- Home

- »

- Processed & Frozen Foods

- »

-

Plant-based Meat Market Size, Share & Trends Report, 2030GVR Report cover

![Plant-based Meat Market Size, Share & Trends Report]()

Plant-based Meat Market Size, Share & Trends Analysis Report By Source (Soy, Pea, Wheat), By Product (Burgers, Sausages, Patties), By Type, By End-user, By Storage, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-145-9

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Plant-based Meat Market Size & Trends

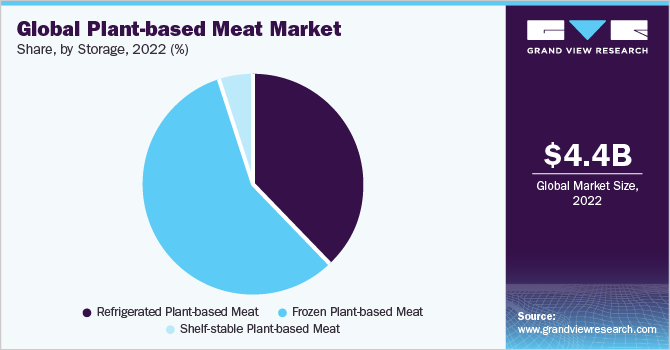

The global plant-based meat market size was valued at USD 4.40 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.9% from 2023 to 2030. Growing consumer interest in plant-based diets, coupled with the rising consciousness for animal rights through various welfare organizations is expected to drive the market growth. However, despite the growing plant-based meat industry, a few companies such as Beyond Meat and Impossible Foods witnessed a dip in demand for plant-based meat products in 2022, primarily owing to the high costs of plant-based meat products.

Plant-based meat is becoming an integral part of a vegan diet, wherein the adoption of a vegetarian lifestyle that is devoid of animal-based foods becomes the norm. Consumers are inclined towards veganism for health and ethical reasons, while some other consumer groups are opting for vegetarian ingredients to avoid animal cruelty and to consume sustainable food & beverage products. Furthermore, soy as a raw material consists of all the standard (nine) amino acids, which are essential for the growth of the human body. Its ability to enhance the water absorption, solubility, emulsification, viscosity, anti-oxidation, and texture of the final product is likely to drive the demand for soy in plant-based meat products over the upcoming years.

Diverse plant-based meat types continue to grow in popularity, which diversifies and expands the category. Moreover, the demand for plant-based chicken, pork, and seafood is on the rise in addition to plant-based beef. The exponential growth of refrigerated plant-based meat is likely to continue over the forecast period of 2023-2030. It reflects a shift in both product innovation and merchandising strategies across the plant-based industry.

During the COVID-19 outbreak, the food supply chain experienced significant shifts, including interruptions to supplies of key inputs, limited access to production spaces, and disrupted distribution of products. Despite these constraints, plant-based companies adapted and continued to launch new products and grow sales. Trade restrictions across the globe in response to Covid-19 led to disruptions in the food supply chain.

Foodservice channel distribution was significantly impaired, and pantry stocking and panic buying led to a sharp increase in retail sales over the prior year. Many plant-based meat categories experienced exponential growth during the initial pantry-stocking period. The COVID-19 pandemic, which led to the imposition of lockdowns has encouraged consumers to order goods online. This, in turn, is projected to encourage the distributors to move towards online retailing channels.

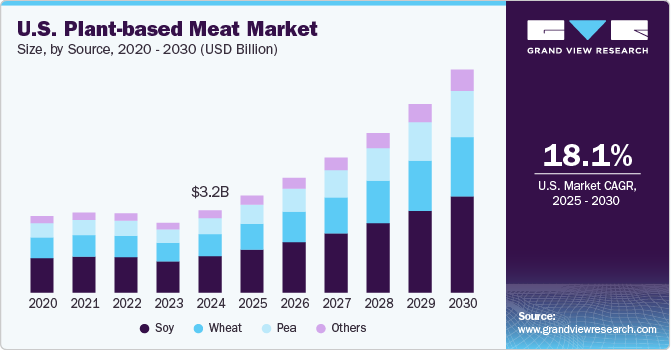

The U.S. has witnessed increasing demand for -plant-based meat over the past few years owing to the growing awareness among consumers about the health benefits of veganism. The demand for vegetarian foods that are high in fiber, vitamin C, and iron, and contain low processed saturated fats is on the rise in the U.S. In addition, the round-the-clock efforts of manufacturers to create a product with a longer shelf life, better texture & aroma, and better nutritious profiles, are estimated to spur market growth in the U.S.

Source Insights

The soy-based meat segment led the market and accounted for 48.55% share of the global revenue in 2022. Soy is a good source of branch amino acids (BCAAs) and is likely to exhibit steady growth over the forecast period on account of its ability to enhance exercise performance, recovery from a heavy workout, and build & strengthen muscle mass.

Additionally, soy-based meat products not only reduce formulation costs but also exhibit a lower carbon footprint as opposed to conventional animal- and dairy-based food products. Growing demand for the product on account of its enhanced convenience, such as improved microwaveability and slice-ability, is projected to spur overall market growth. Furthermore, pea-based patties in burgers can be easily substituted instead of chicken, beef, or pork-based patties. Various characteristics such as high protein content, resemblance in texture and consistency to meat, easy availability, and quick preparation are some of the key factors that are expected to allow pea-based meat products to grow at the highest rate of 26.3% over the forecast period.

Product Insights

Plant-based burgers led the market and accounted for a 28.15% share of the global revenue in 2022. Ingredients in these burgers strive to imitate the aroma, flavor, and “bleeding” texture of meat. Impossible Foods’ product- Impossible Burger- is made with a genetically modified form, mimicking the natural heme-iron present in an animal, which gives their burger a distinctive meaty flavor. Various companies offering distinguished plant-based burgers are Kellogg NA Co.; Quorn; Amy's Kitchen, Inc.; VBites Foods Limited; Kraft Foods, Inc.; Yves Veggie Cuisine; and Beyond Meat.

Plant-based sausages are manufactured to mimic the look, texture, sizzle, and satisfaction of conventional pork sausage. Companies such as Beyond Meat and Lightlife Foods, Inc. are offering juicy and meaty alternatives to traditional sausage, which are also devoid of hormones, nitrates, GMOs, nitrites, gluten, and soy. The growing investment by companies to introduce new and innovative flavors to their plant-based sausages, such as hot Italian, sweet Italian, and spinach pesto is projected to spur product demand. Some of the prominent players in the plant-based sausages market are Marlow Foods Ltd.; Impossible Foods Inc.; and Moving Mountains.

Type Insights

The plant-based chicken segment led the market and accounted for a 33.57% share of the global revenue in 2022. In the traditional meat industry, chicken is the prime ingredient in various products such as nuggets, patties, and cutlets, as it is loaded with animal fats, cholesterol, and protein. In comparison, plant-based chicken products constitute about the same amount of protein while the other nutrients tend to vary on a product-by-product basis.

Veggie bacon, also known as vegetarian bacon or vacon, is marketed as a plant-based pork product. These products, manufactured from soy and pea protein, are high in fiber and protein, have no cholesterol, and are low in fat. Brands such as Morningstar Farms; Vegetarian Butcher; Yves Veggie Cuisine; and Smart Bacon are some of the key manufacturers offering the products.

Various startup ventures and established players in the industry are launching new products to increase their sales and capitalize on rising consumer preference towards plant-based diets. For instance, in July 2019, Beyond Meat announced that the company is developing steak and bacon alternatives to its existing line of vegan sausage and beef products for its flexitarian consumers.

End-user Insights

The hotel/Restaurant/Café (HORECA) segment led the market and accounted for 58.59% share of the global revenue in 2022. In lieu of the rising popularity of vegan and flexitarian diets, many restaurants, fast food chains, and casual dining venues are dedicating a section of their menu solely to “meat-free” options, which in turn is projected to drive the market growth. Key players in the industry are capitalizing on shifting consumer preferences and the rising demand for a more personable, tailored service. For instance, in April 2019, Amy’s Kitchen Inc., a US-based vegetarian and vegan foods manufacturer opened a third plant-based and vegan-friendly “Amy’s Drive-Thru” restaurant in Walnut Creek, California.

Furthermore, products such as burger patty, nuggets, and strips are gaining traction in fast-food restaurant chains. These brands have launched distinguished plant-based meat products to target health-conscious individuals; while Beyond Meat in collaboration with Yum! Brands RSC is supplying plant-based fried chicken to various KFC stores in the US.

Storage Insights

The frozen plant-based meat product segment led the market and accounted for 56.48% share of the global revenue in 2022. The growing demand for innovative vegetarian products has led to a significant rise in new product development across ambient, chilled, and frozen segments. This, in turn, gives the consumer a broad range of products and brands, thereby allowing plant-based meat goods to gain increased recognition and shelf space.

The refrigerated plant-based meat products segment is likely to exhibit the fastest growth and is projected to grow at a CAGR of 20.2% in terms of revenue from 2023 to 2030. Various factors contributing to this trend are meat shortages and concerns over the COVID-19 outbreak in meat processing facilities.

Though frozen plant-based meat products were consistently outpaced by their refrigerated counterparts amidst the pandemic, the same trend is projected to continue even after the COVID-19 outbreak owing to the growing environmental concerns among consumers and their desire to eat vegetarian food products.

Regional Insights

North America region emerged as the most dominating region with a total market share of 36.82% in 2022. The growth of the market in this region is attributed to rising consumer awareness of the risks associated with consuming contaminated meat goods along with increasing consumption of meatless meat products. Consumers' perceptions about food sustainability and safety are expected to shift further in response to accelerated consumption of plant-based foods including plant-based meat.

The market in Europe is anticipated to witness the fastest growth rate on account of a positive consumer outlook on vegetarian and vegan-meat products together with the practice of stringent regulations against cruelty towards animals. Key manufacturers are implementing strategic initiatives such as capacity expansion, product innovation, and mergers & acquisitions to increase their sales in the regional market. For instance, in October 2022, Beyond Meat, Inc. launched a new plant-based product; Beyond Steak following the growing demand for plant-based meat from the meat lovers and flexitarian population in the U.S.

Key Companies & Market Share Insights

The global plant-based meat industry is characterized by the limited presence of players in the market. Industry players are focusing on research & development activities and on diversifying their portfolio to launch new and innovative alternative meat products. These innovative products mimic the taste and texture of exotic meats, including lobster and veal. Certain companies are focused on expanding in high-growth countries and regions such as Brazil and Europe. For instance, in October 2022, JBS SA-owned plant-based meat division Planterra shut down its operations in the U.S. to focus on growing alternative protein markets such as European countries and Brazil. This is primarily due to sluggish plant-based meat sales in 2022 in the U.S.

Major players in the market are characterized by robust sales channel partnerships with restaurants and retail chains worldwide for the distribution of their faux meat products. Some prominent players in the global plant-based meat market include:

-

Beyond Meat

-

Impossible Foods Inc.

-

Maple Leaf Foods (Field Roast & Maple Leaf)

-

Vegetarian Butcher

-

Conagra, Inc. (Gardein Protein International)

-

Kellogg NA Co. (MorningStar Farms)

-

Quorn

-

Amy's Kitchen, Inc.

-

Tofurky

-

Gold&Green Foods Ltd.

-

Sunfed

-

VBites Foods Limited

-

Kraft Foods, Inc.

-

Lightlife Foods, Inc

-

Trader Joe's

-

Yves Veggie Cuisine (The Hain-Celestial Canada, ULC)

-

Marlow Foods Ltd. (Cauldron)

-

Ojah B.V.

-

Moving Mountains

-

Eat JUST Inc.

-

LikeMeat GmbH

-

Gooddot

-

OmniFoods

-

No Evil Foods

-

DR. PRAEGER'S SENSIBLE FOODS

Plant-based Meat Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.23 billion

Revenue forecast in 2030

USD 24.80 billion

Growth Rate

CAGR of 24.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD millions, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, product, type, end-user, storage, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; The Netherlands; China; Japan; Australia & New Zealand; Brazil; Argentina; UAE;

Key companies profiled

Beyond Meat; Impossible Foods Inc.; Maple Leaf Foods (Field Roast & Maple Leaf); Vegetarian Butcher; Conagra, Inc. (Gardein Protein International); Kellogg NA Co. (MorningStar Farms); Quorn; Amy's Kitchen, Inc.; Tofurky; Gold&Green Foods Ltd.; Sunfed; VBites Foods Limited; Kraft Foods, Inc.; Lightlife Foods, Inc.; Trader Joe's; Yves Veggie Cuisine (The Hain-Celestial Canada, ULC); Marlow Foods Ltd. (Cauldron); Ojah B.V.; Moving Mountains; Eat JUST Inc.; LikeMeat GmbH; Gooddot; OmniFoods; No Evil Foods; DR. PRAEGER'S SENSIBLE FOODS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant-based Meat Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global plant-based meat market report based on source, product, type, end-user, storage, and region:

-

Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Soy

-

Pea

-

Wheat

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Burgers

-

Sausages

-

Patties

-

Nuggets, Tenders & Cutlets

-

Grounds

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Chicken

-

Pork

-

Beef

-

Fish

-

Others

-

-

End-User Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

HORECA (Hotel/Restaurant/Café)

-

-

Storage Outlook (Revenue, USD Million, 2017 - 2030)

-

Refrigerated Plant-based Meat

-

Frozen Plant-based Meat

-

Shelf-stable Plant-based Meat

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

The Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plant-based meat market size was estimated at USD 4.40 billion in 2022 and is expected to reach USD 5.23 billion in 2023.

b. The plant-based meat market is expected to grow at a compound annual growth rate of 24.9% from 2023 to 2030 to reach USD 24.8 million by 2030.

b. Soy-based meat dominated the plant-based meat market as of 2022 with a share of 48.55% and is expected to advance at a substantial CAGR of 24.2% through 2030.

b. Some of the key players in the market are Beyond Meat, Impossible Foods Inc., Maple Leaf Foods (Field Roast & Maple Leaf), Vegetarian Butcher, Conagra, Inc. (Gardein Protein International), Kellogg NA Co. (MorningStar Farms), Quorn, Amy's Kitchen, Inc., Tofurky, and Gold&Green Foods Ltd.

b. The key factors that are driving the plant-based meat market include the growing adoption of a plant-based lifestyle and diet among health-conscious consumers in traditionally meat-eating developed economies, such as the U.S., Canada, UK, and France. Plant-based meat products, obtained from soy- or gluten-based sources, have juiciness, fibrous consistency, and a meaty texture resembling the traditional meat.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."