- Home

- »

- Biotechnology

- »

-

Global Plasma Fractionation Market Size Report, 2030GVR Report cover

![Plasma Fractionation Market Size, Share & Trends Report]()

Plasma Fractionation Market Size, Share & Trends Analysis Report By Product (Albumin, Immunoglobulins), By Method (Centrifugation, Depth Filtration), By Application, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-962-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

The global plasma fractionation market size was valued at USD 28.50 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.3% from 2022 to 2030. The major driver of the market's expansion is the growing prevalence of elderly people around the globe, who are more susceptible to rare disorders that call for the usage of blood derivatives. Additionally, the increased use of immunoglobulins & alpha-1-antitrypsin in various fields of medicine around the world is anticipated to drive market growth. Another important element driving the expansion of this market is the rise in blood collection facilities worldwide.

The increased government funding and corporate involvement in research and development activities for plasma treatments are also anticipated to boost market growth. In addition, the COVID-19 pandemic has provided numerous chances for biotechnology and biopharma firms to participate in R&D projects involving plasma treatments. A lot of businesses have started working together to research how well fractionation therapy works for COVID-19 patients. For instance, in March 2020, the Food and Drug Administration (FDA) and the Biomedical Advanced Research Development Authority (BARDA) joined forces with Grifols, a biopharma business focused on producing medicines made from plasma, to develop treatments for COVID-19.

Despite the destructive effects of the new coronavirus pandemic on some businesses, the global industry has been observed to have grown significantly over the past several years. More people were adversely impacted by the viral infection with serious problems as the COVID-19 pandemic neared its worst stage, which prompted plasma as a treatment. However, the cost of this therapy is anticipated to rise as a result of increased government support and corporate involvement in research and development, impeding the market growth. Moreover, plasma therapy gave patients reason for optimism because COVID-19 patients were effectively treated using fractionation therapy. For instance, in July 2020, the Hindu reported that patients with COVID-19 in Chennai's Rajiv Gandhi Government General Hospital had made a full recovery through plasma therapy.

Growing R&D activities, awareness programs encouraging blood donation, and investments from major players are projected to create profitable revenue opportunities for industry participants in the global market. Moreover, the market is also being driven ahead by supportive government initiatives to increase awareness of the use of plasma-derived products. For instance, in March 2021, the WHO Model List of essential medicines includes several plasma-derived medicinal products (PDMPs), identifying them as drugs thought to be the most efficient and secure for addressing the most essential requirements in a health system and providing guidelines on increased supply of PDMPs in low & middle-income countries.

Increased investments by major players in the production of advanced & effective treatments are likely to support market growth throughout the projected timeframe. For instance, in April 2020, To create a viable plasma-derived medication for treating COVID-19, CSL Behring & Takeda Pharmaceutical Company Ltd. partnered with Biotest, BPL, LFB, and Octapharma. The collaboration will get started right away with the research and development of a single, unbranded anti-SARS-CoV-2 polyclonal hyperimmune immunoglobulin drug that has the potential to help people with major COVID-19 problems. Such initiatives by companies are likely to supplement the market growth in the coming years.

Product Insights

The immunoglobulins segment is anticipated to witness a significant growth rate of 8.9% from 2022 to 2030. Immunoglobulin is becoming more extensively used for the administration, cure, and identification of metabolic disorders globally, which is one of the most significant aspects influencing the industry's expansion. As a result, immunoglobulin's extensive use will also increase its supremacy and enhance market opportunities.

Additionally, the market for coagulation factors is expanding as a result of factors like the approval of new medications, the high frequency of bleeding diseases, and growing initiatives & donation for people with severe bleeding disorders like hemophilia. For instance, in April 2019, under a long-term initiative to support people with hemophilia, Grifols International SA, a supplier of plasma-derived therapeutics, provided blood clotting factor medications (100 million international units) for the treatment of hemophilic patients.

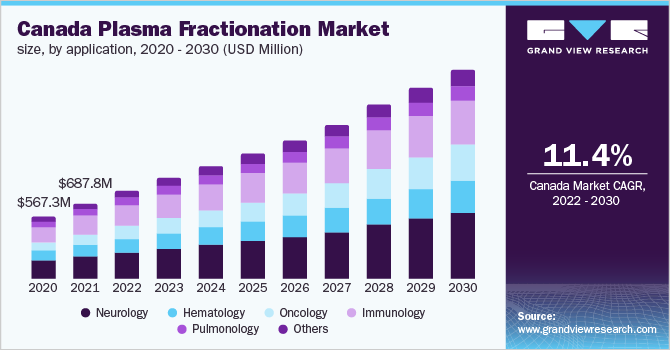

Application Insights

The neurology segment dominated the global market with a revenue of USD 8,356.9 in 2021. The global rise in the prevalence of neurological disorders is a major driver of market expansion. For instance, the Centers for Disease Control and Prevention estimates that over 795,000 Americans get a stroke each year. Additionally, the growing elderly population raises the risks of neurovascular illnesses such as stroke becoming more prevalent. Additionally, after the age of 55, the risk of having a stroke doubles, which encourages the use of plasma-based products for the treatment and supports market expansion.

On the other hand, the oncology segment exhibits the fastest rate during the projected period. The range of plasma therapies for cancer is quickly growing to address challenging targets that were previously incurable, including those with the possibility of metastasis and drug resistance. Furthermore, a comprehensive investigation of the multifaceted impact of cold atmospheric plasma in cancer treatment is required to get toward widespread clinical implementation of the drug, which contributes to the segment's growth.

Method Insights

The centrifugation segment captured the highest share of 33.32% in 2021, as well as the fastest growth rate throughout the forecast period. Centrifugation is an essential step in getting high-quality blood supernatant. Additionally, it aids researchers in consistent blood separation and better clinical outcomes for patients. Thus, the increasing demand for centrifugation instruments would supplement the market growth.

The utilization of industrial-scale chromatographic fractionation as well as purification techniques for plasma fractionation has increased recently. A new generation of therapeutic plasma products, particularly coagulation factors, protease inhibitors, and anticoagulants, have been developed. As a result, chromatography has made it possible to create new therapeutic items for treating patients who have acquired or congenital impairments in plasma protein levels. Thus, it will drive market growth.

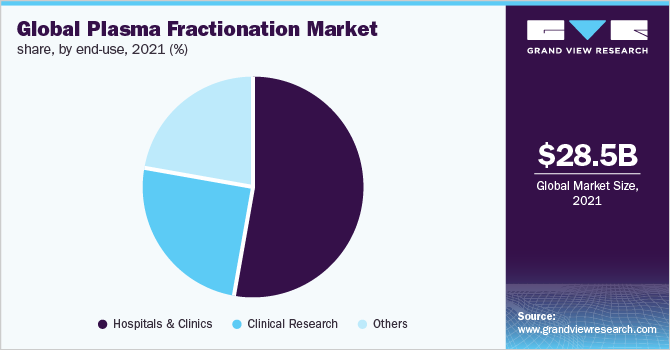

End-Use Insights

The hospitals & clinics segment captured the highest revenue share in 2021, as well as the fastest growth rate throughout the forecast period. Due to the increased off-label use of plasma fractionation products in hospitals to treat a variety of diseases, improved infrastructure & healthcare services offered by hospitals, the segment is anticipated to witness significant growth. Furthermore, the complex disorders that can be treated in modern clinical settings have a significant demand for plasma fractionation products.

Moreover, the growing number of surgical procedures and the increasing use of plasma-derived products drive the market growth. As per the NCBI, a total of 13 million surgical procedures were conducted in the US between January 1, 2019, and January 30, 2021. Such factors are also expected to fuel market growth.

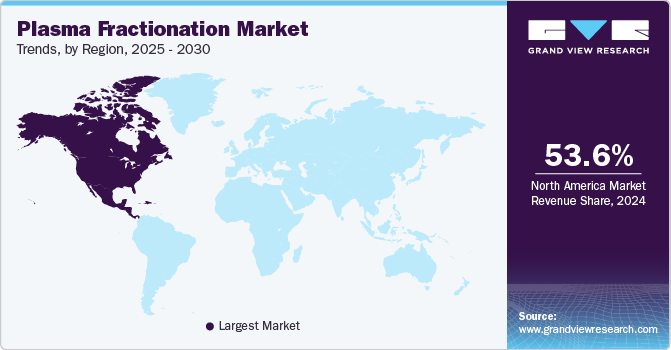

Regional Insights

North America dominated the regional market with a share of 53.93% in 2021. This is a result of increased awareness and numerous advantages of plasma among North American citizens and an increase in the occurrence of respiratory disorders. Additionally, the presence of significant players, an increase in the number of plasma collection facilities, a rise in the consumption of immunoglobulin, and the ability to supply plasma owing to the viability of plasma collections & distribution all support the expansion of the regional market.

The plasma fractionation market in the Asia Pacific is expanding due to an increase in public and private funding for research and development, favorable government regulations,increased use of immunoglobulins, and rising prevalence of target diseases with an aging population with blood-related diseases, and rising plasma-based treatment adoption.

Key Companies & Market Share Insights

Key players in this market are implementing various strategies, including partnerships through mergers and acquisitions, geographical expansion, and strategic collaborations, to expand their market presence. For instance, in May 2022, in Douglas County, Colorado, Terumo Blood and Cell Technologies opened its newest production facility. The company's purpose of contributing to society via healthcare and serving more patients is aligned with the state-of-the-art production facility, which cost USD 250 million. The 170,000-square-foot facility will produce single-use collection sets for the recent FDA-approved Rika Plasma Donation System to provide source plasma collections to clients (Rika).Some of the key players in the global plasma fractionation market include:

-

Grifols S.A.

-

CSL Limited

-

Takeda Pharmaceutical Company Limited

-

Octapharma AG

-

Kedrion S.p.A

-

LFB S.A.

-

Biotest AG

-

Sanquin

-

Bio Products Laboratory Ltd.

-

Intas Pharmaceuticals Ltd

Plasma Fractionation Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 30.71 billion

Revenue forecast in 2030

USD 58.24 billion

Growth rate

CAGR of 8.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, method, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK, France, Italy, Spain China; Japan, India, Australia, South Korea; Brazil, Mexico; South Africa, Saudi Arabia, and UAE.

Key companies profiled

Grifols S.A., CSL Limited, Takeda Pharmaceutical Company Limited, Octapharma AG

Kedrion S.p.A, LFB S.A., Biotest AG, Sanquin, Bio Products Laboratory Ltd., Intas Pharmaceuticals Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

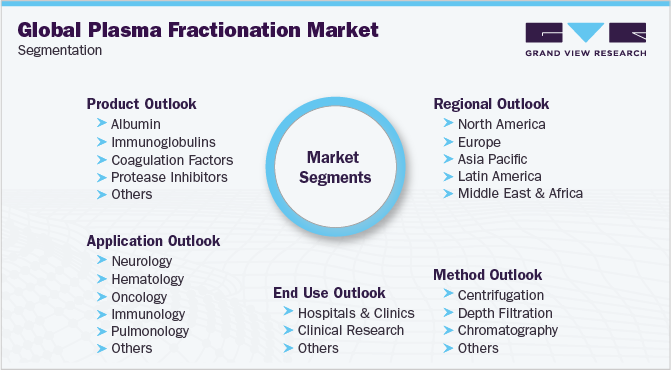

Global Plasma Fractionation Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2020 to 2030. For this report, Grand View Research has segmented the plasma fractionation market based on product, application, method, end-use, and region.

-

Product Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Albumin

-

Immunoglobulins

-

Intravenous immunoglobulins

-

Subcutaneous immunoglobulins

-

Others

-

-

Coagulation Factors

-

Factor VIII

-

Factor IX

-

Von Willebrand Factor

-

Prothrombin Complex Concentrates

-

Fibrinogen Concentrates

-

Others

-

-

Protease Inhibitors

-

Others

-

-

Method Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Centrifugation

-

Depth Filtration

-

Chromatography

-

Others

-

-

Application Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurology

-

Hematology

-

Oncology

-

Immunology

-

Pulmonology

-

Others

-

-

End Use Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Clinical Research

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plasma fractionation market size was estimated at USD 28.50 billion in 2021 and is expected to reach USD 30.71 billion in 2022.

b. The global plasma fractionation market is expected to grow at a compound annual growth rate of 8.3% from 2022 to 2030 to reach USD 58.24 billion by 2030.

b. Immunoglobulins dominate the plasma fractionation market with a share of 59.95% in 2021. This is attributed to the extensive use of immunoglobulins for the administration, cure, and identification of metabolic disorders globally.

b. Some key players operating in the plasma fractionation market include Grifols S.A., CSL Limited, Takeda Pharmaceutical Company Limited, Octapharma AG, Kedrion S.p.A , LFB S.A., Biotest AG, Sanquin, Bio Products Laboratory Ltd., and Intas Pharmaceuticals Ltd.

b. Key factors that are driving the plasma fractionation market growth include the increasing number of rare diseases, increasing demand for plasma protein therapies, and the growing use of immunoglobulins in various therapeutic areas.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."