- Home

- »

- Medical Devices

- »

-

Plastic Surgery Instruments Market Size, Industry Report, 2019-2026GVR Report cover

![Plastic Surgery Instruments Market Size, Share & Trends Report]()

Plastic Surgery Instruments Market Size, Share & Trends Analysis Report By Product Type (Handheld Surgical Instruments, Electrosurgical Instruments), By Procedures (Face & Head, Breast, Body & Extremities, Reconstruction Surgeries), And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-508-3

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Healthcare

Report Overview

The global plastic surgery instruments market size was valued at USD 962.7 million in 2018 and is expected to grow at a CAGR of 8.8%. The market is primarily driven by the increasing adoption of minimally invasive and non-invasive procedures coupled with the aging population.

Plastic surgeries are performed to restore tissue function and improve the body’s appearance in areas such as craniomaxillofacial, skin, hand, breast, musculoskeletal, and torso. The development of minimally invasive surgeries or less invasive surgeries has led to an increase in the number of surgeries being performed each year. According to the American Society of Plastic Surgeons, in 2015, 15.9 million minimally invasive cosmetic surgeries were performed in the U.S. In addition, increase in the number of road accidents, aging population, and healthcare expenditure in emerging economies are among factors likely to boost plastic surgeries during the forecast period. These factors are anticipated to positively impact revenue generation.

The demand for cosmetic procedures is growing globally due to women, and they accounted for more than 86% of cosmetic patients. Cosmetic surgery focuses on body enhancement, whereas plastic surgery reconstructs damaged tissues caused due to burns or trauma. The most common procedures performed on women are breast augmentation (silicone implants), liposuction, eyelid surgery, abdominoplasty, and breast lift.

The rise in the number of minimally invasive cosmetic procedures that involve the usage of newer technologies, such as laser to remove the outer layer of the skin, is another driver. Laser surgery helps ameliorate fine lines, wrinkles, crow’s feet, and forehead creasing. Furthermore, eyelift surgery is one of the most commonly requested procedures, both by women and men.

According to an article published in Frontline Medical Communications, Inc. by American Society of Plastic Surgeons (2017), around 15 million minimally invasive cosmetic procedures were performed in 2016. The other minimally invasive cosmetic procedures include onabotulinumtoxinA, soft tissue fillers, chemical peel, and microdermabrasion.

In addition, there is a noticeable rise in the number of men considering plastic surgeries. However, there is always a risk involved in plastic surgery. Those with a history of obesity, diabetes, and cardiovascular & lung diseases have a higher risk of cardiac arrest or blood clots in lungs & legs. These post-surgery complications may hinder growth over the forecast period.

Product Insights

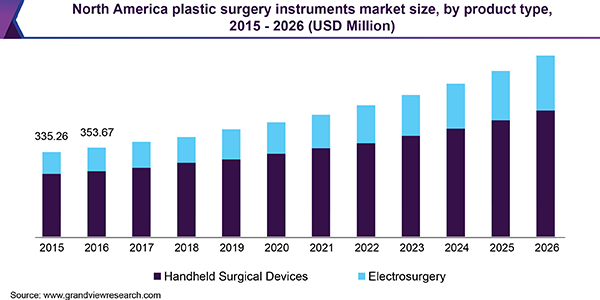

On the basis of product, the market is segmented into handheld surgical instruments and electrosurgical instruments. Handheld surgical instruments held the largest share in 2018. The segment is expected to grow at a CAGR of 9.3% over the forecast period. Handheld surgical instruments can be categorized into forceps, retractors, graspers, auxiliary instruments, cutter instruments, elevators, chisels & gouges, cannulas, dissectors, and sutures & staplers. Electrosurgical instruments are divided into monopolar and bipolar instruments.

In the handheld surgical instruments segment, forceps held the largest share and is growing at a CAGR of 7.8% over the forecast period. Rising awareness about various surgical procedures, an increasing number of plastic surgeries, and technological advancement are factors driving the market. In addition, monopolar instruments dominated the electrosurgical instruments segment with over 50% share in 2018. The rise in plastic surgery procedures, an increase in the number of plastic surgeons, and high technological advancement are factors boosting growth.

Procedure Insights

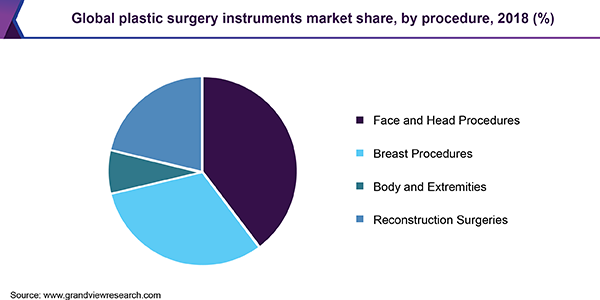

On the basis of procedures, plastic surgery instruments market is segmented into face & head, breast, body & extremities, and reconstruction surgeries. According to statistics by the American Society of Plastic Surgeons, over 1.8 million surgeries were performed in the U.S. in 2018, of which breast augmentation, liposuction, and eyelid & tummy tuck surgeries were most commonly performed.

Signs of aging such as wrinkles, lack of skin elasticity, and dark spots start appearing between 25 and 30 years of age and become more prominent from 30 to 65 years of age. Moreover, there was a rise of 200% in minimally invasive cosmetic procedures in the U.S. since 2000. Most minimally-invasive surgeries involve the use of surgical instruments, thereby propelling the market growth. Face and head procedures accounted for the highest market share in 2018. This can be attributed to the global presence of large geriatric population, increase in demand for plastic surgeries among teenagers, and high social media influence.

Regional Insights

North America dominated the market in 2018 and is expected to maintain its position during the forecast period. Major factors contributing to this growth are favorable reimbursement policies, presence of key players, and an increase in the number of government initiatives, providing access to advanced devices for plastic surgery & training sessions for physicians. In 2015, Global Surgery Initiative was launched by the department of surgery at Massachusetts General Hospital to help establish international partnerships and enhance medical technology for conducting surgeries efficiently.

Asia Pacific is anticipated to grow at the fastest pace during the forecast period due to rising investments in the region. Japan, China, India, Australia, and South Korea are the major contributing countries in Asia Pacific. Government initiatives to incorporate improvements in reimbursement policies and rise in awareness about reconstructive or plastic surgeries are other factors anticipated to aid growth during the forecast period.

Plastic Surgery Instruments Market Share Insights

Market players are undertaking strategic initiatives, such as product development, geographical expansion, launches, mergers, and acquisitions, due to the presence of significant opportunities in developing countries to increase market share. For instance, in March 2019, Zimmer Biomet Holdings, Inc. became the first company to obtain 510(k) clearance of ROSA ONE Spine System for robotically assisted minimally invasive and complex spine surgeries, which strengthened the company’s comprehensive product portfolio. Some of the key companies are Sklar Surgical Instruments; Zimmer Biomet Holdings, Inc.; B. Braun Melsungen AG; Blink Medical Ltd.; Bolton Surgical Ltd.; Integra Life Sciences; TEKNO-MEDICAL Optik-Chirurge GmbH; Karlz Storz; BMT Medizintechnik GmbH; and Anthony Product, Inc.

Plastic Surgery Instruments Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1,114.6 million

Revenue forecast in 2026

USD 1,870.1 million

Growth Rate

CAGR of 8.8% from 2019 to 2026

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2026

Quantitative units

Revenue in USD million and CAGR from 2019 to 2026

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Design, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Mexico; Brazil; Colombia; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Sklar Surgical Instruments; Zimmer Biomet holdings, Inc.; B. Braun Melsungen AG; Blink Medical Ltd.; Bolton Surgical Ltd.; Integra Life Sciences; TEKNO-MEDICAL Optik-Chirurge GmbH; Karlz Storz; BMT Medizintechnik GmbH; Anthony Product, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, & country levels as well as provides an analysis on the latest industry trends in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented the plastic surgery instruments market report on the basis of device type, application, and region:

-

Type Outlook (Revenue, USD Million, 2015 - 2026)

-

Handheld Surgical Instruments

-

Forceps

-

Retractors

-

Graspers

-

Auxiliary Instruments

-

Cutter Instruments

-

Elevators

-

Chisels and Gouges

-

Cannulas

-

Dissectors

-

Sutures and Staplers

-

-

Electrosurgical Instruments

-

Bipolar Instruments

-

Monopolar Instruments

-

-

-

Procedure Outlook (Revenue, USD Million, 2015 - 2026)

-

Face and Head Procedures

-

Brow Lift

-

Ear Surgery

-

Eyelid Surgery

-

Face and Neck Lift Surgery

-

Face and Bone Contouring

-

Rhinoplasty

-

-

Breast Procedures

-

Breast Augmentation

-

Breast Lift

-

Breast Reduction

-

Gynecomastia

-

-

Body and Extremities Procedures

-

Buttock Augmentation

-

Thigh Lift

-

Upper and Lower Body Lift

-

Arm lift

-

Labiaplasty

-

-

Reconstruction Surgeries

-

Abdominoplasty

-

Liposuction

-

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2026)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."