- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Films And Sheets Market Size, Share Report, 2030GVR Report cover

![Plastic Films And Sheets Market Size, Share & Trends Report]()

Plastic Films And Sheets Market Size, Share & Trends Analysis Report By Product (PA, PVC, BOPP, LDPE/LLDPE, HDPE, CPP), By Application (Food, Consumer Goods, Medical, Construction, Healthcare, Agriculture), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-240-2

- Number of Pages: 135

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Plastic Films And Sheets Market Trends

The global plastic films and sheets market size was valued at USD 134.53 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030. Plastic sheets are mainly used in greenhouse construction, mulching, walk-in tunnels, and low tunnel covering in agricultural sector. HDPE sheet has a variety of applications in agricultural industry. These films are equipped with multiple rows containing multiple pores, which help plants grow and develop better. They are weather-resistant, highly durable, lightweight, corrosion-resistant, bond-resistant, and waterproof. Increasing demand for processed foods further drives the demand for plastic films and sheets in packaging applications.

Changes in dietary habits, including a growing preference for processed foods, are likely to supplement the demand for plastic films and sheets. Major market players are also involved in producing various types of plastics based on user requirements and perishability of food. Some countries have imposed strict regulations on usage of plastic films and sheets. There are a number of government and non-governmental organizations in the U.S. and UK that are supporting a ban on the use of plastics in packaging and non-packaging industries.

In the U.S., some governmental and nongovernmental organizations are also involved in discouraging the use of plastic sheets and films in packaging of organic produce. Environmental agencies and various plastic associations are constantly working to develop and update recycling specifications, quantities used, scope of application, and environmental policies for plastic films and sheets, which manufacturers must comply with. Moreover, numerous economies, including India, Bangladesh, Taiwan, Cambodia, Malaysia, Indonesia, and Hong Kong impose additional taxes on use of plastic film in packaging.

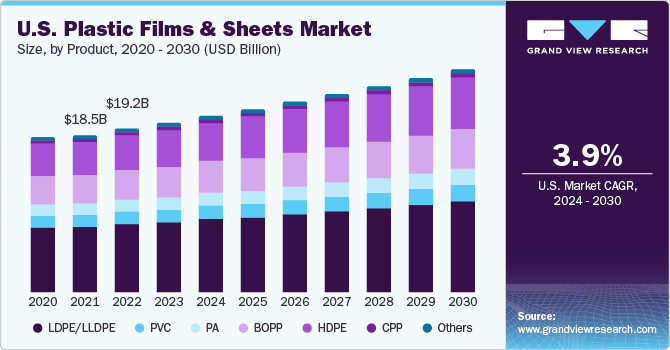

Strong manufacturing base in the U.S. by global consumer goods manufacturers such as Procter & Gamble, Johnson & Johnson Consumer Inc., and Unilever is expected to boost product demand for plastic packaging in the formulation of personal care products. In addition, growth in food & beverage industry in North America on account of ‘on-the-go’ lifestyle of consumers is expected to boost plastic packaging market in the next few years.

Increasing demand for plastic sheets and films for roof flooring helps limit leaks and protect buildings from extreme heat and low temperatures. It requires a smaller amount of paint and cement for landscaping and gives the ceiling a smooth texture. In large cities such as New York, Seattle, Washington, etc., use of plastic sheeting has increased, and spending and purchases have increased.

Market Dynamics

The rising demand for plastic films in the agricultural sector serves as a significant catalyst for the growth of the plastic films and sheets industry. Plastic sheets find predominant use in agricultural applications, particularly in mulching, construction of greenhouses, walk-in tunnels, and low tunnel covers. HDPE sheets, in particular, are gaining widespread use in agriculture.

These films are designed with multiple rows of holes, promoting optimal plant growth and development. They possess qualities such as being lightweight, highly durable, weather-resistant, corrosion-resistant, binding-resistant, and waterproof. Manufactured using high-quality polythene sheets, HDPE sheets contribute to moisture retention in the soil, thereby reducing the need for irrigation.

The growing desire for processed food is driving an increased need for plastic films and sheets in packaging applications. Evolving dietary preferences, marked by a rising inclination toward processed food, are expected to boost the demand for plastic films and sheets. Additionally, industry participants are actively involved in producing different types of plastics tailored to the specific needs and perishability of various food products.

Product Insights

Based on products, the industry has been divided into LDPE/LLDPE, PVC, PA, BOPP, HDPE, CPP, and others. LDPE/LLDPE was the largest product segment in 2023 accounting for more than 40.7% market share. LDPE/LLDPE is dominating product type among all other product types and is expected to continue to dominate during the forecast period. Properties of LDPE/LLDPE films include higher tensile strength and flexibility, as well as higher puncture and impact resistance. Features include high transparency and low barrier, along with the low cost is a major growth contributor to its global market demand.

Common applications for plastic films and sheets include food packaging, textile packaging, and other special applications in tents and outdoor equipment. HDPE is the second-largest product segment in 2023 due to its unique properties including chemical and corrosion resistance, wear resistance, low coefficient of friction, good electrical properties, moisture and odor resistance, and high impact strength. HDPE has been approved by FDA and is widely used in the food packaging industry, due to its radiation protection capabilities. Whereas borated HDPE is used in nuclear facility applications. HDPE sheets can be extruded with a pebble finish. It is used as a cutting board in various end-use industries, such as slaughtering and meat packaging.

Application Insights

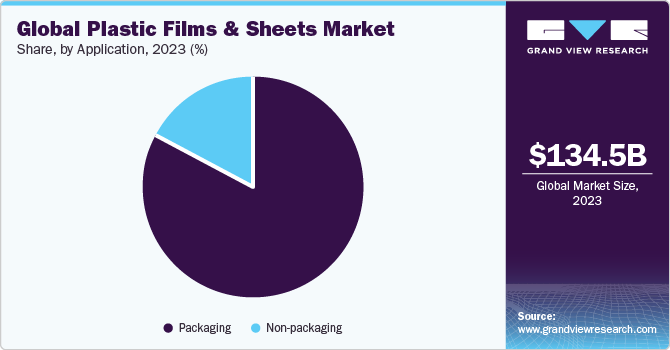

Packaging was the largest segment in 2023 accounting for more than 82.8% market share. Plastic films and sheets are becoming increasingly popular in packaging applications across a wide range of industries. Active lifestyles, Demographic changes, and rising sustainability trends are leading the way in development and innovation of plastics, which in turn provides marketing opportunities for key industries such as consumer goods and food and beverages. Strong manufacturing base in the global industry and growing demand from developing economies in Central and South America and the Asia Pacific are likely to drive industry growth.

Non-packaging applications of plastic films and sheets include agriculture, healthcare, construction, and others. Plastic films and sheets are majorly used in construction industry on account of their unique properties, such as non-corrosiveness, durability, and cheaper costs that make them more compatible for applications, which primarily include interior and exterior covering, ceilings, weatherboarding, roof covering, counter ceilings, and insulation. Plastic films are used to make cephalographers and are used worldwide to manually draw cephalograms while protecting the underlying X-rays.

Orthopedic surgeons and other medical professionals also utilize this film to preserve the quality of X-ray images. Furthermore, mouth guards and face shields are made from plastic films. Additionally, equipment is fully covered with plastic film during an MRI to prevent any magnetic pull from MRI machine from attracting anything. LDPE/LLDPE films are frequently used in agricultural applications, primarily in greenhouses, mulching, low tunnel covers, and walk-in tunnels. NIR-blocking films, UV-blocking films, ultra-thermic films, and fluorescent films are just a few of the latest product breakthroughs that the industry is seeing in China along with some encouraging growth.

Regional Insights

Asia Pacific was the largest regional market in 2023 accounting for more than 40.5% market share. This expansion can be ascribed to the quickly growing food and pharmaceutical sectors in developing nations like China and India. This APAC region's primary growth markets are anticipated to be China, India, and Southeast Asia. Demand for products in construction, packaging, and electrical & electronics industries will be driven by the expanding manufacturing sector.

Well-established electrical and electronics manufacturing bases in China, Taiwan, and South Korea will further fuel the market's expansion. Expansion of Indian regional market is being aided by expanding economies, increased urbanization, a thriving manufacturing sector, and rising infrastructure-related activities. Moreover, Rapid GDP growth in nations like India, China, Vietnam, Indonesia, and the Philippines presents a profitable potential for plastic marketers.

Plastic sheets and films used in packaging applications are anticipated to be impacted by pharmaceutical industry's slowing expansion in Germany, France, and Italy due to relocation of manufacturing bases to regions with cheap manufacturing costs. However, it is anticipated that rising R&D spending in pharmaceutical sector in Europe will indirectly support product demand in upcoming years. Additionally, it is anticipated that, expanding personal care products market in Germany, U.K., France, and Italy will have a favorable effect over the forecast period.

Key Companies & Market Share Insights

Key players are investing in the development of new technologies while acquiring raw material manufacturers. Agreements and cooperation are also one of the main strategies adopted by major market players. R&D activities and product lines added due to addition of new products are expected to have a significant impact on overall competitive scenario. For instance, in March 2023, Sangeeta Poly Pack Pvt Ltd. a manufacturer of plastic products and polypropylene films and sheets launched a polypropylene film which is produced by 50% scrap collected from industrial waste.

Key Plastic Films And Sheets Companies:

- Toray Industries, Inc.

- British Polythene Ltd.

- Toyobo Co., Ltd.

- Berry Global, Inc.

- SABIC

- Plastic Film Corporation of America

- Sealed Air

- Dow

- DuPont de Nemours, Inc.

- Novolex

- Amcor plc

- UFlex Ltd.

Plastic Films And Sheets Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 141.72 billion

Revenue forecast in 2030

USD 196.23 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil

Key companies profiled

Toray Industries, Inc.; British Polythene Ltd.; Toyobo Co., Ltd.; Berry Global, Inc.; SABIC; Plastic Film Corporation of America; Sealed Air, Dow Inc.; DuPont de Nemours, Inc.; Novolex, Amcor plc; UFlex Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Films And Sheets Market Report Segmentation

This report forecasts volume and revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic films and sheets market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

LDPE/LLDPE

-

PVC

-

PA

-

BOPP

-

HDPE

-

CPP

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Packaging

-

Food

-

Consumer Goods

-

Medical

-

Others

-

-

Non-packaging

-

Construction

-

Healthcare

-

Agriculture

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global plastic films and sheets market size was estimated at USD 134.53 billion in 2023 and is expected to reach USD 141.72 billion in 2024.

b. The global plastic films and sheets market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 196.23 billion by 2030.

b. LDPE/LLDPE segment dominated the plastic films & sheets market with a share of 40.7% in 2023. This is attributable to the rising demand for food packaging and textile packaging.

b. Some key players operating in the plastic films & sheets market include Toray Industries, Inc., British Polythene Industries Plc, Toyobo Co. Ltd., Berry Global, Inc., Saudi Basic Industries Corporation, Sealed Air Corporation, DowDuPont, Novolex, Bemis Company, Inc., and Uflex Ltd.

b. Key factors that are driving the plastic films and sheets market growth include the increasing prominence of eco-friendly and water-soluble films.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."