sales are done through its distributors in Japan and China. The company’s sales in Asia are administered by its offices in Malaysia, China, and Singapore

-

Impact Coatings AB was established in 1997 and has headquarters in Linkoping, Sweden. The company primarily supplies PVD technology for end-users in the automotive, fuel cells, and fashion industries. It has coating processes for plastics & metals and the products are marketed under the brand name MAXPHASE. The company’s PVD equipment is marketed under the brand name INLINECOATER. It operates mainly with two verticals called PVD Equipment and Coating Services. PVD Equipment has a product line called INLINECOATER, along with services, such as maintenance and support. Whereas coating services vertical includes tailored coating solutions called Ceramic MAXPHASE, Silver MAXPHASE, and Ultra MAXPHASE

Key Physical Vapor Deposition Companies:

- Oerlikon Group

- Angstrom Engineering Inc.

- Kurt J. Lesker Company

- Voestalpine AG

- NISSIN ELECTRIC Co., Ltd

- IHI Corporation

- HEF Groupe

- Kobe Steel Ltd.

- Lafer S.p.A.

- Inorcoat

- KOLZER SRL

- Advanced Coating Service

- Impact Coatings AB

- Denton Vacuum

- Intevac, Inc.

Recent Developments

-

In June 2023, Oerlikon Balzers entered into a ten-year agreement with ITP Aero to utilize Oerlikon's innovative wear-resistant coating, BALORA TECH PRO, for the PW800 turbofan engine components, which are integral to the propulsion systems of the newly launched Dassault Falcon 6X business jets and Gulfstream G500/G600

-

In June 2022, Denton Vacuum LLC revealed its success in securing a new order for a semiconductor laser facet coating system from a prominent laser manufacturer. The Infinity Biased Target Sputtering system, incorporating Denton's patented bias target technology, stands out for its ability to deliver exceptionally dense and low-contamination optical films. This technology, surpassing other Physical Vapor Deposition methods, ensures optimal laser damage threshold performance

Physical Vapor Deposition Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,213.8 million

Revenue forecast in 2030

USD 4,997.3 million

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Australia; Brazil; Argentina; South Africa; UAE

Key companies profiled

Oerlikon Group; Angstrom Engineering Inc.; Kurt J. Lesker Company; Voestalpine AG; NISSIN ELECTRIC Co., Ltd.; IHI Corp.; HEF Groupe; Kobe Steel Ltd.; Lafer S.p.A.; Inorcoat; KOLZER SRL; Advanced Coating Service; Impact Coatings AB; Denton Vacuum; Intevac, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Physical Vapor Deposition Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the physical vapor deposition market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Thermal Evaporation

-

Sputter Deposition

-

Arc Vapor Deposition

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Semiconductor & Electronics

-

Solar Products

-

Cutting Tools

-

Medical Equipment

-

Other

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global physical vapor deposition market size was estimated at USD 2,996.6 million in 2023 and is expected to be USD 3,213.8 million in 2024.

b. The global physical vapor deposition market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 4,997.3 million by 2030.

b. Asia Pacific region dominated the market and accounted for 43.1% share in 2023. The region's burgeoning electronics and semiconductor industries are major contributors, with increasing demand for PVD in the fabrication of advanced microelectronic components and semiconductor devices. Moreover, the rapid expansion of solar energy projects, coupled with a focus on renewable energy sources, propels the demand for PVD in the production of efficient and durable solar panels.

b. Some of the key players operating in the physical vapor deposition market include Oerlikon Group, Angstrom Engineering Inc., Kurt J. Lesker Company, Voestalpine AG, NISSIN ELECTRIC Co., Ltd, IHI Corporation, HEF Groupe, Kobe Steel Ltd., Lafer S.p.A., Inorcoat, KOLZER SRL, Advanced Coating Service, Impact Coatings AB, Denton Vacuum, Intevac, Inc.

b. The ever-expanding semiconductor industry, with its continuous demand for advanced thin-film deposition techniques, acts as a primary growth catalyst. Additionally, the rise in medical device manufacturing, driven by the need for enhanced durability and biocompatibility, contributes significantly to the market's upward trajectory.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."